How To Swing Trade Crypto In 2025?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to swing trade crypto:

Crypto swing trading offers a great way to take advantage of market ups and downs. This strategy involves holding digital assets for short- to medium-term periods, typically from a few days to several weeks, to profit from price changes. However, since the market moves quickly, swing trading calls for a good grasp of charts, trends, and managing risk.

This guide shares crypto swing strategies and tips to help you make informed moves in 2025's unpredictable market. Keep reading.

How to swing trade crypto

Swing trading in the cryptomarket is about capturing medium-term price movements that last anywhere from a few days to several weeks. Swing traders look for medium-term trends in price movements, often relying on on-chain data, like wallet movements, to predict potential price swings.

Here's how to get started:

1. Understand swing trading basics

Swing trading aims to profit from short- to medium-term price swings by buying low and selling high. It relies on technical and fundamental analysis to time entries and exits.

- Pros

- Cons

Less time-consuming than day trading.

Potential for significant gains in volatile markets.

Suitable for part-time traders.

Market volatility can lead to losses.

Requires technical analysis skills.

Risk of overnight price gaps.

2. Choose the right crypto assets

Not all cryptocurrencies are ideal for swing trading. Look for:

High liquidity.

High volatility (but avoid ultra-low market cap coins).

Strong trading volume (prevents slippage).

3. Learn technical analysis

Swing traders rely on charts and indicators. Key tools include:

Trend Indicators like Moving Averages (MA, EMA) and Bollinger Bands, Momentum Indicators and Relative Strength Index (RSI).

Support & Resistance Levels - identify key price levels where assets tend to reverse or consolidate.

Fibonacci Retracement – predict pullback levels.

4. Use fundamental analysis (optional)

While swing traders focus on charts, fundamental analysis can help filter trades:

News & events – regulatory updates, partnerships, or upgrades.

On-chain metrics – whale activity, network usage.

5. Develop a swing trading strategy

Here are three common strategies:

Breakout Trading

Buy when price breaks above resistance.

Sell when price breaks below support.

Range Trading

Buy at support levels and sell at resistance levels.

Trend Following

Use moving averages to ride an uptrend/downtrend.

6. Manage risk & set stop-loss

Risk management tips:

Use a stop-loss: set a limit to minimize potential losses.

Risk-reward ratio: Aam for 1:2 or better.

Avoid overleveraging: high leverage = high risk.

7. Track & adjust trades

Monitor trades regularly but avoid emotional decisions.

Adjust stop-loss/take-profit levels as market conditions change.

Key factors to consider in swing trade crypto

Swing trading in the crypto market requires thoughtful analysis and well-timed decisions. Successful traders rely on a blend of technical analysis, fundamental analysis, and market sentiment to spot opportunities and manage risks.

1. Technical analysis

Technical analysis involves studying historical price data, trading volumes, and market indicators to predict future price movements. It’s essential for timing entries and exits in swing trading.

Key tools and indicators

Moving Averages (MA). Use the 50-day and 200-day MAs to identify long-term trends. A golden cross (short MA crossing above long MA) signals an uptrend, while a death cross indicates a downtrend.

Relative Strength Index (RSI). Measures price momentum on a 0-100 scale. An RSI above 70 indicates an overbought condition (potential sell signal). An RSI below 30 indicates oversold (potential buy signal).

Support and resistance levels. Support - the price level where demand is strong enough to prevent further decline. Resistance - a level where selling pressure may limit further upward movement.

2. Fundamental analysis

Unlike traditional assets, cryptocurrencies are driven by technology, adoption, and market perception. Fundamental analysis helps assess a project’s long-term potential.

Key elements to evaluate

Technology and use case. Analyze the coin’s unique technology and its real-world application. A blockchain offering fast, low-cost transactions may outperform competitors.

Development team and partnerships. Check the team’s track record and strategic partnerships. Experienced developers and alliances with big firms strengthen a project’s credibility.

Revenue streams and tokenomics. Review how the project generates revenue. Look for models that reward token holders through staking, interest, or profit-sharing mechanisms.

