deposit:

- $1

Trading platform:

- DEGIRO's proprietary platform

- Netherlands Financial Markets Authority (AFM) and the Central Bank (DNB)

- UK Financial Regulatory Authority (FCA)

DEGIRO Review 2024

deposit:

- $1

Trading platform:

- DEGIRO's proprietary platform

- Not indicated

- Provides access to 50 European and world exchanges

Summary of DEGIRO Trading Company

DEGIRO is a reliable broker with the TU Overall Score of 7.57 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by DEGIRO clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. DEGIRO ranks 4 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

DEGIRO has a high reputation and is a trusted broker for stocks, bonds, funds, options, and ETFs. DEGIRO provides its clients access to more than four world's largest stock exchanges. Trading is carried out through a convenient platform that allows you to track the quotes of the trading instruments you are interested in real-time. Commission fees in DEGIRO are low compared to competitors. DEGIRO is a regulated broker suitable for experienced and professional traders in the Eurozone who prefer to invest in stock market assets.

DEGIRO is a Dutch investment company operating since 2008. The broker has been providing online services since 2013. Today DEGIRO is headquartered in Amsterdam and has offices in 18 European countries. Its activities are controlled by the Financial Conduct Authority (FCA, 574048), as well as regulators in the Netherlands: Financial Markets Authority (AFM, 12048408) and Central Bank (DNB, R128868). DEGIRO was awarded over 86 international awards: financial publications of Germany, France, Denmark, and the Netherlands have repeatedly recognized the company as the best stock market broker. How to open a DEGIRO account

| 💰 Account currency: | State currency of the client’s residence country |

|---|---|

| 🚀 Minimum deposit: | From 1 unit of the base account currency |

| ⚖️ Leverage: | Not indicated |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, ETFs, Currencies, Leveraged products, Bonds, Options, Futures |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with DEGIRO:

- Low brokerage fees for trading stock market assets;

- The ability to open transactions on European and American exchanges;

- Simple trading platform functionality.

👎 Disadvantages of DEGIRO:

- There is no online chat on the company's website.

Evaluation of the most influential parameters of DEGIRO

Geographic Distribution of DEGIRO Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of DEGIRO

DEGIRO broker is perfect for investors who value low fees, European regulation, stability, and reliability. The company provides clients with access to all types of regulated financial instruments on the stock market around the world — to over 50 exchanges and a variety of assets such as bonds, stocks, funds, options.

DEGIRO's main priority is to provide retail investors with professional services with minimal commissions. The broker has developed an advanced trading platform that is perfect for all types of investors. Access to services is open to traders from the largest European countries, and not only from the Netherlands.

Each representative office of the company has its website, which allows clients to evaluate trading conditions in terms of their regional and trading needs.

Latest DEGIRO News

Dynamics of DEGIRO’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

DEGIRO is an investment company that offers solutions for generating income from operations in the stock market. The broker provides its clients with access to 50 exchanges from Europe, North America, Asia, and Oceania.

DEGIRO’s affiliate program:

-

"Online Partner" is a program for website owners, bloggers, and publishers, which offers remuneration for information about DEGIRO promotion.

In addition to commissions, the partner gets a full package of marketing products: individual content, different types of advertising materials, and the personal account manager assistance.

Trading Conditions for DEGIRO Users

DEGIRO is a convenient broker for Europeans. There is no minimum deposit amount, that is why demo accounts have been canceled because even small amounts can be invested. Also, the company doesn’t charge commissions for the lack of activity on the account and its maintenance. An investment account can be opened within 1 day. DEGIRO offers convenient replenishment and withdrawal. The base currency is always the currency of the client's country of residence. How to buy/sell on DEGIRO read here.

