Best Gold Trading Strategies And Tips

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

Some of the best gold trading strategies and tips for gold trading are:

- Position Trading - Long-term approach based on fundamentals

- Utilizing Real Interest Rates - Focuses on inflation-adjusted interest rates

- Breakout Trading (Technical Analysis) - Capitalizes on significant price movements

- Expert Advisors/ Copy Trading - Automated or copied trades for efficiency

- News and Sentiment Analysis - Gauges market mood and investor sentiment

In this comprehensive article, TU experts delve into the domain of gold trading, offering a wealth of strategies and insights tailored to both novice and experienced traders alike. From fundamental analysis to technical indicators, risk management techniques to market sentiment analysis, we cover everything you need to know to navigate the dynamic world of gold trading successfully. Whether you're seeking long-term investment strategies or short-term trading opportunities, this article provides expert guidance to help you optimize your approach and capitalize on the diverse opportunities within the gold market.

Best gold trading strategies and examples

Navigating the gold market requires strategic insight. Here are some top-performing gold trading strategies with practical examples.

Position trading

Position trading in the gold market involves taking a longer-term approach to trading, focusing on fundamental factors rather than short-term price movements. Unlike trading stocks or currencies, where news about specific companies or economic data drives price action, gold trading requires a broader perspective.

One key factor to consider is geopolitical developments. Gold is often viewed as a safe haven during times of uncertainty or geopolitical tensions, causing prices to rise as investors seek refuge in the precious metal.

Inflation fears also play a significant role in gold trading. When investors are concerned about rising inflation, they tend to shift to gold as a hedge against currency devaluation, driving up its price.

Monetary policy, particularly in the United States, can impact gold prices due to its inverse relationship with the US Dollar. Expectations of rising interest rates in the US can strengthen the Dollar and suppress gold prices, while the opposite scenario can lead to a weaker Dollar and higher gold prices.

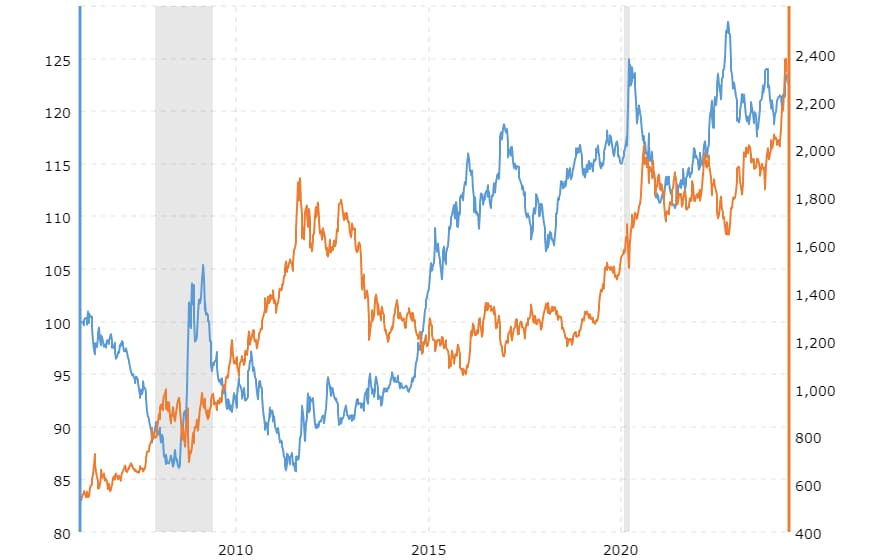

Gold price vs Dollar index

Gold price vs Dollar indexThis chart shows how the price of gold, set by the LBMA each day, compares with the closing price of the U.S. dollar index, which measures the dollar's strength against other major currencies, over the past decade.

