According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MT4

- MT5

- FSA

- CySEC

- DFSA

- FSCA

- 2019

Brief Look at M4Markets

The M4Markets broker offers contracts for difference (CFDs) on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals. This broker provides a free demo account, four real accounts, and an Islamic (swap-free) account option. Spreads and commissions depend on the selected account, with minimum spreads starting from 0 pips and fees from $0. The initial minimum deposit is $5. Traders can use USD, EUR, JPY, or ZAR as the base currency for their accounts. Trading with dynamic leverage up to 1:5000 is available. This broker does not impose restrictions on trading styles and strategies, and traders can use expert advisors. Additional earning opportunities include a copy trading service, MAM and PAMM accounts, and a “Refer a Friend” program. Educational materials and basic analytical tools are also provided. Client support is available 24/7 and offered in 10 languages.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Low entry barrier due to a minimum deposit of $5.

- MT4 and MT5 trading platforms are available.

- This broker offers several hundred assets across seven groups, providing a high-profit potential when combined with dynamic leverage up to 1:5000.

- Traders can expect optimal trading conditions by choosing from four real accounts (plus a swap-free trading option).

- The platform offers various alternative earning options, including joint accounts, copy trading, and a referral program.

- Trader costs are minimized, as some accounts have no trading commissions, and this broker does not charge withdrawal fees.

- Desktop and mobile versions of MT are available, and the copy trading service is presented as an integrated proprietary solution.

- This broker's website features an economic calendar, various calculators, signals, market sentiment indicators, and other tools.

- This broker has an extensive pool of financial instruments, but it's important to note that all of them are CFDs.

- This broker does not cooperate with residents of Cuba, Sudan, Syria, North Korea, and several other countries.

TU Expert Advice

Author, Financial Expert at Traders Union

M4Markets provides a comprehensive range of CFDs across Forex, cryptocurrencies, stocks, indices, commodities, energies, and metals. It supports MT4 and MT5, along with mobile trading options. Traders can choose from a variety of account types with a minimum deposit starting at $5. Leverage is up to 1:5000. M4Markets offers multiple income opportunities, such as copy trading, and charges no fees for withdrawals. Key advantages include a broad asset selection and support for diverse trading strategies.

However, the reliance solely on CFDs can limit diversification, and some traders may find the educational resources basic. Furthermore, regional restrictions may apply. Overall, M4Markets is a suitable choice for traders seeking flexibility and high leverage but may not appeal to those who require access to assets beyond CFDs or seek in-depth educational resources.

We checked the office of the M4Markets brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

Spyrou Kyprianou Ave 78, Limassol 3076

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

M4Markets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, МТ5 |

|---|---|

| 📊 Accounts: | Demo, Standard, Raw Spread, Premium, Dynamic Leverage, Swap Free |

| 💰 Account currency: | USD, EUR, JPY, ZAR |

| 💵 Deposit / Withdrawal: | Bank transfer, Visa, MC, Skrill, Neteller, Perfect Money, FasaPay, and PayRedeem |

| 🚀 Minimum deposit: | $5 |

| ⚖️ Leverage: | Up to 1:5000 (dynamic leverage) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals |

| 💹 Margin Call / Stop Out: | Depends on the account type |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo, four real accounts plus Swap Free Many assets from seven groups (all represented by CFDs) Support for top-end trading platforms Passive income available copy trading service |

| 🎁 Contests and bonuses: | Yes (50% Credit Bonus and rebates from TU) |

Usually, the minimum deposit depends on the selected account type, and the same applies to M4Markets. To open a “Standard” account, a minimum deposit of $5 is required. For the “Raw Spread” account type, a minimum deposit of at least $500 is needed. The highest minimum deposit is for the “Premium” account, requiring a deposit of $10,000 or more. The account with dynamic leverage has the same minimum deposit as the “Standard” account, starting from just $5.