Degiro short selling explained$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | DEGIRO's proprietary platform — mobile app and web terminal |

|---|---|

| 📊 Accounts: | Custodian, Basic, Active, For a trader, For a day trader |

| 💰 Account currency: | State currency of the client’s residence country |

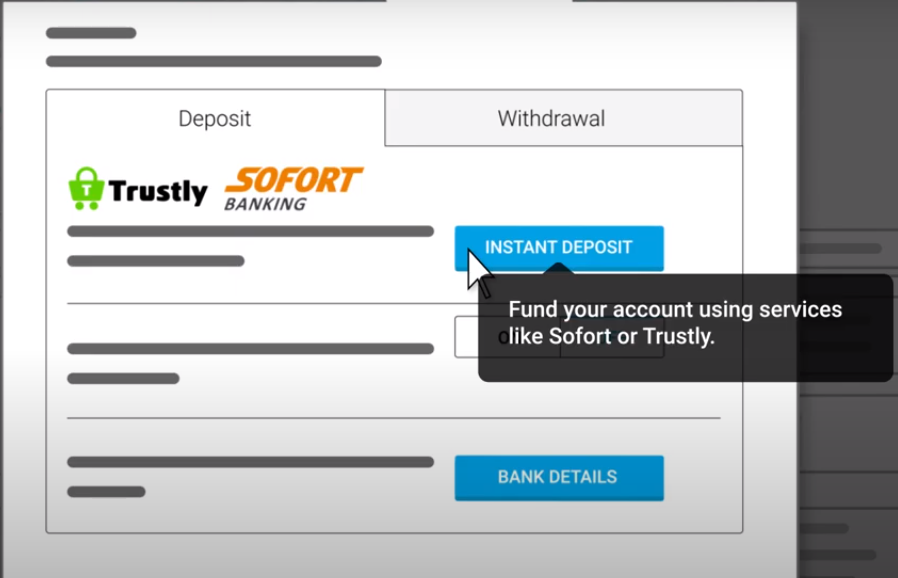

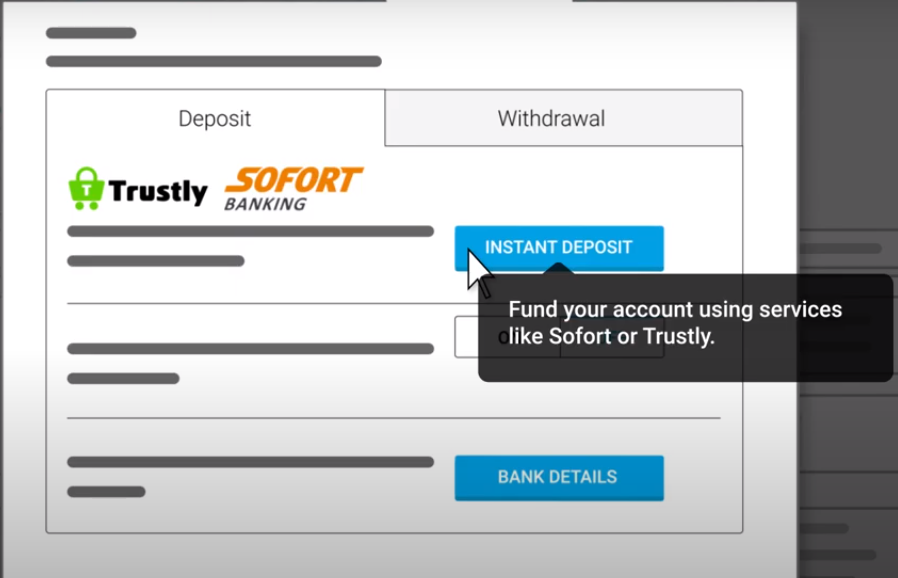

| 💵 Replenishment / Withdrawal: | Bank transfer using the Sofort and Trustly services |

| 🚀 Minimum deposit: | From 1 unit of the base account currency |

| ⚖️ Leverage: | Not indicated |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, ETFs, Currencies, Leveraged products, Bonds, Options, Futures |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Nasdaq, Xetra, CME Group, Euronext, Eurex, Borsa Italiana |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Provides access to 50 European and world exchanges |

