Best Forex Copy Trading Platforms and Software for 2024

Best copy trading platform in 2024 - RoboForex

TOP copy trading platforms in 2024:

RoboForex CopyFx — best copy trading software provider by users reviews;

eToro CopyTrader — best copy trading platform in the US;

PrimeXBT Copy Trading — best crypto copy trading software;

AvaTrade — best copy trading app for beginners;

ZuluTrade — one of the best copy trading platforms.

Various traders use the popular copy trading feature when trading in the financial markets. Copy-trading offers an opportunity for new traders to benefit from the proficiency of expert traders by copying their trades. This improves their chance of profiting from reliable strategies rather than losing their investments. Here are the top 8 copy trading software providers in the market today.

Top 8 Copy Trading Software Providers

A table comparing the top 8 copy trading software providers

| Copy Trading Provider | Software | Minimum Investment | Markets | Regulation | Available in the US | Subscription Cost |

|---|---|---|---|---|---|---|

CopyFX |

$100 |

Forex, Stocks, CFDs |

IFSC, CySec, FCA |

No |

Free |

|

eToro CopyTrader |

$200 |

Forex, Stocks, CFDs, Crypto |

CySEC, FCA, ASIC |

Yes |

Free |

|

Own platform PrimeXBT |

$1 |

Cryptocurrencies, currencies |

SVG FSA |

NO |

Free |

|

AvaSocial, DupliTrade, ZuluTrade, MetaTrader MQL5 |

$100 |

Forex, Stocks, Cryptocurrencies, Commodities |

Central Bank of Ireland, ASIC, FSCA, Japanese FSA, ADGM, FRSA |

No |

Free |

|

MT4 |

$100 |

Forex, Stocks, CFD |

FCA, CySec, FSCA |

No |

Free |

|

Auto Copy |

$250 |

Forex, stocks, CFDs on stocks, indices, commodities, cryptocurrencies, ETFs |

Cyprus – CySec, |

Yes |

Free |

|

MetaTrader, cTrader, Myfxbook, and ZuluTrade |

$200 |

Forex, CFDs |

(ASIC) |

Yes |

Free |

|

MetaTrader4, MetaTrader5 |

$10 |

Currency pairs, CFDs on stocks, indices, commodities, commodity futures, cryptocurrencies |

British Virgin Islands – SIBA/L/14/1082 Saint Vincent and the Grenadines |

Yes |

Free |

RoboForex CopyFx - Best Software by Users

Regulated by Belize (IFC), Roboforex is a popular copy trading platform that serves many traders.

Users of Roboforex CopyFx love the platform because of its well-designed and user-friendly interface, convenient and relative analytics for traders and its low minimum deposit. It has a wide network scale of 1400 strategy providers with a minimum deposit of $10. Roboforex charges a percentage on profitable trades, the average being 40% commission on all profitable trades.

RoboForex provides a social copy trading platform that functions as an affiliate program. You can earn a partner commission when referring new subscribers to the strategy provider.

However, the disadvantages of using Roboforex are that the filters are not extensively developed, and the commissions being charged are pretty high, discouraging traders. Also, the broker is registered in an offshore company, which creates doubt in potential traders' minds.

eToro CopyTrader - Best Copy Trading Platform in the US

eToro has an easy-to-use platform that allows traders to duplicate investors' trades across over 2300 instruments, including forex, exchange-traded securities, popular cryptocurrencies, and CFDs. Founded in 2007 and regulated in one tier-2 jurisdiction and two tier-one jurisdictions, eToro is a safe broker for trading CFDs and Forex.

Read more about Copy Trading on eToroAlthough the company recently introduced zero-dollar commissions and cut spreads for US stock trading, eToro is still slightly pricier higher than its competitors. Its primary innovation and product is merging copy trading and self-directed trading within a unified trading experience.

