Best Forex Automated Trading Software

Top automated trading software:

-

1

RoboForex Forex EAs Builder - Best For Beginners

-

2

eToro - Best Copy Trading Software

-

3

cTrader Copy via IC Markets - Provides advanced risk management features

-

4

AvaSocial (AvaTrade) - Best user-friendly app

The forex market is volatile, fast-paced, and requires constant monitoring to spot fleeting trading opportunities. But what if you could design a digital co-pilot to do the watching and waiting for you, taking the wheel to buy and sell at precisely the right moments?

Thanks to automated trading software, you no longer need to sit glued to charts and screens all day. Programs like Expert Advisors, social trading platforms, and broker-specific bots are the trading assistants of the future.

In this guide, we'll introduce you to leading automated software and show how each works its magic.

Do you want to start trading Forex? Open an account on Roboforex!-

What types of automated trading software exist?

The two main types are Expert Advisors (EAs) and social/copy trading platforms. EAs use algorithms to place trades while copy trading follows successful traders.

-

What is the minimum deposit required for copy trading?

Deposit requirements vary by platform but are typically low, for example $200 on eToro or $100 on AvaTrade. DupliTrade requires a higher $5,000 minimum.

-

Is automated trading suitable for beginners?

Copy trading is ideal for novices, while experienced traders may find more advanced uses of EAs. Beginners should use demo accounts, keep strategies basic, diversify funds copied, and prioritize education.

-

What performance can traders expect?

Historical returns on successful strategies averaged between 10-40% annually, but past results don't guarantee future profits. Reasonable to expect 5-15% average returns depending on the market and one's skill

What is Automated Trading?

Automated trading, usually referred to as algorithmic trading, is a way of executing trades using predefined trading parameters or conditions accounting for different variables like price, time, and volume.

👍 Pros

• Minimizes emotional involvement while trading

• Traders do not have to conduct deep market analysis before placing trades

• Allows traders to execute trades even when they do not sit in front of the screen

• Multiple transactions can be performed simultaneously

• Traders can take advantage of trading opportunities they are not aware of

• They can work autonomously without human involvement and require very little attention.

👎 Cons

• They can lead to losses if trading parameters are not correctly predefined

• Technical issues can occur, causing the software to malfunction

Main Types of Automated Trading

The main types of automated trading software for Forex trading that exist today are Forex expert advisors (EAs), also called trading bots, and copy trading also referred to as social trading. Although they both allow you to perform automated trades, they do this in different ways. Here is what you need to know about these automated trading software:

Forex Expert Advisors

An expert advisor (EA) is a piece of software that has been specially designed to perform trading functions. This software alerts forex traders to trading opportunities and advises them on which trades to execute. In addition, an expert advisor can manage trades in place of a forex trader. So, you can use an EA for discovering profitable trading opportunities and then place the trades manually, and you can also let it automatically execute the trades.

Read more about Best Free Forex Trading Advisors👍 Pros

• They are great opportunities for beginners to make more successful trades

• A forex EA speeds up the process of testing various strategies while making decisions

• A forex EA can stay active on the market and be on the lookout for opportunities all day

👎 Cons

• A technical issue can interrupt the trade execution, leading the EA to miss opportunities or make wrong decisions

• A forex EA cannot carry out trading strategies that involve multiple instruments

• A Forex EA does not recognize fundamental data, such as industry trends and political factors

Forex EAs Builders

Simply, an EA builder is a software used for programming EAs. The MetaTrader platform is the best trading platform for EAs. Those EAs are usually built in the MetaTrader’s Meta Quotes Language (MQL), which is a Forex EAs builder. The EAs are one of the best features of the MetaTrader platform and are made up of a mathematical model that employs trade signals to identify the optimal entry points into trades.

