deposit:

- €5

Trading platform:

- BUX Zero

- AFM

BUX Review 2024

deposit:

- €5

Trading platform:

- BUX Zero

- No

- One real account, more than 3,500 assets from four groups, proprietary trading platform for mobile trading, automatic investment, accrual of interest on funds that are not used in trades

Summary of BUX Trading Company

BUX is a moderate-risk broker with the TU Overall Score of 6.31 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by BUX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. BUX ranks 26 among 78 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Neobroker BUX provides traders with the widest range of stocks and ETFs for trading, as well as ETCs and cryptocurrencies. The entry threshold and fees are objectively low, and operational processes are tuned to the smallest detail. The application contains much relevant and useful information, allowing clients to forecast the movement of quotes for assets they are interested in more accurately. An agglomeration of measures is implemented to ensure the security of funds and client data. For example, money is stored in separate accounts, and there is deposit protection of up to €100,000.

Neobroker BUX provides access to stocks, exchange-traded funds (ETFs), exchange-traded commodities (ETCs), and cryptocurrencies. Its clients can register for one account type under universal conditions. Trading fees depend on the asset type; the most common rate is €1.99. Some operations do not involve trading fees. There is no leverage. Trading is conducted through the BUX Zero mobile application. Client support is available 24/7 via phone and email. Deposits and withdrawals are made without broker fees via bank transfer, Visa and Mastercard cards, and payment systems. The website offers a huge volume of educational materials in various formats.

| 💰 Account currency: | EUR |

|---|---|

| 🚀 Minimum deposit: | €5 |

| ⚖️ Leverage: | No |

| 💱 Spread: | No (commission only) |

| 🔧 Instruments: | Stocks, ETFs, ETCs, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with BUX:

- The minimum deposit is only €5, with no fees for zero orders.

- Over 3,500 assets are traded without any restrictions from the company, allowing scalping, hedging, and expert advisors.

- Trades are executed promptly, with rare and insignificant slippages.

- Passive income of 2.75% annually is provided on uninvested funds.

- Upon registration, each client receives a share worth from €1 to €200.

- The broker has been in the market for a long time and is regulated by the Netherlands Authority for the Financial Markets (AFM).

- Automatic investment based on the trader's investment plan is possible.

👎 Disadvantages of BUX:

- Clients are offered only the proprietary mobile app, and traditional trading platforms such as MT4, MT5, cTrader, etc., are unavailable.

- The broker operates in 8 countries, specifically the Netherlands, Belgium, Germany, Austria, France, Italy, Spain, and Ireland.

- There is no demo account, and leverage is not implemented.

Evaluation of the most influential parameters of BUX

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of BUX

The new broker BUX, legally known as BUX BV, has been operating since 2014 and is authorized and regulated by the Netherlands Authority for the Financial Markets (AFM). It is available in the Netherlands, Belgium, Germany, Austria, France, Italy, Spain, and Ireland and constantly expands its reach. It will soon be acquired by ABN AMRO Bank, which undoubtedly will accelerate its development and increase its influence in the global financial market.

Traders can trade stocks, ETFs, ETCs, and cryptocurrencies. With over 3,500 assets, there is significant potential for deep diversification of investment portfolios. Easy access is provided with a deposit starting from €5 and one account type, the conditions of which are optimal for clients of any level. Trading is conducted with various volumes, including fractional shares. There are no restrictions on strategies or methods. As such, scalping, hedging, trading on news events, and algorithmic trading are allowed.

The commission policy is advantageous and transparent. Zero orders are executed at the end of the trading day, between 16:00 CET and market close, and do not incur fees. The fee for limit and market orders is €0.99 or €1.99. It’s 0.5% of the amount for cryptocurrencies, or 0 if holding a minimum of 1,000 BUX tokens in the account. Trades are conducted through the mobile app, which is available for free download on the Play Market or App Store. Leverage is not provided. Automatic investing can be set up, and the process takes no more than 10 minutes.

Even funds simply present in the account bring income to the trader. They accrue 2.75% annual interest. The safety of funds is guaranteed, as they are held in separate accounts at ABN AMRO Clearing Bank and insured for up to €100,000.