With copy trading on eToro, you can invest in and trade top stocks and ETFs, set up a meeting with your investors, and build your crypto-based portfolio. With a minimum deposit of $50, eToro lets you open four types of accounts: Standard account, Micro account, Islamic account, and the VIP account.

Available on Web Trader, mobile and Tablet apps, eToro’s advantages are that it supports a wide range of assets to trade, has an innovative platform, and is a highly regulated broker (CySEC, FCA, and ASIC). However, the disadvantages of eToro are that the spreads are a bit higher than the average, and it does not have the MetaTrader platform.

PrimeXBT

PrimeXBT Copy Trading module allows you not only to follow the most successful traders but also to learn and gain experience along the way. Copy trading with PrimeXBT is quick, easy, and requires no prior trading experience.

PrimeXBT provides access to a wide range of markets for copy trading, including Forex, cryptocurrencies, stock indices, and commodities. And if you’re on the go, you can use PrimeXBT’s mobile app to access your trading account and monitor your trades – anywhere, anytime.

Copy-trading technology provided by our partner Covesting.io. The Managers trade in public with their own Strategies. The Followers who prefer someone to be trading instead of them subscribe to follow a strategy and profit from it.

AvaTrade

A global brand famous for providing traders with various trading platform options, AvaTrade is an excellent platform for copy trading. It is mobile-friendly and competitive in terms of the industry average for research and pricing. AvaTrade is also a winner for educating its investors.

Founded in 2006, AvaTrade is a safe broker for forex and CFDs trading, regulated in three tier-1 and tier-2 jurisdictions. In terms of commissions, it is not a low-cost trading platform, except for professional traders in the EU. AvaTrade copy trading platforms include its proprietary platforms, MetaTrader, DupliTrade and ZuluTrade for social trading. Its variety of trading platforms gives it a competitive edge.

AvaTrade is preferable because it offers negative balance protection to its traders. It has a global presence with locations in various countries. It is regulated by some of the most reputable financial and forex trading bodies in multiple regions. The disadvantage is that its demo account has a lifespan of 21 days which is relatively short for many traders. Also, AvaTrade charges high inactivity fees, and this discourages casual traders.

ZuluTrade

Supporting over 40 forex brokers, including their integrated solution (AAAFx), Zulutrade is one of the best copy trading platforms because it allows easy linking of existing brokerage accounts with new accounts by investors. Zulutrade also facilitates the filtering of brokers based on minimum deposits.

With ZuluTrade, you can easily download a spreadsheet of all the simulated trades, and it’s free to join, requiring only payment of the spread on trades. ZuluTrade allows copying and sharing of other investors portfolios. Another distinguishing feature of ZuluTrade is that it sends an alert if a margin call occurs.

Founded in 2007 and a minimum deposit of $200, ZuluTrade has a friendly platform interface, and there are lots of traders to copy. The Trader's Union experts have compiled a list of the best forex brokers that allow the use of the ZuluTrade copy trading platform. The pitfalls of ZuluTrade is that the model for trader compensation is not suitable for investors. Also, there are complaints about the illegal sale of customers' details to brokers and frequent copy trade errors.

FXTM

One of the most popular copy trading platforms, FXTM is an international ECN broker with an active presence in African and Asian markets. With a minimum deposit of $100, FXTM Invest is available among a wide range of account types.

One of the key features of FXTM is that you can access all your trading accounts from the same place while trading over 250 financial CFD instruments on the go. FXTM supports cross-device trading between your phone and desktop. This enables you to access live price updates and real-time prices. FXTM is preferable to many traders because it offers commission-free trading and a wide range of education and research. It provides quick deposit and withdrawal, no deposit fee, minimal fees for stock index CFDs.

The disadvantages of FXTM are that it does not provide its trading platform and has a limited product portfolio.

NAGA

Launched in 2015, Naga is a German financial holding company that embraces innovation in the copy trading industry. There are over 500,000 active and passive traders who use the NAGA platform. NAGA has over 950 assets on its platform.