Community engagement. A passionate, engaged community often indicates strong market support. Monitor social media, GitHub updates, and user forums for project activity.

3. Market sentiment: reading the crowd

Market sentiment measures how investors feel about the market at a given time. It can influence price swings, making it crucial for swing traders.

Monitor news updates, influencer opinions, and major crypto announcements.

Sudden positive or negative coverage can spark market rallies or sell-offs.

Key crypto swing strategies

Swing trading in the crypto market requires a deeper understanding of trends, volatility, and unique timing. Here are some advanced strategies that can elevate your trading game.

Use Fibonacci retracements for precise entry points. These aren't just random levels but are incredibly effective in crypto markets due to their intrinsic connection with human psychology. When a crypto asset hits these retracement levels, the odds of a reversal or breakout increase significantly, especially when combined with other indicators like RSI or MACD.

Trade the market's volatility with range-bound strategies. Cryptocurrencies are often in constant fluctuation, making them ideal for range-bound strategies. If you focus on markets that have established clear resistance and support zones, you can capitalize on price bouncing between these zones. However, the key is to avoid chasing breakouts, as most crypto assets experience false breakouts.

Monitor on-chain data for swing confirmation. Unlike traditional markets, crypto offers on-chain data like wallet activity, transaction volumes, and miner behavior, which can give you a real-time edge. A surge in wallet inflows or a sudden increase in transaction fees often precedes a significant price move, signaling the best times to enter a swing trade.

Utilize the RSI divergence for deeper insight. While RSI is a standard tool, using it in divergence with the price action gives you a nuanced entry point. If a crypto asset is making higher highs while RSI prints lower highs (or vice versa), it indicates a hidden trend shift, often a precursor to a major price move.

Integrate time-of-day analysis for crypto. Most swing traders focus solely on price action, but timing matters deeply in the crypto world. Certain times of the day, like early hours post-Asian market open or before the US market closes, often see a spike in volume and volatility. Trading during these windows can provide you with better risk/reward setups.

These strategies enable traders to navigate various market scenarios effectively.

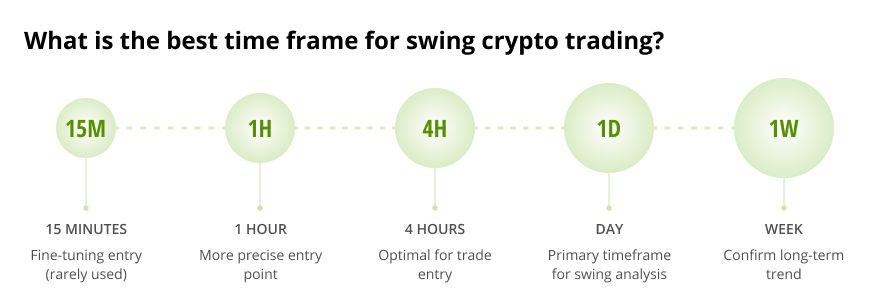

What is the best time frame for swing crypto trading?

Entry & Exit Confirmation (4H - 1D)

4-Hour Chart (4H) – good for spotting short-term swings and breakouts.

1-Day Chart (1D) – best for overall trend direction and trade confirmation.

Trend Analysis (1D - 1W)

Daily Chart (1D) – identifies major trends and key support/resistance.

Weekly Chart (1W) – confirms longer-term trends before making decisions.

Fine-Tuning Entries (1H - 4H)

1-Hour Chart (1H) – good for precise entry/exit timing.

