Fake Forex Brokers List In Colombia

Blacklisted Forex brokers in Colombia:

-

Go4Rex: Unregulated, multiple user complaints, suspected scam activities

-

OmegaPro: Lack of regulation, frozen funds, and withdrawal issues reported

-

Deriv: Cloned broker, suspected scam, withdrawal rejections without explanation

-

BingX: Lack of valid regulatory information, and customer complaints on withdrawals

-

NINJA TRADER: Clone warning, withdrawal issues, security measures undisclosed

-

FXWINNING: Unregulated, significant withdrawal delays, potential fraudulent activities

-

EXMA TRADING: Lack of valid regulation, and failure to return funds

-

Broker Group: Unregulated, lack of transparency, extended withdrawal delays

-

STAGE FIVE: Regulatory doubts, potential license cloning, high minimum deposit

-

BBI Trading: Unauthorized status by NFA, withdrawal challenges, server issues

In Colombia, being aware of the fake Forex brokers is essential. These are brokers operating without proper regulation, raising suspicions of potential scams. This list aims to shed light on such brokers, offering reviews that help traders make informed decisions and steer clear of fraudulent practices. Understanding the risks associated with unregulated brokers is key to safeguarding your investments in the Forex market.

-

Are there fake Forex brokers?

Yes, there are instances of fake Forex brokers that operate intending to deceive traders. These fraudulent brokers may engage in activities such as misappropriating funds, providing false information, or even disappearing with clients' money. Traders must exercise due diligence and research the legitimacy of a Forex broker before engaging in any transactions.

-

Where can I check if a Forex broker is legit?

To verify the legitimacy of a Forex broker, individuals can check the regulatory status on official regulatory websites, review the broker's website for transparent information, avoid brokers guaranteeing profits, read client reviews on platforms like Traders Union, and conduct thorough research before making investment decisions.

-

Is Forex trading legal in Colombia?

Yes, Forex trading is legal in Colombia. The country allows its residents to engage in Forex trading through authorized and regulated brokers. Traders should ensure they choose a reputable broker that complies with Colombian regulations to ensure a secure and legal trading environment.

-

What is the trade restriction in Colombia?

Colombia does not impose significant trade restrictions on Forex trading. However, traders should stay updated with any regulatory changes and adhere to the guidelines set by Colombian authorities. It is advisable to choose brokers regulated by recognized financial authorities to ensure compliance with local regulations and a secure trading experience.

Rules and Regulation

Forex regulation in Colombia

In Colombia, the Forex market is regulated by the Securities Commission of Colombia (SFC). This regulator sets the requirements for the authorized capital, risk management, representation in Colombia.

Investor protection

The SFC and the Association of Forex Dealers of Colombia (ASOFX) are responsible for protecting investors in Colombia. The regulatory framework is provided by the Law on Stock Exchanges (Ley del Mercado de Valores)

Taxation

Forex traders have to pay taxes. The tax rate is progressive - from 0% to 25%.

Forex brokers blacklist in Colombia

Go4Rex

A multitude of users has expressed dissatisfaction with Go4Rex, particularly regarding issues related to withdrawals and unresponsive communication from assigned advisors. One distressed investor narrates an experience of investing $15,000 with the understanding that withdrawals would be seamless. However, the promised accessibility to funds became a protracted ordeal when advisors Lisa Rodrigyez and Caesar abruptly ceased responding to calls, messages, and emails. In an alarming turn, another advisor, Marisol Nieves, allegedly demanded an additional $8,000 for the withdrawal to proceed. This has left investors in distress, seeking resolution for denied access to their funds since September 25.

Go4Rex's operations in Latin America have been harshly criticized, with accusations of scamming naive customers. The broker is flagged as unregulated, and its advertising practices are labeled as misleading. This culmination of issues has led to a resounding 0% recommendation for Go4Rex.

OmegaPro

OmegaPro raises concerns for traders due to its lack of valid regulation. Operating without oversight from recognized financial regulatory authorities, the broker exposes traders to potential risks. Issues may arise in dispute resolution, fund security, and transparency, necessitating caution from those considering trading with OmegaPro.

