Best Trading Apps In Spain For 2024

The best trading app in Spain - FxPro

Top trading apps in Spain are:

-

FxPro - tight spreads, low latency, reputable regulators

-

Exness - high leverage, competitive spreads, regulatory trust

-

Tickmill - low fees, FCA-regulated, bonus offerings

-

IC Markets - reduced spreads, vast tradable instruments, global reach

-

eToro - social trading, user-friendly, diverse assets, regulatory compliance

In this article TU experts will analyze and highlight the top trading apps in Spain for 2024. The discussion will delve into the distinctive features of FxPro, Exness, Tickmill, IC Markets, and eToro, emphasizing their usability, low spreads, and analytical tools. The article aims to provide valuable insights for readers seeking reliable and efficient trading platforms in the evolving financial landscape.

Do you want to start trading Forex? Open an account on RoboForex!-

How to choose the best app for trading in Spain?

To choose the best app for trading in Spain, consider factors like user-friendly interfaces, available features, and regulatory compliance.

-

How can I trade stocks in Spain?

You can trade stocks in Spain by opening an account with a licensed brokerage, depositing funds, and using their trading platform to buy and sell stocks.

-

What is the best trading app in Spain?

The best trading app in Spain depends on individual preferences, but any mentioned in this article may be a solid choice.

-

How to start trading in Spain?

To start trading in Spain, first, educate yourself about the financial markets, choose a reputable broker, open a trading account, deposit funds, and begin executing trades based on your analysis and strategy.

Top trading apps in Spain

| App | Best For |

|---|---|

|

Spread from 0 pips - Reputable regulators - Large number of trading platforms - Good choice of trading instruments (2100) - Negative Balance Protection |

|

|

Regulated and trustworthy with oversight from FCA, CySEC, and FSA - Variety of trading accounts and platforms, including MT4 and MT5- Competitive spreads and commissions - High leverage up to 1:2000 - Educational materials and responsive customer support. |

|

|

Regulated in Tier-1 and Tier-2 jurisdictions.- Full MetaTrader suite with competitive pricing.- Especially competitive pricing for Pro and VIP accounts.- Suitable for traders focused on low fees and tight spreads. |

|

|

Multi-asset trading with low fees, commissions, and tight spreads.- Over 1750 tradable instruments, including forex, commodities, indices, bonds, and cryptocurrencies.- Three types of trading accounts to choose from - Low commissions and tight spreads- Research and educational resources available. |

|

|

Social trading for beginners to follow and copy trades of experienced traders - CopyPortfolios feature for a diversified portfolio managed by eToro’s team - Low fees for trading and investing - User-friendly interface ideal for beginners - Regulated by FCA and CySEC. |

| Forex Trading Platform | Regulatory Authority | Copy-trading (yes/no) | Max Leverage | Dollar (USD) Accounts (yes/no) |

|---|---|---|---|---|

|

FCA, CYSEC, FSCA, SCB |

Yes |

1:500 |

Yes |

|

|

FCA, CySEC, ASIC |

Yes |

1:Unlimited |

Yes |

|

|

FCA, ASIC |

Yes |

1:500 |

No |

|

|

ASIC, CySEC |

Yes |

1:500 |

No |

|

|

CySEC, FCA |

Yes |

1:30 |

Yes |

FxPro

FxPro website

FXPro is an online brokerage company that provides trading services in Forex, shares, metals, futures, and indices. Broker offers trading through several platforms, including its own proprietary platform, as well as MetaTrader 4, MetaTrader 5, and cTrader. The company also provides a variety of trading tools, such as technical analysis, economic calendars, and VPS services.

FXPro is regulated by several financial authorities, including the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). The company is also a member of the Investor Compensation Fund, which provides protection to clients' funds in the event of the broker's insolvency.

The broker also supports social trading, allowing users to follow and copy the trades of successful traders.

In terms of education and research, FXPro provides a range of resources to help traders improve their skills. They offer webinars, video tutorials, and market analysis to help traders stay informed and up-to-date with market trends.

FXPro has won numerous industry awards, including "Best Forex Broker" and "Best Forex Trading Platform" at the UK Forex Awards.

👍 Pros

•Regulated by reputable regulators ensuring safety and reliability.

•Wide selection of tradable assets and account choices.

•Excellent trading conditions with low spreads and fast execution.

•Robust educational resources and risk management tools.

•Strong brand reputation with several Forex broker awards.

