Forex Guide For Beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Top Forex tips for beginners are:

- learn the basics

- use a demo account

- start small

- develop a trading plan

- manage risk

Forex, which stands for foreign exchange, is a global market where people trade currencies 24 hours a day, five days a week. Although Forex trading can be profitable, it's important to understand the basics to make smart decisions and avoid common mistakes. In this article, we'll cover 15 key facts about Forex trading and give you tips to help you understand the market and improve your trading skills.

Top Forex tips for beginners

Having interviewed numerous Forex trading experts over the years, we have prepared the following list of top Forex trading tips for beginners:

-

Understand that success takes time - be patient, dedicated, and learn from your mistakes.

-

Educate yourself - learn about the currency pairs, economic indicators, central bank policies, and geopolitical events. Read Forex news, take courses, attend webinars, and join trading communities.

-

Make a plan and stick to it - create a detailed plan that includes your goals, risk tolerance, strategies, and performance benchmarks.

-

Use demo account - practice trading and test your strategies without risking real money.

-

Use fundamental and technical analysis. Combine economic news and data with charts and indicators to be double-sure of the trade you’re entering.

-

Manage risk - use tools like stop-loss orders to protect your investments.

-

Keep emotions in check - stay disciplined and avoid emotional decisions. Stick to your trading plan and focus on long-term goals.

-

Re-evaluate your trading plan regularly - adjust your trading plan to reflect changes in your experience, goals, or market conditions.

-

Be patient with your trades - avoid chasing quick profits and focus on developing a consistent, long-term strategy.

-

Choose the right broker - ensure that it is regulated by reputable authorities and offer the trading platforms and tools you need.

Also, it is essential to choose an account type that suits your trading style, experience and budget. For a successful start in trading, we can choose between demo accounts, cent accounts, copy trading accounts or PAMM accounts.

| Broker | Demo | Cent | Copy trading | PAMM | Minimum deposit, $ | Deposit fee, % | Withdrawal fee, % | Open an Account |

|---|---|---|---|---|---|---|---|---|

Yes |

No |

No |

No |

100 |

0 |

0 |

Open an account Your capital is at risk. |

|

Yes |

No |

Yes |

Yes |

0 |

0 |

0 |

Open an account Your capital is at risk.

|

|

Yes |

No |

Yes |

No |

0 |

0 |

0 |

Open an account Your capital is at risk. |

|

Yes |

No |

Yes |

No |

100 |

0 |

0 |

Study review | |

Yes |

No |

No |

No |

0 |

0 |

Yes |

Open an account Your capital is at risk. |

Top Forex facts to know

-

Biggest financial market. Every day, about $6.6 trillion is traded in the Forex market (according to the Triennial Central Bank Survey of FX and OTC derivatives markets).

-

Currencies traded. You can trade around 70 to 90 different currency pairs. This number includes major, minor, and exotic currency pairs