👍 Pros

• You can create your own EA to execute trades the way you like it

• EA builders are usually free to use

👎 Cons

• You should have solid programming knowledge to create the best EAs

Copy Trading

Copy trading, also called social trading, is another effective automated trading software that can be used to make Forex traders’ lives easier. A copy trading service lets traders connect their trading account to a trading network. When the trader that is responsible for that network makes a trade, that trade is automatically copied by the other trading accounts connected to it through the copy trading software.

What is Forex Copy Trade and how is it use? Learn more about it👍 Pros

• A beginner Forex trader can copy the trades executed by more experienced traders and gain higher profits

• It is done automatically without any involvement from the trader that copies the trades

👎 Cons

• If the trades placed by the trader responsible for the network are not successful, all the other traders experience losses

• Some traders charge monthly payments to let other traders copy their trades

MT4 - Best Forex Software for Expert Advisors

MT4 is one of the most popular trading platforms used by Forex traders for its intuitive interface and advanced charting tools. MT4 is well known for being a great platform for EAs. Although other trading platforms offer expert advisors as well, MT4 is considered the best trading platform for EAs at the moment.

One of the best benefits of using MT4 for EAs is that the EAs run smoothly and seamlessly on the MT4 platform, as opposed to other platforms that support expert advisors.

Also, it is a lot easier to add new expert advisors to a trading account using the MT4 platform, as it is for other platforms. All you have to do is to download or buy them directly from the Meta Trader website or other places online and connect them to your trading account through a very simple process.

Learn more about Top-10 M4 Signals and How to Download them for FreeHow to Use Forex EAs With MT4?

If you want to create your own EA, you can do that in MT4’s MQL language. This method is free. Although it is considered to be an easy way to build an EA, you should have some solid programming knowledge if you want to create a highly effective expert advisor.

Building an EA in MT4

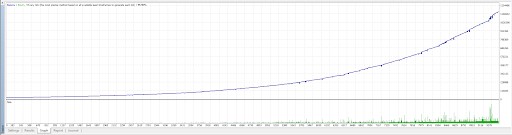

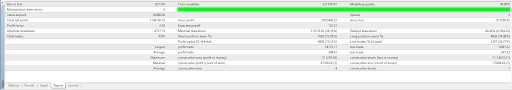

After building an EA, it is very important to backtest it.

Backtesting results

Backtesting results

If you want to use EAs, but you do not want to spend a lot of time figuring out how to build it, your best options would be to buy one or to download a free one from the MetaTrader website or other places online.

Expert Advisors vs Manual Trading - Which is Better? Read more about itTop 3 Free Forex EAs to Download

For Forex traders who do not want to create their own expert advisors and also do not want to pay for one, we have created a short rating of the three free best EAs for MetaTrader4. Here they are:

Trader New

This EA uses the Ichimoku indicator. It creates a pending order at the current price + OP Level. If the price moves in the opposite direction of CL Level, a pending order is deleted.

List of parameters:

Position opening signals (0 - forbidden, 1 - permitted); CL Signal - Position forced closure signal (0 - forbidden, 1 - permitted);

OP Level - A pending open order's level (a drift towards the current price); CL Level - A pending order deletion's level.

Daydream01

In a one-hour test with the British Pound or the American Dollar, it produced fairly good results.

Step-by-step installation instructions:

Put the *.ex4 or *.mq4 advisor file in your trading terminal's "Experts" directory. However, the first part of a path (before "Experts") may vary depending on the broker you use and where your terminal is installed.

You can begin trading with the advisor after copying the file to the appropriate directory. To accomplish this, launch your MetaTrader 4 terminal (terminal.exe file) and attach your advisor to a chart by performing one of the following actions.

When your terminal has loaded, navigate to the "Navigator" window, open the "Advisors" branch, and drag the advisor to a chart. Don't worry about your advisor being displayed in grey – it does not affect its performance and efficiency (all advisors without initial code are displayed in the same color). After dragging your advisor to a chart, a window will appear with two tabs: General and Input Parameters. Go to the General tab and check the boxes next to "Enable advisor to trade" and "Enable signals." Check that the "Manual confirmation" and "Don't repeat signals" boxes are not checked. Long and short positions must be enabled as well. The rest of the settings should be left alone. After clicking "OK," your advisor will appear in the top right corner of the chart.

