How to Use VWAP Indicator in MT4

When trading forex, indicators are valuable technical analysis tools that show you how the market is trending and allow you to time your market entries and exits more precisely. The thing is, when using indicators, you have to know and understand how they work and what they show you. In this way, you’ll be able to interpret their signals better.

Learn More about the Best Indicators for Successful TradingWith that in mind, we’ll now look at the volume-weighted-average-price (VWAP) indicator on MT4 in more detail. You’ll learn how it works, how to calculate the VWAP value, and, more importantly, how to use the VWAP indicator.

What Is Volume-Weighted Average Price (VWAP) Indicator?

The volume-weighted-average-price indicator is an advanced technical indicator that shows you the average price a security has traded for over a specific period, but the price is weighted by volume.

Let’s explain this in a bit more detail. Let’s say you look at the EUR/USD currency pair on a chart with an hourly timeframe. Now, let’s say the pair has closing prices of 1.100, 1.200, 1.110, 1.210, 1.115 at the end of each of the previous 5 hours. Now, if we use a simple moving average indicator over these 5 periods, it will show us that the average price over the 5 hours was 1.147.

Now, if we use to VWAP calculator, it will calculate the average price, weighted by volume. In other words, despite these closing prices, if the pair traded at 1.110 or close to it for most of the time, the VWAP indicator will show an average price closer to this value which is then much lower than the average price indicated by the simple moving average indicator.

Some traders believe that, because the VWAP indicator provides insights into both the price and volume of a security, it’s a more accurate indicator to reflect price action.

How to Calculate VWAP?

Fortunately, by adding the VWAP indicator to a chart, you won’t need to calculate it yourself. However, it is important to understand how the indicator works, and here, knowing how to calculate it is valuable.

To calculate the volume-weighted-average-price of a security, you’ll need to multiply the price the security traded at for a specific period by the volume that was traded and then divide that number by the total volume traded.

Learn More about the Best Indicators for MT4!To illustrate the concept better, let’s look at a simple example:

-

Let’s assume you’re looking at the 1-hour price chart for a specific security. Based on the formula above, you’ll then need to calculate the price of the security for the first 1-hour period. To do this, you’ll add the high, low, and closing prices for the period and then divide by 3.

-

You’ll then multiply this number by the volume traded to arrive at a figure we’ll call the PV number. You’ll then divide the PV number by the total volume to arrive at the VWAP. This means, for the first period, the VWAP will basically be the average price the security traded for.

-

For the following periods you’ll do the same. In other words, you’ll calculate the average price for the security for the period and then multiply it by the volume for the period. You’ll then add this number to the previous PV numbers you calculated to arrive at a cumulative value.

-

Once calculated, you’ll divide this by the total volume. In other words, you’ll divide the figure by the total volume for all periods. This will allow you to calculate the VWAP over time.

Simple Moving Average vs VWAP – What’s the difference?

As mentioned in our definition and example above, the VWAP is calculated as the price of a security over a period multiplied by the volume for the period, divided by the total volume.

In contrast, a simple moving average is just the calculation of the average price of a security for a specific period. It’s calculated by adding the closing prices for the security for each of the periods and then dividing by the number of periods.

As mentioned earlier, one of the main benefits of VWAP over a simple moving average indicator is that it provides a more accurate reflection of the average price of a security.

VWAP Signals

Now that we’ve looked at what the VWAP indicator is and how its value is calculated, let’s look at some simple signals that you can use when using the VWAP when trading. Keep in mind, though, that these are just some simple examples and there are many other strategies where you can use the VWAP indicator.

Learn More about Technical Analysis!Buy Signals

At its most basic, if the current price of a security is below the VWAP line, you can consider it to trade at below value which would mean that it’s a buy signal. Other traders prefer to use two VWAP indicators and then look for crossovers to signal a buy.

For instance, let’s say you use an 8-period VWAP and a 20-period VWAP. When the 5-period line crosses the 8-period line from below, this would be a buy signal.

Sell Signals

For sell signals, you’ll reverse the above. So, if the current price of a security is above the VWAP line, it could mean that that the security is trading at a premium which would then be a sell signal.

Likewise, if we once again use two VWAP indicators with different timeframes, the sell signal would occur when the line with the lowest value crosses the line with the highest value from above. So, if you’re using an 8-period VWAP and a 20-period VWAP, the sell signal would be when the 8-period line crosses the 20-period line from above.

Support and Resistance Signals

The VWAP line can be a strong indicator of support and resistance. So, if the price hovers below the VWAP line but doesn’t break it for several periods, it could indicate resistance. Likewise, if the price stays just above the VWAP line and doesn’t go below, it could indicate that the price has found support.

How to Use VWAP Indicator in Your Trading Strategy?

There are several ways in which you can use the VWAP indicator in your trading strategy. You can, for instance, use it by itself to give you buy and sell signals as described above. Here, another example would be when the price of the security goes far beyond the VWAP on either side.

Read More about Strategies with RSI Indicator!This could mean that the security is either overbought or oversold which, in turn, could signal a reversal. For example, if the price is way above the VWAP line, it could be overbought, and that traders might start going short. The opposite is true if the price goes far below the VWAP line. Here, it could signal that traders might go long.

Another possibility is using the VWAP indicator alongside other indicators to give more precise and accurate signals. A perfect example of this is where you’ll use the VWAP indicator with the MACD indicator. In this case, you’ll then get confirmation of any buying or selling signals described above.