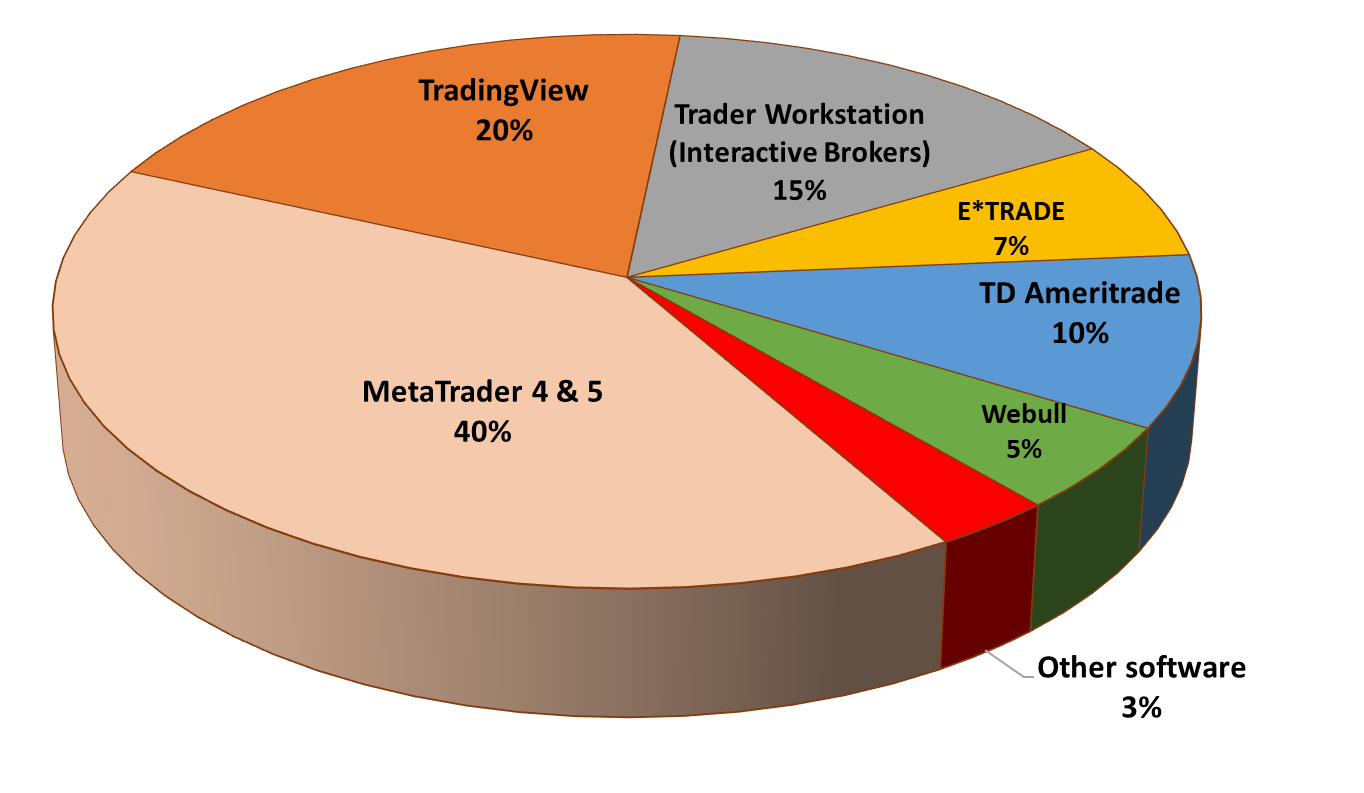

Popular trading software platforms

Popular trading software platforms

-

Top currency. The US dollar is the most traded currency, appearing in 88% of all trades.

-

Market hours. The Forex market operates 24/5, starting at 5 PM EST on Sunday and closing at 4 PM EST on Friday. It has four major trading sessions.

-

Major currency pairs. There are seven major currency pairs, and they all include the US dollar. Examples are EUR/USD and GBP/USD.

-

Volume of majors. Major currency pairs make up over 67% of the daily trading volume.

-

Minor currency pairs. Minor pairs do not include the US dollar, such as EUR/GBP and GBP/JPY.

-

Global traders. There are about 13.9 million online Forex traders worldwide (data from 2021).

-

Trading activity. 41% of traders make 9-20 trades each month.

-

Time spent trading. 14% of traders spend more than 6 hours trading each month, while 45% spend 1-2 hours.

-

Largest broker. IC Markets is the biggest Forex broker in the world, with $15 Billion of trades processed daily.

-

Trader experience. Only 7% of traders have been trading for over 10 years, while 31% are beginners with less than a year of experience.

-

No central exchange. The Forex market operates through brokers and exchanges, with major trading sessions in New York, Tokyo, Sydney, and London.

Best Forex strategies for beginners

With so many options available, it can be challenging to determine which strategy is the best fit for you.

Here are three popular Forex strategies that beginners can use to get started:

1. Price Action Trading

Price action trading focuses on making trading decisions based on the movement of prices rather than relying on technical indicators.