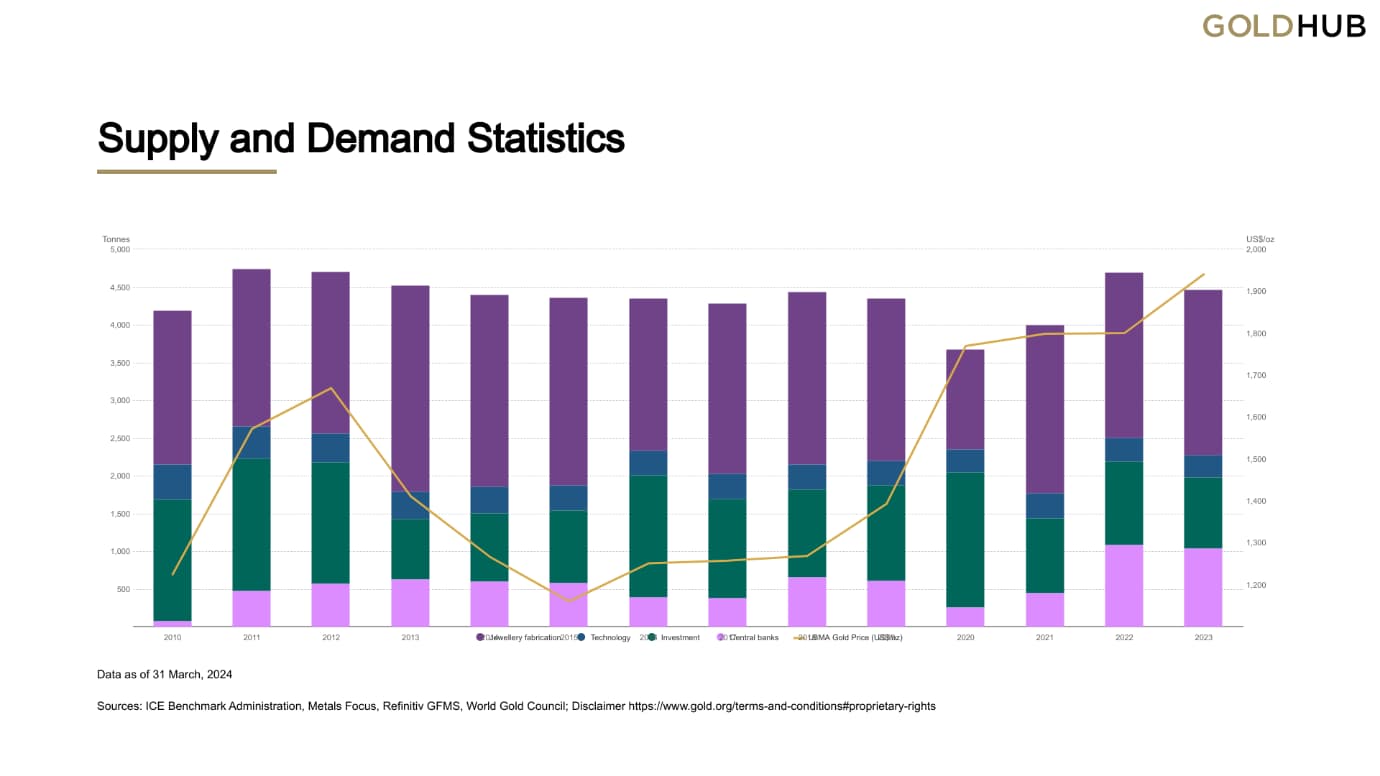

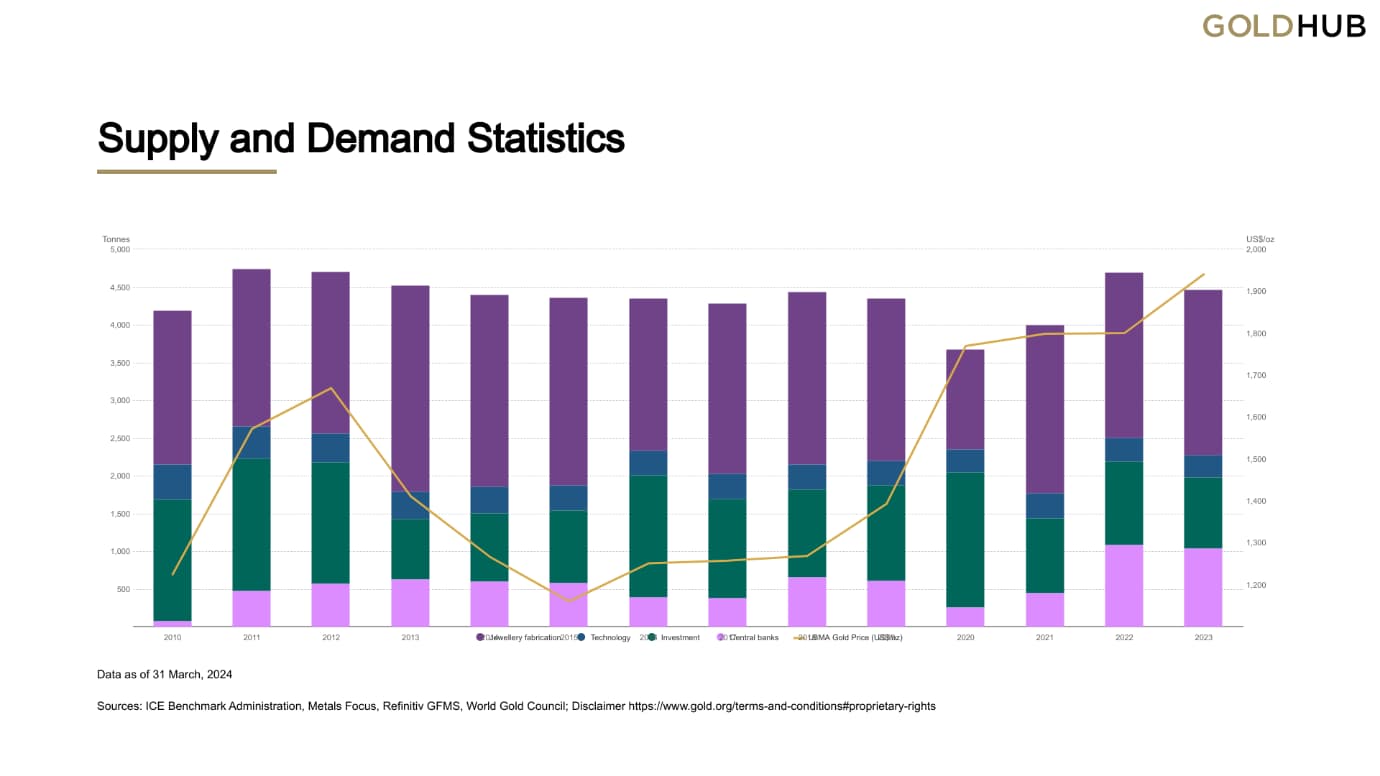

Physical supply and demand also influence gold prices. While gold ETFs and other financial instruments have gained popularity, there is still demand for physical gold for jewelry and investment purposes. Changes in demand for these products can affect the overall price of gold.

Demand statistics for gold

Demand statistics for gold Supply statistics for gold

Supply statistics for goldTo trade gold successfully using position trading strategies, it's essential to monitor global events and trends that could impact these fundamental factors. Position traders typically hold their positions for medium to long-term periods, allowing them to capitalize on broader market trends rather than short-term fluctuations.

Utilizing Real Interest Rates in Long-Term Trading Strategy

For long-term traders looking to make informed decisions in gold trading, focusing on real interest rates can be a valuable strategy. Real interest rates, which factor in inflation, play a significant role in driving gold prices over the long term.

When real interest rates rise, so do the returns on alternative investments like bonds and savings accounts, making gold comparatively less attractive. In response, gold prices may stagnate or even decline as investors seek higher returns elsewhere. On the other hand, when real interest rates are low or negative, gold becomes more appealing as it offers a hedge against inflation and currency devaluation.

As a long-term trader, you can use the level of real interest rates as a guide for your gold trading decisions. If real yields on alternative investments are below 1%, it may signal a supportive environment for gold prices. In this scenario, considering buying more gold could be advantageous, as there is potential for future price appreciation.

Conversely, if real yields exceed 2%, it may be wise to consider selling gold. This is because gold typically doesn't offer returns exceeding 2% in the short to medium term, and prices may begin to decline as investors seek higher-yielding opportunities elsewhere.

By monitoring real interest rates and adjusting your gold trading strategy accordingly, you can position yourself to capitalize on long-term trends and maximize your profits in the gold market.

