Best Forex Investment Options Without Trading

How to make Money in Forex without actually trading:

Affiliate programs - receiving rewards for attracting new customers.

Copy trading - automatic copying of trades of professional traders to your account.

PAMM/MAM accounts are investor accounts managed by professional traders.

Investment portfolios - investments in a balanced pool of assets.

Ever feel like making consistent money in forex is impossible? Between unpredictable markets and the need for near-constant monitoring, successfully trading can feel out of reach for many. The good news is, you don't necessarily need to trade to tap into forex profits.

Believe it or not, there are actually several ways regular folks can generate income from currency markets without facing the direct challenges of live trading. In this article, we'll walk you through some practical alternatives investors use to profit from forex's big swings.

We'll look at lower-stress passive plays like copy trading, as well as hands-off options for setting up affiliate sites or managed accounts. I'll give you the lowdown on how each strategy works plus the pros and cons to consider. You'll find details on how each approach works, what to expect in terms of returns, and which platforms are best for getting involved.

Do you want to start trading Forex? Open an account on Roboforex!-

Do I need to be an expert trader to join an affiliate program?

No specific trading experience is required. Focus on building an audience in finance niches through quality content and broker promotion.

-

What is the minimum deposit required to get started with managed accounts?

The minimum deposit amounts vary depending on the strategy and platform, but range from as low as $10 for copy trading to $100-200 for PAMM accounts and portfolio investing.

-

Is there a fee to use social trading strategies?

Most platforms allow use of their features like copy trading and PAMM accounts for free. However, expert traders on copy platforms may charge a 1-30% commission on followers' profits.

-

Are these strategies suitable for beginners?

Yes, options like portfolio investing require no trading experience. Copy trading is also beginner-friendly since others do the analysis. Just ensure the trader copied has a proven track record.

-

How do I choose a professional fund manager?

Check credentials, trading history, offered instruments. Aim for managers with 3+ years' experience, annual returns over 20%, and transparency on funds, strategy and past performance.

Can I Make Money In Forex Without Trading?

Most newbies to forex trading will agree that it can be overwhelming and time-consuming as they try to understand trading strategies and concepts . Professional traders are not left out either. The constantly changing market conditions and uncertainty surrounding the financial markets make it hard for expert traders to reap steady profits. Regardless, it is not all doom and gloom. The forex market, despite its complexities, is profitable.

As a beginner, you might be wondering: Is forex trade profitable? Is it a good idea to continue on your forex trading journey or quit to avoid ruining your finances? It will interest you to know that there are secrets to making money through Forex without any form of trading. For example, you can participate in a broker's affiliate program, copy other traders automatically, build a long-term portfolio, or give money for management.

Using these options, you reduce risks, save time and increase your chances of making profits.

We will explain the following options with which you can earn passive income from Forex:

-

Affiliate programs

-

Copy-trading

-

PAMM/RAMM/MAM accounts

-

Forex Portfolio

Active Trading Vs Forex Investments

| Active Trading | Forex Investments | |

|---|---|---|

Risks |

High |

Average |

Potential Profit |

High |

Average/High |

Time Requirement |

At least 2-3 hours per day for trading and learning market |

20-30 minutes per week |

Minimal Funds |

$1 |

$1 |

Forex Education |

Strongly Needed |

Unnecessary |

Strategy |

Short term |

Long term |

Forex Brokers Affiliate Programs

Affiliate marketing is an arrangement, in this context, where a broker pays a third-party (affiliate) a commission for directing traffic to its service. This model appeals to many as it allows them to earn passive income. If you are a website owner, social media influencer, or rich online social network, forex affiliate programs provide a suitable means to make money by promoting a specific Forex broker.

Forex affiliate programs require minimal involvement in the forex market itself. You can earn bonuses or commissions for active referrals when you join one. In general, here’s how forex affiliate programs work:

-

-

Sign up or register on the platform to receive a unique affiliate link.