Client support is multilingual, and managers are available by phone and email daily at any time. Deposits and withdrawals can be made via bank transfer, Visa and Mastercard cards, or electronic payment systems with no broker fees. Unfortunately, there is no demo account or analytical tools. However, there is a Knowledge Center with a large volume of basic and advanced information.

Based on the above, the BUX neobroker and its commitment to constant development persuade me to recommend it for exploration by all traders.

Dynamics of BUX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Some brokers offer their clients the opportunity to earn passive income. It is often copy trading, while PAMM and MAM accounts are much less common. Are there financial risks for the trader? Of course! In the case of an unsuccessful signal provider or account manager’s choice, not only will it be impossible to earn, but losses will also be inevitable. BUX stands out from its competitors by offering a truly risk-free option.

Interest on deposits

Such an investment offer can always be found at banks, but this is a rarity for brokers. However, it's quite logical, considering that BUX already actively works with ABN AMRO and will soon be acquired by this major Dutch financial conglomerate. Interest accrues at 2.75% per annum on funds stored in accounts and not used for trading. Calculation is done daily, and payouts are made monthly.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trading Conditions for BUX Users

The BUX broker has only one account type, and a minimum deposit of at least €5 is required. With fractional shares available, such an amount would allow some trades. However, substantially more capital will be necessary if the goal is to make significant profits. Leverage is not provided. This means that the trader always trades solely with their own funds. The company's technical support operates 24/7, responding via email and phone, and supports multiple languages.

€5

Minimum

deposit

no leverage

Leverage

24/7

Support

| 💻 Trading platform: | BUX Zero |

|---|---|

| 📊 Accounts: | Standard |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa and Mastercard, payment systems |

| 🚀 Minimum deposit: | €5 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No (commission only) |

| 🔧 Instruments: | Stocks, ETFs, ETCs, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | One real account, more than 3,500 assets from four groups, proprietary trading platform for mobile trading, automatic investment, accrual of interest on funds that are not used in trades |

| 🎁 Contests and bonuses: | Yes |

BUX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | €0, €0.99, or €1.99 | No |

Additionally, there is a monthly service fee of €2.99. However, withdrawals are made without a broker fee. The client must independently clarify whether there is a fee from the bank or payment system. This is to avoid any misunderstanding later on as to why one amount was deducted and a slightly smaller amount was received.

The table below provides data on the average trading costs for traders cooperating with BUX when compared to its two leading competitors.

| Broker | Average commission | Level |

| BUX | $1.2 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed review of BUX

BUX rightfully holds a place as one of Europe's leading neobrokers. It has been operating for about 10 years and serving hundreds of thousands of traders. Advanced financial technologies are implemented, and the proprietary trading platform is convenient, intuitive, and functional. Additionally, BUX has a close relationship with the renowned Dutch bank ABN AMRO, which will soon be acquiring BUX. This should significantly strengthen the platform's potential and further accelerate its infrastructure development.

BUX by the numbers:

-

Minimum deposit is €5.

-

More than 3,500 financial instruments to trade.

-

Trading fees start from €0.

-

The annual passive income is 2.75%.

-

The broker covers 8 countries.

BUX is a broker for comfortable trading with minimal risks.

Reducing trading risks is facilitated by a portfolio that includes varied assets. This allows for mitigating the negative trend of one or several assets through the stability and progress of others. BUX offers stocks, ETFs, ETCs, and cryptocurrencies, totaling over 3,500 instruments. Such diversity is sufficient for quality diversification. The company allows for many trading methods and strategies, from using advisors to scalping and hedging. Transactions are executed promptly. Client funds are secure and protected. Deposits are held in ABN AMRO Clearing Bank and insured for up to €100,000.

BUX’s analytical services:

-

Automatic investing. A trader needs to set up his investment plan in the app and specify the monthly payment amount, priority stocks, and ETFs. Then, it is enough to make small adjustments from time to time.

-

Passive income. The neobroker pays out 2.75% on funds that are not used in trading. This is the responsibility of the leading Dutch bank ABN AMRO, and all guarantees come from it.

-

Knowledge Center. A large selection of extremely useful informational and analytical materials is available. Additionally, all the platform’s features are covered.

Advantages:

Trading volumes of any size are done without significant commissions and no restrictions on strategies.