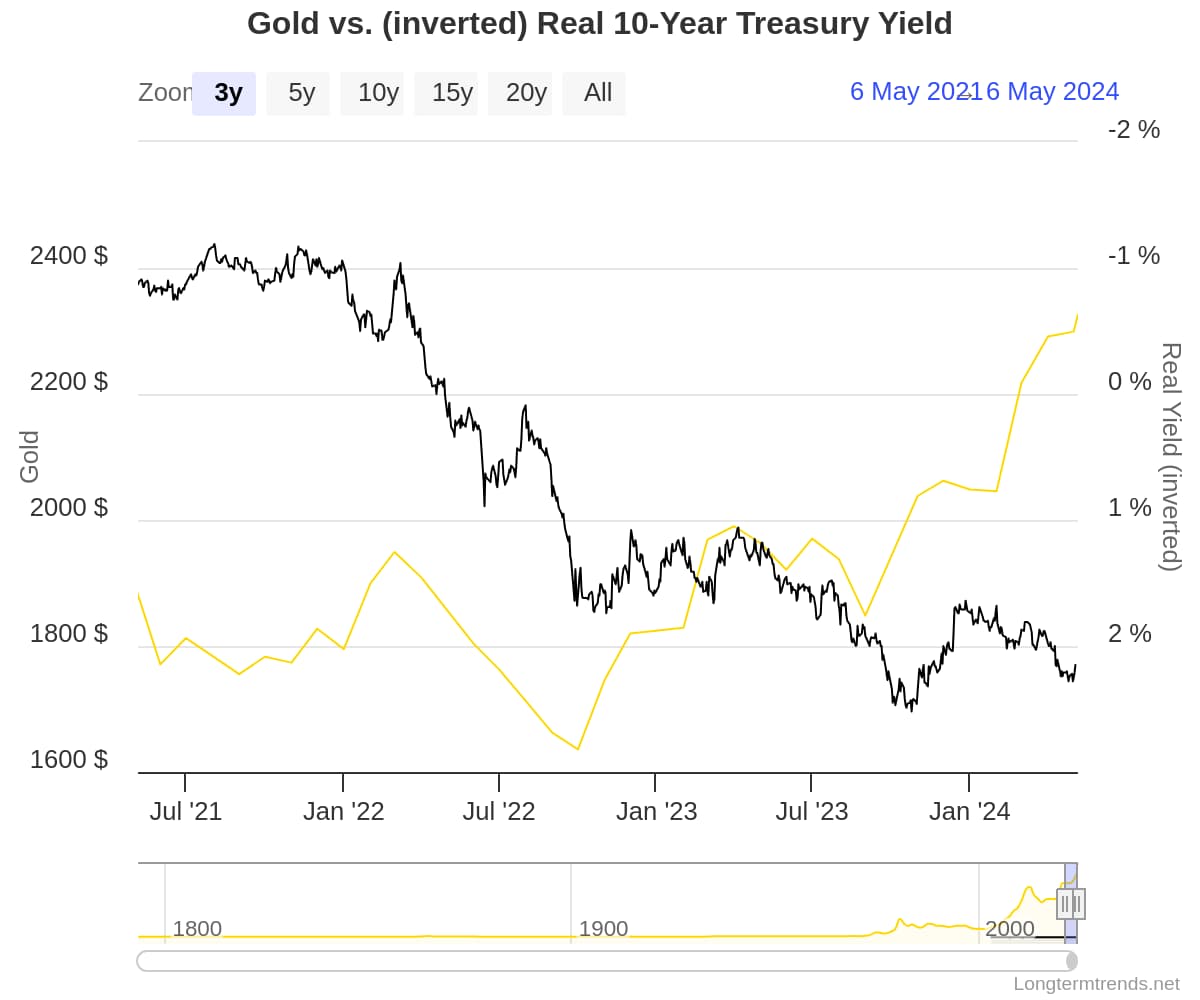

Gold vs 10-Year Treasury Yield

Gold vs 10-Year Treasury YieldThe chart shows the price of one ounce of gold alongside the inflation-adjusted 10-year Treasury yield. Real interest rates, which are calculated by subtracting the expected or actual inflation rate from the nominal interest rate, are represented by the difference between the 10-year Treasury Constant Maturity Rate and the 10-year (expected) inflation rate.

In simpler terms, the chart helps us see how changes in interest rates, adjusted for inflation, impact the price of gold. When real interest rates are low or negative, gold tends to perform well as investors seek alternatives to traditional investments. Conversely, when real interest rates are high, gold may become less attractive relative to other investment options, leading to potential declines in its price.