On the “Raw Spread” and “Premium” accounts, the maximum trading leverage may not exceed 1:500, while for the “Standard” account, it is set at 1:1000. On the account with dynamic leverage, the leverage can go up to 1:5000. This broker provides technical support through all major communication channels, operates 24/7, and supports multiple languages.

M4Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

GB North Shields

GB North Shields  AE Dubai

AE Dubai  CU

CU  GB Washington

GB Washington  BM Hamilton

BM Hamilton  AU Sydney

AU Sydney  CA Williams Lake

CA Williams Lake Trading Account Opening

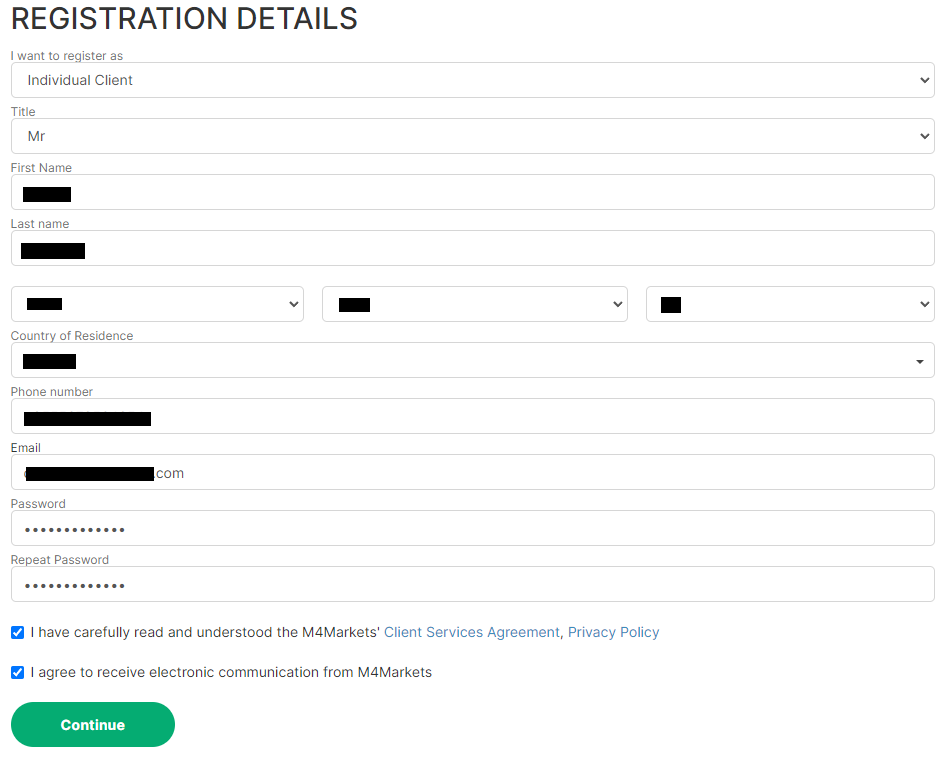

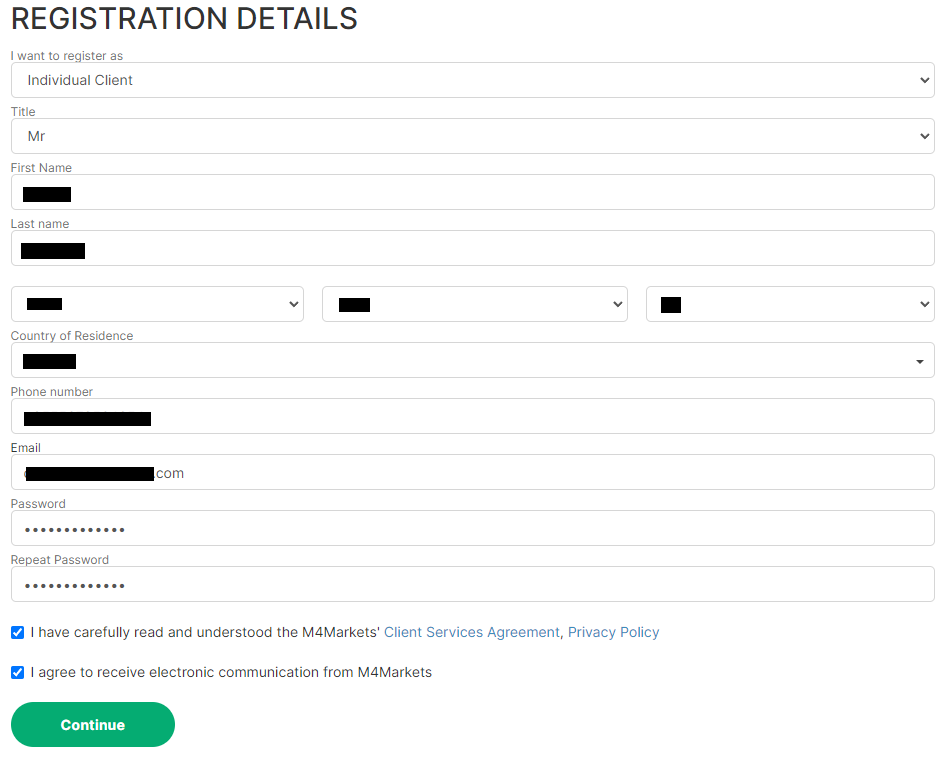

To start collaborating with this broker, you need to register on its official website. Then, you'll need to open a real account, make a minimum deposit, and download the trading platform. Once you log into the platform, you can start trading. The experts at TU have prepared the below step-by-step guide for your convenience. TU experts will walk you through each stage of registration and describe the features of the M4Markets user account.

Go to this broker's website. In the top right corner, select your preferred language. Click on “Open Account”.

Choose the account type (individual or corporate) and your salutation. Enter your first and last names, and date of birth. Specify the country of your residence. Next, provide your contact details, including your phone number and email address. Create a password and enter it twice. Agree to the terms and conditions by ticking the checkboxes at the bottom. Click “Continue”.

You will receive an email with a PIN code to the provided email address. Enter the PIN code in the corresponding field on the website. Alternatively, you can click on the “Confirm Email” button in the email.