The "Input Parameters" tab allows you to modify the settings (variables) of your trading process.

Calypso

This is a multi-currency EA, which means it can work with any currency pair or even multiple currency pairs at the same time. You can configure it in two ways: with StopLosses or without StopLosses. Because this trading system hedges risks, there is no possibility of your trading account zeroing out.

This EA is best suitable for the EUR/USD, GBP/USD, and USD/JPY currency pairs.

The recommended time frame is one hour.

This expert advisor has profitability from 30% per month. It requires a minimum deposit of 100$, and the minimum lot size that can be traded is 0.01. It allows you to trade with a leverage of 1:100 and higher.

Advisor input parameters:

Target – this is a profit target parameter, which is common to all currency pairs.

Lots – this is a trading lot, which will be used for trading (you should indicate a lot size that is allowed for your trading terminal).

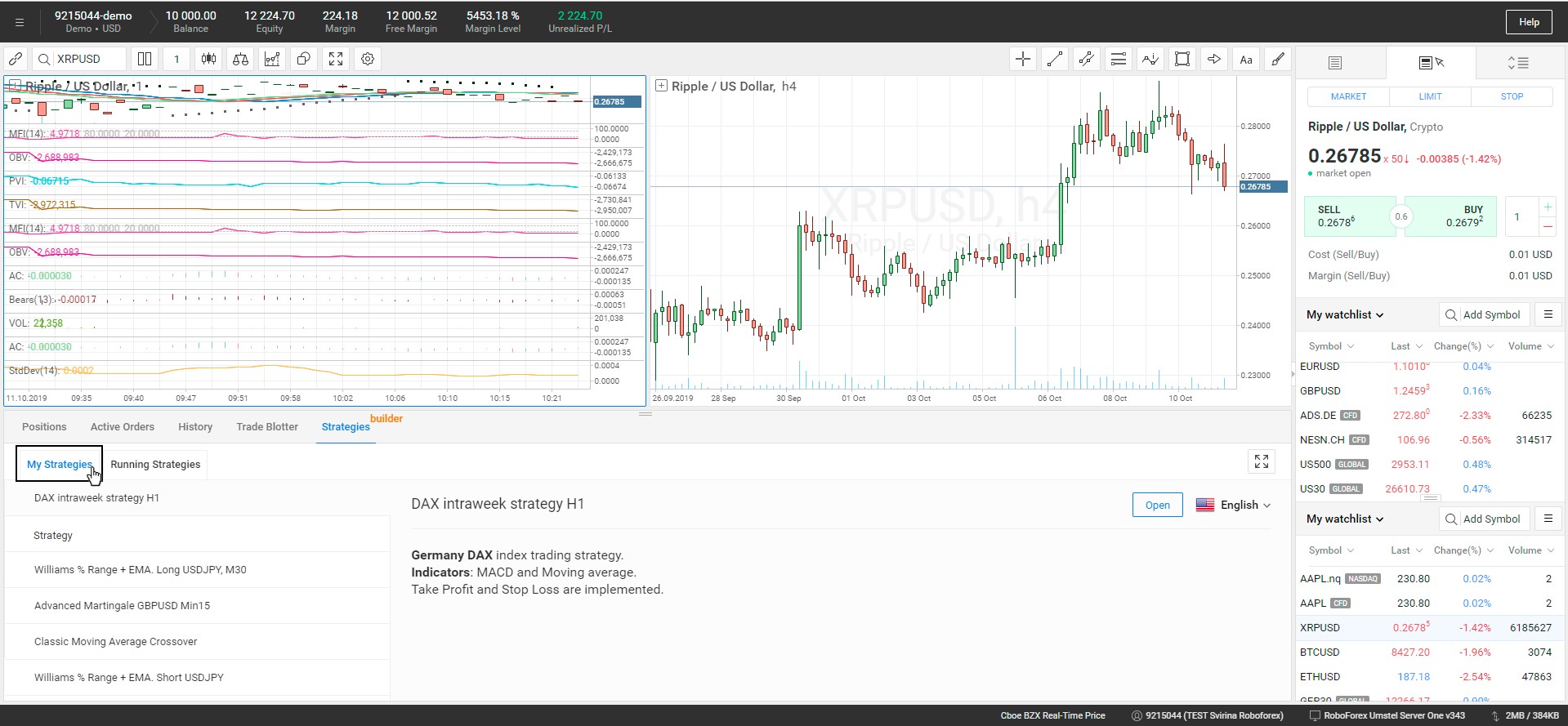

Read more about Major currency pairs to tradeRoboForex Forex EAs Builder - Best For Beginners

RoboForex is a well known Forex broker that offers a quite easy to use EAs builder for building expert advisors that run on the brokers proprietary platform, R StocksTrader.

RoboForex claims that its EAs builder is the easiest to use in the market because it uses templates instead of having to write your own code. Overall, this is a great EA builder for beginners looking to easily create a simple EA that will automate some of their trading jobs.