With a minimum deposit of $200, NAGA copy trading platform supports a wide range of trading instruments and offers the opportunity to earn passive income. Users love NAGA because it is registered with the Cyprus Securities and Exchange Commission (CySEC), an authoritative and reliable European regulator.

The disadvantages of using NAGA are that it offers high spreads on standard accounts. They don't offer bonuses like Welcome bonus, and there is a limited choice of payment methods for funding and withdrawing funds.

IC markets

Established in 2007 and used by over 180,000 traders, IC markets offer only an Islamic account and a VIP account to its users. IC markets have a minimum deposit of $200 and no withdrawal fees or inactivity fees, although its deposit fees vary and they charge CFD commission fees.

IC Markets boast of superfast order execution speeds in the range of 40 milliseconds, processing over $15 Billion in trades daily.

IC markets support several trading platforms, including ZuluTrade, MT4, MT5, Mirror Trader, Web Trader, cTrader.

The disadvantage of using IC markets is that it is not FCA regulated and therefore not available in the US. Also, IC markets allow negative balance with the potential of losses exceeding deposits.

InstaForex

InstaForex is an award-winning broker that was launched in 2007 and has over 260 representative offices and locations nationwide. InstaForex EU is fully compliant with European legislation and is regulated by the CySEC.

Read more about InstaForex Copy TradingOne of the reasons traders love InstaForex and it's ForexCopy platform is the sensible leverage availability. The maximum leverage set at 1:30 reflects the EU's regulation on forex trading for retail clients.

Depending on the account, InstaForex has a minimum deposit of $100 and offers MetaTrader4 and MetaTrader5 as their platforms of choice. Additionally, InstaForex provides a Forex Portal App that offers analysis, live quotes, trading signals and other relevant information. They also offer the Forex Courses App that has proven helpful for beginners.

What Is A Copy Trading Software

A copy trading software is a platform that offers newbie traders the opportunity to copy positions from expert traders. Brokers can easily significantly increase their turnover since it presents new opportunities to anyone interested in the financial markets. While successful and expert traders can keep getting paid weekly or monthly by trading on their accounts, newbie traders, less experienced traders, those who don't want to trade, or anyone finding it difficult to make profits can copy the positions of the successful traders.

The primary benefit of copy trading is that it transfers the hard work of analyzing financial markets to others, making it relatively easy to manage your copy account and track results even from your mobile phone.

Copy trading is either offered through proprietary software or third-party platforms. Also, some brokers offer research tools and networking forums — for example, TradingView or Telegram.

How To Use Copy Trading Signals

The first step is to open an account with your preferred trader, and for this article, we will use Roboforex in our illustration. To be an investor on Copyfx, you are required to open a trading account on MetaTrader4 through your Personal Members Area on the RoboForex website. There are different account types, and the most suitable for investing are Pro-Cent, ECN-Pro, Pro-Standard, Pro-Affiliate and Prime.

