How Will Bitcoin ETFs Affect The Price Of Cryptocurrencies?

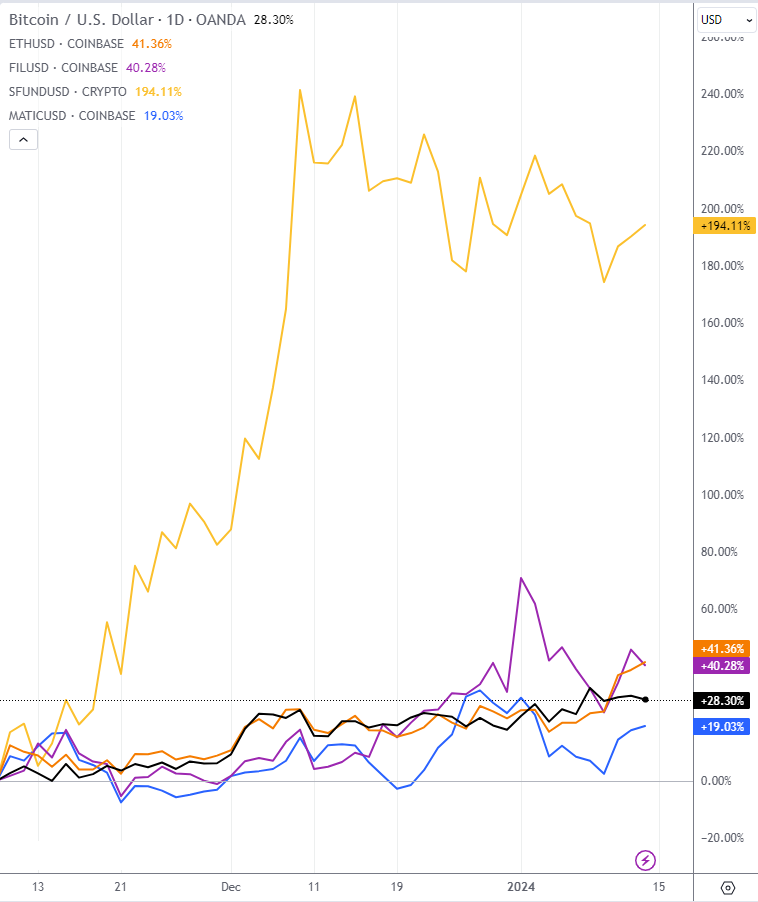

Top 5 crypto to consider buying after bitcoin ETF approval:

-

Bitcoin: The pioneer of cryptocurrencies, Bitcoin offers a stable and widely recognized investment opportunity, further bolstered by the recent ETF approval.

-

Ethereum: Ethereum's vast potential in decentralized applications and smart contracts, makes it a compelling choice for forward-looking investors.

-

Polygon: As an integral solution to Ethereum's scalability challenges, Polygon presents an opportunity to leverage the growth of the Ethereum ecosystem with added efficiency.

-

Filecoin: With its unique approach to decentralized storage, crucial for the future of technologies like decentralized AI, Filecoin is an innovative investment choice in the blockchain space.

-

Seedify Fund: Representing the burgeoning sector of blockchain gaming and NFTs, Seedify Fund offers a high-risk, high-reward investment in early-stage projects within this dynamic market.

The recent approval of a Bitcoin ETF by the US Securities and Exchange Commission (SEC) on January 10, 2024, marks a pivotal moment in the world of cryptocurrency. This groundbreaking decision opens a new chapter for digital assets, potentially transforming the landscape of crypto investment. But what does this mean for the average investor and the broader crypto market?

In this article, we dive into the implications of this historic approval. We'll explore the significance of the ETF for investors, analyze its potential impact on the future of cryptocurrencies, and identify the top five cryptocurrencies to consider in the wake of this development.

Start trading cryptocurrencies with ByBit-

How does a Bitcoin ETF work?

A Bitcoin ETF is a financial instrument that tracks the price of Bitcoin, allowing investors to buy shares of the ETF through traditional stock exchanges without directly purchasing and managing the actual cryptocurrency.

What does ETF approval mean for investors?

The approval of 11 Bitcoin ETFs introduces a paradigm shift in crypto investment. For the first time, investors can gain exposure to Bitcoin through a regulated financial product, a move that bridges the gap between traditional finance and the burgeoning world of cryptocurrencies. This accessibility is a significant stride forward, offering a safer and more familiar entry point for institutional and retail investors alike.

However, there are cons to consider. The introduction of an ETF could lead to increased market volatility, as large inflows and outflows of funds become more commonplace. Additionally, the ETF's reliance on the underlying Bitcoin market means that investors are still subject to the inherent risks and fluctuations of the cryptocurrency market.

The approval of the Bitcoin ETF signifies a major endorsement of cryptocurrencies by a leading regulatory authority. It's a signal to the market that digital assets are becoming a more accepted part of the financial system. This validation is likely to spur further innovations and investments in the crypto space, potentially leading to more stability and growth for cryptocurrencies. Find out what a Bitcoin Spot ETF is and how it works in the TU article.