The platform offers a wide range of European and American company stocks, with all popular ETFs and ETCs available.

The proprietary mobile app features extensive functionality and is constantly being improved in response to client requests.

The company is licensed and operates under the supervision of the Dutch Financial Markets Authority, providing unquestionable guarantees of reliability, transparency, and security.

The professional level of technical support specialists is high, and they are always ready to help.

Guide on how traders can start earning profits

If a broker offers multiple account types, choosing between them can be quite challenging. However, BUX offers only one account, so this question does not arise for the trader. The same goes for the trading platform, as only BUX Zero is available for mobile devices. It is advantageous for traders to study the platform's offerings, such as the conditions for order types, the potential of automatic investing, security aspects, and much more. Clients should first determine the amount they will use in trading, considering that leverage is not provided. Plus, consider the possibility of passive interest income from the deposit.

Account type:

One of the main drawbacks of BUX is that a demo account is unavailable. However, fractional shares can be purchased, so the broker can be studied and strategies experimented with minimum risks.

Bonuses from BUX

At the time of writing this review, the company offers one benefit for traders upon registration. Each trader will receive a stock ranging from €1 to €200. However, bonuses on deposits and other bonuses directly from Bux are absent.

TU rebates

It is very easy to make trading with this broker more profitable. Register on the TU website and, by accessing the user account, find the affiliate link there. Follow it to the BUX website. Open a real account. Follow the simple instructions, and link it to the Traders Union account. As a result, a part of the commissions charged on all transactions will be automatically refunded to you. These rebates are free and do not result in any trading restrictions, only savings.

Investment Education Online

Traders need to constantly study expert materials, and learn from the experience of professionals. Only in this way can they keep up with market trends, understand trading tools, and use current gyrations to their advantage. BUX provides its clients with access to the Knowledge Center, where they will find a lot of useful and relevant training information.

The selections are extensive, and the articles are conveniently categorized. Beginners should not limit themselves to the Knowledge Center, as it is important to use other third-party sources, but its capabilities should not be ignored either.

Security (Protection for Investors)

Everything is simple. If a broker is registered, it means it operates legally and can be trusted. Regulatory oversight protects traders' interests during disputes and conflicts. The company BUX BV is registered with the Chamber of Commerce of the Netherlands under number 58403949. Its regulator is the AFM. It's also worth noting the close collaboration between the broker and ABN AMRO bank, which protects clients' funds and data.

👍 Advantages

- The broker has been in the market for a long time

- The broker is officially registered

- The broker is regulated by the Authority for the Financial Markets of the Netherlands

👎 Disadvantages

- The competence of the regulator extends only to some EU countries

Withdrawal Options and Fees

-

A clear, well-tested strategy and deep diversification of risks have led consistently to profitable trading by its clients.

-

Funds can be withdrawn at any time and in any amount, large or small, either fully or partially.

-

The broker does not charge a commission for this transaction type.

-

Withdrawals are processed to a bank account or card through electronic transfer systems.

Customer Support Service

Traders sometimes encounter situations they cannot resolve independently. In such cases, they turn to the broker's specialists. A prompt and competent response leaves them with exclusively positive impressions. Otherwise, disappointment is inevitable, possibly leading to rejection of the company’s services. Realizing this, BUX pays special attention to the quality of technical support. It works 24/7 and is available by phone and email.

👍 Advantages

- Technical support operates 24/7

- Support handles requests from unregistered clients as well

- Highly professional support managers

👎 Disadvantages

- There is no live chat available

- Responses via email arrive within 24 hours

Here are the current contact channels:

-

Phone;

-

Email.

There are also accounts on X, LinkedIn, YouTube, and Instagram. Traders can also request support through them.

Contacts

| Registration address | Plantage Middenlaan 62, Amsterdam, 1018DH, Netherlands |

| Regulation |

AFM |

| Official site | https://getbux.com/ |

| Contacts |

Email:

support@bux.com.