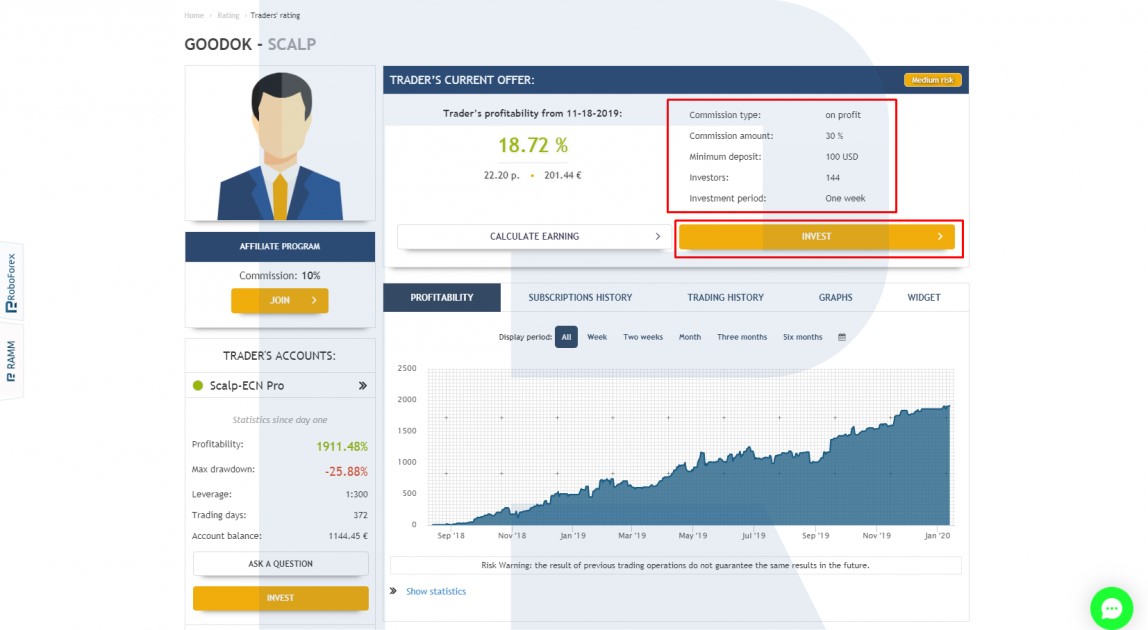

The next step is to select a trader, which is done by comparing and evaluating the work of different traders. There is a special instrument called the rating of traders. The rating shows the assessment of every traders work, and this helps investors decide which trader they will subscribe to. The rating can be found in the PMA and the Copyfx website.

Traders rating on CopyFX

After you have decided on your trader based on your preferences and the rating, you have to subscribe to copy the trades. We access the trader's personalized card in the rating and then evaluate their subscription conditions. These conditions include:

First, check the type of commission fees to determine how they charge, which could either be for the profit without commission fees or on commission fees.

Then, confirm the amount charged by the trader. This is usually a percentage of the profit or a fixed fee for profitable trades.

Also, there is a minimal deposit, which is the least amount you must have in your account for the subscription.

You can also see the number of investors that are already subscribed to the trader.

Finally, the investment period signifies when the commission fee will be deducted from your account.

After accepting all parameters, you can click “Invest” and proceed to your PMA to customize your subscription.

The PMA is divided into the left and right sides, and on the left, you will see the assessment of work the traders account. And on the right, your account is displayed. It's advisable to choose one account for copying if you have several suitable accounts. In the centre of the PMA, choose "set up subscription manually". After choosing your subscription mode, you can then click "Subscribe to trader", and your subscription will be complete.

How To Choose A Copy Trading Signal Provider

Choosing the right copy trading signal provider is important, and here are a few tips to guide you:

a) Reputation

The first factor to consider when choosing a signal provider is its reputation. A copy trading platform with a good track record and longevity in the market will guarantee your success as well as the security of funds. The reviews and ratings by other users of this provider will inform your decision.

b) Leading signal provider

Another factor to consider when choosing a signals provider is to ensure they are world-leading or considered world-leading. You want a provider that is known as an industry leader in terms of innovation. With the right provider, you can easily access an array of markets, trade both through an online platform and through your mobile phone. The best signals provider are the ones that are always looking for ways to improve their competitive advantage.

c) Commissions and Fees

It’s important to know how competitive your provider’s fees are. With various providers in the market comes a variety of charges and dues. Most experienced copy traders make it a point of note to ensure transparency when it comes to how much they are being charged by their signals provider.

d) Payment methods

It is easier and more convenient to trade when your provider offers a wide range of funding methods. Reliable funding facilities make the trading experience and process smooth. Common ways to fund your account include bank transfer, credit card, PayPal, Skrill, Payoneer, Neteller etc. You would need to research the facilities allowed by your preferred provider before making any commitment.

e) Customer support

One of the major determinants of a successful copy trading experience is your broker's customer service. Customer service can be a range of support services, including training, installation, cancellation, upgrading, and troubleshooting a product or service. These services can ensure the correct use of the copy trading platform and make your experience cost-effective.