-

Share the link on your website, social media profiles, or blogs.

-

A potential client clicks on the link.

-

The link redirects the client to the Forex broker’s site.

-

The client signs up, funds, and activates the account.

-

The broker pays you a commission.

You can choose the type of affiliate program to try based on the following:

Partner program: This model is similar to conventional affiliate marketing. As an affiliate, you receive a bonus for each successful referral. At times the broker pays a commission only after multiple transactions by your referral.

Introducer program: An affiliate generates leads using educational programs, funnels, websites, or even local offices. It is a higher-level program with often better compensation plans.

Cost-per-action (CPA) program: An affiliate marketing model that pays a one-time commission when leads complete a specific action. The action can be anything from funding their account to maintaining a stipulated amount in their trading account.

Pros and Cons

Now you know being a forex affiliate is a lucrative way to earn passive income, you might be wondering what the risks are. Read below the positives and negatives of forex broker affiliate programs:

👍 Pros

• Being a forex broker affiliate does not require you to pay any money to promote the broker’s platform.

• You can choose what options to use in promoting the platform- websites, social media handles, blogs- as you like.

• Affiliate marketing requires minimal upfront fees which fits those on a low budget.

👎 Cons

• It is highly competitive, and you have no control over the competition.

• It is harder to implement if you don't have the funds to invest in tools like marketing funnels, domains, and websites.

Best Forex Brokers Affiliates 2024

If you want to maximize your success as a forex broker affiliate, you will need a suitable broker. Some platforms offer better compensation packages than others. Take a look at our top picks of Forex affiliate programs that offer the best rates below. Learn what the requirements are and how you can earn using each program.

| Broker | Name of Program | What Should I Do? | How Much Can I Earn? | |

|---|---|---|---|---|

The Traders Union Affiliate Program |

This is a 2-tier program. To earn money you will attract new active traders to Traders Union, who will be a part of the partner's referral network, and their trade will bring the referrer (you) a stable income. |

1. The affiliate rate for the first referral level is 10% of the income of the attracted referral in Traders Union. 2. The affiliate rate for the second referral level is 5% of the income received by the second level Traders Union referral. |

||

FxPro Partner |

Share referral links or introduce people to the platform as an "Introducer." |

Up to $1,100 per profile referred |

||

XM Partners |

Share referral links |

Up to $25 per lot (unlimited commission per referral) |

||

Admiral Markets Affiliate Program |

Share affiliate link |

Up to $600 per referral |

||

AvaPartner |

Share links and introduce people who are new to trading |

Variable |

||

eToro Partners |

Promote affiliate links |

Up to $500 per sale |

||

FXCM Affiliates |

Share affiliate and referral links/invite friends and family |

Up to $750 per qualified client |

||

Swissquote Partnerships |

Multiple account types |

Up to CHF 800 for every qualified referral |

How to Make Money with the Traders Union Affiliate Program?

The Traders Union Affiliate Program guarantees maximum rewards. As a partner, you can earn commissions from multiple brokers at once. We have discovered that most traders sign up on average 2-3 brokers' platforms, and it isn't easy to qualify for every program with each partner.

With the TU affiliate program, you can earn commissions from more than 100 forex brokers. Besides, it doesn't matter which broker your referred clients choose because you will continually make a percentage from their returns.

TU affiliate program offers the following incentives:

-

High average return- you'll receive 10% of each referred client's return and 5% commission on the returns of your attracted client's referrals.

-

Earn even higher returns by using our two-tier system to grow your network.

-

Detailed affiliate statistics.

-

Rich selection of promotional materials to attract referrals.

-

Get better bargains and conditions.

-

Cashback rebates for each completed Forex transaction despite trading outcomes.

Forex Copy Trading

Forex copy trading is another way to profit from the forex markets without directly participating in trading activities. Unlike affiliate programs, this option involves a much closer interaction with forex trading platforms. It is a great investment opportunity for those who have little experience in trading but still want to enjoy the benefits of forex trading.