Breakout trading (Technical analysis)

Breakout trading is a strategy used by traders to take advantage of significant price movements in the gold market. It works like this: imagine the price of gold has been moving within a certain range or pattern on a chart for some time. Breakout traders watch for the moment when the price breaks out of this pattern, signaling a potential shift in market sentiment. Once the breakout occurs, traders enter positions in the direction of the breakout, hoping to ride the momentum of the price movement for profit.

To manage the risks associated with breakout trading, traders often use stop-loss orders. These are orders placed with a broker to automatically sell a position if the price moves against them beyond a certain threshold. By using stop-loss orders, traders can limit their potential losses if the breakout turns out to be a false signal.

Overall, breakout trading is about identifying and capitalizing on opportunities for quick profits when the price of gold breaks out of its usual trading range or pattern on a chart.

Breakout trading in Gold

Breakout trading in GoldExpert Advisors/ Copy trading

When it comes to trading gold, there are specialized tools and services available to help traders make informed decisions and potentially increase their profits. Expert advisors (EAs) are one such tool. These are automated trading programs designed specifically for gold trading. They analyze market data and execute trades on behalf of the trader, based on predefined rules and algorithms.

In addition to EAs, there are signal providers who specialize in gold trading. These signal providers analyze market trends and movements and then send signals to traders, indicating when to buy or sell gold. Traders can subscribe to these signals and automatically copy the trades made by the signal provider, using various copy trading apps or platforms.

This strategy can be particularly useful for beginners who may not have the experience or expertise to trade gold successfully on their own. It can also benefit experienced traders who may not have strategies that are well-suited to gold trading, or who simply lack the time to develop a new strategy specifically for gold.

