Successful Forex Traders Typical Profit

Typically successful traders can expect to make 3-5% profit per month trading Forex, though this number can be increased by using leverage and engaging in riskier trades. The annual average salary for a Forex trader in the US is $111,581, but some make millions of dollars per year. The rate of traders who succeed varies depending on the source but tends to be around 5-10%, with 85-95% of Forex traders failing to make a profit.

Forex is one of the most popular forms of trading available, with over 10 million people trading Forex 24 hours a day throughout the world. Someone entering the world of Forex for the first time would probably wonder how much they are set to make as a trader - after all, the aim of Forex trading is to make money! But how much exactly can one make from Forex trading? The answer is not so simple.

In this article, we look at what makes a successful trader and how much they tend to make. We explain how many traders make a profit, how to calculate your profit, and what factors impact it. By the end of this article, you should have a more defined idea of how much profit you can make as a Forex trader.

-

Can you make 1% a day in Forex?

Can you make 1% a day in Forex? While it is possible, it’s extremely unlikely. If you made 1% profit every trading day for a year starting with $1,000, you’d end up with $13,290.99, an increase of 1229.099%. A more realistic outcome is to make 2% to 5% profit per month.

What makes a successful trader?

Unfortunately, there’s no surefire way to become a successful trader and no magic recipe for a profitable Forex trading career. Forex trading is a high-risk, high-reward activity that, while producing a large number of millionaires, also creates a lot of losers. Fear not, however, as although there’s no way to guarantee success at foreign exchange trading, there are definitely steps you can take to maximize your chances of doing well in the often precarious world of Forex. It takes a lot of learning, dedication, and hard work, but becoming a successful trader is attainable.

In spite of what you may read on some websites, Forex trading is not a get-rich-quick scheme. It’s a professional endeavor that requires an incredible amount of learning and understanding, supported by a consistent ability to trade according to a disciplined strategy and continuous engagement with market-related news and events. To many traders, it’s a full-time job.

You’ll probably come across an abundance of tips online on how to become a successful Forex trader. While some might make false promises, some tips ring true and apply to most successful traders. You need to carefully adhere to a well-crafted trading strategy, but at the same time, be flexible enough to adapt to changing market conditions or unforeseen outcomes. You should be using the wide array of tools available to perform technical analysis, following trends and using indicators, while at the same time keeping an eye on fundamentals such as geopolitical events or interest rates. You need to be keenly focused, using risk management like take-profit or stop-loss orders, but at the same time avoid getting emotional and basing trades on greed or fear. Like we said – it’s not easy! You need strategy, discipline, and patience.

Best Forex brokers

How much can You make from Forex trading?

Giving a clear insight on how much you can make from Forex trading is not straightforward, as the answer is dependent on many factors, including how much starting capital you have, how much time you’re dedicating to trading daily, and the strategies being employed. However, you can generally expect to make 3-5% of your account holdings per month. That means with an account of $100,000 you could realistically be consistently making $3000 to $5000 a month. Of course, the average trader doesn’t have $100,000 lying around when they get into trading.

The top traders in the world can make millions of dollars or in rare cases billions. Billionaire hedge-fund manager George Soros famously made over $1 billion in one day when he took a huge short position against the British pound in 1992 on what was dubbed ‘Black Wednesday’ in the UK. Other well-known Forex traders such as Andy Krieger, who shorted the New Zealand dollar for $300 million, or Stanley Druckenmiller who made hundreds of millions shorting the German mark, show that Forex trading can lead to unimaginable profits.