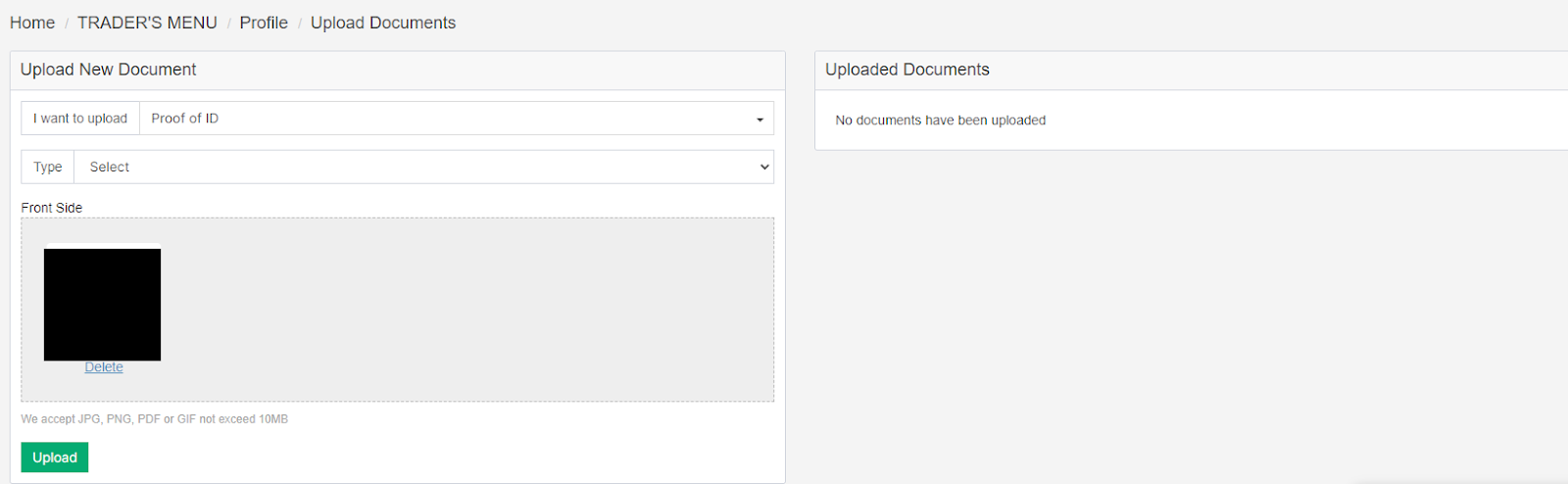

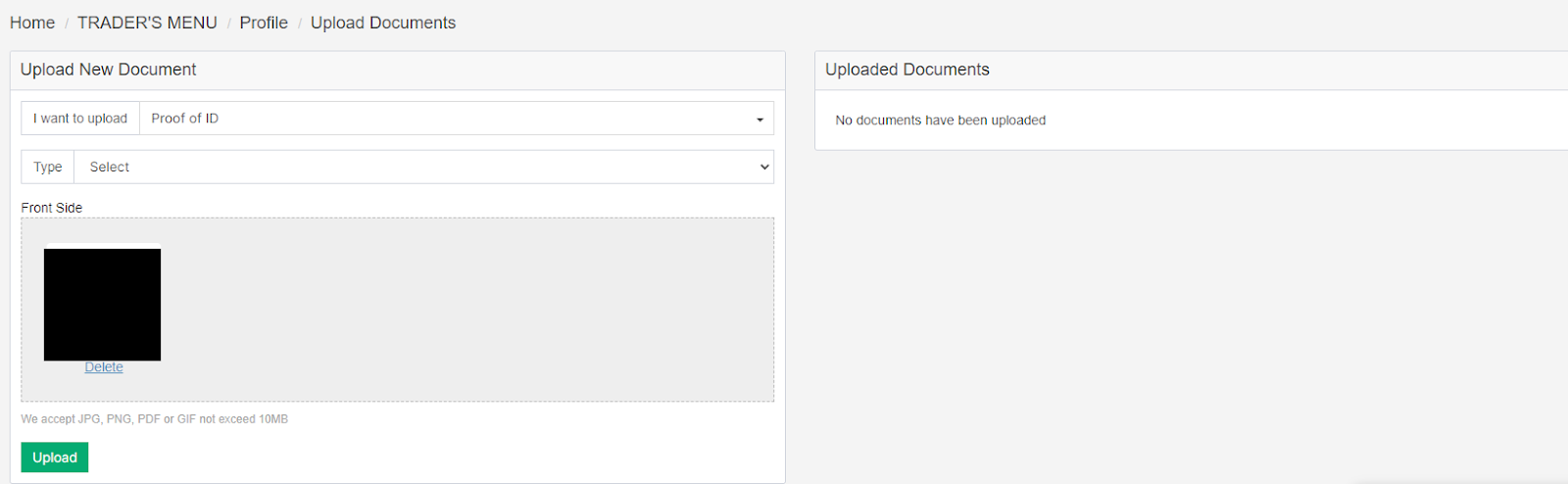

Click on the link at the top of the screen (message prompting verification). On the following page, the required documents will be listed on the right side. Upload their scanned copies/photos, following the on-screen instructions. Wait for the managers to verify the information.

