Advanced Forex Patterns

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Advanced Forex chart patterns are basic tools for predicting market trends and making informed trading decisions. Key patterns are:

Forex trading, as a dynamic and complex form of trading, requires a deep understanding of various analysis tools and strategies. Understanding advanced chart patterns and analysis techniques has a direct impact on a trader’s success. They allow one to accurately predict market movements and make informed decisions. In this article, we will look at the basic chart patterns, analysis techniques, and advanced trading strategies that will help traders improve their efficiency and profitability.

Advanced Forex chart patterns

Understanding and using advanced chart patterns is a great tool in the hands of every trader. Patterns help traders identify current market trends and possible entry and exit points for trades.

Head and shoulders

The Head and shoulders pattern is one of the most reliable and widely recognized reversal patterns. It signals a potential trend reversal from bullish to bearish or vice versa. The pattern consists of three peaks, where the middle peak (the head) is higher than the other two (the shoulders). The neckline, which connects the lows between the shoulders, serves as a support or resistance level.

When the price breaks the neckline, it signals a trend reversal and provides an opportunity to enter a trade. For example, with a bullish Head and shoulders pattern, traders can set a target by measuring the distance from the head to the neckline and projecting it downwards from the breakout point.

Double top and double bottom

The Double Top and Double Bottom patterns are reversal patterns that indicate a change in trend. The Double Top is formed when two peaks form at the same level, separated by a trough, and signals a possible bearish reversal. The Double Bottom, on the other hand, indicates a bullish reversal when two troughs form at the same level, separated by a peak.

When the neckline connecting the troughs of the Double Top or the peaks of the Double Bottom is broken, traders can enter a trade in the direction of the breakout. An example of successful use of these patterns includes waiting for confirmation of the breakout on a higher time frame to minimize false signals.

Flag and pennant

The Flag and Pennant patterns are continuation patterns that indicate temporary consolidation within the current trend before it continues. The Flag is formed as a parallel channel, and the Pennant is formed as a contracting triangle after a sharp price move (flagpole).

Traders look for a breakout of the upper border of the flag or pennant to enter a long position or the lower border to enter a short position. The target is set by measuring the height of the flagpole and projecting it in the direction of the breakout.

Forex analysis techniques

Using advanced Forex analysis techniques can help traders gain a deeper understanding of market trends and make more informed trading decisions. In this section, we will look at the importance of multiple time frame analysis, support and resistance levels, and key candlestick patterns that can signal potential market reversals or trend continuations.

Multiple time frame analysis

Multiple time frame analysis involves examining price data across multiple time frames to gain a comprehensive view of the market. Traders often use daily, weekly, and monthly charts to identify long-term trends and short-term entry and exit points.

For example, if a daily chart is trending up while a weekly chart is trending down, this may indicate a potential reversal or correction. By combining information from multiple time frames, traders can make more informed decisions and avoid false signals.

Support and resistance levels

Support and resistance levels are areas on a chart where price has stalled or reversed in the past. These levels act as barriers that prevent price from moving further in one direction.

Traders identify support and resistance levels by analyzing previous reversals or consolidations. These levels can be identified using trend lines, horizontal lines, or Fibonacci levels. By trading near these levels, traders can enter trades at favorable prices and minimize risk.

Candlestick patterns

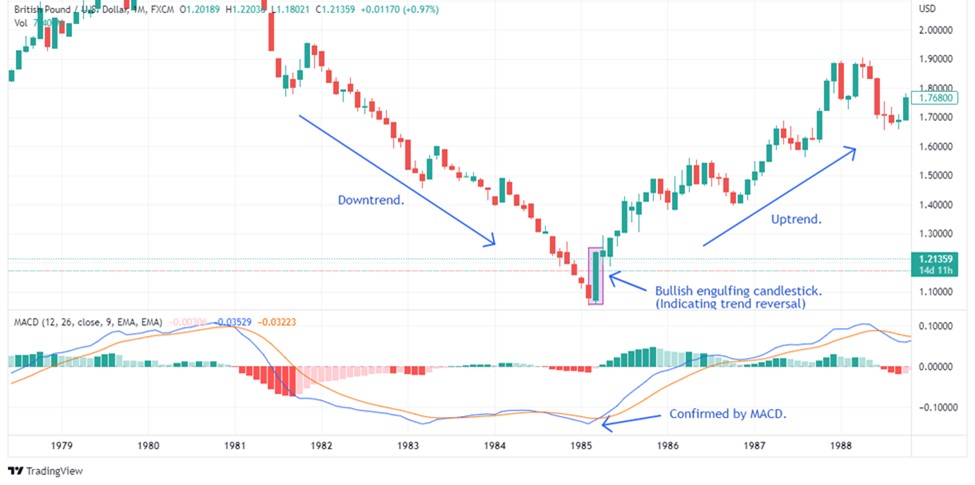

Candlestick patterns are chart patterns that display price movements and are widely used by advanced traders to predict market reversals or continuations. Basic patterns include doji, engulfing, hammer, and others.

