What is Market Sentiment and How To Use it Effectively

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Market sentiment refers to the collective mood or psychology of investors towards a market or asset. It can be bullish (optimistic) or bearish (pessimistic). Bullish sentiment drives prices up, while bearish sentiment pushes them down.

Market sentiment, the overall attitude of investors towards a particular security or financial market, plays a crucial role in trading. Understanding market sentiment helps traders anticipate market movements and make informed decisions. It encompasses the psychological and emotional factors driving the market, influencing prices beyond fundamental values. In this article we will tell you what market sentiment is and how to use it effectively.

What is market sentiment?

Market sentiment refers to the overall attitude or feeling of investors toward a particular market or asset. It reflects the collective emotions and perceptions of market participants, which can drive market movements and influence trading decisions.

Market sentiment captures whether investors feel optimistic (bullish) or pessimistic (bearish) about the market:

Positive sentiment can drive prices up as more investors buy.

Negative sentiment can lead to price declines as investors sell.

Sentiment can sometimes lead to irrational behaviors, like panic selling or exuberant buying, which might not align with fundamental analysis. Understanding market sentiment helps investors anticipate potential market movements and make informed decisions based on the prevailing mood of the market.

Tools to measure market sentiment

Several tools and indicators help measure market sentiment:

1. Volatility Index (VIX)

The VIX, often called the "fear index," measures market volatility and investor fear. It reflects the market's expectation of future volatility based on S&P 500 index options. High VIX values indicate increased fear and potential market declines, while low values suggest complacency and potential market peaks. Source: Investopedia.

2. Put/Call Ratio

The put/call ratio compares the volume of put options to call options. A ratio above 1.0 indicates bearish sentiment, while below 1.0 suggests bullish sentiment. This ratio helps gauge market sentiment by showing the balance between bearish and bullish bets.

3. Bullish Percent Index (BPI):

The BPI measures the percentage of stocks exhibiting bullish patterns. A BPI above 70% indicates extremely optimistic sentiment, while below 30% signals negative sentiment. This index helps identify overbought or oversold conditions in the market.

4. Moving Averages:

Moving averages, particularly the 50-day and 200-day averages, help identify market trends. A "golden cross" (50-day MA crossing above 200-day MA) indicates bullish sentiment, while a "death cross" (50-day MA crossing below 200-day MA) suggests bearish sentiment.