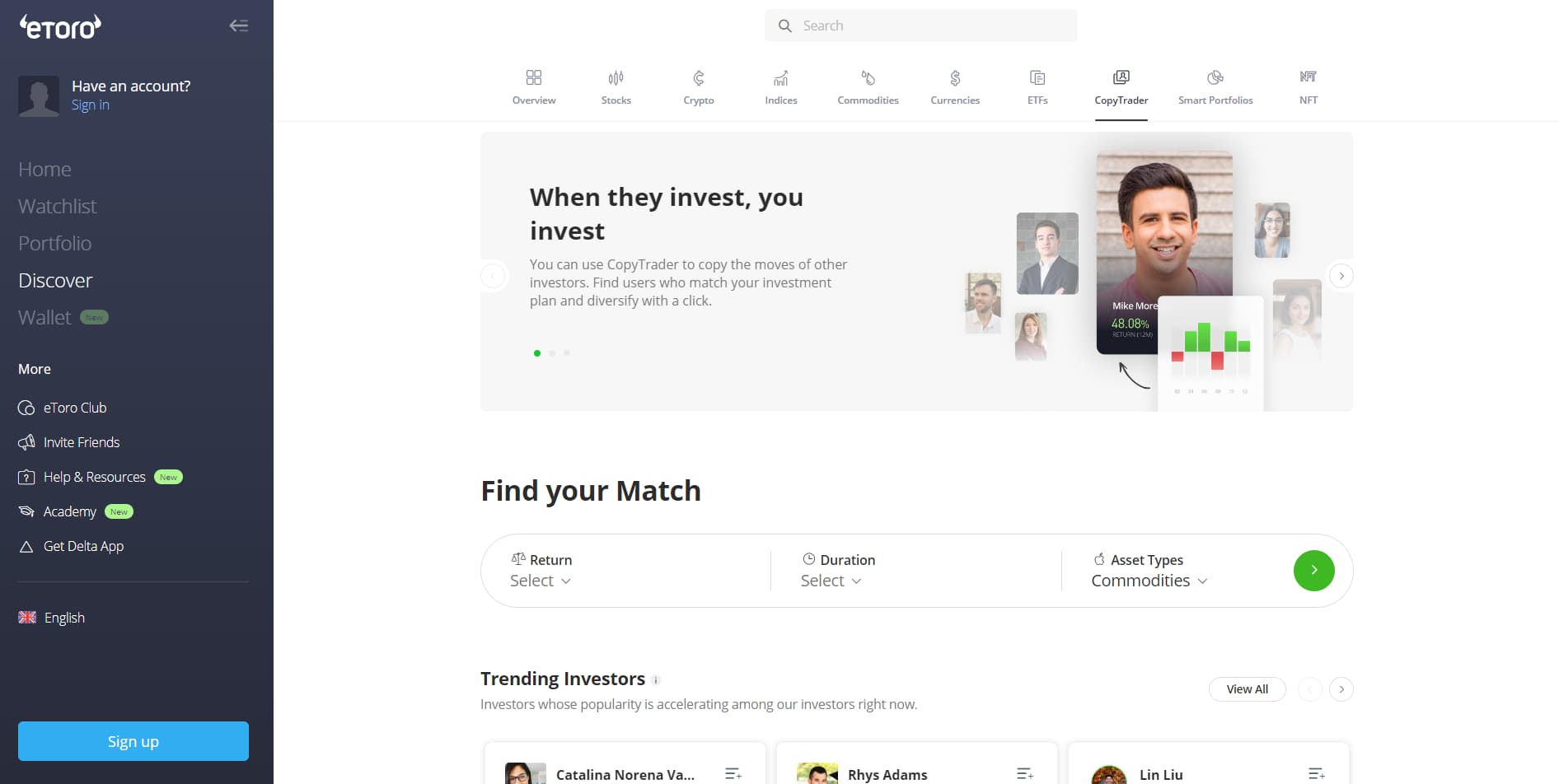

One popular platform for copy trading is eToro. eToro allows traders to browse through a selection of signal providers, review their performance history and risk metrics, and choose the ones that best suit their trading goals and risk tolerance.

Trading Gold through Copy trading

Trading Gold through Copy tradingNews and Sentiment Analysis

Sentiment analysis is a strategy used by traders to understand the overall mood or attitude of the market participants towards a particular asset, such as gold. By gauging market sentiment and investor psychology, traders aim to anticipate future price movements in the gold market.

One way traders conduct sentiment analysis is by monitoring various sentiment indicators. These indicators provide insights into the collective behavior and sentiment of investors. For example, the Commitments of Traders (COT) report is a widely used sentiment indicator in the gold market. It provides information about the positions taken by large institutional traders, such as hedge funds and commercial traders, in the futures market. By analyzing the COT report, traders can gain valuable insights into the positioning of these large players and identify potential shifts in market sentiment.

In addition to the COT report, traders also pay attention to investor surveys and sentiment polls. These surveys measure the sentiment of retail investors and traders, providing another perspective on market sentiment. By comparing the sentiment of retail investors with that of institutional traders, traders can get a more comprehensive view of market sentiment and make more informed trading decisions.

News analysis is another important aspect of sentiment analysis. Traders closely monitor news headlines, economic reports, and geopolitical events that could impact market sentiment. Positive news, such as strong economic data or geopolitical stability, can boost investor confidence and drive up the price of gold. Conversely, negative news, such as economic downturns or geopolitical tensions, can dampen investor sentiment and lead to declines in the price of gold.

CFTC Website

CFTC WebsiteTop-3 brokers for gold trading

Top Gold trading tips for beginners

Here are some beginner-friendly tips for trading gold:

| Tip | Explanation |

|---|---|

| Start Small | Begin with a small investment and gradually increase your position size as you gain experience and confidence in your trading strategy. Starting small allows you to learn without risking large amounts of capital and helps you build confidence over time. |

| Diversify Your Portfolio | Don't put all your eggs in one basket. Diversify your investment portfolio by allocating a portion of your funds to gold trading and other asset classes, such as stocks, bonds, and cryptocurrencies. Diversification helps spread risk and can potentially enhance returns by capitalizing on different market trends. |

| Stay Informed | Keep up-to-date info related to market news, economic reports, and geopolitical events that could impact the price of gold. Staying informed will help you make better-informed trading decisions and react quickly to market developments. It's essential to stay updated to understand market dynamics. |

| Practice Patience | It is important to be patient, disciplined, and persistent in your trading efforts, and don't let emotions cloud your judgment. Successful trading takes time and requires discipline to stick to your trading plan through ups and downs. |

| Risk Management | Always use proper risk management techniques, such as setting stop-loss orders and limiting the size of your trades relative to your account balance. This will help protect your capital and minimize potential losses in volatile market conditions. Effective risk management is crucial for long-term success. |

How to choose the best gold trading strategy?