For example, a bullish engulfing pattern, which represents strong buying pressure, can indicate a possible reversal. Traders combine candlestick patterns with other technical indicators to improve the accuracy of their strategies.

Advanced Forex trading strategies

Using advanced Forex trading strategies allows traders to effectively exploit market conditions to achieve maximum profits. Let's look at breakout and reversal strategies that help traders identify optimal entry and exit points for trades, minimizing risk and maximizing profit potential.

Breakout strategy

Breakouts occur when the price of a currency pair breaks through a key support or resistance level, indicating a change in market sentiment and a potentially significant price move.

Traders identify horizontal breakouts when the price fluctuates in a narrow range for a long time and then breaks out sharply higher or lower. An example is a triangle breakout, where the price creates a series of higher lows and lower highs before breaking out.

Reversal strategies

Reversal strategies are based on patterns that indicate a change in trend direction after a long move. One of the most well-known reversal patterns is the triple top or triple bottom.

A triple bottom pattern is formed when the price reaches a low, rebounds, and then tests that low two more times without breaking it. This indicates a weakening bearish trend and a potential reversal. Traders wait for a break of the neckline to confirm the reversal and enter a long position.

We have selected several reliable brokers to test your investment decisions based on advanced Forex patterns. The key criteria when choosing a broker are low fees, access to a wide range of markets, platform convenience, quality of analytical tools, as well as the reputation and reliability of the company.

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | MT4 | MT5 | cTrader | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | 0,5 | 0,9 | No | No | No | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,5 | 1,5 | Yes | Yes | Yes | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,1 | 0,5 | Yes | Yes | No | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,7 | 1,2 | Yes | Yes | No | Study review | |

| Yes | No | 1:30 | 0,2 | 0,8 | No | No | No | Open an account Your capital is at risk. |

Even the most accurate patterns do not guarantee success

I would like to draw your attention to the importance of psychological preparation and risk management. Even the most accurate patterns and strategies do not guarantee success if a trader is unable to control their emotions and manage their capital wisely. For example, using stop losses and take profits helps to minimize losses and secure profits, which is a key element of successful trading.

I also recommend paying attention to fundamental analysis, which can complement technical analysis and provide a more complete picture of the market. Economic indicators, news, and events can significantly affect the movement of currency pairs, and taking these factors into account will help traders make more informed decisions. For example, unexpected changes in interest rates or important economic reports can cause sharp market fluctuations that are not always predictable using chart patterns alone.

Also, do not forget about the importance of continuous learning and adaptation to changing market conditions. The Forex market is dynamic and subject to constant change, so it is important for traders to constantly update knowledge and improve strategies. Attending professional seminars, reading specialized literature and sharing experiences with fellow traders will help you stay up to date with the latest trends and techniques, which in turn will increase your trading efficiency and confidence.

Conclusion

Using advanced chart patterns and analysis techniques is a key aspect of successful Forex trading. Understanding patterns such as Head and Shoulders, Double Top and Flag, as well as applying analysis techniques on different time frames and support and resistance levels, helps traders make informed decisions. Integrating this knowledge into trading strategies can significantly improve trading efficiency and profitability.

FAQs

What role does risk management play in Forex trading?

Risk management plays a key role in protecting a trader’s capital and minimizing losses. Using stop losses, setting daily loss limits, and diversifying a portfolio help control risk and protect a trader from sudden market fluctuations. Without effective risk management, even the best strategies can result in significant losses.

How can fundamental analysis complement the use of advanced patterns in Forex?

Fundamental analysis complements technical analysis by providing information on macroeconomic factors that can affect currency pairs. For example, changes in interest rates, economic reports, and political events can cause significant market movements that are not always predictable through chart patterns. Combining these methods provides a more complete picture of the market.

What resources and learning methods can you use to improve your Forex trading expertise?

Traders can use a variety of resources to improve their Forex trading skills, including professional seminars, webinars, specialized literature, and online courses. Sharing experiences with other traders on forums and participating in trading communities can also be helpful in gaining new knowledge and strategies.

How do psychological aspects affect success in Forex trading?

Discipline, emotional control, and endurance significantly affect success in Forex trading. Fear and greed can lead to making unfounded decisions, so it is important to develop emotional stability and follow established trading plans. Regular practice and self-control help traders cope with emotional challenges in the market.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

A long position in Forex, represents a positive outlook on the future value of a currency pair. When a trader assumes a long position, they are essentially placing a bet that the base currency in the pair will appreciate in value compared to the quote currency.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.