Channels of communication for most brokers include Phone answering services, Email customer service support and Live chat support.

f) Comprehensive Trader Resources

When choosing a signals provider, the final factor is to ensure they also offer free resources like education, analysis, and risk-management tools.

Is Copy Trading Legal?

Copy trading is the practice of using automated software to replicate or copy investment decisions made by experienced traders or investors. In recent years, it has become increasingly popular due to its convenience and success in yielding results. When it comes to legality, copy trading is legal in the US, UK, and most other countries.

The regulations governing this activity may differ slightly between nations but typically focus on ensuring that investors understand the risks involved with this type of trading. Ultimately, however, there are no current bans or restrictions around using copy trading applications. As long as all regulations are followed, investors can easily enjoy its advantages.

Can I Make Money With Copy Trading?

Yes, it's certainly possible to make money through copy trading on the foreign exchange market. However, to see success, you'll need to do some research and take certain steps for yourself. To start, choose experienced traders with successful trading habits that suit your own risk preferences and financial objectives.

How to Make Money in Forex Without Actually Trading

You may also consider setting up a specific investment plan to manage your funds according to your available capital. Pay close attention to the trades your chosen trader shares, as they are not guaranteed success. The income you generate from copy trading can be influenced by several factors, including:

Choice of Broker

The choice of broker can significantly impact income in copy trading. The broker's commission structure, reliability, and quality of execution can affect the profitability of trades. It is important to choose a broker with low fees, fast and reliable execution, and a good reputation.

Choice of Signal Provider

The performance of the signal provider is one of the most important factors influencing income in copy trading. A signal provider is an experienced and successful trader whose trades are being copied. The trader should choose a signal provider with a proven track record of success, consistent profits, and a low drawdown.

Diversification of Signal Providers

Diversification is an important risk management strategy that can help reduce the impact of poor performance by any signal provider. By copying multiple signal providers, an investor can spread the risk and improve the chances of generating a positive return.

Risk Management

An investor should clearly understand their risk tolerance and carefully manage their exposure to the market. This can involve setting stop-losses, managing leverage, and diversifying across different asset classes.

Is Copy Trading a Good Idea for Beginners?

Copy trading is an excellent way for novice traders to start out in the market without having to put in a substantial investment of both time and money. It allows beginner traders to observe and copy more experienced traders and learn from their strategies, tactics, and expertise. Here are several reasons why copy trading can be great for beginners.

Access to expertise: One of the main advantages of copy trading is that beginners can access the expertise of experienced traders. By copying the trades of successful traders, beginners can learn from their strategies and gain valuable insights into the markets.

Low entry barrier: Copy trading allows beginners to start investing with a low entry barrier. In contrast to traditional investing, copy trading often requires minimal capital and has low fees, making it accessible to a broader range of people.

Reduced learning curve: Copy trading also allows beginners to bypass the steep learning curve associated with traditional trading. By following successful traders, beginners can avoid making common mistakes and quickly gain experience.

Diversification: Copy trading also allows beginners to diversify their investments by copying multiple traders with different strategies. This helps spread the risk and reduce exposure to any single asset or market.

Automation: Copy trading platforms often offer automation features that can help beginners easily manage their investments. For example, some platforms automatically allocate investments among multiple traders and adjust position sizes based on risk management rules.

How Much Money Do I Need for Copy Trading?

The amount of money you need for copy trading can vary depending on the platform you use and the strategy you choose to follow. Some platforms have minimum deposit requirements, which can range from a few dollars to several thousand dollars.

