Interactive Brokers Hong Kong Review in 2024

Interactive Brokers is a famous U.S. investment company, which was founded in 1977 by Thomas Peterffy. Over the last 40+ years, it has grown to become one of the leading securities firms. With $10.01 billion dollars of equity capital, Interactive Brokers has shown that it is worthy of your time and money. Furthermore, their Hong Kong branch has continued that trend of success and smart investment.

Interactive Brokers Hong Kong - General Information

Interactive Brokers Hong Kong is great for active traders with low per-share pricing. It’s an advanced trading platform and offers a huge selection of tradable securities, which includes foreign stocks, as well as ridiculously low margin rates.

-

💰 Account currency:

USD, EUR, GBP, AUD, NZD, CAD, CZK, PLN, DKK, HKD, HUF, ILS, NOK, JPY, MXN, SGD, SEK, CHF, CNH

-

🚀 Minimum deposit:

No

-

⚖️ Leverage:

Depending on the asset

-

💱 Spread:

From 0 pips

-

🔧 Instruments:

Stocks, options, currency, futures, bonds, metals, ETF, mutual funds, Robo-portfolios, CFD, EPF, hedge funds

-

💹 Margin Call / Stop Out:

Depending on the asset

Pros and Cons

👍 Pros

• A wide variety of investment selections.

• Great research and robust tools.

• Over 7,000 mutual funds without transaction fees.

• Easy access to 135 markets spread around 33 countries.

• A great selection of training material.

👎 Cons

• The website can be difficult to navigate.

• Support services don’t respond on Saturdays and Sundays.