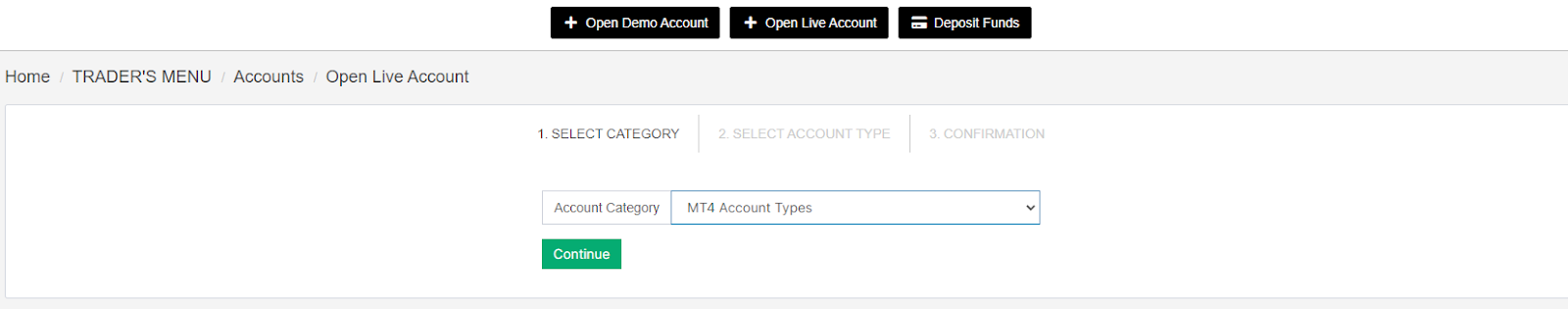

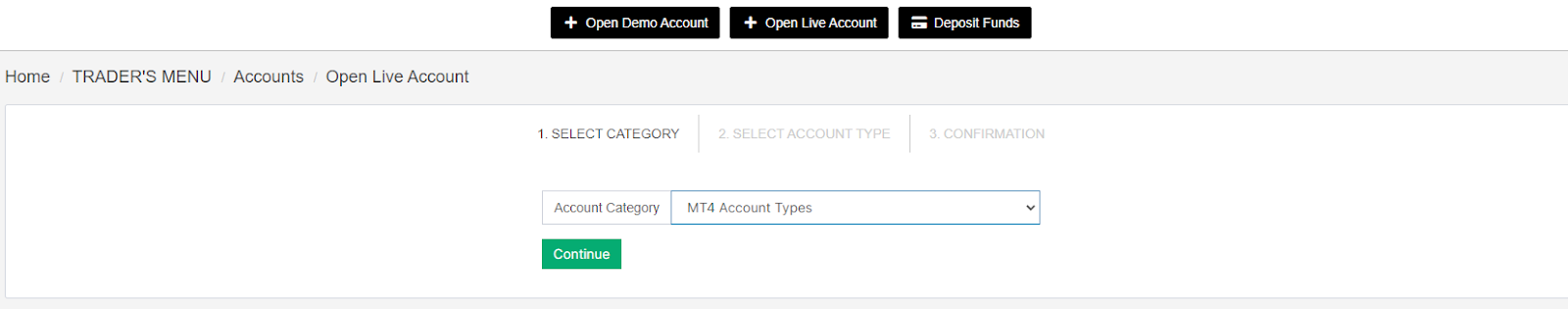

In the top part of the screen, click on the “Open Real Account” button. Choose the account type and its specifications.

