Silver Investment In 2025: Price Trends, Famous Investors And Future Potential

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Silver investment offers a balance between industrial demand and precious metal security. Its lower entry price than gold makes it attractive for beginners, while market trends point to growing use in green technologies. With rising demand and limited supply, silver remains a promising long-term asset.

The Silver outlook for 2025 suggests bullish momentum, driven by rising industrial demand and potential Federal Reserve rate cuts. While prices fluctuate, Silver has never become worthless.

Unlike stocks that can collapse overnight, Silver has a 4000-year history of preserving wealth.

This article will explore the key factors influencing Silver investment in 2025, why investors like RayDalio and Robert Kiyosaki praise it, and how digital trends are reshaping its future.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Silver investment for 2025

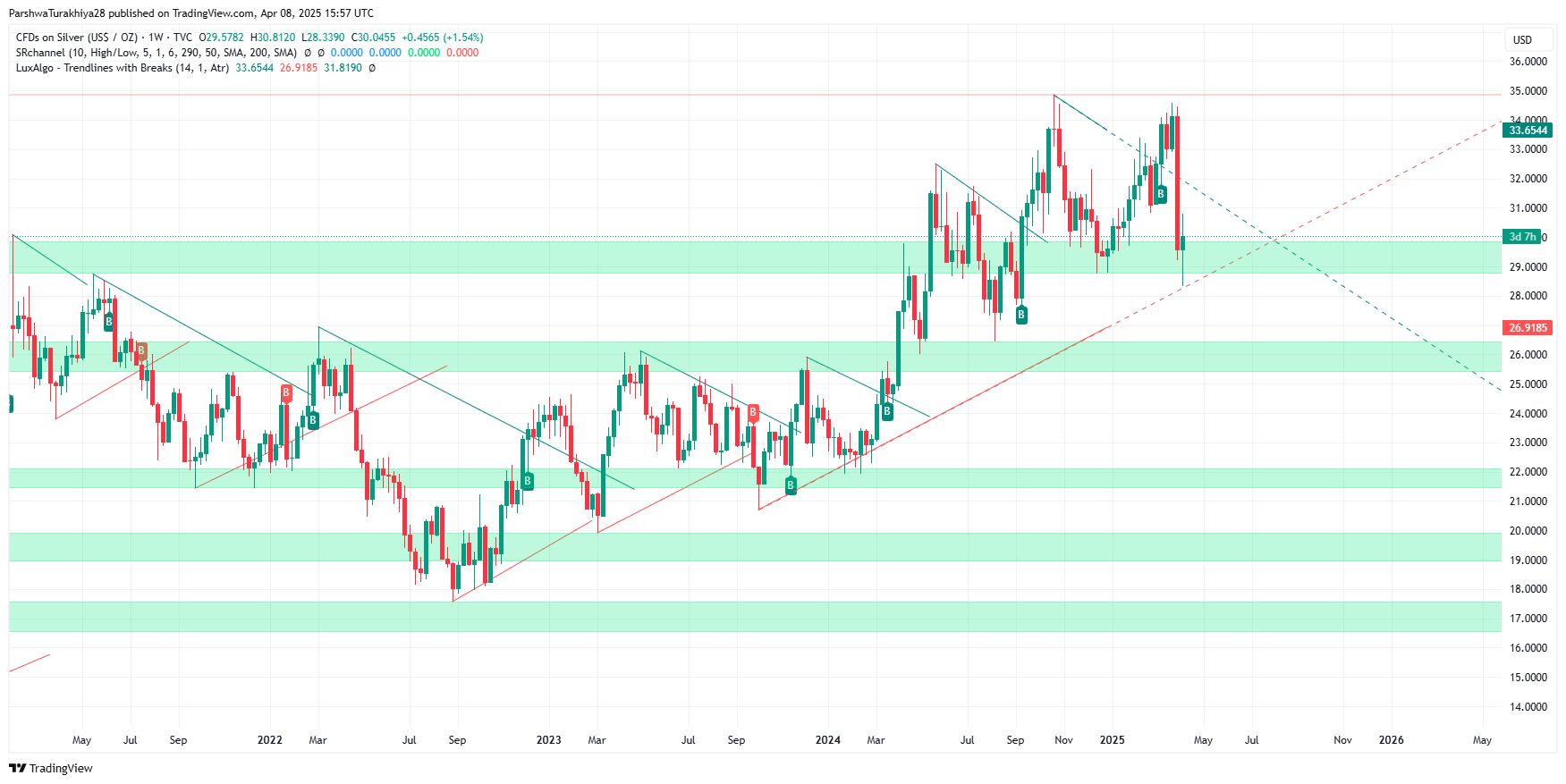

Silver recently experienced a dramatic collapse, plunging from the $34.00 resistance zone to an intraday low near $28.00. This drop, amounting to a nearly 18% fall in a matter of days, broke multiple ascending trendlines and confirmed a bearish reversal pattern. The fall came after silver failed to break above the upper trendline of a rising wedge — a pattern that often signals exhaustion in an uptrend.

Key resistance zones to watch

Following the breakdown, silver has managed a short-term bounce and is now hovering around the $30.10–$30.50 region. This zone coincides with the 0.236 Fibonacci retracement level, which acts as the first major resistance. The next upside hurdles are $31.46 (0.382 Fib) and $32.23 (0.5 Fib). These levels are crucial: if silver fails to break above them with strong volume, the bounce may simply be a relief rally before another leg down.

EMA structure confirms trend reversal

All major exponential moving averages on the 4-hour chart — 20, 50, 100, and 200 — have flipped bearish. Price is currently trading below all these key moving averages, with the 20 EMA ($30.80) acting as immediate dynamic resistance. This alignment confirms a clear shift in momentum. Historically, such setups lead to prolonged corrections unless aggressively reversed.