👎 Cons

•Minimum deposit requirement of $100 is relatively high for new traders.

•Leverage limits may be lower due to strong regulation.

Key Features

-

Offers access to trade Forex, stocks, indices, commodities and cryptocurrencies. Over 2,100 assets available.

-

Provides various account types on different trading platforms like MT4, MT5, cTrader and FxPro proprietary platform.

-

Supports flexible deposit and withdrawal options including credit cards, wire transfer and cryptocurrencies.

-

Known for tight spreads from 0 pips, high leverage up to 1:500 and fast order execution averaging 14-30ms.

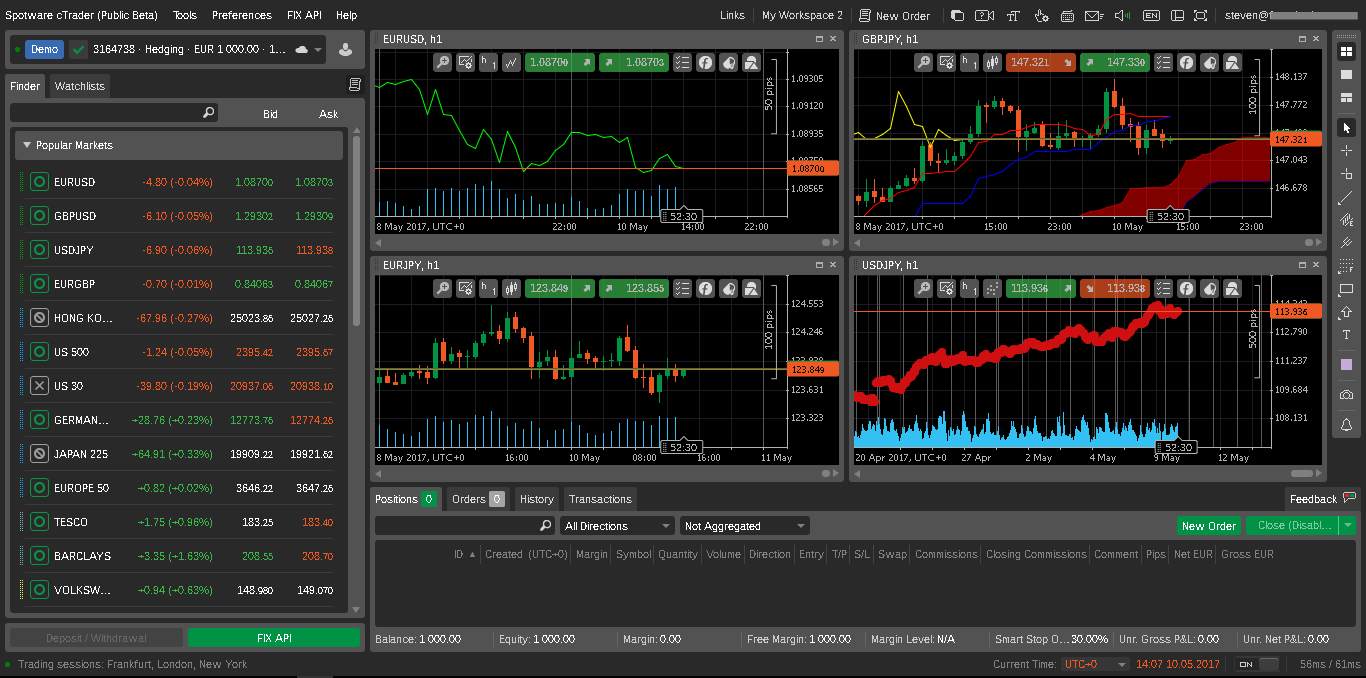

Tickmill

Tickmill website

Tickmill, established in 2014, stands out as a low-cost forex and CFD broker regulated by the esteemed FCA in the UK. For investor protection, it offers up to £85k for UK and €20k for EU clients, with no cost for others. The broker prides itself on low forex and non-trading fees, ensuring a cost-effective trading experience. Account opening is a seamless, fast, and fully digital process, enhancing user convenience.

The minimum deposit for Tickmill is contingent on the selected account type. As indicated on the official website, both Classic and Pro accounts necessitate a minimum deposit of $100. Conversely, for individuals opting for a VIP account, a substantially higher minimum balance of $50,000 is mandated.

👍 Pros

•Tickmill stands out for its low forex and non-trading fees, making it an economical choice for traders.