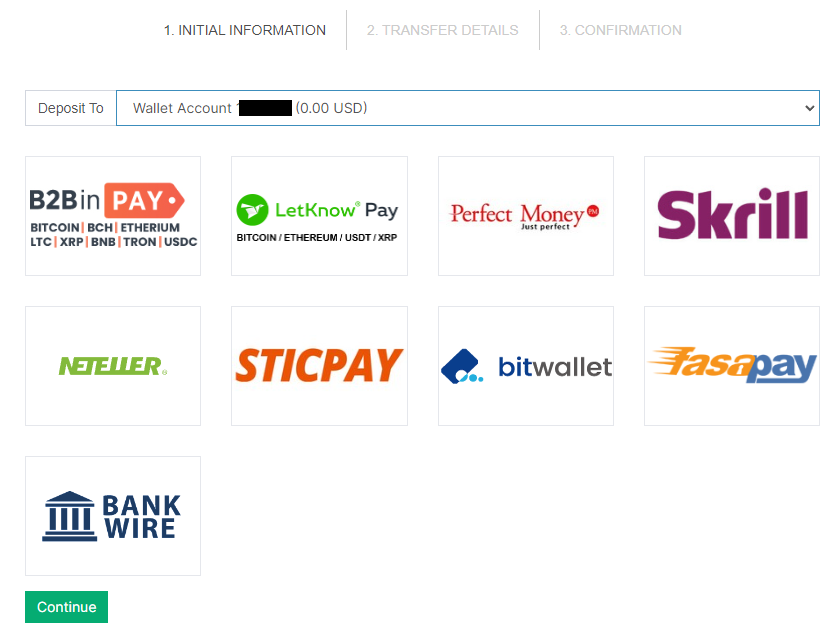

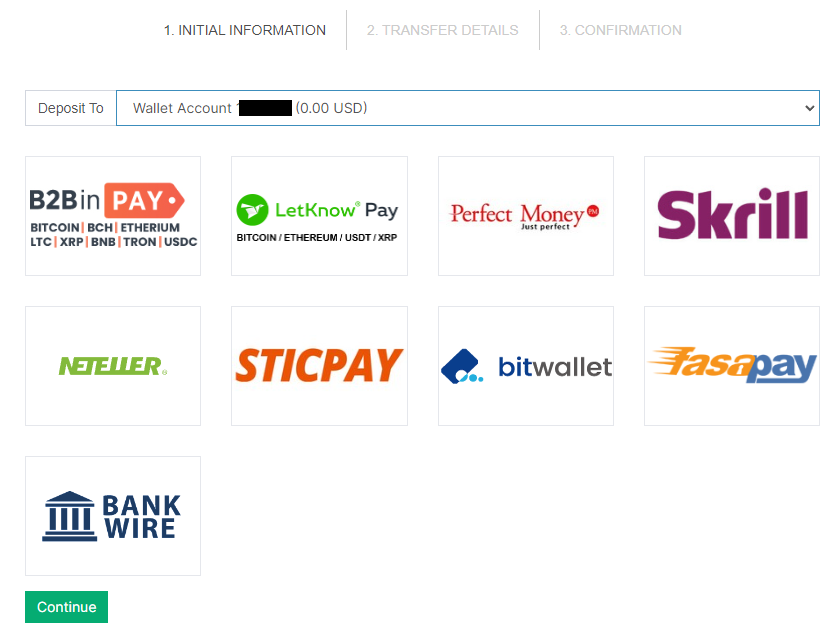

Click on the “Deposit” button in the top menu. Choose a suitable deposit method and follow the on-screen instructions to fund your account.

Go to the “Downloads” section. Select the appropriate trading platform and its version (desktop or mobile). Download the distribution file, install the platform, log in, and start trading.

Your M4Markets user account also provides access to:

Traders can open/close demo and real accounts, with detailed information available for each account.

In the corresponding sections, traders can deposit/withdraw funds and track transaction status.

The “Profile” section allows traders to update personal information and set security parameters.

A separate section provides distributions of available trading platforms which are MT4 and MT5.

Access to joint accounts and copy trading service is available through the user account.

There is a section dedicated to participants of the “Refer a Friend” referral program.

Educational materials, a section for contacting technical support, and a LiveChat are also available.