In general, it's a good idea to have at least $100-$400 to use for copy trading, as this will allow for some degree of diversification and reduce the risk of putting all your eggs in one basket. However, you can start with as little as $10 on some platforms.

It's important to keep in mind that copy trading involves risks, just like any other type of investment. While it can be a good way to potentially earn returns without having to research and analyze the markets yourself, it's important to carefully consider the risks and to only invest money that you can afford to lose.

Risks of Copy Trading

While following successful traders can be profitable, it's important to understand the risks involved with copy trading. No one, not even the most experienced investors, can guarantee profits 100% of the time. Markets fluctuate regularly, and strategies that were winning yesterday may not work out tomorrow.

Relying on a single trader is taking a big gamble. If their approach starts underperforming, your entire investment is at risk. Traders may also unexpectedly change their strategies without telling anyone. This could leave copiers holding unattractive positions.

Liquidity is another concern - some trades may end up losing money simply because you can't get out of them quickly during volatile periods. And we all know how unpredictable markets can be.

Then there's always the chance that your broker runs into financial troubles, leaving your funds in limbo. Not fun to think about but a real possibility nonetheless.

In very rare instances, shady operators may try to mislead copiers through dodgy strategies just to manipulate prices.

Diversifying across multiple traders with different styles is key to managing the inherent uncertainty of the markets. No investment strategy removes risk entirely, but spreading your bets in this way can help minimize nasty surprises.

Summary

Traders interested in short term trading or traders with less time to be updated with the market trends benefit more from copy trading. By assessing and filtering traders with a successful track record, the copy trading portfolio management software offers both new traders and professional traders an opportunity to benefit.

With several brokers that provide the copy trading feature for their users, it is important to analyze and study each of the platforms to ensure they are well regulated and suited for your needs.

As a beginner trader, it is best to trade with certified reliable brokers through extensive monitoring. TradersUnion has done the groundwork of monitoring and curating the best brokers for the last ten years, and with over 300,000 participants, you too can get started on your trading journey. Get started with TradersUnion today.

Best copy trading platforms by countries

FAQs

Which copy trading platforms are the best?

There are several copy trading platforms available, and the best one for you depends on your preferences and needs. Some popular copy trading platforms include eToro, RoboForex, and PrimeXTB. These platforms offer various features, such as social trading, low fees, and a wide range of assets to copy. It's essential to do your research and choose a platform that meets your requirements.

Is it profitable to copy trade?

Copy trading can be profitable, but there's no guarantee you'll make money. The profitability of copy trading depends on several factors, such as the traders you choose to copy, the market conditions, and your risk management strategy. It's essential to remember that copy trading involves risks, and you should only invest what you can afford to lose.

Is copy trading good for beginners?

Copy trading can be a good option for beginners who want to invest in the financial markets but lack the knowledge or experience. Copy trading allows beginners to copy the trades of experienced traders, potentially leading to profits. However, it's essential to do your research and choose a reputable copy trading platform and traders to copy. Beginners should also have a basic understanding of the financial markets and risk management strategies.

Is it illegal to copy trades?

Copy trading is legal in most countries, but it's essential to check the regulations in your jurisdiction. Some countries may have specific laws and regulations governing copy trading activities, and it's essential to comply with them. It's also important to choose a reputable copy trading platform and traders to copy, as some fraudulent platforms or traders may engage in illegal activities.

Is copy trading legal?

Yes, copy trading is legal in most countries. However, to ensure you are on the right side of the law, it is best to research your country's available brokers and regulations.

What is the best copy trading platform?

We found RoboForex to be the best and most reliable copy trading platform through our extensive research and data polled from traders.

How do you copy trade?

Using a copy trading platform, traders can automatically copy the trades of the signal providers in real-time.

How do you know the best traders to copy?

Before deciding on who to copy, it's advisable to look beyond the absolute returns and more into other metrics, like the number of traders placed, average profit and loss, and average trade duration.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.