Interactive Brokers Hong Kong Review

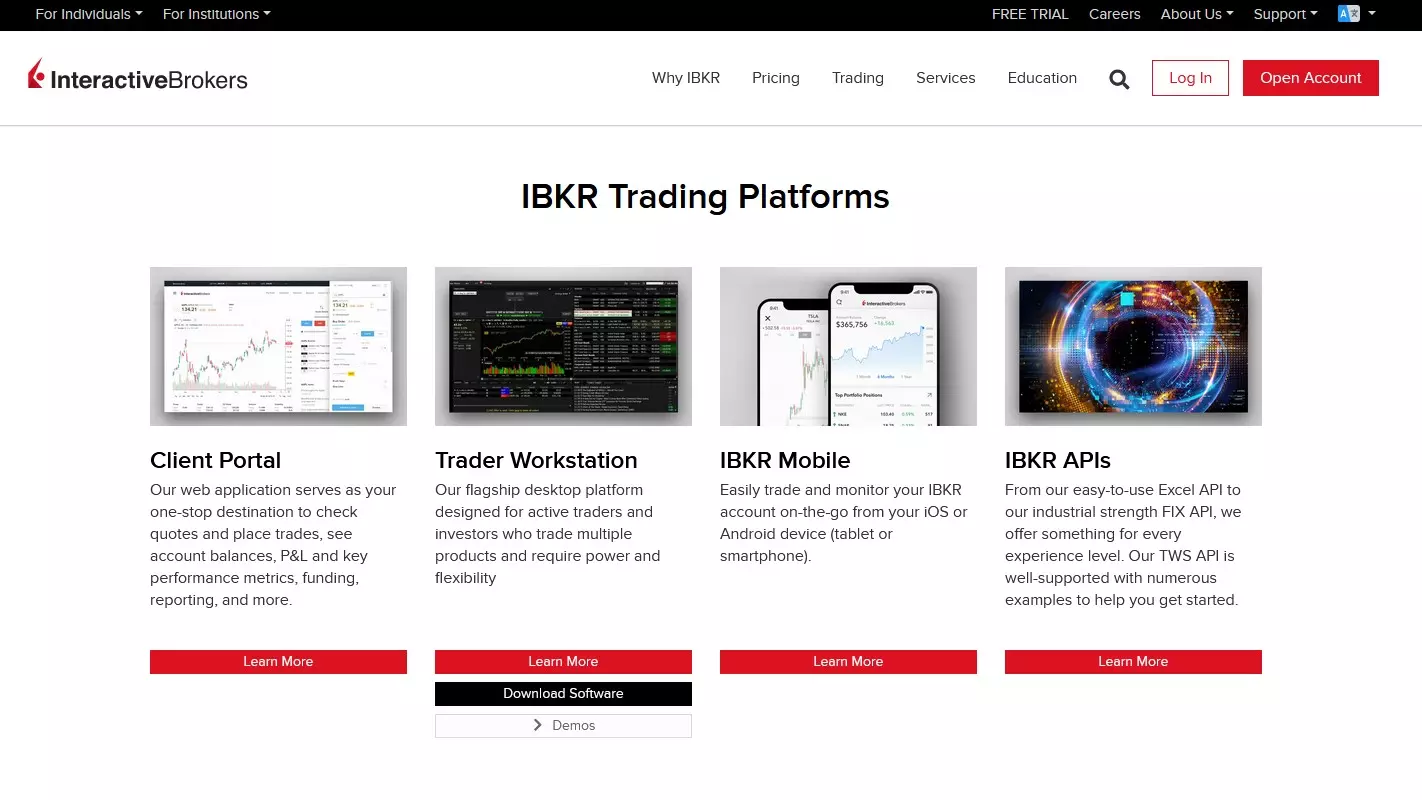

Photo: Interactive Brokers platform

Interactive Brokers Hong Kong is a well-known establishment both locally and abroad. These brokers provide services all over the world and offer both investors and traders the best possible condition to enlarge their capital.

For trading, these brokers offer the use of their Client Portal web platform, as well as the IBKR Mobile app, the TWS for PC, and even the IBKR API for creating your own trading software. Among their services they also offer investors’ platforms, mutual fund platforms, bond platforms, portfolio analysts, and even interactive advisors.

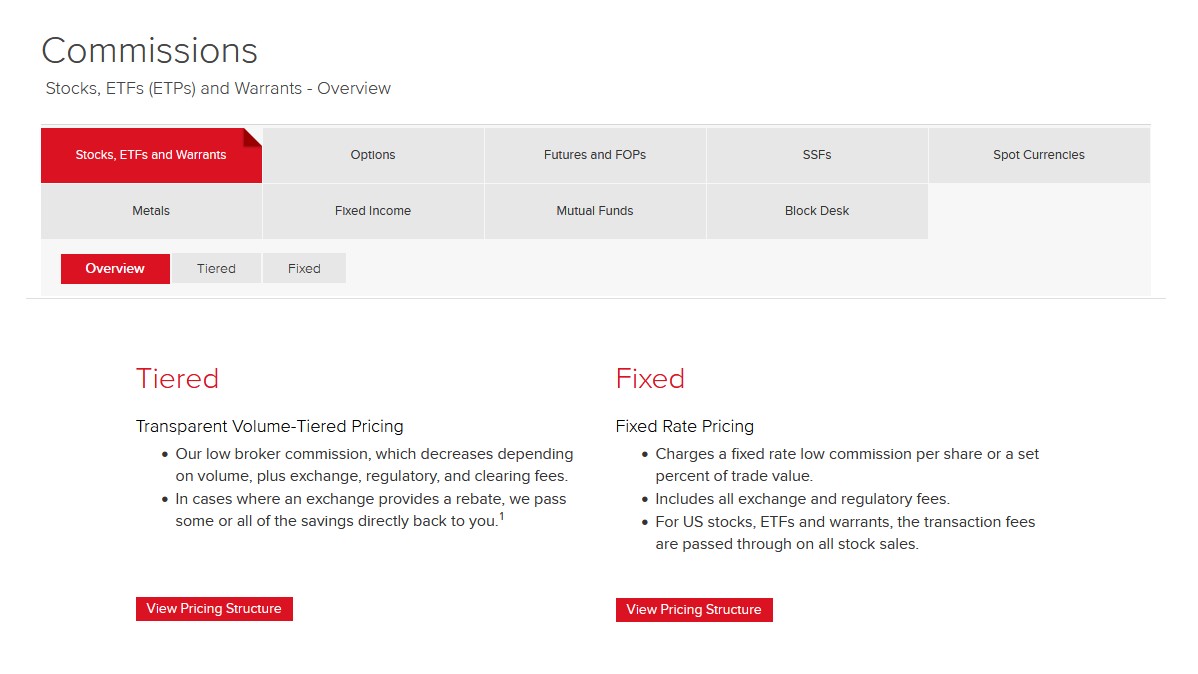

Broker’s Fees

Tiered pricing is transparent and has low broker commissions, which results in decreased fees based on the volume traded. This is in addition to standard exchange, clearing, and regulatory fees. If any exchanges provide a rebate, they pass along a part or all of the savings back to you.