Copy-trading reduces risk exposure and saves time while still earning more money. The principle is simple: you apply the trading algorithms of expert traders to your forex trading account. As these professionals trade and make profits, you earn profits too. Hence, you benefit from their skills and experience, save time and minimize financial risks. There are no limits to how much you can earn with automated copy-trading.

Pros and Cons

Most beginners choose copy trading to bypass the risks of forex trading. But, mimicking the trades of other traders does not entirely shield you from risk. For instance, your investment can be affected by erroneous trading decisions made by traders whose strategies you copy. However, you can increase your chances of success by diversifying your portfolio and choosing expert traders with a proven track record.

👍 Advantages

• Trading decisions are not based on your intuition.

• Reduced risk because experts do the trading.

• Requires no knowledge of the forex market.

• Choose a variety of brokers, traders, and trading conditions.

• Huge profit potential.

👎 Disadvantages

• Automated copy-trading stalls your forex learning since you do not practice making predictions to gain experience.

• Errors in decision-making by experts can still lead to significant losses.

Top 8 Forex Copy Trading Providers

The table below highlights 8 of the best forex trading platforms. With a minimum of $10, you can copy the trades of expert traders on any of these platforms.

| Copy Trading Provider | Software | Minimum Invest-ment | Markets | Regulation | Available in the US | Sub-scription Cost | |

|---|---|---|---|---|---|---|---|

CopyFx |

$100 |

Forex, Stocks, CFDs |

IFSC, CySec, FCA |

No |

Free |

||

eToro Copy Trader |

$200 |

Forex, Stocks, CFDs, Crypto |

CySEC, FCA, ASIC |

Yes |

Free |

||

AvaSocial, Dupli Trade, ZuluTrade, Meta Trader MQL5 |

$100 |

Forex, Stocks, Crypto currencies, Comm-odities |

Central Bank of Ireland, ASIC, FSCA, Japanese FSA, ADGM, FRSA |

No |

Free |

||

MT4, MT5, ZTP |

$50 |

Forex, CFD, crypto currencies, stocks, comm-odities |

Greece and EU (HCMC), USA (CFTC), Japan (KFB) |

Yes |

Free |

||

MT4 |

$100 |

Forex, Stocks, CFD |

FCA, CySec, FSCA |

No |

Free |

||

Auto Copy |

$250 |

Forex, stocks, CFDs on stocks, indices, comm-odities, crypto-currencies, ETFs |

Cyprus – CySec, Great Britain – FCA |

Yes |

Free |

||

Meta Trader, cTrader, Myfxbook, and Zulu Trade |

$200 |

Forex, CFDs |

(ASIC) |

Yes |

Free |

||

Meta Trader4, Meta Trader5 |

$10 |

Currency pairs, CFDs on stocks, indices, comm-odities, commodity futures, crypto currencies |

British Virgin Islands – SIBA/ L/14/1082 Saint Vincent and the Grenadines |

Yes |

Free |

How Does Copy Trading Work

Copy-trading involves connecting a portion of your portfolio to a professional trader on a forex platform.