•Regulated by the UK's FCA, it adheres to international standards, ensuring a secure trading environment.

👎 Cons

•Tickmill falls short for investors looking for stocks, funds, and bonds, limiting investment options.

•The MetaTrader trading platforms provided by Tickmill are criticized for an outdated design and a poorly-structured news feed.

Key Features

-

It offers a 30% bonus for depositing funds into your account

-

Tickmill users have access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

-

Tickmill is regulated by reputable authorities such as the FSA, LFSA, FSCA, CySEC, and FCA, ensuring a secure and compliant trading environment.

-

Tickmill provides low forex and non-trading fees, making it an economical choice for traders.

Exness

Exness website

Exness website

Exness sets itself apart in the world of forex and CFD brokerage by providing users with substantial leverage, reaching 1:2000 by default for smaller accounts and the option for unlimited leverage under specific conditions, though with limitations on certain markets. The platform facilitates trading through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, while Tickmill's MT5 platform extends the trading experience across various asset classes.

Recognized for its competitive spreads, diverse account offerings, and support for multiple funding methods, including cryptocurrencies, Exness maintains an impressively low minimum deposit requirement of just £1. The platform prioritizes security, holding regulatory approval from esteemed authorities such as the FCA, CySEC, FSA, CBCS, FSC, and FSCA. With user-friendly features and a commitment to safety, Exness presents traders with a compelling choice for navigating the intricacies of financial markets.

👍 Pros

•Exness provides a decent education section, contributing to the overall trading knowledge and skill development of its users.

•Exness stands out by offering unlimited leverage, providing traders with unique flexibility compared to many other forex brokers.

👎 Cons

•Exness has a limited selection of instruments, potentially restricting the diversity of trading opportunities for users.

Key Features

-

The platform provides reasonably competitive spreads, ensuring cost-effective trading for its users.

-

The platform is regulated by several reputable authorities, including the FCA, CySEC, FSA, CBCS, FSC, and FSCA.

-

Exness provides a web-based proprietary trading terminal with 50 drawing tools and 100 indicators, offering a lightweight and user-friendly experience for MT5 accounts.

IC Markets

IC Markets website

IC Markets website

IC Markets stands out as an award-winning trading platform, catering particularly to forex traders. The site claims a substantial trading volume, reaching an impressive US $646 billion in the last year. Traders appreciate the flexibility offered by reduced spreads down to 0.0, making it an ideal choice for frequent trading.

With a vast array of over 1750 tradable instruments, including forex, commodities, indices, bonds, and digital currencies, IC Markets appeals to high-volume traders seeking optimal prices. The platform's global reach is evident with over 200,000 clients worldwide, emphasizing its popularity.

A reasonable minimum deposit of $200 (£141) makes IC Markets accessible to a broad range of traders. Additionally Customer support and educational resources enhance the overall trading experience.

👍 Pros

•IC Markets offers competitive and low fees for forex trading, making it cost-effective for traders.

•The account opening process with IC Markets is user-friendly and efficient, allowing traders to start trading quickly.

•The broker provides free deposit and withdrawal options, saving traders from additional financial burdens.

👎 Cons

•IC Markets has a relatively limited selection of trading products compared to some other platforms, potentially limiting investment choices.

•Non-EU clients do not benefit from investor protection, which could be a drawback for traders outside the European Union.