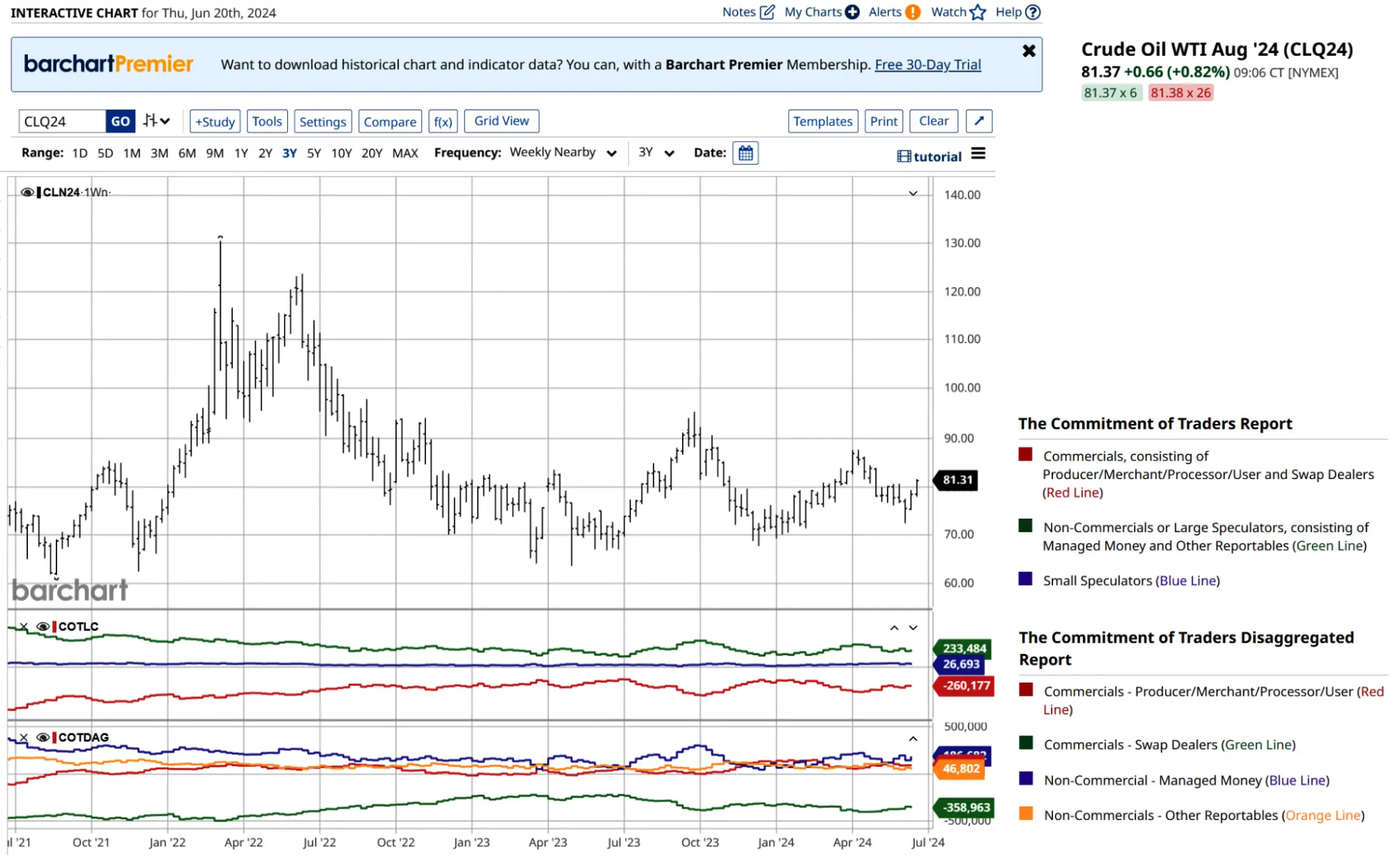

5. Commitment of Traders (COT) Report:

Published weekly by the CFTC, the COT report shows the positions of major market participants, revealing shifts in sentiment among hedge funds, banks, and corporations. Significant changes in these positions can precede market trends.

6. Social Media and News Sentiment:

Analyzing social media discussions and news trends provides real-time insights into investor sentiment. Tools like sentiment analysis algorithms can quantify sentiment from social media and news articles, offering a broader view of market mood.

How market sentiment affects trading

Market sentiment significantly impacts trading in various ways:

Price Movements: When investors are optimistic, they tend to buy more, driving prices up. Pessimism leads to selling, causing prices to drop.

Trading Volume. High sentiment (either bullish or bearish) usually results in increased trading volume as investors react strongly to their perceptions. Neutral sentiment may lead to lower trading volumes due to uncertainty or lack of strong conviction.

Volatility. Positive or negative sentiment can increase market volatility as rapid buying or selling leads to sharp price movements. Neutral sentiment can lead to reduced volatility.

Market Trends. Sustained bullish sentiment can lead to long-term upward trends (bull markets). Prolonged bearish sentiment can result in long-term downward trends (bear markets).

Investment Decisions. Bullish sentiment encourages risk-taking, leading to more speculative and growth-oriented investments. Bearish sentiment promotes caution, leading to a preference for safer, more defensive investments.

Economic Indicators. Positive sentiment often correlates with strong economic indicators (e.g., GDP growth, low unemployment). Negative sentiment is often linked to weak economic indicators (e.g., economic downturns, high unemployment).

News and Events. Positive news (e.g., strong earnings, economic growth) can boost sentiment and prices. Negative news (e.g., poor earnings, economic decline) can dampen sentiment and lower prices.

Understanding market sentiment helps traders anticipate potential market movements, align their strategies with prevailing trends, and manage risks effectively.

Sentiment analysis can be a powerful tool for developing trading strategies. Here are some common strategies that traders use based on market sentiment:

Contrarian strategy - involves going against the prevailing market sentiment.

How it works: Buy when sentiment is extremely bearish (expecting a price increase) and sell when sentiment is extremely bullish (expecting a price decrease).

Rationale: The market often overreacts to news and events, creating opportunities for contrarian traders to profit from reversals.

Momentum trading - involves trading in the direction of the prevailing market sentiment.

How it works: Buy assets that are gaining momentum (bullish sentiment) and sell assets that are losing momentum (bearish sentiment).

Rationale: Trends tend to persist for some time, allowing traders to capitalize on sustained price movements.

Sentiment-based signal confirmation - use sentiment analysis to confirm or validate trading signals from other technical indicators.

How it works: If a technical indicator suggests a buy signal, ensure that sentiment is also bullish to confirm the trade.

Rationale: Combining sentiment analysis with technical signals can increase the probability of successful trades.

News and event trading based on sentiment shifts caused by news and events.

How it works: Monitor news sources and social media for significant events that can shift sentiment. Trade in the direction of the sentiment change.

Rationale: Markets often react quickly to news, and early detection of sentiment shifts can lead to profitable trades.

Algorithmic sentiment trading - use algorithms to automate trading decisions based on sentiment analysis.

How it works: Develop algorithms that process sentiment data from news, social media, and other sources to generate buy or sell signals.

Rationale: Automated trading can quickly respond to sentiment changes, capturing opportunities that manual trading might miss.

Sentiment index tracking - use sentiment indices as part of the overall trading strategy.

How it works: Track sentiment indices like the VIX (Volatility Index) or other sentiment-based indices and use them to guide trading decisions.