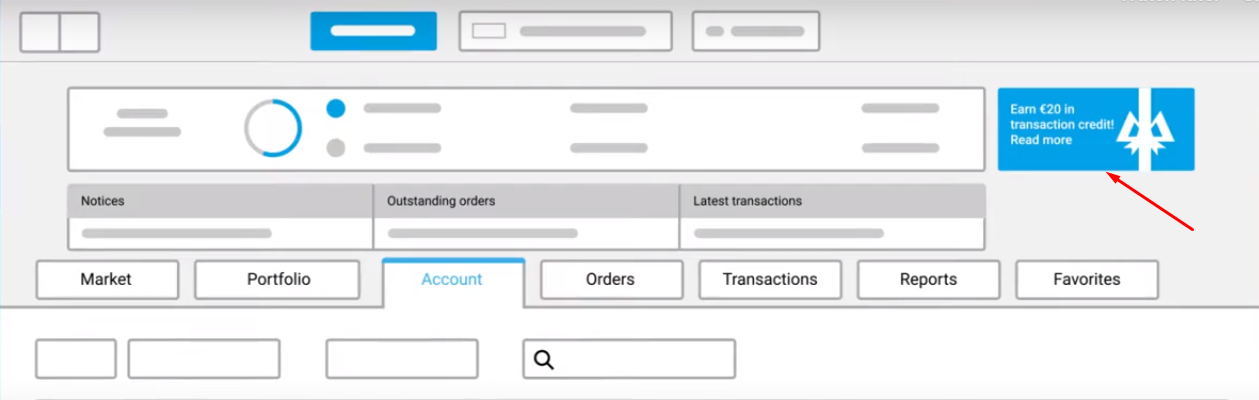

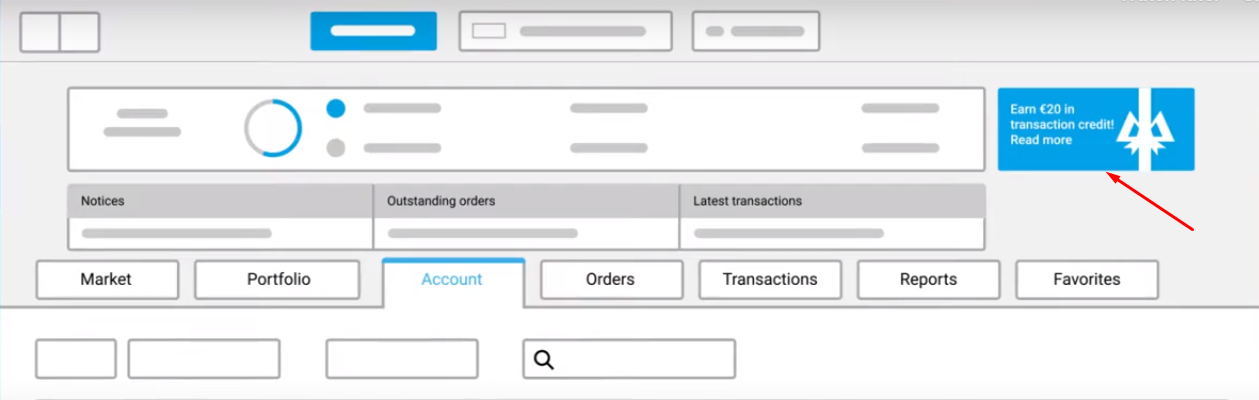

| 🎁 Contests and bonuses: | 20 euros for participation in the "Member gets member" bonus program |

DEGIRO Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| All the accounts for trading in the stock market. | 1.5$ | There is a bank commission |

Sue to services specifics swaps (commission for shifting transactions to the next day) is not credited. Also, we’ve compared trading commissions at DEGIRO.eu with those of the competitors. As a result, each of them was assigned with a level from low to high.