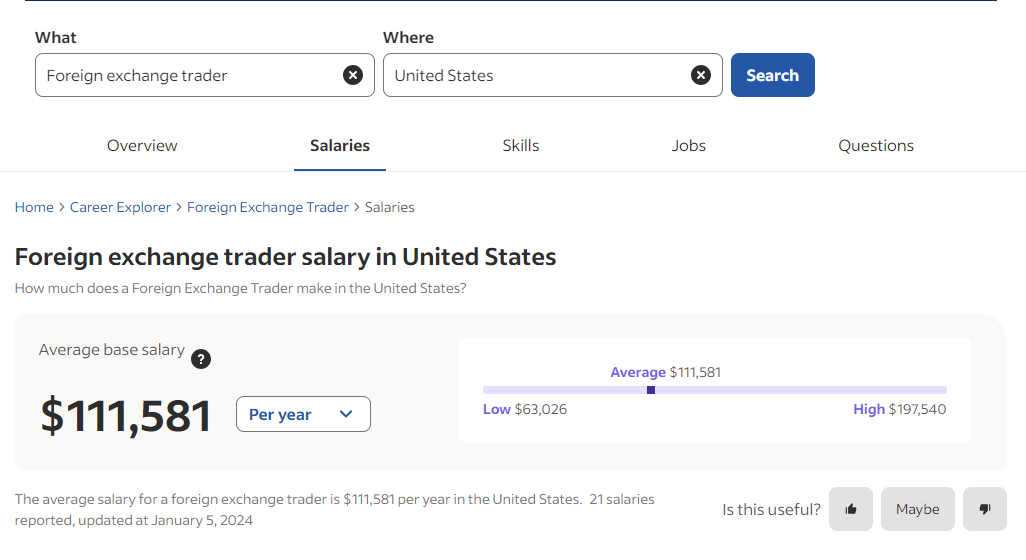

For regular traders though, expected profits are a lot more grounded. Some research puts annual estimates for the average Forex trader at roughly $5,000. According to recruitment website Indeed however, a professional Forex trader on average takes home a salary of $111,581 per year. This number is most likely for prop traders, who use a prop trading firm’s capital to generate profit.

Forex trader salary in United States

As a general trader or a beginner, it’s more difficult to turn such large profits, particularly if you don’t have a lot of starting capital. Traders with lower capital would need to engage in higher-risk trading using leverage to see such large profits, which is not always advisable. Alternatively, you can become a funded trader or enter Forex competitions to increase trading capital. It’s important to remember though that few Forex traders actually succeed.

How many Forex traders make money

The ratio of successful traders to unsuccessful ones is alarmingly high, especially if you’re a beginner just dipping your toes in the Forex ocean. According to multiple online sources, less than 10% of traders consistently make a profit while 85-95% break even or lose money. The number of Forex traders who succeed changes when certain factors are altered. According to a poll of users on Daily Forex, 85% of Forex traders succeeded when they had four or more years of experience, indicating that as you gain more experience as a Forex trader, the likelihood of positive returns increases.

Forex = an opportunity to get rich but with low chances of success

It's difficult to find an exact number regarding how many Forex traders make money, but the general numbers seem to be anywhere between 5% and 10%. What we can say with certainty though, is that the difference between those who do well and those who don’t is: experience, knowledge, and strategy. Successful Forex traders have a deep understanding of the market and know which factors affect currency prices. They stay ahead of trends, keenly follow economic news and events, and have a comprehensive strategy based on technical and fundamental analysis, with clearly defined entry and exit points.

Decades of research provide clearer numbers of success rates in trading other financial assets such as stocks, which you can read about in our article: How Many Traders Make Money?

Factors that affect Your profits

Although your starting capital will be the biggest determinant of how many dollars you make in profit, there are a multitude of other factors that will impact your bottom line. A beginner Forex trader with $1,000,000 in capital could still trade at a loss or only make $10, and someone with $1000 could turn it into $10,000. How you trade is as equally important as what you trade. Let’s take a closer look at those other factors.

Trading strategy

The way that you trade could make or break your future in Forex trading. Some strategies are inevitably going to be more successful than others, so it’s crucial to carefully choose an approach that aligns with your financial goals, available hours, and personal taste. For example, using scalping strategies can generate frequent profits of small amounts but would require you to be very active as well as disciplined. If you opted for a trend-following strategy instead, you could generate larger profits but less frequently, which requires patience and doesn’t necessarily need to be done full-time.