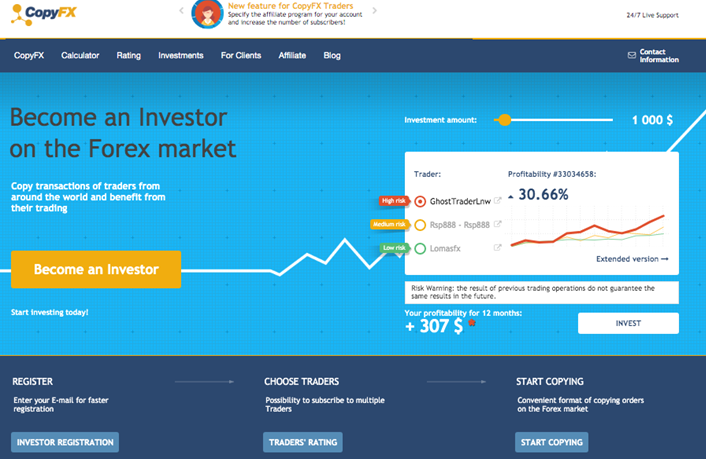

When you specify the amount to invest and copy a trader, your account reflects all the trader's open trades and strategies. Then, any decisions they make on their trades will automatically reflect on your portfolio. For instance, Roboforex, one of the best investment brokers, offers copy-trading opportunities to clients using its CopyFx trading platform.

Photo: CopyFX platform

Photo: CopyFX platform

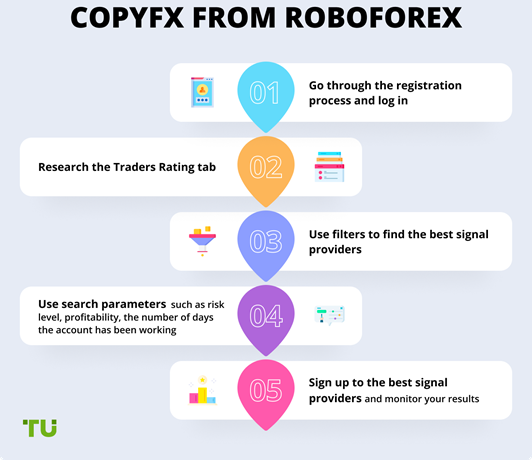

The pictorial illustration above shows how to earn using CopyFx. Once you complete a registration on the CopyFx platform, the next thing to do is go to the Traders Rating tab to search for suitable traders to copy, as shown below.

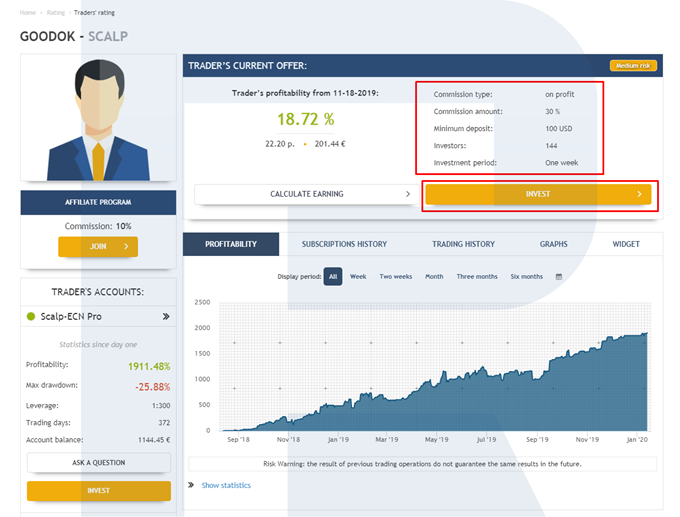

Photo: CopyFX platform

The tab displays vital information such as the trader's current offer, profitability, and trading history. It also shows the trader's risk level (a critical indicator), commission type, and the minimum investment amount.

Once you have found a trader that suits you, proceed to invest your desired amount, and the trader's strategy and open positions will reflect on your terminal.

Forex PAMM/RAMM/MAM Accounts

Another means to earn from forex without active trading is through managed accounts. PAMM is an acronym for Percent Allocation Management Module or Percent Allocation Money Management. You can make huge profits by investing in a PAMM account.

In this arrangement, you and other investors provide a pool of capital and allocate a portion of it to a fund manager or professional trader through a brokerage firm. Then, the fund manager uses the pooled funds, including his own, to trade the financial markets using his strategy to make profits. After that, the profit made after a stipulated period is shared accordingly; the investor with the most significant capital being the highest paid. PAMM investors can diversify their trading capital by allocating portions of their money to different traders' accounts.