Key Features

-

Easy and fast account opening

-

Offers standard and raw spread accounts

-

Offers more than 5 different base currencies for your trading account

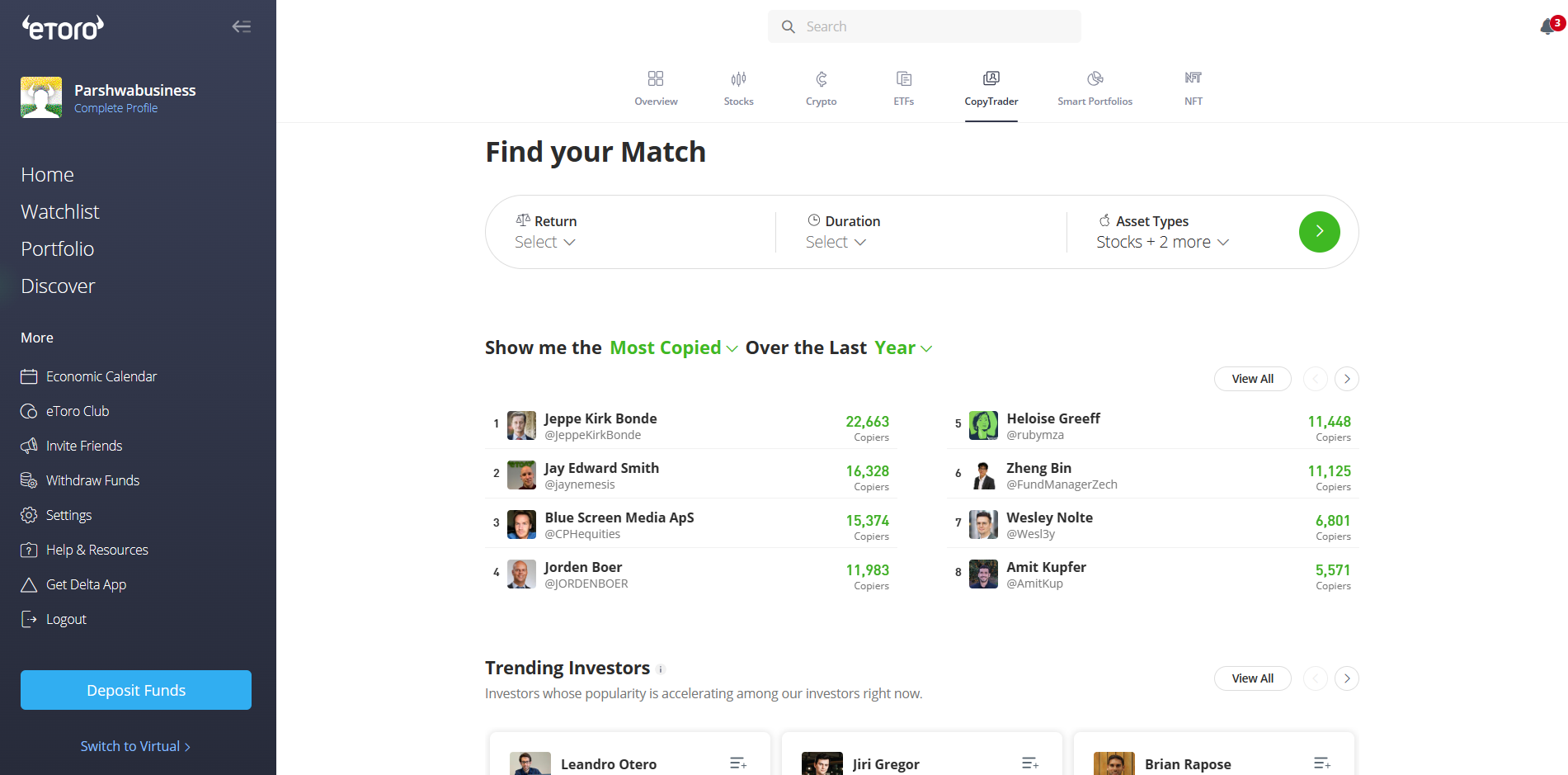

eToro

eToro website

eToro website

eToro, established in 2007, stands as a regulated social trading and multi-asset brokerage with oversight from the FCA, CySEC, and ASIC. Catering to a diverse audience, it offers a user-friendly interface and an array of assets, including stocks, ETFs, and cryptocurrencies. One notable feature is its social trading, allowing users to emulate the trades of successful investors. With a reasonable minimum deposit of $50 and support for various payment methods, such as credit/debit cards, bank transfers, and e-wallets, eToro is particularly suitable for novice traders seeking an accessible platform with social trading capabilities.

👍 Pros

•Users have the option to copy the trading strategies of successful investors, fostering a social trading community.

•With a user-friendly mobile app, eToro enables traders to engage in the market conveniently on the go.

•eToro offers a diverse range of these assets, catering to the growing demand in the market.

👎 Cons

•eToro has a relatively higher minimum deposit requirement ($200) compared to some competitors.

•eToro lacks crypto-to-crypto trading pairs, limiting choices for cryptocurrency traders.

Key Features

-

Community where users can copy trades, interact, share insights, and follow experienced investors, enhancing collaborative trading experiences.

-

Access to 3,000+ financial assets, including stocks, cryptocurrencies, ETFs, indices, currencies, and commodities.

-

eToro offers a demo account, allowing users to practice and explore the platform's features.

How to choose a Forex broker’s app in Spain?