4-Hour Chart (4H) – helps refine entries and spot consolidations.

| Min. Deposit, $ | Coins Supported | Spot leverage | Spot Maker Fee, % | Spot Taker fee, % | Foundation year | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 10 | 329 | 1:10 | 0,08 | 0,1 | 2017 | 8.9 | Open an account Your capital is at risk. |

|

| 10 | 278 | 1:5 | 0,25 | 0,4 | 2011 | 8.48 | Open an account Your capital is at risk. |

|

| 1 | 250 | 1:3 | 0,25 | 0,5 | 2016 | 8.36 | Open an account Your capital is at risk. |

|

| 1 | 72 | 1:5 | 0,1 | 0,2 | 2018 | 7.41 | Open an account Your capital is at risk. |

|

| No | 1817 | No | 0 | 0 | 2004 | 7.3 | Open an account Your capital is at risk. |

Finding the best crypto for swing trading

To succeed in swing trading, it’s essential to focus on cryptocurrencies that have high volatility and are influenced by unique catalysts. Here’s what you need to consider:

Look for emerging blockchain ecosystems. Emerging cryptos in innovative sectors like decentralized identity or tokenized real estate tend to experience higher swings, driven by announcements, partnerships, and user adoption.

Analyze liquidity patterns over time. Focus on coins with high liquidity that are stable over several days. This means they have enough market depth, but also periodic volatility that can trigger rapid swings within a short timeframe.

Track macroeconomic factors influencing adoption. Major economic shifts, like new regulations or country-wide adoption of blockchain technologies, can lead to sudden swings in prices. Cryptos benefiting from real-world problems, such as supply chain inefficiencies, tend to have more volatile movements, especially when global trends shift.

Use on-chain data for price action signals. Unlike traditional trading methods, on-chain data like wallet movements, smart contract activity, or the frequency of large transactions can give precise insights into the next swing.

List of the best crypto for swing trading

Bitcoin (BTC). High liquidity and frequent price swings.

Ethereum (ETH). Strong market presence with consistent volatility.

Solana (SOL). Known for sharp price movements and active development.