Users who invested with OmegaPro report frustrations as promised withdrawal timelines are not honored. A case is highlighted where an investor committed $5,000 in March 2022 with an expectation of withdrawal after 16 months. However, complications arose when OmegaPro allegedly moved the funds to Booker Group, resulting in a frozen state. The investor remains halfway, unable to access their funds despite the lapse of the stipulated withdrawal period.

Deriv

Deriv, operating under the name Deriv (FX) Ltd, is flagged as a cloned broker, utilizing the website URL of a legitimate Deriv to confuse traders. The use of established broker names, logos, and websites by cloned brokers poses a significant risk. Traders are enticed with favorable conditions, but once funds are deposited, withdrawal becomes a challenge. Users have reported suspicions of a scam, advising others to refrain from trading with Deriv.

Traders who engaged with Deriv share concerns about suspected fraudulent activities. Despite depositing funds and engaging in trading activities, withdrawal requests are allegedly declined without clear explanations. The absence of support further adds to the skepticism surrounding Deriv.

BingX

BingX faces uncertainness and concerns due to a lack of valid regulatory information, casting doubt on its legitimacy. Users report various issues, including network problems affecting quick order placement and inadequate support. Dissatisfied customers express frustration with the platform, raising questions about its reliability and customer service.

One user recounts their experience trading bitcoin on BingX, initially experiencing profit. However, when attempting to withdraw funds, they encountered challenges. The platform purportedly cited the need for identity verification, a process that, despite repeated submissions, remained unresolved. This frustrating situation further adds to the growing list of concerns regarding BingX.

NinjaTrader

While NinjaTrader claims regulation under the National Futures Association (NFA), a "suspicious clone" status adds a layer of uncertainty. Traders are urged to exercise caution and conduct thorough due diligence. The platform's regulatory credibility is called into question, necessitating careful consideration before engaging in any trading activities.

Several users report challenges with NinjaTrader, specifically about unfulfilled withdrawal requests. Traders claim that their requests were not honored, and NinjaTrader allegedly provided excuses to avoid settlement. The lack of transparency and payment-related issues prompt strong advisories against trading with NinjaTrader. Notably, information regarding the broker's security measures remains elusive, adding to the apprehensions expressed by traders.

FXWINNING

FXWINNING operates without regulation from major financial authorities, leaving traders without a guarantee of the platform's safety. Users express concern over the delayed withdrawal process, with over 50,000 clients waiting for more than a month to access their capital. The lack of transparency, including undisclosed account details, raises suspicions among users who fear potential fraudulent activities.

EXMA TRADING

EXMA TRADING's lack of valid regulations intensifies the air of caution surrounding the broker. Traders express dissatisfaction, emphasizing the company's failure to return funds despite promising lucrative returns. The extended waiting period for money compounds frustrations, prompting doubt about the reliability and integrity of EXMA TRADING. The absence of regulatory oversight amplifies the financial setbacks experienced by users, further undermining confidence in the broker.

Broker Group

Broker Group operates without regulation from any financial authority, a red flag for potential traders assessing the credibility of the platform. The lack of disclosed spreads on the website raises transparency concerns, leaving users in the dark about the costs associated with trading on the platform. The absence of information on commissions and other expenses adds to the opacity. Limited details about account types and the dearth of educational resources contribute to a lack of clarity for potential investors. Users vent their frustration, citing an inability to withdraw invested capital for over 10 months. Allegations of an ongoing audit by the owners further exacerbate concerns, fueling suspicions of mismanagement or fraudulent practices.

STAGE FIVE

STAGE FIVE's regulatory uncertainties cast a shadow over its credibility and safety for traders. Despite the company's claim of United States NFA regulation with license number 0444666, doubts arise regarding the authenticity of this assertion. Suspicions point to the license number being potentially cloned, raising questions about the broker's integrity. The high minimum deposit requirement of $100 acts as a barrier for retail traders, limiting accessibility to a broader market. The absence of regulation implies potential challenges in fund withdrawals, further contributing to the uncertainty faced by users on the platform.

BBI Trading

BBI Trading's unauthorized status according to the National Futures Association (NFA) signals significant regulatory risks for traders. The absence of approval or a license from the NFA indicates a deviation from established regulatory standards. This unauthorized status poses inherent risks, as the company operates outside the regulatory framework set by the NFA, potentially jeopardizing the security of traders' investments. Users share their struggles, recounting challenges in withdrawing funds. Server issues and unsatisfactory explanations from customer service compound the difficulties faced by traders. The unauthorized status adds an extra layer of concern for those seeking a secure and regulated trading environment, highlighting the need for caution when dealing with BBI Trading.