Draw out how you will determine entry and exit points based on technical analysis, fundamental analysis, or both, and incorporate your approach into your strategy. Decide on what levels to set your take-profit and stop-loss levels at, based on your risk-reward ratio. There are several ways to calculate suitable levels for limit orders – you should choose one that works with your wider strategy. Overall, the most important thing is to adhere to the strategy you line out but regularly adjust it based on prevailing market conditions.

To get ideas for building your own unique trading system, use this article: Top 10 Effective Forex Trading Strategies

Risk tolerance

Taking on more risk can help to significantly increase your profits, which is particularly tempting if you’re already starting with low capital. However, you should bear in mind that risk and reward are inversely correlated – that is, the higher the risk the higher the reward, and vice versa.

You might consider using high leverage to increase the size of the positions you control, but be aware that the higher the leverage, the more you expose yourself to huge risk. Determine how comfortable you are with risk and set take-profit and stop-loss orders accordingly, to avoid incurring substantial losses.

Experience

As with any money-making endeavor, experience plays a vital role in determining Forex trading success and profit levels. Novice traders may encounter challenges in decision-making and risk management, which can be alleviated with the right know-how. With experience, traders often develop better judgment, refine strategies, and learn to navigate various market conditions.

Although some studies suggest that it can take four years before success rates turn positive for Forex traders, there are ways to speed up the process of becoming an educated and experienced trader. Consider using demo accounts and paper trading to practice strategies and become familiar with market conditions and behaviors. Use all the educational tools at your disposal to deepen your understanding of markets and learn about various strategies. Participate in community forums, sign up for Forex newsletters, follow market news – anything to solidify your knowledge of Forex and build on your experience.

Leverage

This ties directly into your risk tolerance, but the use of leverage can have a huge impact on your profit levels. High leverage allows you to control larger positions with a smaller capital outlay, but it magnifies both gains and losses. Managing leverage wisely is crucial for balancing risk and potential rewards. It’s generally recommended that only experienced traders use leverage, and don’t engage in unfounded speculation based on greed.

Slippage

Slippage occurs when the actual price that a buy or sell order executes at differs from the expected price that the trader opened or closed a position. It can impact profit levels, especially during volatile market conditions when prices are moving rapidly and significantly. Managing expectations and using tools like limit orders can help mitigate the impact of slippage.

Psychological factors

Emotional discipline and psychological resilience are critical aspects of successful trading. Fear, greed, and impatience can lead to poor decision-making. It’s common for traders without a well-defined strategy to leave a position open for too long in the hope of increasing profits, only for the price to decline again and those profits be lost. Alternatively, letting a position stay open for too long during a price drop, in the hope that it will recover, can lead to losses that could be avoided with some basic trading discipline. Developing emotional intelligence and maintaining a disciplined approach both contribute to long-term profitability.

Broker selection

The broker and platform that you conduct your trades on can have a large impact on your bottom line too. Trading on those with high spreads or additional fees and commissions can eat into your profits, while opting for a reliable broker with efficient order execution ensures that your trades are executed at the desired levels. Make sure to thoroughly research a broker before committing to trading with them.

How is profit calculated in Forex?

The best way to explain how to calculate profit in Forex is to use an example. Let’s imagine we are starting with an account size of $10,000 and we’re going to make 5 trades every day, Monday to Friday, totaling 25 trades per week or 100 per month. We’ll assume a 50% success rate, meaning half of the trades turn a profit while the other half come out at a loss.

With each trade, we risk a healthy 1% of our capital ($100), at a risk-reward ratio of 2:1, meaning we will exit the position if it incurs a loss of $100 or a profit of $200. We can set the position size of each trade at $1000, so if it decreases by 10% ($100) or increases by 20% ($200), we will exit the trade. That means that over the course of one month, we close 50 winning positions at 20% and 50 losses at -$100 each. We can total up the successful trades and subtract the losing ones to calculate our total profit for the month, which looks something like this:

Total profit = (Number of trades X success rate X percentage profit on winning trades X position size) – (number of trades x (1 – success rate) x loss on losing trades)

Using the values we’ve set, this amounts to:

Total profit = (100 x 50% x 20% x $1,000) – (100 x (1 – 0.5) x $100)

Which comes to $10,000 minus $5000. We then deduct commissions for the 100 trades at $5 per trade ($1000), which leaves us with $4500 profit for the month, or 45%.