Detailed Review of DEGIRO

DEGIRO broker is a popular brokerage company among European traders. Investment firms are prohibited from keeping clients' money inside the company in the Netherlands so DEGIRO investor funds are automatically transferred to one of the money market funds. FundShare Fund Management and Morgan Stanley Investment Management Morgan Stanley Investment Management are suppliers of money market funds. Also, all deposits of traders up to 20,000 euros are protected thanks to the Central Bank of the Netherlands license.

A few figures that could be interesting for traders choosing a broker:

-

Over 12 years on the European market.

-

Over a million active clients.

-

Over 86 international awards;

DEGIRO is an honest broker for medium and large investments

DEGIRO is a reliable intermediary between traders and major trading exchanges. The broker's clients can invest in stocks, bonds, ETF (trackers), investment funds, options, and other products that are listed on North America, Europe, Asia, and Oceania stock exchanges. Investors are provided with a convenient platform that allows them to monitor transactions in real-time. The company is chosen for its low trading fees, multiple licenses, and a wide range of assets available for trading. DEGIRO strives to provide clients with a secure trading environment, therefore, ensures the maximum degree of data protection and the investors' assets safety.

DEGIRO Profile Details: key information about the company

You can trade both in the web terminal and using the mobile application. After opening an account, you get access to the current news feed, current market analytics and quotes from the largest stock exchanges in Europe and the world.

Useful services of DEGIRO:

-

Blog. Section with investment ideas, analytical articles, and analyzes of the latest economic and financial events.

-

Exchanges’ working hours. Displays the world exchanges working hours, as well as a holiday calendar.

-

Investor Academy. A section with investment lessons for novice traders.

Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products which match your knowledge and experience.

Advantages:

Trader's risk insurance for 20,000 euros.

A large selection of accounts for both novice investors and professionals.

Thousands of investment instruments with the lowest possible commissions are available.

Convenient trading platform with an intuitive interface.

There is a quality section with training in stock market trading.

You can profit from dividends or passive investing.

!Investing involves risk of loss

The broker doesn’t limit traders in strategies. At the same time, it offers professional tools, so the company is good enough for investors who prefer to hold profitable positions for at least 3 months, and do not often open transactions.

Guide for Traders

DEGIRO allows you to open several types of accounts at the same time. These accounts are perfect for both investors with a small deposit and professionals with accumulated capital or managing traders. Accounts differ in a feature set but are available in one platform, which is convenient when switching from one type of account to another.

Types of accounts:

The broker doesn’t provide a demo account, however, there is no minimum deposit, so a trader can immediately carry out financial transactions with small amounts.

DEGIRO is a company for private European traders who strive to trade on the best terms previously available only to professional investors.

Investment Education Online

An extensive “KNOWLEDGE” section has been created on the DEGIRO website to help novice investors. It is full information about the basics of trading in the stock market, various types of analysis and charts of the world's stock exchanges.

The broker doesn’t offer a demo account, since theoretical knowledge can be immediately applied in the real market.

Can you learn trading with DEGIRO?

Regulation (Protection for Investors)

The Dutch investment compensation system Beleggerscompensatiestelsel with insurance coverage of up to 20,000 euros is used to protect customer funds.

The company flatex DEGIRO Bank Dutch Branch (trading under the name DEGIRO) is primarily supervised by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). In the Netherlands, the flatex DEGIRO Bank Dutch Branch is subject to integrity supervision by DNB and conducted surveillance by the AFM (The Netherlands Financial Markets Authority) and the Central Bank (DNB). The British division is also supervised by the FCA — the UK Financial Regulatory Authority.

👍 Advantages

- Client funds are kept in money market funds

- In the event of bankruptcy of the company, investors have access to compensation for up to 20 thousand euros

- Contact government regulators to resolve disputes

👎 Disadvantages

- Limited choice of payment systems for replenishing the balance and funds withdrawing

Withdrawal Options and Fees

-

The DEGIRO.eu company carries out withdrawals only to verified bank accounts.