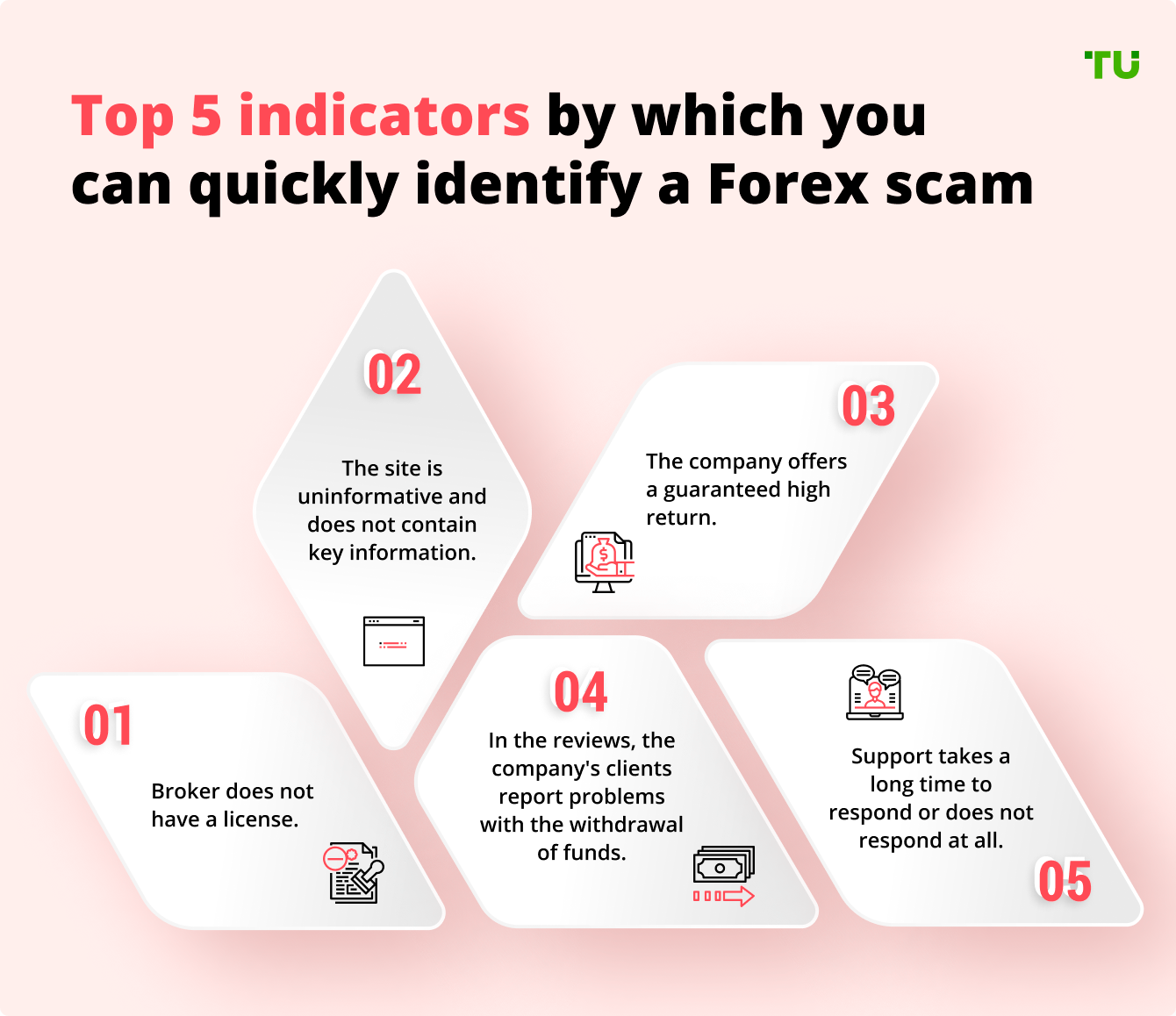

How to check if a Forex broker is legit in 5 steps?