Fixed pricing is a simple, transparent amount per share. It includes all of the IBKR commissions, clearing and exchange fees, as well as regulatory transaction fees.

US Stocks and ETFs

The tiered commissions for the U.S. are as follows:

| Commission per Share | Share Volume (per month) |

|---|---|

USD 0.00351 |

≤ 300,000 |

USD 0.0021 |

> 300,001, < 3,000,000 |

USD 0.00151 |

> 3,000,001 < 20,000,000 |

USD 0.0011 |

> 20,000,001 < 100,000,000 |

USD 0.00051 |

> 100,000,000 |

While the fixed commissions are a simple $0.005 per share.

Hong Kong Stocks

The tiered commissions for Hong Kong stocks are as follows:

| Fee per Trade Value | Hong Kong Warrants, Structured Products |

CNH-Denominated | All Other | Monthly Trade Value (HKD) |

|---|---|---|---|---|

0.050% |

HKD 12.00 |

CNH 15.00 |

HKD 18.00 |

≤ 15,000,000 |

0.050% |

HKD 10.00 |

CNH 10.00 |

HKD 12.00 |

>15,000,000.01 < 300,000,000 |

0.030% |

HKD 8.00 |

CNH 7.00 |

HKD 8.00 |

>300,000,000.01 < 900,000,000 |

0.020% |

HKD 6.00 |

CNH 5.00 |

HKD 6.00 |

>900,000,000.01 < 2,000,000,000 |

0.015% |

HKD 4.00 |

CNH 3.00 |

HKD 4.00 |

> 2,000,000,000 |

The fixed commissions vary depending on the product:

| Fee per trade value | Minimum per Order | Product |

|---|---|---|

0.081% |

HKD 18 |

SEHK Stocks |

0.081% |

HKD 10 |

SEHK Warrants, Structured Products |

0.081% |

HKD 15 |

Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect Stocks |

Options

For options, Interactive Brokers Hong Kong offers both tiered and fixed fees as well and has a minimum of $1. These options fees vary depending on the region:

United States - Smart Routed Tiered Commissions

| Commissions per contract | Contract Volume (per month) |

|---|---|

≤ 10,000 |

|

USD 0.25 |

Premium < USD 0.05 |

USD 0.50 |

Premium ≥ USD 0.05 and Premium < USD 0.10 |

USD 0.65 |

Premium ≥ USD 0.10 |

> 10,001 < 50,000 |

|

USD 0.25 |

Premium < USD 0.05 |

USD 0.50 |

Premium ≥ USD 0.05 |

> 50,001 < 100,000 |

|

USD 0.25 |

All Premiums |

≥ 100,001 |

|

USD 0.15 |

All Premiums |

United States - Direct Routed

| Commissions per contract | |

|---|---|

USD 1.00 |

All Premiums |

However, for Hong Kong itself, only fixed commissions are available.

Hong Kong - Fixed Commissions

| Commissions per contract | Minimum Per Order | Options Type |

|---|---|---|

HKD 30.00 |

HKD 30.00 |

Index Options |

Stock Options |

||

0.21% of option value + HKD 1.00 |

HKD 18.00 |

SEHK Tier II Options |

0.21% of option value + HKD 0.50 |

HKD 18.00 |

SEHK Tier III Options |

0.21% of option value + HKD 3.00 |

HKD 18.00 |

All other stock options |

HKD 20.00 per contract |

HKD 20.00 |

HHI, HSTECH |

HKD 17.00 per contract |

HKD 17.00 |

MHI |

Forex

Interactive Brokers Hong Kong has low commissions with no mark-ups for quotes, as well as tight spreads that are as narrow as 1/10 of a PIP. The fees are tiered and based on a combined monthly trade value of the spot currency trades.