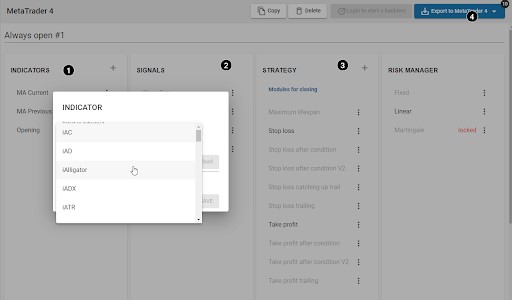

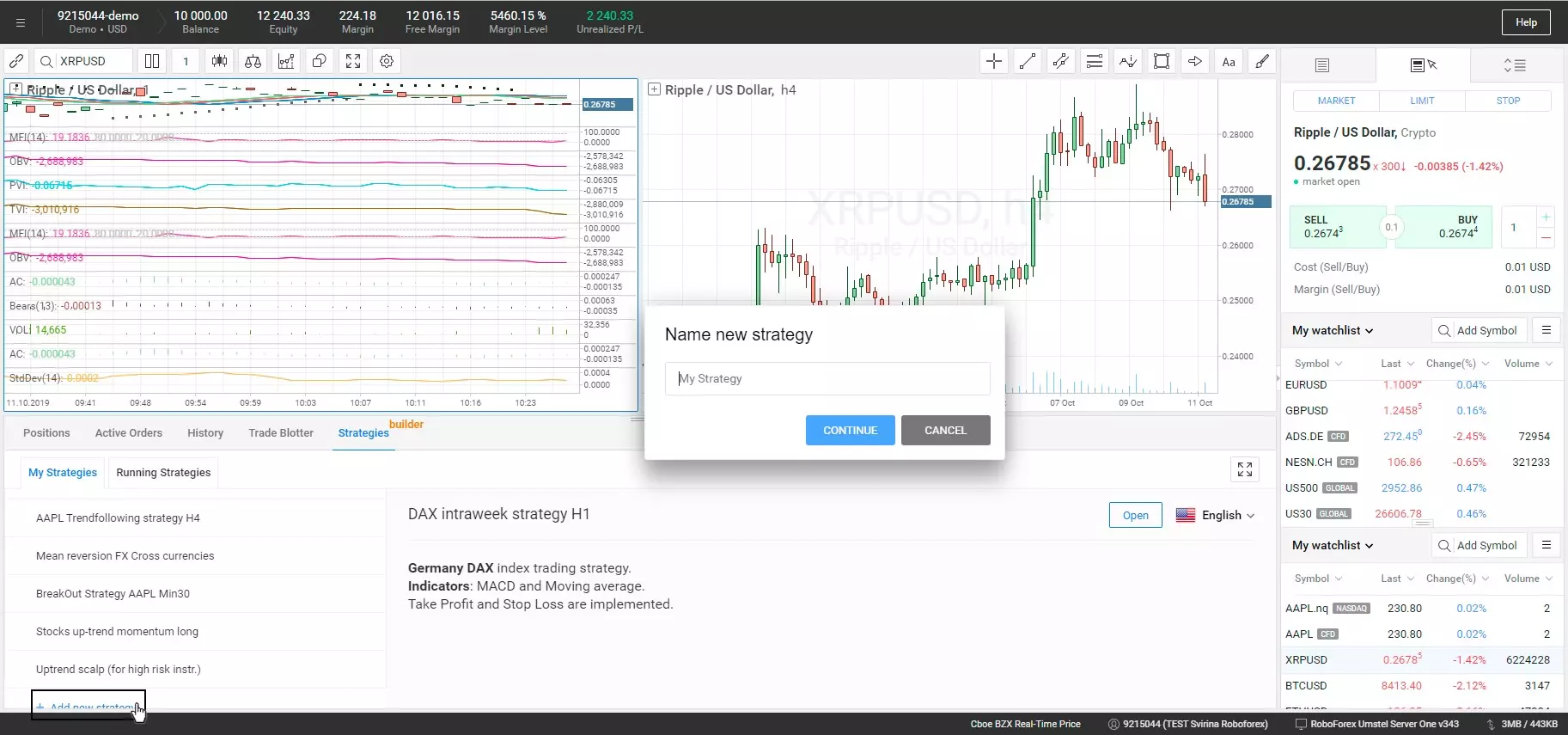

How to Use Forex Bots Builder

If you are already intrigued by how you can build your own EA with the RoboForex EAs builder, here is a short step by step guide that explains that to you:

Navigate to the "Strategies" section of the R StocksTrader platform

How to use Forex bots

Click "Add New," then enter a name and description for your robot

How to use Forex bots

Add all necessary technical indicators and rules

Save and backtest the EA you created

How to Set-up Forex EA builder

If you decide to create a simple EA, here are some key aspects you should pay attention to:

Add the indicator you want your EA to follow

Create a condition

Add a money management strategy for your EA

Export trading robot to a file

After creating any EA, it is very important to backtest it to determine if you should use it for trading.

Here is how to backtest an EA on MetaTrader:

Download or create an EA

Open the Strategy Tester in MetaTrader 4

Select the EA to test from the drop-down list

Select the currency pair and timeframe

Select the start and end dates

Set the expert advisor's input parameters

Click the Start button.

The Expert Advisor will be run on historical data, and the results will be displayed. If you are happy with the results, feel free to use it for trading.

Forex Telegram Copier RevieweToro - Best Copy Trading Software

If you want to try copy trading, you should consider the eToro broker because it is considered one of the best brokers for copy trading. This broker has one of the most advanced, powerful and extensive social trading networks for generating passive income. It stands out for its low entry threshold, favorable trading conditions, excellent functionality, and simplicity.

The best advantages of this copy trading software are:

Minimum investment – $200

There are lots of experienced traders who allow other traders to copy their trades

Largest copy trading network in the world

No additional commission. The broker only earns from the spread

Regulation in the UK, EU and Australia

To use this copy trading software, click on “Copy People” after you access the eToro online platform. Then, you can select the most successful traders by strategy, the number of copiers, return rate, and risk score.

After you do that, you can analyze traders by different trader statistics, such as:

An average risk score of the specified period

Maximum drawdown per day, month and year

Assets under management

Dynamics of the number of copiers

How To Copy Trades of Successful Traders Automatically

If you are wondering what are the steps you have to take for copying the best traders on eToro, here is a short step by step guide you should follow:

Pay close attention to the criteria you select for identifying the best traders on the platform

Carefully study those traders’ profiles to select 4-5 traders you want to copy

After you have chosen a few traders you want to copy, click on the “Copy” button in the profiles of the selected traders. Then, a page will open with customized copy settings.