To ascertain the legitimacy of a Forex broker, you can undertake the following five steps highlighted by our experts

| Steps to Check Forex Broker Legitimacy | Details |

|---|---|

1. Check Regulatory Info |

Verify proper licensing from reputable financial regulators. Confirm registration through official channels for legitimacy. |

2. Regulator's Website Database |

Authenticate the broker's registration on the regulator's website. Ensure genuine registration to avoid potential fraud. |

3. Learn Broker's Website |

Visit the broker's site; ensure it discloses risks, legal info, and regulatory affiliations. A transparent site signals legitimacy. |

4. Caution on Profit Guarantees |

Be wary of brokers promising guaranteed profits; legit ones avoid such claims due to trading risks. No profit guarantees indicate legitimacy and ethical practices. |

5. Read Client Reviews |

Check client reviews on platforms like Traders Union for insights into the broker's reputation and real experiences. Valuable for informed decisions on choosing a legitimate Forex broker. |

Best Forex brokers in Colombia

RoboForex

RoboForex stands out as a highly reputable and well-established Forex broker, catering to both novice and experienced traders. The platform offers an impressive array of features, including a user-friendly interface and an extensive selection of tradable assets, exceeding 12,000 instruments. Noteworthy is the broker's commitment to education, providing high-quality webinars and educational resources. With a minimum deposit of $10, RoboForex ensures accessibility for various traders. The broker's efficient financial transactions, diverse payment options, and 24/7 customer support further enhance the overall trading experience.

Key features

-

$10 minimum deposit

-

12,000+ trading instruments

-

User-friendly platform

-

Diverse tradable assets

-

High-quality educational resources

-

Efficient and rapid financial transactions

-

Wide array of payment options

-

24/7 customer support

👍 Pros

• Swift execution of orders

• Over 2,100 instruments

• Excellent customer service

• Numerous analytical training resources available

• Permission to use trading advisors and mobile trading apps

IC Markets

IC Markets, established in 2007, stands as a leading Forex broker with a strong regulatory standing under ASIC, CySEC, SCB (Bahamas), FSA (Seychelles), and FSCA (South Africa). Offering over 60 currencies and 10+ cryptocurrencies, IC Markets provides a diverse selection of trading instruments, including 1,600+ CFDs such as Gold, Silver, Stocks, Indexes, and Bonds. With user-friendly trading platforms like MT4, MT5, and cTrader available on various devices, IC Markets ensures a seamless trading experience. Additional services such as VPS, cAlgo FIX API, MT4 add-ons, educational content, and market analysis blog contribute to its comprehensive offerings.

Key features

-

Regulators: CySEC, FCA, CMA, FSCA, FSA, CBCS

-

Copy trading platform: Yes

-

Minimum deposit: $1

-

Free VPS server: Yes

-

Trading platforms: MT4, MT5, Web terminal, Mobile platforms, Exness Trade Terminal

-

Leverage: 1:2000

-

Demo account: Yes

-

Instruments: Currencies, assets of stock and commodity markets, cryptocurrencies

👍 Pros

• Low Forex fees

• Easy and fast account opening

• Free deposit and withdrawal

• Offers standard and raw spread accounts

👎 Cons

• Limited product selection

• Slow live chat support

• No investor protection for non-EU clients

Exness

Founded in 2008, Exness is a Forex and CFD broker providing access to a wide range of trading assets, including currencies, cryptocurrencies, stocks, indices, and commodities. The broker offers a proprietary Trading Terminal platform and supports MetaTrader 4 and 5. Exness caters to traders of varying experience levels through multiple account types. With a base in Cyprus, the broker boasts over 400,000 active clients and a global workforce of more than 2,000 employees.

Key features

-

Extensive range of assets with competitive spreads

-

High maximum leverage for versatile trading strategies

-

High trade volume

-

Free VPS hosting for uninterrupted trading

-

Comprehensive price history and signals

-

MetaTrader Suite available

-

Swap-free assets

-

Low trading fees

👍 Pros

• $10 minimum deposit

• Low and stable spreads

• 70+ MetaTrader servers worldwide

• Customizable leverage

• No overnight charges on most assets

👎 Cons

• Limited educational resources for beginners

• No welcome bonus offered

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.