RSI and MACD hint at weak bullish momentum

The Relative Strength Index (RSI) has bounced from oversold territory, currently sitting at 34.83. While this indicates a short-term bounce, it still reflects bearish pressure as long as RSI remains below the neutral 50 level. On the other hand, the MACD histogram has just turned positive, with a crossover below the zero line. This is typically interpreted as early bullish momentum but still fragile and prone to reversal.

Bollinger Bands suggest consolidation phase

Silver sharply breached the lower Bollinger Band during its recent fall, indicating panic selling. It has now re-entered the band range, signaling the start of a potential consolidation. The mid-band (20 SMA) around $30.60 remains the barrier. Unless the price sustains above this level, we may see continued sideways movement or a fresh retest of the lower band near $29.00.

Stochastic RSI flags overheated recovery

The Stochastic RSI on the 4-hour chart has surged above 95, signaling overbought conditions. If a bearish crossover occurs in this zone, it could trigger another wave of selling. Given the proximity of key resistances and bearish macro structure, caution is warranted for long positions until momentum indicators cool down.

Support levels and downside risk

On the daily chart, the $28.00–$28.50 zone stands out as the next significant demand area. Below that, $27.00 serves as the next key support, followed by a major accumulation range between $25.00–$26.00. If silver fails to hold $30.00 in the coming sessions, these zones could quickly come into play.

Silver price prediction

The silver market is witnessing a notable shift. Silver prices have dropped to an eight-week low, largely due to concerns over weakening industrial demand amid growing fears of a global economic slowdown. While gold continues to rally and hit record highs, silver’s dual role as both an industrial and precious metal has made it more vulnerable to recessionary pressures.