This strategy involves analyzing candlestick patterns, chart patterns, and key support and resistance levels.

-

Candlestick patterns. Learn to recognize patterns like Doji, Engulfing, and Hammer, which can indicate potential market reversals or continuations.

-

Support and resistance. Identify key levels where the price tends to bounce or reverse. These levels can help determine entry and exit points.

-

Chart patterns. Look for patterns such as head and shoulders, triangles, and flags to predict future price movements.

-

Start with simple patterns and gradually move to more complex ones.

-

Practice on a demo account to understand how price action works in real-time markets.

Price Action Trading Strategy

Price Action Trading Strategy

2. Trend Trading Strategy

Trend trading involves identifying and following the direction of the market trend.

This strategy assumes that prices will continue to move in the same direction as the current trend.

-

Identify the trend. Use tools like moving averages, trend lines, and the ADX (Average Directional Index) to identify the direction of the trend.

-

Enter the trade. Enter trades in the direction of the trend. For an uptrend, look for buying opportunities. For a downtrend, look for selling opportunities.

-

Use stop-loss orders. Place stop-loss orders below support levels in an uptrend and above resistance levels in a downtrend to manage risk.

-

Be patient and wait for clear trend signals before entering a trade.

-

Use multiple time frames to confirm the trend.

Trend Trading Strategy

Trend Trading Strategy

3. Swing Trading Strategy

Swing trading aims to capture short-to-medium-term gains in a stock or currency over a period of a few days to several weeks. This strategy takes advantage of “swings” in the market.

-

Identify swings. Look for price swings using technical indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Stochastics.

-

Enter the trade. Enter trades at the beginning of a swing, typically after a pullback or retracement within the larger trend.

-

Set targets and stops. Set profit targets at previous highs/lows and place stop-loss orders to limit potential losses.

-

Swing trading requires patience to wait for the best entry points.

-

Monitor the market regularly to adjust your trades as needed.

Swing Trading Strategy

Swing Trading Strategy

I recommend to start with a demo account

For beginners, I would advise to start slow and absorb all the knowledge you can before you risk bigger portions of your capital. I started with a demo account to understand how Forex works and I would suggest the same for you as well.

This guide has already covered the essentials of Forex trading, including understanding the basics, practicing with demo accounts, and starting with small investments. The emphasis on risk management, staying informed, and continuous education is spot on. To add to it, I would suggest you make your own strategies and see where they fall short. This will help you focus better and learn faster.

Lastly, remember to remain patient and never stop learning.

Summary

In this guide, we covered the importance of understanding basic Forex concepts, practicing with a demo account, starting with small investments, and developing a solid trading plan. We also talked about the need for risk management, staying informed about market trends, controlling emotions, and continuously educating oneself. Some key statistics about the Forex market were also discussed, giving you a broad idea about it.

FAQs

How to trade Forex successfully for beginners?

To trade Forex successfully, beginners should first educate themselves about the currency market and various trading strategies. Practicing with a demo account helps them experience real market conditions without financial risk. They should use both fundamental and technical analysis, manage risk with stop and limit orders, and maintain emotional discipline.

What is the trick to Forex trading?

There is no single "trick" to guarantee success in Forex trading. However, traders can enhance their chances by educating themselves about the market, creating and sticking to a trading plan, and using both fundamental and technical analysis. Managing risk with stop and limit orders and maintaining emotional discipline are also important.

Is Forex trading good for beginners?

Forex trading can be good for beginners, but it requires education, practice, and discipline. It's important to learn the basics, practice with a demo account, develop a trading plan, manage risk, and maintain emotional control.

How to start Forex trading without investments?

You can start Forex trading without investments by taking advantage of no-deposit bonuses, participating in Forex contests, or joining affiliate programs offered by brokers.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

The Stochastic Oscillator is a technical indicator used in financial analysis to gauge the momentum of a security's price and identify overbought or oversold conditions by comparing the closing price to a specified price range over a defined period.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.