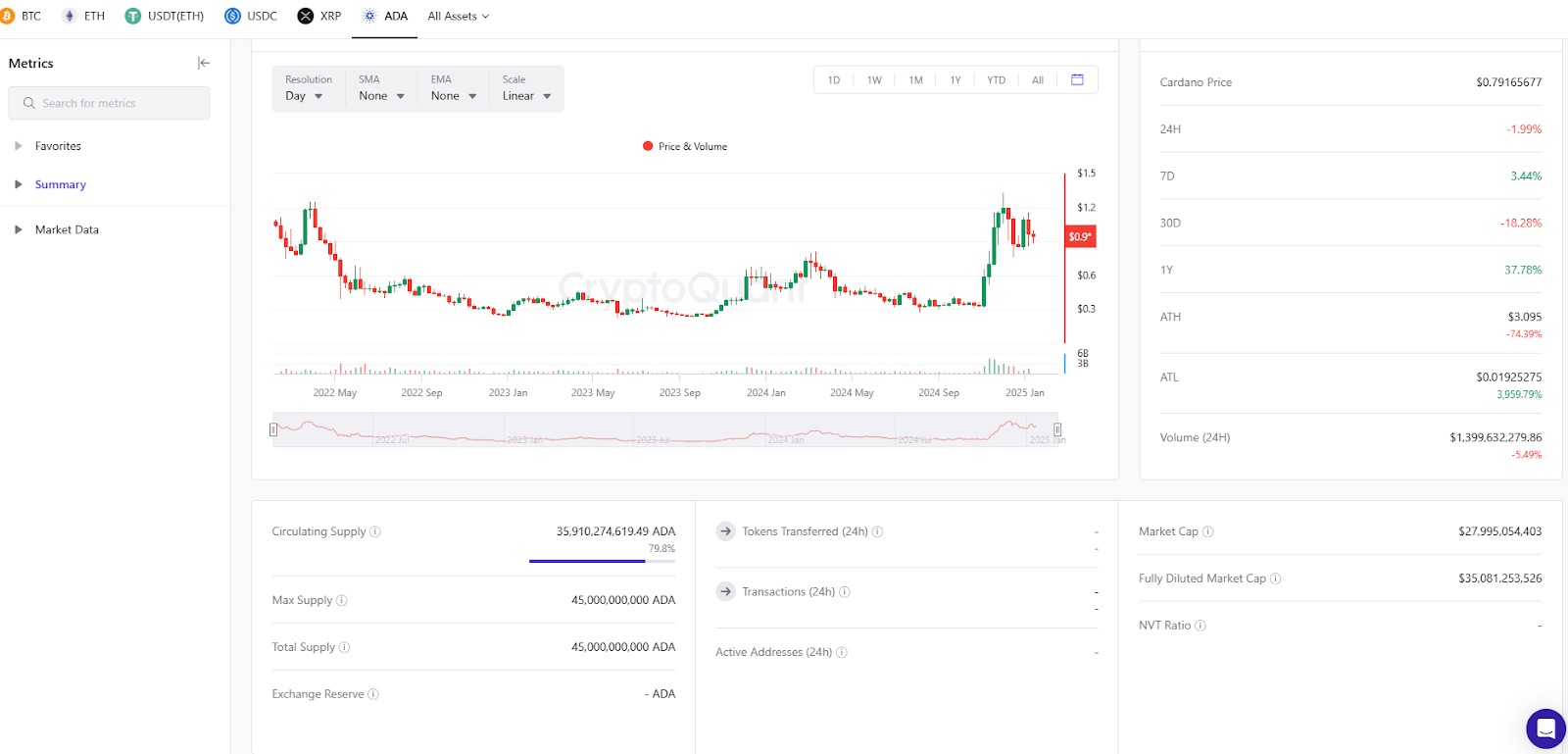

Cardano (ADA). Frequently experiences price swings due to project updates.

Binance Coin (BNB). Strong fundamentals with high trading volume.

Polygon (MATIC). Gaining popularity due to scalability solutions and market interest.

Dogecoin (DOGE). Highly reactive to social media trends and market sentiment.

Advanced swing trading strategies using on-chain data and sentiment analysis

As a beginner swing trader in 2025, your focus should not just be on picking coins with high volatility, but rather on understanding blockchain trends that reveal hidden potential. Watch for cryptos in their growth phase, where the market hasn't fully recognized their value yet. Tools like Glassnode or Santiment can track wallet movements, offering insights into coins being accumulated by big investors. These early indicators, which are often missed by casual traders, can show you where prices might be headed. Look for projects leveraging cutting-edge technologies like zero-knowledge proofs or cross-chain compatibility, as these assets often experience sharp price swings when adoption begins, but they can be overlooked in the early stages.

Another key element for success in swing trading is utilizing sentiment analysis from decentralized sources. Many traders still rely solely on traditional chart patterns and indicators, but these can often miss out on market shifts driven by communities. Some platforms provide valuable insights into social media sentiment, which can help you predict where the market is headed. Also, watch crypto projects with decentralized governance, as major decisions like protocol upgrades or voting outcomes can create massive price movements. By staying ahead of these developments, you'll be able to spot opportunities that others might not even see.

Conclusion

Swing trading cryptocurrency offers a lucrative opportunity to profit from market fluctuations without the stress of day trading or the long-term commitment of HODLing. By leveraging technical analysis, understanding market sentiment, and implementing risk management strategies, traders can maximize their gains while minimizing potential losses.

Success in crypto swing trading requires selecting the best crypto for swing trading, utilizing the best time frame for crypto trading, and following proven crypto swing strategies. By incorporating tools like moving averages, RSI, Fibonacci retracements, and volume analysis, traders can make informed decisions and optimize their trades.

FAQs

How much capital do I need to start swing trading?

You can start with as little as $100, though $1,000 or more is recommended for meaningful profits and better trade flexibility.

Is swing trading risky?

Yes, swing trading carries risk due to crypto market volatility. Proper risk management, stop-loss orders, and portfolio diversification help minimize losses.

How do I choose the best cryptocurrencies for swing trading?

Look for coins with high liquidity, trading volume, and market volatility like Bitcoin, Ethereum, and trending altcoins. Use technical analysis and monitor crypto news for better decision-making.

How much can you make swing trading crypto?

Swing traders can expect 10–30% annual returns with disciplined strategies. Earning 1-2% monthly leads to 12-24% yearly, considered a strong performance. Success depends on market conditions, risk management, and consistent trading practices.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.