Despite the recent dip, analysts remain optimistic about silver’s long-term potential in 2025. Alan Hibbard from GoldSilver expects silver to deliver a return of around 25 percent this year, projecting its price to reach approximately $40 per ounce. WisdomTree echoes this sentiment, forecasting silver to touch $40 by the third quarter of 2025, supported by strong demand from industries such as solar energy and electronics, coupled with limited new supply. Meanwhile, Morgan Stanley predicts silver to reach $35, and UBS expects it to range between $36 and $38 per ounce during the year.

| Year | Price in the middle of the year | Price at the end of the year |

|---|---|---|

| 2025 | $33.02 | $43.09 |

| 2026 | $44.69 | $39.34 |

| 2027 | $39.2 | $37.48 |

| 2028 | $43.39 | $39.57 |

| 2029 | $40.24 | $40.58 |

| 2030 | $39.75 | $39.12 |

| 2031 | $38.77 | $41.46 |

| 2032 | $41.57 | $49.99 |

| 2033 | $49.64 | $46.9 |

| 2034 | $43.5 | $47.51 |

| 2035 | $46.4 | $47.47 |

| 2036 | $23.63 | $47.68 |

| 2037 | $49.28 | $43.93 |

| 2038 | $43.79 | $42.07 |

| 2039 | $47.98 | $44.16 |

| 2040 | $44.83 | $45.17 |

What factors are driving the bullish outlook for Silver in 2025?

The Silver outlook for 2025 remains positive despite recent volatility. Several key factors are influencing Silver’s price movement:

| Factor | Impact on Silver Prices |

|---|---|

| Federal Reserve Rate Cuts | Lower interest rates make non-yielding assets like Silver more attractive. |

| Inflation & Currency Devaluation | Silver acts as a hedge against a weakening U.S. dollar |

| Geopolitical Tensions | Global uncertainty boosts demand for safe-haven assets. |

| Industrial Demand Growth | Expanding use in EVs, solar panels, and 5G technology increases Silver consumption. |

Why Silver has been a valuable investment for centuries

Silver has been prized for thousands of years. It was once used as currency, traded in ancient markets, and recognized as a symbol of wealth. But why is Silver valuable even today?

Silver as money and a store of value

Unlike fiat currencies, which governments can print at will, Silver is a finite resource. For over 4,000 years, civilizations have used Silver as money and a store of wealth. Even in modern times, central banks and investors turn to Silver during economic crises.

Historically, Silver has:

Served as a global currency across different civilizations.

Outperformed inflation, unlike paper money, which loses purchasing power.

Held value for centuries, making it a trusted safe-haven asset.

Industrial demand: The new gold?

Silver isn’t just a precious metal — it’s an industrial powerhouse. More than 50% of global Silver demand comes from technology and manufacturing. It is critical for:

Solar panels (photovoltaic cells).

Electric vehicle (EV) batteries.

5G technology and AI-driven electronics.

Medical applications, including antibacterial coatings and X-ray films.

Hedge against inflation and economic crisis

When economies struggle, Silver shines. It acts as a hedge against inflation and a defense against financial instability. This is why many investors ask, is Silver a good investment in uncertain times?

Silver prices spiked to $50 per ounce in 2011 during the Eurozone crisis.

In the 1970s, Silver rose over 3,800%, proving its value in inflationary periods.

The 2008 financial crash saw Silver outperform most stocks.

Famous investors who believe in Silver’s value

Smart investors know Silver investment isn’t just about price speculation. Some of the world’s top financial minds have openly praised Silver as an undervalued asset with massive potential.

Ray Dalio: Hard assets are the future

Ray Dalio, the billionaire behind Bridgewater Associates, believes precious metals like Silver offer protection against economic crises. He has repeatedly warned that paper currencies lose value over time due to inflation.

Dalio’s investment strategy focuses on hard assets, including Silver, as a hedge against financial instability. His philosophy? "Cash is trash" — real assets hold value.

Robert Kiyosaki: “Silver is a bargain”

The Rich Dad Poor Dad author frequently speaks about Silver. He sees it as an investment that is undervalued and underappreciated.

He calls Silver "real money" unlike fiat currencies that governments print endlessly.

He believes Silver is one of the best inflation hedges in today’s economy.