Interactive Brokers Hong Kong managed to combine more than 60% of the world’s market share for interbank markets by combining data from 17 largest forex dealers. This means that the displayed quotes are as small as 1/10 PIP. Interactive Brokers Hong Kong goes through the various prices that it gets before charging a separate but low commission. That allows for a transparent pricing structure instead of mark-ups for quotes.

0.20 basis point × Trade Value |

USD 2.00 |

≤ 1,000,000,000 |

0.15 basis point × Trade Value |

USD 1.50 |

>1,000,000,000.01 <2,000,000,000 |

0.10 basis point × Trade Value |

USD 1.25 |

>2,000,000,000.01 <5,000,000,000 |

0.08 basis point × Trade Value |

USD 1.00 |

> 5,000,000,000 |

Trading Assets

Photo: Interactive Brokers trading assets

Interactive Brokers Hong Kong offers a lot of various trading assets. Through this company, you can trade stocks, indices, metals, ETFs, options, futures, bonds, spot currencies, mutual funds, as well as other assets. You can trade in 23 different currencies and options.

Market-wise, Interactive Brokers offers access to 135 markets in 33 different countries. That includes all of the major players like Hong Kong, the U.S., Russia, various European countries, Japan, Singapore, India, Canada, and many others.

Is Interactive Brokers Hong Kong Regulated? Is This Сompany Safe?

Photo: Interactive Brokers regulatory information

Now, to explain this in simple terms and avoid all of that legalistic jargon will be hard but bear with us. Interactive Brokers are an agency-only, direct market access brokerage firm. That means that they provide clearance, execution, prime brokerage, and settlement for their customers. They don’t engage in proprietary trading.

The broker regulated by the Hong Kong Securities and Futures Commission, and is a member of the SEHK and the HKFE

When it comes to client protection, the company tracks the amount of securities and cash that is owed to clients daily and separates the funds needed, along with a large buffer. They are also not affiliated with any bank, which makes them more stable in case of worldwide market crises.

Interactive Brokers - Best for Advanced Traders

Advanced traders.

Margin accounts.

Options traders.

Those looking for great research and data.

International investors.

Summary

To end this Interactive Brokers Hong Kong review, we’ll conclude with this — this company is an amazing choice for active traders, especially those that manage to get up into the cheaper tier setups. However, beginners might prefer brokers who have some more educational materials and hand-holding practices.

Top 5 Interactive Brokers Reviews

-

Comment

I am very glad that I found Interactive Brokers, because it is convenient to work with — the service is well made and streamlined, the user account is convenient, and you can trade on different platforms and use robots. There are a lot of tools for traders. In general, their approach to work is serious.

-

Comment

I recently started trading with interactive brokers, but I am already trading on a live account. There is no delay in withdrawing money, the execution is excellent, and they make life easier for traders, as they allow you to trade with different strategies. You can try whatever you want and the choice of platforms is amazing, so there is a space for experiments.

-

Comment

There are no problems with Interactive Brokers. All trading operations are carried out as needed. There is a license and regulators, and that definitely says a lot.

-

Comment

Attempts to successfully invest funds haven’t always brought me the positive results that were promised to me by the brokers with whom I worked. I had to start searching, and those who search always find. I found interactive brokers. As a result, in six months, I doubled the money invested. I hope that I will stay here for a long time.

-

Comment

No worries with Interactive Brokers. I know for sure that the company will not let you down. How many years here and only a positive opinion about Interactive Brokers. Always, on all thematic resources, I advise this company.

FAQs

Are there any fees to open an account?

There are no fees to open an account with IBKR.

How do I contact Interactive Brokers Hong Kong customer support?

Simply by visiting the IBKR support page on their website.

What are the commission costs?

Interactive Brokers Hong Kong offer two types of commissions, tiered and fixed. The numbers vary on the type of commission selected.

Is there a minimum deposit to open an account?

Depending on the account type, yes. Certain account types require minimum deposit amounts.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.