On that page, you have to select a few copy trading parameters. The first is the amount you want to allocate for the specific trader from the general portfolio. The second is the drawdown value, upon reaching which the system must automatically stop copying.

When you click the Copy button again, the trader's trades for the selected amount will be copied automatically. The results are available in your eToro Portfolio tab.

How to Set-up Copy Trading Software

Before you start copying other traders on eToro or other copy trading platforms, you are required to select the parameters by which those traders’ trades will be copied on your account.

eToro lets you select how much money from your account balance you want to be allocated towards copying that trader’s trades. The amount of money you choose to allocate depends on your account balance size and other individual conditions, but you should not allocate too much money towards a single trader.

eToro also lets you choose a drawdown value for the funds you allocate towards copying that trader. It acts as a stop loss, which means that if you lose money and the amount of money you allocated for copying that trader reaches the drawdown value, you will automatically stop copying that trader to save your account balance.

So, the drawdown value that you choose should not be less than 70% of the funds you allocate for copying that trader, but you can choose an even higher drawdown value.

cTrader Copy via IC Markets

cTrader Copy is a scalable forex trade copier for algorithmic traders. It allows forex traders to copy strategies used by successful traders through trade signals, to benefit every user. cTrader has a visually appealing website with attractive and valuable features for automatic forex traders.

Valuable features include a premium chart, cTrader automated and manual options, cTrader forex trader copy and a web-based version. A mobile option is also available, downloadable to iOS and Android users. The commission varies depending on the broker and is usually charged on the profit earned.

Plenty of resourceful research and analysis tools like webinars and blogs exist for easy trading execution.

👍 Pros

• A high-speed website with attractive and easy-to-use features

• Clean interface and charting

• Demo account for an easier understanding of the platform

• Supports nearly 20 languages

• Easy to access on mobile, computer and web

👎 Cons

• Stop-loss orders have drastic fluctuations

• Trading bots are sometimes unreliable

Since its establishment in 2012, cTrader has proven to be a reliable forex trade copying platform for forex traders. The advanced charts will help you monitor price fluctuations, and it can be profitable if you employ the right strategies.

AvaSocial (AvaTrade)

AvaTrade is a highly trusted forex trade copy platform ideal for CFD and forex traders. It has many valuable features like hedging and scalping, stop orders, email and sms alerts, charting packages and round-the-clock trading. The platform currencies include USD, EUR, GBP, and PLN. AvaTrade has a minimum deposit requirement of $100 and accepts bonds, shares, stocks, crypto, bonds and CFDs. This platform uses 1260 symbols and has a mobile platform known as AvaOptions.

About fees and commissions, AvaTrade spreads are below one pip (0.9 pips). The charting comes with 93 indicators and a demo account where you can practice before investing real money. There are no commission fees, and withdrawals take a maximum of two business days.

👍 Pros

• Demo account for trading trials

• Great education section with plenty of learning tutorials, videos and webinars

• A mobile trading app, AvaOptions offers excellent forex trading options.

👎 Cons

• Retail pricing is slightly lower than that of market leaders.

• Education research is limited to two videos and articles every day.

Founded in 2006, AvaTrade is a privately held broker ideal for new and undercapitalized brokers. To open an AvaTrade trading account, fill out the form and add in your details. Fund the account with a minimum of $100, choose payment methods and go live.

MyFxbook Copy via Pepperstone

MyFxbook is a well-connected forex trading community that allows you to copy trades, thanks to its analytical tools and resources. The platform welcomes traders of all skills and levels, although beginners and intermediate-level traders are the best fit. MyFxbook has a wide array of terminals and charts which show your balance, profits and growth rate.