In 2022, he stated: “Silver is the most undervalued investment compared to gold.”

Jim Rogers: Silver over gold?

Jim Rogers, the legendary commodities investor, often says Silver is a better buy than gold. His reasoning? Silver is used in industries, while gold is mostly stored.

Rogers predicts Silver demand will skyrocket as technology advances.

He believes Silver could outperform gold in the next major commodities bull run.

Why should I buy Silver now?

If you’re considering investing in Silver, now may be the perfect time. Despite being below its 2011 highs, multiple factors suggest Silver is significantly undervalued. Here’s why:

Rising market volatility. Stock markets are experiencing extreme fluctuations. A prolonged bull run often signals an impending correction. Holding Silver ensures your portfolio remains resilient if markets crash.

Supply vs. demand imbalance. Silver production is flat, yet demand for electronics, solar panels, and EVs is surging. A supply squeeze could drive prices higher in the coming years.

Geopolitical uncertainty. The world is facing rising tensions, trade wars, and political instability. Historically, Silver performs well in times of crisis, acting as a hedge against economic downturns.

End of quantitative easing. Central banks are tightening monetary policies, reducing liquidity in markets. When easy money dries up, traditional assets may suffer, while Silver remains strong.

Higher ROI potential. Silver is more volatile than gold, which means its price swings can offer greater profit opportunities. A balanced portfolio should include both metals, with at least 25% in Silver for growth potential.

We have selected a list of top brokers to trade silver efficiently based on spreads, tools, and global trust.

| Metals | Account min. | Demo | Deposit Fee | Withdrawal fee | Inactivity fee | Android | iOS | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| No | No | Yes | No | $25 for wire transfers out | $50 | Yes | Yes | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| No | No | No | No | No charge | No inactivity fees | Yes | Yes | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| Yes | No | No | No | $25 | No | Yes | Yes | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| No | No | No | No | No charge up to a limit | Not specified | Yes | Yes | FCA, SEC, FINRA | 7.69 | Study review | |

| Yes | No | Yes | No | No | No | Yes | Yes | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

Silver-backed tokens and EV tech shaping next-generation investment trends

Most beginners treat silver like a cheaper alternative to gold, but that lens is too narrow. In 2025, the real play is in digital tokenization of physical silver reserves. Platforms are emerging where each token is backed by audited, vault-stored silver, allowing 24/7 trading and micro-investments. These tokens are starting to get integrated into DeFi protocols, where silver can now be staked or used as collateral. If you’re just starting out, watch for platforms merging physical silver with blockchain utility — this is where traditional value meets digital flexibility, and it’s still under the radar.

Another powerful angle is tracking silver’s industrial usage in battery-grade alloys, especially in the EV supply chain. While most investors chase lithium or nickel stocks, few realize that silver’s conductive properties make it essential in high-performance battery tech used in next-gen EV prototypes. When pilot projects or patents reference silver-based components, they usually signal upcoming demand spikes well before it shows in price charts. Beginners who pay attention to R&D filings, not just mining reports, will be first in line when silver gets re-rated from just a store of value to a tech-critical asset.

Conclusion

Silver remains a unique asset thanks to its dual role in both industry and finance. With rising demand from green tech and a historically high gold-to-silver ratio, it offers strong potential for growth and diversification. As global trends favor sustainability and real assets, silver stands out as a smart, long-term investment choice.

FAQs

What is the best way to invest in silver in 2025?

Choose based on your goals: physical silver for stability, ETFs for liquidity, or tokenized silver for a tech-forward option with real backing.

Can silver outperform gold in the coming years?

Yes, silver's growing industrial demand — especially in clean energy and tech — gives it strong potential to outpace gold.

Is it safe to buy silver during a market downturn?

Silver often holds or gains value during downturns, but expects short-term volatility. Long-term strategies work best.

How much of my portfolio should be in silver?

Experts suggest 10–25% in precious metals. Go higher if you're confident in silver’s growth potential and can handle more risk.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.