-

There is no broker commission for funds withdrawing, however, traders have to pay fees charged by banks for making transactions.

-

Bank transfer takes up to 3 business days.

-

There are no restrictions on the withdrawal of funds. The broker works within the limits that can be set by the client's bank.

-

Verification is required before making a deposit.

Customer Support Service

The broker's support service is available on weekdays: the exact opening hours depend on the representative office location.

DEGIRO Customer Service Review👍 Advantages

- Make a call or send an email.

- Multilingual support

👎 Disadvantages

- No online chat

There are several ways to contact the Company representatives:

-

call by phone numbers indicated on the site;

-

send email request;

Support is available on the broker's website and in a personal account.

Contacts

| Foundation date | 2013 |

| Registration address | Rembrandt Tower - 9th floor, 1096 HA Amsterdam, The Netherlands |

| Regulation |

Netherlands Financial Markets Authority (AFM) and the Central Bank (DNB), UK Financial Regulatory Authority (FCA) |

| Official site | https://www.degiro.com/ |

| Contacts |

Email:

clients@degiro.co.uk,

Phone: +31 20 261 3072 |

Review of the Personal Cabinet of DEGIRO

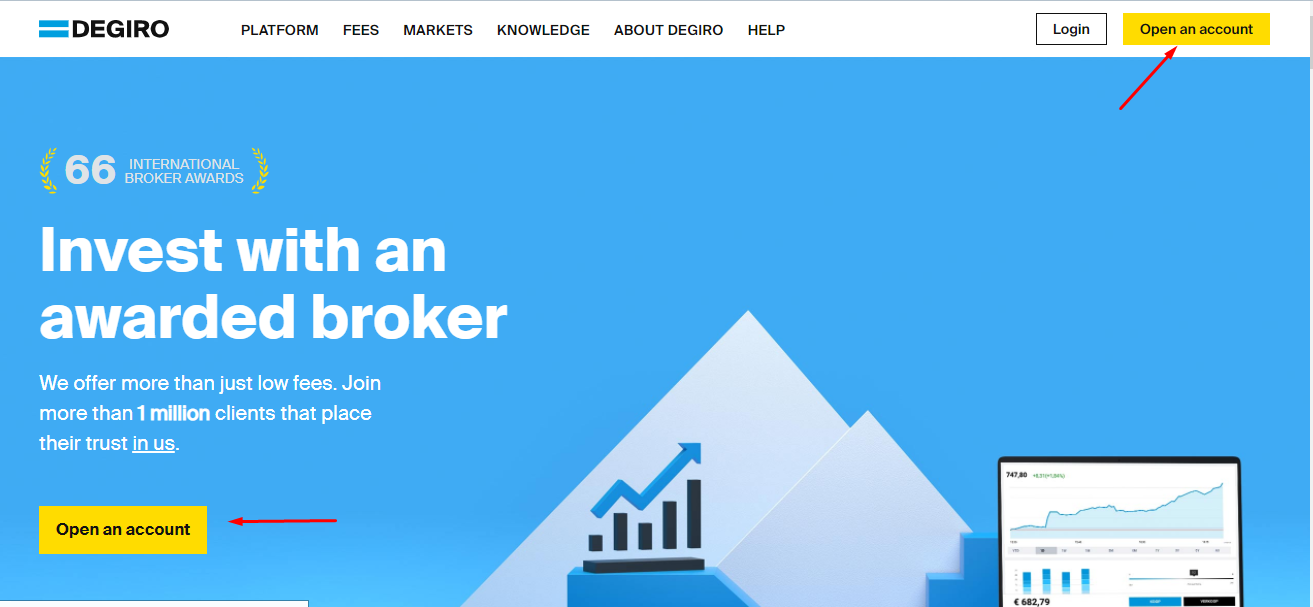

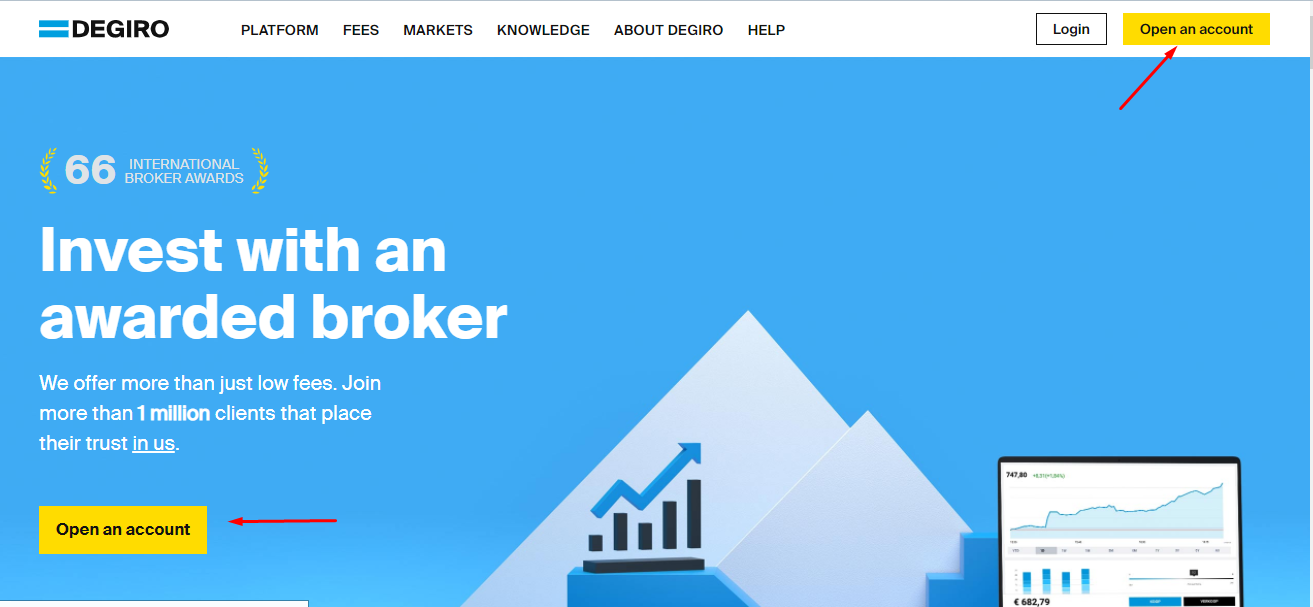

To start trading on the stock market through the DEGIRO broker, please:

Visit the broker's website and select your country of residence. Click "Open an account” on the regional website.

Specify a username and email address in the registration form for opening a trading account, and then come up with a password Next, confirm your email and log in to the system. Then enter your personal data according to your passport and link your active bank account to DEGIRO.

The following is available in the DEGIRO personal account:

1. Account replenishment and cash withdrawals.

2. Creating a referral link and viewing statistics on the "Member gets member” bonus program.

1. Account replenishment and cash withdrawals.

2. Creating a referral link and viewing statistics on the "Member gets member” bonus program.

Additional personal account functionality:

-

Transaction history.

-

Account and card management.

-

Personal data management.

-

Investment sections.

Disclaimer:

Your capital is at risk. Investing involves risk of loss Disclaimer for UK clients: Deemed authorised and regulated by the Financial Conduct Authority (FCA). The nature and extent of consumer protections may differ from those applicable to firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the FCA's website.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the DEGIRO rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about DEGIRO you need to go to the broker's profile.

How to leave a review about DEGIRO on the Traders Union website?

To leave a review about DEGIRO, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about DEGIRO on a non-Traders Union client?

Anyone can leave feedback about DEGIRO on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.