Phone: +31 (0) 70 333 8 999 |

Review of the Personal Cabinet of BUX

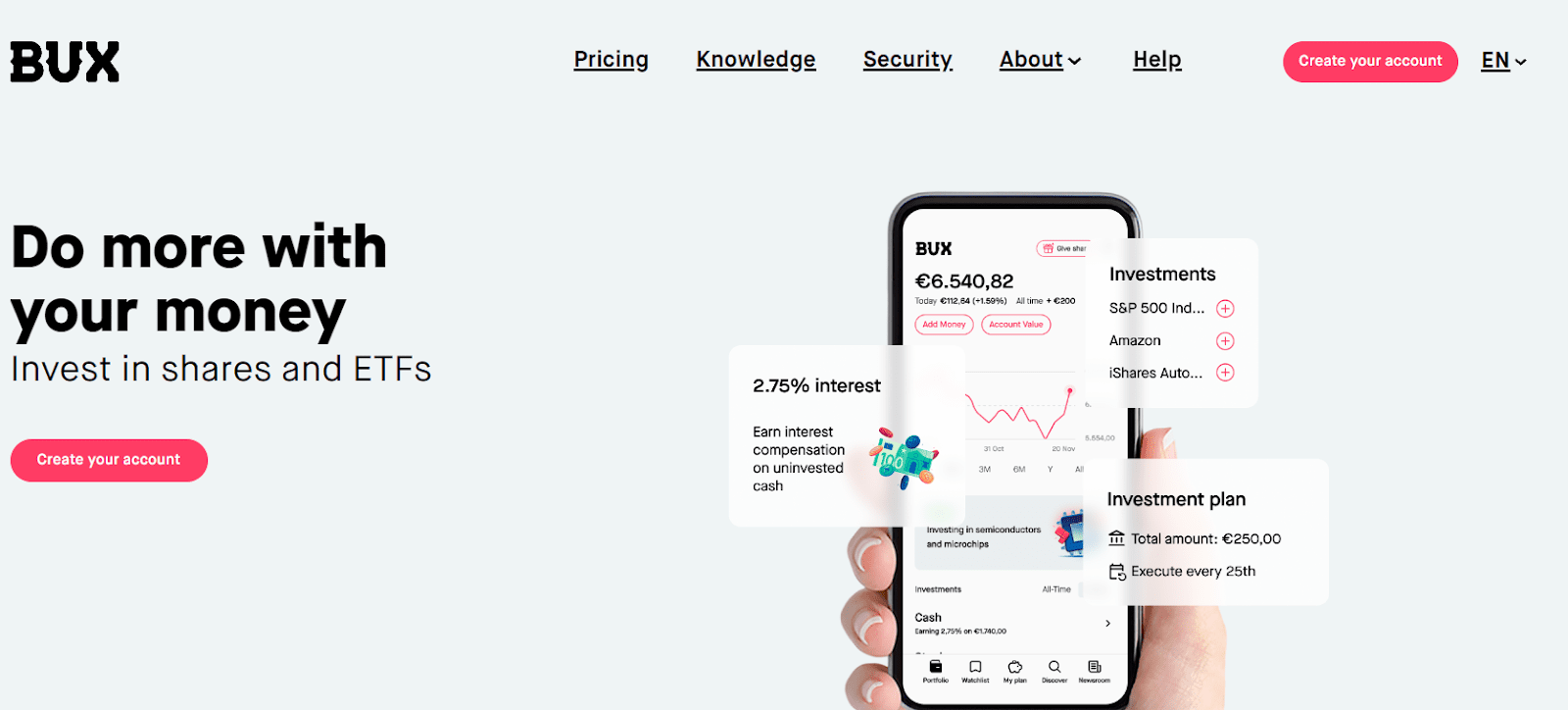

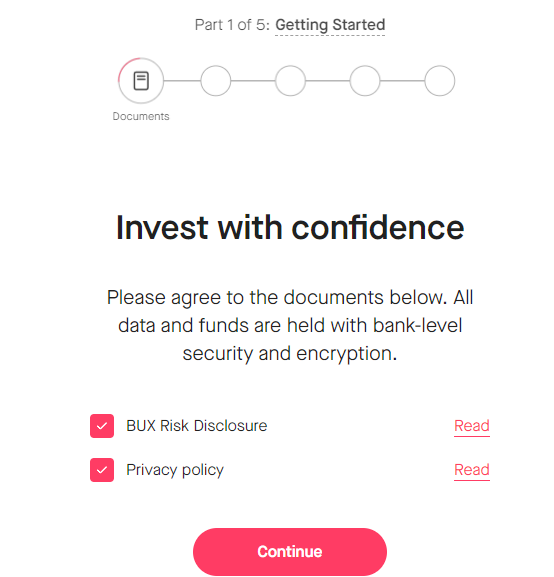

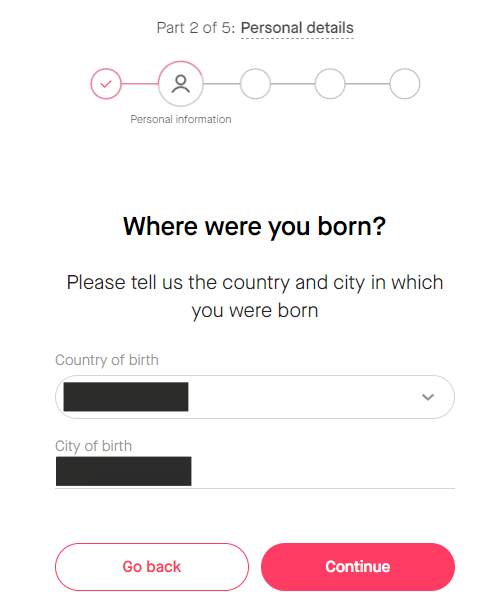

This process involves several standard steps.

Go to the broker's website. Select the interface language in the top right corner: English, German, Dutch, French, Spanish, or Italian. Then click on the "Create your account" button.

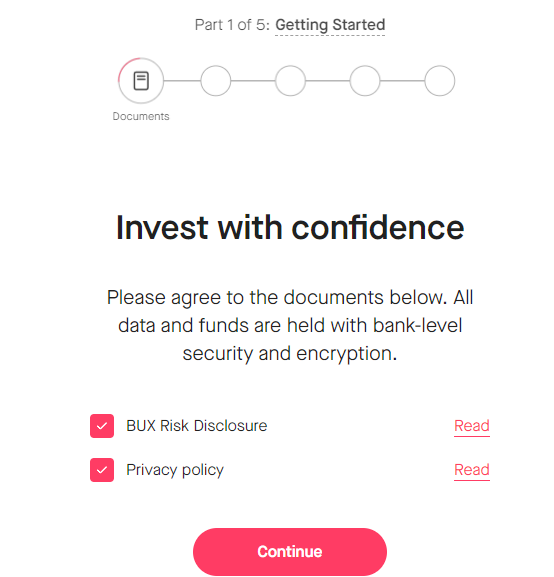

Read the cooperation terms and agree to them by checking two boxes. Click "Continue".

Enter your email address and confirm it by following the link from the email.

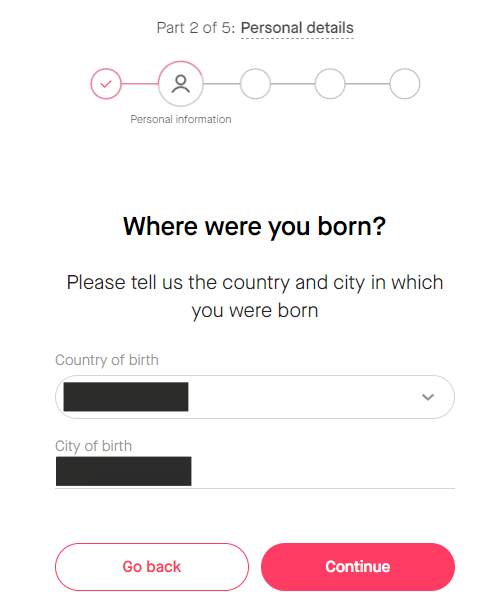

Enter your first and last names, date of birth, gender, and nationality. Specify your country and place of birth, as well as residence. Complete the identity verification by providing scans or photos of the requested documents.

Download and install the BUX Zero mobile app from Google Play or the App Store. Open an account and deposit funds into it. Start trading.

Disclaimer:

Your capital is at risk. Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the BUX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about BUX you need to go to the broker's profile.

How to leave a review about BUX on the Traders Union website?

To leave a review about BUX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about BUX on a non-Traders Union client?

Anyone can leave feedback about BUX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.