4 Steps To Open Position In Forex Trading

Opening a position in Forex trading involves four critical steps:

-

opening and funding an account

-

connecting your trading platform

-

making a strategic trading decision

-

using specific orders to open and manage your position

A position in Forex trading refers to a trader's exposure in the market. Essentially, it's about whether you've bought (long) or sold (short) a currency pair. Going long means you anticipate an increase in the value of the currency pair, while going short indicates your expectation of a decrease. Managing these positions effectively is key to successful Forex trading.

This guide will walk you through the essential steps to open a position in Forex trading, ensuring you have the knowledge and confidence to make informed trading decisions.

-

What is an open position in Forex trading?

An open position in Forex trading refers to any trade that has been established, or entered, and is still subject to gains and losses due to fluctuations in the currency pair price until it’s closed.

How do I enter a position in Forex?

To enter a position and start trading in Forex, there are 4 key steps you should follow:

-

Open and fund account;

-

Connect your platform;

-

Make a trading decision;

-

Use orders to open a position.

Understanding these steps and executing them with precision can significantly enhance your trading experience and potential for success. We’re going to explain each more detail.

Step 1: Open and fund account

Entering the realm of Forex trading begins with a fundamental step - opening and funding a trading account. This process starts with choosing a reputable Forex broker. A broker acts as your gateway to the markets, so it's vital to select one that offers a blend of reliability, user-friendly interface, competitive fees, and strong regulatory compliance.

Once you've selected a broker, the next step is to create an account. This usually involves providing personal information and going through a verification process to comply with financial regulations. After your account is set up, the next crucial step is funding it.

The amount you deposit plays a pivotal role in your trading journey. It determines not only your trading capacity but also the level of risk you can afford to take. It's important to invest an amount that aligns with your risk tolerance and trading strategy.

Remember, Forex trading involves significant risk, so it's advisable to start with a sum that you're comfortable potentially losing.

Step 2. Connect your platform

The second step involves connecting to a Forex trading platform, which is essential in today's digital trading environment. This platform is the tool through which you will analyze the market, execute trades, and manage your portfolio.

The choice of platform can have a substantial impact on your trading experience. Key features to look for include user-friendliness, technical analysis tools, real-time data, and stability. Most brokers offer their own trading platforms, and some also support third-party platforms like MetaTrader 4 or 5.

Once you've chosen a platform, the next step is to download and install it. After installation, you will need to connect it to your trading account. This usually involves entering your account details and ensuring a secure connection to the broker's server.

A properly connected platform will offer you real-time access to Forex markets, allowing you to execute trades and analyze market trends as they happen.

Step 3. Make a trading decision

Making a trading decision is arguably one of the most challenging aspects of Forex trading due to numerous factors that influence currency values, such as economic indicators, geopolitical events, and market sentiment. The Forex market's volatility further complicates this process, as currencies can experience rapid fluctuations.

Despite these challenges, thorough analysis is crucial. It is the bedrock of informed trading decisions, distinguishing strategic trading from mere speculation. Effective analysis helps identify market trends, assess trading opportunities, and forecast potential movements. It's also key in managing risks, allowing traders to set appropriate stop-loss and take-profit orders.

To navigate this complexity, traders need to be adept at interpreting economic data, understanding technical indicators, and staying updated with global financial news. Resources like economic calendars and news feeds are invaluable in this regard.

Step 4. Use orders to open a position

In the final step of entering a Forex trade, you will use specific trade orders to open and protect your position. Trade orders are directives that traders set to execute a trade when certain conditions are met.

The most basic order types are “market orders” which execute a trade immediately at the current market price. “Limit orders” and “stop orders” are used to open a position when the price reaches a predetermined level, allowing for strategic entry points. For example, if you believe the price of a currency pair will rise after hitting a certain point, you might place a “buy limit order” at that price level.

To manage risk and protect your investment, you can use “stop-loss orders” to automatically close the position at a certain price, thus preventing further losses if the market moves against your prediction. Similarly, “take-profit orders” can be set to secure profits by closing the position once the price reaches a favorable level.

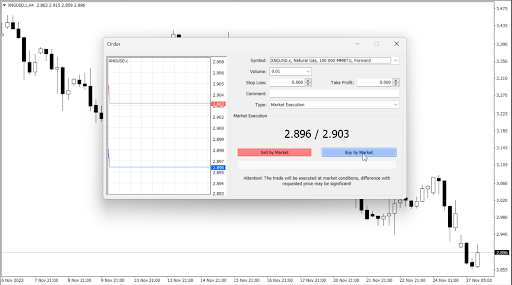

How to open a position in Metatrader

Example. To open a position in MetaTrader, as shown in the image, you would follow these steps:

-

Analyze the chart and decide on the direction of your trade (buying or selling).

-

Choose the volume of your trade.

-

Set any stop-loss or take-profit levels as part of your risk management strategy.

-

Click “Sell by Market” or “Buy by Market” depending on your decision.

MetaTrader will execute your market order immediately. Remember, attention to detail is key—monitoring the execution of your trade ensures that it has been carried out as planned.

Best Forex brokers

Conclusion

Successfully opening a position in Forex trading requires a blend of strategic planning, market analysis, and the judicious use of trade orders. Following the four essential steps allows traders to navigate the Forex markets with greater confidence and precision.

Remember, consistent practice and ongoing education are key to refining your trading skills.

Glossary for novice traders

-

1

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

2

Limit order

A limit order is a type of order used in trading where an investor specifies a particular price at which they want to buy or sell a financial asset. The order will only be executed if the market price reaches or exceeds the specified limit price, ensuring that the trader gets the desired price or better when the trade is executed.

-

3

Forex Risk Management

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).