Rationale: Sentiment indices provide a broad measure of market sentiment and can help traders identify overall market trends.

To successfully implement strategies based on sentiment analysis, it is important not only to have good practical experience, but also to find a reliable broker. We invite you to familiarize yourself with the terms and conditions of reliable brokers:

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investor protection | Open account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:500 | 0,4 | 1,5 | £85,000 €20,000 | Open an account Your capital is at risk. |

|

| Yes | 5 | 1:1000 | 0,7 | 1,2 | £85,000 €20,000 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | Not supported | Not supported | No | Open an account Your capital is at risk. |

|

| Yes | 10 | 1:2000 | 0,5 | 2 | €20,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:500 | 0,4 | 1,2 | No | Open an account Your capital is at risk. |

Combining sentiment with other analyses

Integrating sentiment analysis with technical and fundamental analysis, quantitative models provides a comprehensive market view:

Technical Analysis

Combining sentiment indicators with technical tools like moving averages and the Relative Strength Index (RSI) helps confirm trends. For instance, using the VIX alongside the 200-day MA provides a clearer picture of market volatility and trends.

Confirm Breakouts: Use bullish sentiment to confirm bullish breakouts and bearish sentiment for bearish breakouts.

Divergence Signals: Look for divergences between sentiment indicators and technical indicators (e.g., price vs. sentiment divergence).

Example: If technical analysis shows a potential breakout and sentiment is also positive, it increases the likelihood of a successful trade.

Fundamental Analysis

Combining sentiment with fundamental indicators like earnings reports and economic data provides a balanced view. For example, positive sentiment combined with strong earnings growth can indicate a solid buy signal.

Earnings Surprises: Positive sentiment can amplify the impact of earnings surprises, making it a good time to enter a trade.

Valuation Support: Use sentiment to gauge whether market sentiment aligns with the intrinsic value derived from fundamental analysis.

Example: If a company's fundamentals are strong but sentiment is negative, it might indicate a buying opportunity due to undervaluation.

Quantitative Analysis

Combine sentiment data with quantitative models that use statistical methods and historical data to predict future price movements.

Model Enhancements: Incorporate sentiment scores into quantitative models to enhance prediction accuracy.

Risk Adjustments: Adjust quantitative model outputs based on current sentiment levels to manage risk better.

Example: A quantitative model may predict a price increase, and if sentiment is also positive, it strengthens the trade signal.

I recommend is combining sentiment analysis with other forms of analysis

I have witnessed firsthand the power of understanding market sentiment. It's not just about following the herd but about recognizing the underlying emotions driving market movements. One of the most effective strategies I recommend is combining sentiment analysis with other forms of analysis.

For example, during the 2020 pandemic, traders who combined sentiment indicators like the VIX with technical analysis tools managed to navigate the market's volatility more effectively. The key is to remain objective, avoid emotional decisions, and use sentiment as one part of a comprehensive trading strategy.

It is also important to improve your skill level. The field of sentiment analysis is constantly evolving, driven by advancements in technology and data science. As a trader, staying updated with these developments can provide new opportunities and enhance your trading strategies. Start by regularly reading industry publications, joining webinars, and attending conferences that focus on sentiment analysis and market psychology. Engaging with professional communities and forums can also expose you to the latest trends and innovations.

Invest time in learning how to use new tools and platforms that offer sentiment analysis features. Many of these tools integrate artificial intelligence and machine learning to provide more accurate and real-time insights. Additionally, familiarize yourself with programming languages like Python, which are often used to develop custom sentiment analysis models.

Conclusion

Understanding market sentiment is essential for traders aiming to navigate volatile market conditions. By leveraging tools like the VIX, put/call ratio, and social media sentiment, traders can gain valuable insights into market moods. Combining sentiment analysis with technical and fundamental analysis enhances its effectiveness, helping traders make informed decisions. Continuous learning and adaptation are crucial, as market sentiment can change rapidly.

FAQs

What are the limitations of market sentiment analysis?

Market sentiment can be influenced by short-term news, events, and even rumors, making it sometimes unreliable for long-term predictions. It is best used in conjunction with other forms of analysis.

How can social media sentiment be used in trading?

Social media platforms provide real-time insights into investor mood and trends. Tools that analyze social media sentiment can help identify shifts in market sentiment early.

What is the significance of the Volatility Index (VIX) in sentiment analysis?

The VIX measures expected market volatility and is often referred to as the "fear index." High VIX values can indicate increased market fear and potential buying opportunities.

How do moving averages assist in sentiment analysis?

Moving averages smooth out price data to identify trends. When shorter-term averages cross above or below longer-term averages, they can signal changes in market sentiment.

Can sentiment analysis be applied to all market types?

Yes, sentiment analysis can be applied to various markets, including stocks, forex, commodities, and cryptocurrencies, to gauge the general mood of investors in those markets.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

The CFTC protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to fosters open, competitive, and financially sound futures and option markets.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.