MyFxbook offers a smooth user experience and helpful features like a calendar, news, volatility, spreads and quote comparison. The platform terminals include MetaTrader 4, MetaTrader 5, FXCM, and cTrader. The brokerage commission depends on the charges of your broker, and you can trade a wide range of products, including commodities, crypto and forex.

👍 Pros

• No commission for social trading

• Demo account for test trading

• Wide access to multiple brokers, markets and terminals

•It supports eight trading signals.

👎 Cons

•The initial minimum copy trading amount is quite high($1000)

• The user interface is limited and outdated.

• Connections are quite complicated.

MyFxbook is a well-known social community that you can rely on for copy trading and generating significant profits. Its robust systems control allows you to remove or add a system anytime. Study and research resources are also available, and you can download MyFxbook for Android for easy access.

DupliTrade via Fusion market

DupliTrade is a simple, user-friendly auto-trading account that allows you to duplicate trades into your Fusion market MT4 account. Unlike most automated forex traders, DupliTrade is relatively small and still growing and only chooses successful traders with remarkable trading history.

This web-based platform has about ten signal providers that it selects. You should have a minimum deposit of $5000 to use the DupliTrade platform, so it’s an ideal forex trading copier for experienced traders with large deposits. There are no monthly commissions, and most site interactions are generally free.

👍 Pros

• Demo account for free trading before going live

• Free to join

• Regulated by CySEC

• User-friendly and transparent in all processes

👎 Cons

• High minimum deposit of $5000

• Limited selection for strategy providers and brokers

DupliTrade is an accommodating platform for experienced auto forex traders that you can try. The demo account has a 30-day trial period that allows you to trade a maximum of 50,000 USD virtually.

MQL5 via XM

MQL5 is another great forex automatic trading platform that supports trading terminals: MetaTrader 4 and MetaTrader 5. It allows a small minimum investment of $1, and you can trade a wide range of products in MGL5, including forex, cryptocurrencies, stocks and commodities.

MQL5 has plenty of features that facilitate the copy-trading process and make it easy to connect with other friends. The chart shows the trading history, reviews, risks, slippage, and what's new. A blog is also available where you can find guides and other informative resources for trading.

👍 Pros

• It supports the two leading trading terminals, MT4 and MT5

• Easy to use with an attractive design

• Informative resources for forex traders

• Demo account for a free trial

• No fees for withdrawals

👎 Cons

• The platform is not regulated

• The commission is charged on transactions

MQL5 is a reliable platform to trade via XM and generate profits. However, risks are still involved, like with any other trading, so you should try the demo first.

You may also be interested in Best auto trading Brokers in the world.

What Type of Automated Trading Software To Choose?

Finally, what type of automated trading software is better? The answer to this question depends on certain individual factors, such as your skills.

If you have solid programming skills and you know what are the best trading parameters to choose for your EA, you should build your own EA. For traders who do not have those skills, there is the option of creating a simple EA using templates. Although they might not be as effective as some EAs that are built with coding, they will still do a decent job.

On the other hand, if you do not have programming skills and you want to use Forex EAs, but you want a professional EA, you should consider the option to buy or download a great Forex EA created by someone else.

Although EAs are capable of trading all day and can execute successful trades, they are not perfect. There are situations where experienced traders can place better trades than some EAs. Copy trading is a great option for Forex traders to copy the trades executed by those traders. However, the biggest difficulty is choosing a trader who can have such performance.

Summary

An EA is an excellent way to increase your earnings in forex trading without intensifying your effort. An EA manages trading opportunities and analyzes the market while you are not available to do it yourself. However, before using an EA, it is very important to backtest the EA and periodically check its performance.

Similarly, copy trading is also recommended for traders who are looking for an effective way to place more profitable trades. But you have to pay close attention to the traders you copy and the copy trading parameters you choose to not put your account balance in danger. The automated trading software you choose depends on your preferences, but you should consider trying both of them.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.