Regulation and safety

M4Markets has a safety score of 8.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

M4Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

M4Markets Security Factors

| Foundation date | 2019 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker M4Markets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of M4Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, M4Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

M4Markets Standard spreads

| M4Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,4 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,1 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,2 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

M4Markets RAW/ECN spreads

| M4Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with M4Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

M4Markets Non-Trading Fees

| M4Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

First, determine the account type that suits you. The “Standard” account is versatile in most aspects, with no commission and a moderate spread starting from 1.1 pips. The spread is higher only on the “Dynamic Leverage” account, starting from 1.6 pips, but there are no commissions. On the “Raw Spread” account, the commission is the highest at $3.5, but the spread starts from 0 pips. On the “Premium” account, the spread also starts from 0 pips, with lower commissions ($2.5), but the minimum deposit is significantly higher ($10,000 compared to just $500 on the “Raw Spread” account). Also, consider that the accounts differ in margin call and stop-out levels. There are no differences in terms of base currency, trade size, and available assets.

Account types:

The optimal approach is to first open a demo account to familiarize yourself with the platform. Then, open a real account based on your capital, strategic preferences, and ambitions as a trader. Representatives of the Islamic religion can open a swap-free account.

Deposit and withdrawal

M4Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

M4Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Supports 5+ base account currencies

- Low minimum withdrawal requirement

- Bank wire transfers available

- No withdrawal fee

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

What are M4Markets deposit and withdrawal options?

M4Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

M4Markets Deposit and Withdrawal Methods vs Competitors

| M4Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are M4Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. M4Markets supports the following base account currencies:

What are M4Markets's minimum deposit and withdrawal amounts?

The minimum deposit on M4Markets is $5, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact M4Markets’s support team.

Markets and tradable assets

M4Markets offers a limited selection of trading assets compared to the market average. The platform supports 120 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Crypto trading

- Copy trading platform

- No ETFs

- Limited asset selection

M4Markets Supported markets vs top competitors

We have compared the range of assets and markets supported by M4Markets with its competitors, making it easier for you to find the perfect fit.

| M4Markets | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 120 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products M4Markets offers for beginner traders and investors who prefer not to engage in active trading.

| M4Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

M4Markets received a score of 8.65/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Free VPS for uninterrupted trading

- API access for automated trading

- One-click trading

- MetaTrader is available

- No access to a proprietary platform

- Strategy (EA) Builder is not available

- No TradingView integration

Supported trading platforms

M4Markets supports the following trading platforms: MT4, MT5, cTrader. This selection covers the basic needs of most retail traders. We also compared M4Markets’s platform availability with that of top competitors to assess its relative market position.

| M4Markets | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | Yes | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key M4Markets’s trading platform features

We also evaluated whether M4Markets offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 120 |

Additional trading tools

M4Markets offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

M4Markets trading tools vs competitors

| M4Markets | Plus500 | Pepperstone | |

| Trading Central | Yes | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

M4Markets supports mobile trading, offering dedicated apps for both iOS and Android. M4Markets received 3.5/10 in this section, which suggests limited user interest or weak performance of the apps.

- Supports mobile 2FA

- Mobile alerts supported

- Weak user feedback on iOS

- Weak user feedback on Android

We compared M4Markets with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| M4Markets | Plus500 | Pepperstone | |

| Total downloads | 50,000 | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Only those traders who trade regularly and actively study specialized materials can be continuously successful. The theory is equally as important as the practice. That's why some brokers offer educational materials and even full-fledged courses to their clients. M4Markets is no exception. Their website includes a section with e-books, as well as a block with webinars. While the books will be more useful for beginners, even experienced traders will find a lot of interesting content in the webinars. Additionally, there are standard FAQs available to facilitate the use of the platform and trading platforms.

As an additional source of information, the “Expert Hub” can be identified, where besides technical analysis, insights from professional market participants are also published. Moreover, investors connected to experienced signals providers in the copy trading service can gain unique firsthand experience.

Customer support

Technical support is crucial for any company. For brokers, it is especially important because traders often encounter disputed or problematic situations. Whether it's a technical glitch, an unclear aspect of deposit or withdrawal, or something else, occasionally users need to receive prompt and competent assistance. If the client service is not satisfactory in terms of speed or quality, traders can easily become disappointed and switch to a competitor. To prevent this, M4Markets offers various communication options with their technical support such as a call center, email, and LiveChat. All channels operate 24/7, and the specialists are proficient in multiple languages, with their expertise confirmed.