CNMV Website

The right forex trading app can make or break your trading experience. If you are new to forex trading, knowing the criteria for selecting the best forex trading app is important. Here are some tips:

1. Regulatory check

Before anything else, ensure the broker is regulated. Regulation ensures brokers operate within the premise of the law, thereby protecting traders from scammers.

2. User-friendly interface

Navigating the trading platform should be easy. A user-friendly interface is your best ally, especially when the markets are moving fast.

3. Demo account availability

Choose a Forex trading app that has a demo account. They allow you to test trading strategies before committing your finances in a live account.

4. Asset variety

A good broker's app offers a number of trading assets. You want options, not a limited menu.

5. Transaction costs and fees

Money matters. Monitor transaction costs and fees – they can eat into your profits. A transparent broker is honest about these charges.

6. Customer support responsiveness

Check how responsive the customer support is – it's your lifeline in times of trouble.

7. Reviews and Reputation

It's the age of online reviews. See what other traders are saying about the trading app. Their experiences are like a roadmap, guiding you away from pitfalls.

Choosing a forex broker's app in Spain is like picking a travel companion – you want reliability, compatibility, and a smooth journey.

Best Forex trading app for beginners in Spain

IC Markets is a popular Forex and CFD broker that offers a range of trading products and services to clients in Spain and beyond. The broker is well-regulated with licenses from ASIC, SFSA and CySEC and provides a secure and reliable way to trade currencies from a smartphone or tablet.

IC Markets provides apps for both Android and iOS devices which are optimized for mobile use. The apps allow easy access to live market quotes, news and the full range of tradable instruments including Forex majors, crosses, commodities and indices. Customizable watchlists, price alerts and push notifications ensure traders are alerted to market movements.

For beginners, one of the standout features of IC Markets is its commitment to education and research. The broker offers a range of resources to help traders improve their skills, including webinars, video tutorials, and market analysis. Additionally, IC Markets provides a range of trading tools, including technical indicators and charting tools, to help traders make informed trading decisions.

Tight spreads from 0 pips and leverage up to 1:500 also help novice traders maximize returns. Social trading is also a useful option for those who are only starting their journey. Overall IC Markets provides an excellent trading platform for beginners in Spain.

Is Forex legal in Spain? Is it safe?

Yes, Forex trading is legal in Spain. The financial authority keeping an eye on financial activities is the National Securities Market Commission. They're the gatekeepers, ensuring that the Forex brokers follow the rules. The CNMV set rules and put measures in place to protect investors from shady dealings.

Forex in Spain is a regulated and monitored landscape. So, get into Forex trading with confidence, armed with the knowledge that the rules are in place to keep your trading journey in Spain secure.

Is Forex taxable in Spain?

Yes, Forex trading is taxable in Spain.

In Spain, income from Forex trading materializes in two distinct categories: trading income, generated from Forex trading activities, and speculative income, derived from asset sales. Forex gains attract taxation, involving both capital gains tax and income tax.

Depending on one's total earnings, individuals may find themselves in various tax brackets, spanning from 19% to 47%. Capital gains tax in Spain encompasses the profits arising from asset transfers, categorized under savings income and subject to progressive tax rates ranging from 19% to 26%. Spain's income tax structure is tiered as follows:

19% for the initial EUR 6,000 of taxable income.

21% for taxable income between EUR 6,000 and EUR 50,000.

23% for taxable income ranging from EUR 50,000 to EUR 200,000.

26% for any amounts exceeding EUR 200,000.

It is important to understand Spain's tax system and to meticulously keep financial records to ensure compliance with tax regulations. Forex traders can leverage deductible expenses and tax allowances, but non-compliance may result in punitive measures such as fines and penalties.

In essence, Forex gains in Spain are undeniably subject to taxation. Staying well-informed, maintaining accurate financial records, and acknowledging the correlation between substantial profits and significant tax obligations are crucial aspects of navigating the tax area.

Which app is the best for stock trading?

The best stock trading app, eToro, excels in user-friendly design and multi-asset offerings. Regulated by FCA, CySEC, and ASIC, providing a secure platform. eToro's standout feature is social trading, allowing users to replicate successful investors' strategies.

With a reasonable $50 minimum deposit and diverse payment methods, including cards and e-wallets, it caters to novices. The app's mobile-friendly interface facilitates convenient on-the-go trading. However, a higher minimum deposit and limited crypto-to-crypto pairs are notable considerations for potential users.

Overall, eToro's accessibility, diverse assets, and social trading make it the top choice for stock trading.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).