VWAP Indicator on the Petrobras Chart

How To Set-Up VWAP Indicator in MT4?

Once you’ve downloaded the indicator as described hereinbelow, you’ll be able to install it. Here, the process also differs depending on where you downloaded the indicator from. If you’ve installed the indicator using the Market in MT4, you’ll be able to install it in the Market itself.

When you’ve downloaded it from the website as we’ll describe later, you’ll need to go to the File menu in MT4 and select Open Data Folder. You’ll then double click on MQL4 and then on Indicators. You’ll then copy the file you downloaded to this folder.

You can then restart the MT4 platform and then navigate to the MT4 Navigator where you’ll find the indicator you’ve downloaded and then double click on it to open it.

Once opened, you’ll be able to adjust the settings of the indicator. Here, it’s important to remember that this will differ based on the indicator you’ve installed but generally, you’ll be able to change the colors of the VWAP line and the period you want to use for the VWAP calculations. Once you’ve selected the period, the VWAP indicator will calculate the volume-weighted-average-price for the period you specified.

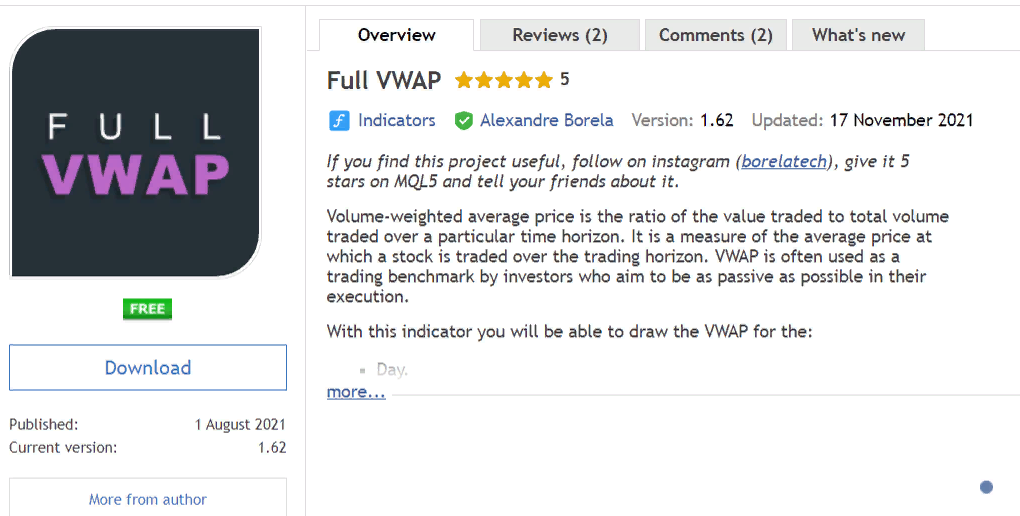

Download VWAP Indicator for Free

To download a VWAP indicator for free, you have two options. The first is to go to the official MQL5 download page where you’ll be able to download a fee VWAP indicator.

MQL5 Platform

In the search box, you’ll then enter “VWAP” and then click on the search icon. You’ll then be presented with both the free and paid results.

How to Download VWAP Indicator

You can then choose one of the free options. Let’s choose the first one on the list.

Once the product page that opens, you’ll then be able to download the VWAP by clicking on the Download button.

The other option is to download a VWAP indicator from the Market within the MT4 platform. Here, you’ll open the platform and then navigate to Market.

Here, you can then type “VWAP” in the search bar and then search. Similar to the example above, you can then choose one of the free options.

Forex Trading Indicators: Download for Free!Best MT4 Broker

Because MT4 is so popular, many brokers offer it as one of their standard trading platforms. In our view, RoboForex is one of the best brokers that offer MT4. In fact, it’s currently rated in the top spot of our Best Forex Broker ratings.

Some of the reasons for this include:

-

Its low minimum deposit requirements.

-

Favorable trading conditions.

-

The opportunity to earn passive income.

When it comes to RoboForex MT4, the platform offers different order execution types, 50 built-in technical indicators, tools for graphic analysis, and the ability to use Expert Advisors.

Summary

VWAP is a very valuable indicator to use when trading because it gives you deeper insights into the true average price of a security. It is, however, vital that you understand how it works and how to use it.

Hopefully, this post helped illustrate the VWAP indicator in more detail and will allow you to use it successfully.

For more insights like these or for broker reviews, trading strategies, and more, why not join Traders Union today.

FAQs

In addition to the information provided above, we’ve also compiled a list of frequently asked questions when it comes to VWAP.

Is VWAP suitable for swing trading?

The VWAP indicator tends to work well for swing trading.

Is the VWAP indicator for MT4 free?

There are several free VWAP options you can choose from on MT4.

What are the ideal timeframes for using VWAP?

Generally, VWAP works well over short to medium timeframes like day trading and swing trading. Keep in mind, though, that how you use it, ultimately, depends on your trading strategy.

Do I have to download the indicator from the official site or the Market?

There are other vendors that offer the VWAP indicator that you then download and install in MT4.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Over the past four years, Alamin has been working independently and through online employment platforms such as Upwork and Fiverr, and also contributing to some reputable blogs. His goal is to balance informative content and provide an entertaining read to his readers.

His motto is: I can dream or I can do—I choose action.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.