Remember that this example uses placeholder values simply for illustrative purposes and making a 45% profit in one month of Forex is highly unlikely, particularly for beginners. When calculating your profit, substitute the values in this example to reflect your own trades.

How to start making money with Forex trading?

Now that you have a better insight into how much profit Forex traders can realistically expect, you likely want to take the next step toward joining the Forex world. Follow these steps to begin your journey into Forex:

-

Educate Yourself: Learn the basics of Forex trading, including terminology, market mechanics, and different trading strategies. The more you know, the better equipped you’ll be. Utilize educational resources, online courses, and reputable trading books. Traders Union offers a free extensive library of information on all things trading, suitable for beginners.

-

Understand Market Dynamics: Gain insight into factors influencing currency movements, such as economic indicators, geopolitical events, and central bank policies. Stay informed about global economic developments and follow appropriate market news to bolster your general Forex studying.

-

Choose Reliable Broker: Select a regulated and reputable Forex broker. Consider factors like regulatory compliance, trading platforms, fees, and customer support. Research each broker you’re considering by reading customer feedback and in-depth reviews online. Make sure the one you settle on aligns with your trading goals and strategy.

-

Develop Trading Plan: Create a well-defined trading plan that includes your financial goals, risk tolerance, and trading strategy. Outline your entry and exit criteria, risk management rules, and position sizing, based on your risk tolerance and starting capital. Implement sound risk management practices. Determine the percentage of your capital you're willing to risk on each trade.

-

Practice on Demo Account: There is perhaps no better way to learn how to trade Forex than to practice on a demo account using virtual money. Demo accounts allow you to familiarize yourself with the trading platform and test your approach in a risk-free environment, while also gaining invaluable hands-on trading experience in a simulated setting.

-

Refine Strategy: Analyze the results of your demo trading. Identify strengths and weaknesses in your strategy and make any necessary adjustments. Refining your approach is crucial for long-term success and is part of a continuous learning process.

-

Start Using Real Capital: Begin with a small amount of capital that you can afford to lose, making small trades and carefully managing your risk. As you gain confidence and experience positive results, you can consider gradually increasing your trading size.

-

Stay Disciplined: Adhere to the trading plan you outlined and remain disciplined. Avoid emotional decision-making, and don't let fear or greed drive your actions. Consistency is key to long-term success.

-

Monitor and Adapt: Although adhering to your strategy is important, you should also be adaptable and adjust your strategy as market conditions evolve. What works in one market situation may need modification in another, so stay flexible and responsive. Stay updated on market developments and continue learning. The Forex market is dynamic, so continuous learning is essential.

If at first you don’t succeed, be persistent, learn from your mistakes, and assess what you did wrong the first time. The Forex market is always evolving, and so traders must evolve and adapt with it. Make sure to only trade what you can afford to lose and treat each trade as an opportunity to learn. With patience and education, you can be part of the dedicated 10% of successful Forex traders who make a solid living from trading.

Conclusion

As a Forex trader, it is possible to make large sums of money with the right strategy and experience. Though the exact success rates can be hard to determine, testimonies from a wide range of sources show that successful Forex traders can make millions of dollars, though the average trader should be looking at more realistic goals in the thousands. The best way to get to a position where you can see strong returns on your Forex trades is through learning, learning, and more learning. A Forex trader with more experience and knowledge about the ever-changing market environments and strategies is much more likely to succeed.

However, it’s crucial to remember that Forex is a risky activity and achieving higher profits usually involves introducing higher risk into your trades. Even with solid experience and knowledge, risk cannot be avoided. As always, do your own research, exercise due diligence with your trading, and apply stringent risk management techniques.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.