Best cryptocurrency exchanges

Top 5 crypto to consider buying after bitcoin ETF approval

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Top 5 crypto to consider buying after bitcoin ETF approval

-

Bitcoin (BTC): As the flagship cryptocurrency, Bitcoin remains a top choice for investors, especially following the ETF approval.

-

Ethereum (ETH): Ethereum, known for its smart contract capabilities, stands as a strong contender.

-

Polygon (MATIC): Working in tandem with Ethereum, Polygon offers a solution to Ethereum's scalability issues.

-

Filecoin (FIL): Filecoin presents an intriguing option for those interested in the intersection of cryptocurrency and emerging technologies like decentralized storage and AI.

-

Seedify (SFUND): Seedify offers an exciting albeit riskier investment. As a blockchain gaming and NFT platform, it represents a niche yet rapidly growing sector within the blockchain space.

Bitcoin

Investing in Bitcoin is akin to holding a piece of digital gold. Its first-mover advantage has secured its position as the most recognized and widely accepted digital currency globally. With the recent approval of the Bitcoin ETF, Bitcoin's appeal has broadened, attracting institutional investors and legitimizing its place in diversified investment portfolios.

The underlying blockchain technology of Bitcoin offers a high level of security and transparency, making it a resilient choice against market volatility. Its capped supply at 21 million coins also introduces a scarcity factor, which can potentially drive value appreciation over time.

Moreover, as more businesses and financial institutions adopt Bitcoin for transactions and as a store of value, its utility and demand are likely to increase, further cementing its status as a foundational asset in the crypto world.

Ethereum

Ethereum stands out not just as a cryptocurrency but as a platform for decentralized applications (dApps) and smart contracts, setting it apart in the blockchain space. The investment appeal of Ethereum lies in its foundational role in the world of decentralized finance (DeFi) and non-fungible tokens (NFTs), areas experiencing rapid growth and innovation.

For investors, Ethereum represents not just a cryptocurrency investment but a stake in a diverse ecosystem of applications, making it a strategic choice for those looking to tap into the potential of blockchain technology beyond mere currency.

Polygon

Polygon (formerly known as Matic Network) is an attractive investment for its unique value proposition in the Ethereum ecosystem. It solves a critical issue: Ethereum's scalability. By providing a side-chain scaling solution, Polygon enables faster and cheaper transactions on the Ethereum network, which is essential for the usability and adoption of Ethereum-based dApps and smart contracts.

As the Ethereum network continues to grow, the demand for efficient scaling solutions like Polygon is expected to increase, potentially boosting its value. Polygon's ability to work seamlessly with Ethereum while providing an enhanced user experience makes it a compelling choice for investors looking to benefit from Ethereum's growth while mitigating some of its limitations.

Filecoin

Investing in Filecoin offers a unique opportunity in the cryptocurrency market, particularly for those interested in the burgeoning field of decentralized storage solutions. Filecoin's network provides a secure, efficient, and decentralized storage option, which is increasingly vital in an era where data is king. The platform incentivizes users to rent out their unused storage, creating a market-driven and cost-effective storage solution.

The potential for Filecoin extends beyond just storage. It's poised to play a significant role in the infrastructure needed for decentralized applications, especially in the realm of decentralized AI.

For investors, Filecoin represents an entry into a niche yet essential segment of the blockchain ecosystem, offering exposure to the growing synergy between blockchain technology and data storage demands.

Seedify Fund

Seedify Fund presents an intriguing investment option for those looking to dive into the world of blockchain gaming and NFTs. As an incubator and launchpad, Seedify Fund provides support and funding for blockchain game and NFT projects, placing it at the forefront of this rapidly expanding sector. Investing in Seedify Fund means getting exposure to a diversified portfolio of early-stage projects in the blockchain gaming space, a sector that's witnessing exponential growth.

The appeal of Seedify Fund lies in its potential to tap into the lucrative and dynamic market of gaming and digital collectibles, which are increasingly incorporating blockchain technology for added security and uniqueness.

How to Buy Crypto?

Entering the world of cryptocurrency trading is more accessible than ever. The first step is selecting a reliable and user-friendly trading platform. It's crucial to choose a platform that aligns with your needs in terms of security, transaction fees, and ease of use.

A comprehensive list of the top free crypto trading platforms can be found in our article 9 Best No Fee Crypto Exchanges for 2024.

Once you've chosen a platform, the next steps typically involve creating an account, completing necessary identity verifications for security purposes, and funding your account. This can usually be done through bank transfers, credit cards, or even PayPal in some cases.

To start, many platforms offer educational resources and demo accounts, allowing you to practice trading without financial risk.

Conclusion

In cryptocurrency trading, making informed decisions is key. It's essential to choose trading indicators and strategies that align with your individual preferences and investment goals. Whether you're a risk-averse investor focusing on long-term growth or an active trader looking for short-term gains, understanding your own trading style and risk tolerance is crucial.

As you navigate the crypto market, remember to stay updated with market trends, regulatory changes, and technological advancements. Above all, consider seeking advice from financial experts when needed, and always invest an amount you are comfortable with potentially losing.

Glossary for novice traders

-

1

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

2

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

3

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

4

Crypto trading

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

-

5

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.