Multi-Account Manager (MAM) is an advanced type of fund management where individual traders' and investors' accounts are managed using one master terminal. All orders executed on the master terminal reflect on every linked account. A MAM account is like a group of PAMM accounts managed as one whole account, and it allows the master trader to use higher leverage. The master trader earns a percentage of the returns as his performance fee.

Risk Allocation Management Model (RAMM) is built on risk management principles and incorporates the best features of PAMM. RAMM provides more security for investors by ensuring their investments are managed using the safest strategies. It gives investors more control of their portfolio, allowing them to directly copy traders' transactions as they choose or determine the level of money protection.

Managed accounts can make you a lot of money in the right conditions. But, there are risks associated with this investment option. Before making a decision, consider the pros and cons of investing through managed forex accounts:

👍 Pros

• Managed accounts like PAMM provide transparency and access to invested funds at will.

• The risk of fraud is reduced as the fund manager has no direct access to your money.

• Risk diversification is possible as investors can allocate funds among several managers.

• Fund managers handle funds with utmost prudence because their funds are also at risk.

👎 Cons

• Investors have less control over decisions made on their accounts.

• Losing trades still occur, which may affect your capital.

Best Pamm Accounts 2024

PAMM accounts are the best investment option a broker can offer. However, you should remember that the conditions for operating a PAMM account differ for every broker. Below, we have selected the three best forex brokers in 2023.

Roboforex, established in 2009, offers RAMM accounts- the most advanced PAMM system. The broker is regulated by IFSC Belize and headquartered in Cyprus. Its platform caters to over 10,000 traders. Roboforex’s platform uses a unique mathematical model to improve profits and minimize risks. They also provide tools for forex education.

FXPro has over 15 years of experience in the industry. Headquartered in the UK and regulated in Cyprus, the UK, and Australia, this broker offers MAM account trading services to its clients.

Founded in 2007 in Sydney, Australia, IC Markets is licensed by the Australian Securities and Investments Commission (ASIC) to provide financial services. The broker’s platform offers clients an Investment Manager program including consultancy services on MAM, PAMM, and LAMM account operations.

Another Alternative to Forex Trading - Forex Portfolio

If you are not an aggressive investor, you can invest long-term in more stable commodities like precious metals, currencies, and even cryptos like Bitcoin. Although it is less profitable, it preserves wealth protecting your money from devaluation. Here's how to go about it:

-

Define your goals, risk appetite and decide how much to invest.

-

Choose a broker and open an account.

-

Create your portfolio by selecting from a pool of less volatile instruments like silver, gold, currencies, etc.

-

Diversify your portfolio by allocating funds into several different assets.

How to make money in Forex without actually trading - a step-by-step guide

As you know by now, forex trading is a risky business, and that's why you seek alternative ways to earn money. How do you make money on Forex if you don't know how to trade? Forex investment is the solution. To guide you in choosing the best way to make money from forex investment, follow the steps below:

Gather insights on forex investment options:

Before you delve into investing your money, you need to gather adequate information on forex investment opportunities, so you can understand how each option works and what is required to get started.

Choose an investment:

We have outlined about 4 investment opportunities in this article. Based on your goals, circumstances, and budget, select one that suits you.

Register with a broker:

Select a broker that offers the best program for your investment option. Read our reviews to gain insights.

Fund an account:

After you register with the broker, select your preferred program and follow the instructions on the broker's website to begin.

Are Forex Investments Profitable and Safe?

Investing is a safer way to earn money than trading forex. However, the risks remain, and the higher the income potential, the higher the risk for any investment option. For instance, although copy trading offers higher possibilities, the risk is much higher than other options we have discussed because it exposes your portfolio to the direct effects of human error.

Summary

So far, we have discussed four alternative ways to enjoy the benefits of the forex market without having to trade. Depending on your objectives, you can choose any of these options and earn passive income. Forex investment is the way to go if you feel trading is not for you.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.