Pros

- You can contact technical support even if you are not a client of this broker.

- Communication through all channels is quite prompt.

- Managers are available 24/7.

- Client service specialists are ready to assist in 10 languages.

Cons

- This broker does not cooperate with residents of Cuba, Sudan, Syria, North Korea, and several other countries.

If you intend to work with M4Markets or are already a client of this broker, you can contact support using the following methods:

-

Request a callback on the website.

-

Email.

-

LiveChat on the website and in the user account.

This broker has official profiles on various social platforms, such as Facebook, Instagram, LinkedIn, Twitter, and YouTube. You can also contact support through any of these platforms. It is recommended to follow at least one profile to stay current with the latest company news.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | JUC Building, Office No. F4, Providence Zone 18, Mahé, Seychelles |

| Regulation |

FSA, CySEC, DFSA, FSCA

Licence number: SD035, 301/16, F007051, 49648 |

| Official site | https://www.m4markets.com/ |

| Contacts |

+248 463 2013

|

Comparison of M4Markets with other Brokers

| M4Markets | Bybit | Eightcap | XM Group | Octa | AMarkets | |

| Trading platform |

MT4, MT5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, OctaTrader | MT4, MT5, AMarkets App |

| Min deposit | $5 | No | $100 | $5 | $25 | $100 |

| Leverage |

From 1:1 to 1:5000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:40 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

100% / 20% | No / 50% | 80% / 50% | 100% / 50% | 25% / 15% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of M4Markets

As the M4Markets platform is owned by the Oryx group of companies, there is no doubt that they have sufficient resources and technologies to provide services by advanced standards. That's why trade execution usually takes place within 30 ms, and besides active trading, this broker offers a range of passive earning options, including its copy trading service. M4Markets uses virtual servers and employs SSL protocols and modern cryptographic methods to ensure data protection.

M4Markets by the numbers:

-

The minimum deposit is $5.

-

The minimum spread is 0 pips.

-

The maximum dynamic leverage is 1:5000.

-

There are 7 types of contracts for difference (CFDs) available.

-

The withdrawal fee is $0.

M4Markets is a CFD broker with convenient working conditions

In addition to this broker's reasonable fees, the number and variety of assets are conceptually important for trading. M4Markets offers hundreds of CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals. This is more than enough to form a diversified investment portfolio, where the negative trend of one asset is offset by the stable and progressive position of others. Moreover, the more instruments available, the wider the strategic opportunities for traders. Plus, this broker does not impose any restrictions against scalping, hedging, news trading, or the use of advisors.

M4Markets’ analytical services:

-

Copy trading. Traders can register as signals providers or investors. Investors copy the trades of the signals providers and pay them a certain commission for the service. They can earn passively with reduced risk and gain unique knowledge and experience.

-

Joint accounts. MAM and PAMM accounts allow managers to control multiple sub-accounts of investors and place trades using combined capital to increase profits. The manager charges a small fee from the investors.

-

Expert hub. Similar to other brokers' “Trading Center” services, M4Markets' Expert Center includes specialized tools such as trading signals and market sentiment analysis, significantly simplifying a traders' work.

Advantages:

It is easy for beginner traders to get started. There is a free demo account, and the minimum deposit for a real “Standard” account is only $5. The MetaTrader platforms are user-friendly, intuitive, and convenient.

Market participants have access to hundreds of assets across seven groups, high leverage, and customizable trading platforms.

This broker maintains a 100% transparent commission policy. Transaction fees are known in advance, and there are no withdrawal fees.

In addition to active earning opportunities, clients can focus on passive income options through managed accounts and copy trading.

The trader's user account is intuitive and comfortable, and technical support is available via call center, email, and LiveChat, providing prompt assistance 24/7.

Latest M4Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i