Choosing the right gold trading strategy depends on your goals and preferences.

For long-term investors, a buy-and-hold approach is simple and involves holding onto gold over time, expecting its value to rise. Another option is to monitor real interest rates, as gold tends to perform well when rates are low or negative.

Active traders have several options. Trend following involves identifying and capitalizing on trends using technical indicators. Swing trading aims to profit from short- to medium-term price swings within trends. Breakout trading looks for opportunities when prices break through support or resistance levels.

Consider factors like risk tolerance and market conditions when selecting a strategy. Experiment with different approaches in a demo account to find what suits you best, and be willing to adapt as needed.

Best indicators for gold trading

When it comes to trading gold, using the right indicators can help traders make informed decisions and improve their chances of success. Here are some of the best indicators for gold trading, along with explanations of how they work:

Moving Averages (MA)

Moving averages are widely used in gold trading to identify trends and potential trend reversals. They smooth out price data over a specified period, making it easier to spot directional changes in the market. Popular moving averages for gold trading include the 50-day and 200-day moving averages. When the shorter-term moving average crosses above the longer-term moving average, it may signal the start of an uptrend, while a cross below could indicate a downtrend.

Moving average indicator for Gold trading

Moving average indicator for Gold tradingRelative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the strength and momentum of price movements in the gold market. It oscillates between 0 and 100 and is typically used to identify overbought and oversold conditions. When the RSI crosses above 70, it suggests that the market may be overbought and due for a correction. Conversely, when it falls below 30, it indicates oversold conditions, suggesting a potential buying opportunity.

RSI indicator for Gold trading

RSI indicator for Gold tradingBollinger Bands

Bollinger Bands consist of a middle line (usually a 20-period moving average) and two outer bands that are two standard deviations away from the middle line. These bands help identify volatility and potential breakout opportunities in the gold market. When the price of gold trades near the upper band, it suggests that the market may be overbought, while trading near the lower band indicates oversold conditions. Breakouts above or below the bands can signal the start of a new trend.

Bollinger Bands indicator for Gold trading

Bollinger Bands indicator for Gold tradingMACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that helps identify changes in trend direction and potential trend reversals in the gold market. It consists of two lines: the MACD line and the signal line. When the MACD line crosses above the signal line, it suggests bullish momentum, while a cross below indicates bearish momentum. Traders also look for divergences between the MACD line and the price of gold, which can signal potential trend reversals.

MACD indicator for gold trading

MACD indicator for gold tradingWhich gold trading session is best?

When it comes to trading gold, understanding the best times to engage in the market can significantly impact your trading success. Gold trading operates 24 hours a day, five days a week, with distinct trading sessions influenced by major financial centers around the world.

Asian Session (Tokyo)

Time: 00:00 - 09:00 GMT

Description: The Asian session kicks off the gold trading week, with Tokyo being the primary financial hub in this region. During this time, the market tends to be relatively quiet, with lower trading volume and liquidity. However, it's a period where trends can begin to form, making it suitable for position traders looking for longer-term opportunities.

European Session (London)

Time: 07:00 - 17:00 GMT

Description: The European session, centered around London, is considered the most active period for gold trading. With high trading volume and liquidity, this session offers ample opportunities for traders. Significant price moves are common during this time, making it ideal for day traders and scalpers seeking short-term profits.

U.S. Session (New York)

Time: 13:00 - 22:00 GMT

Description: The U.S. session, centered around New York, overlaps with the European session, resulting in increased trading activity and volatility. This period sees the highest trading volume and momentum, making it suitable for traders of all styles. However, competition and market noise are also heightened during this time.

In addition to these main trading sessions, there are overlapping hours when two sessions coincide

London + Tokyo Overlap

Time: 07:00 - 09:00 GMT

Description: During this overlap, both the Asian and European sessions are active, leading to increased trading activity. Traders can expect higher volatility and liquidity, making it an ideal time for gold trading.

New York + London Overlap

Time: 13:00 - 17:00 GMT

Description: The overlap between the European and U.S. sessions is another period of heightened trading activity. With both major financial centers in full swing, traders can capitalize on significant price movements and trading opportunities.

Note: for those who trade not only spot gold, but also other assets on it (futures, options, shares of gold mining companies), as well as placing trading orders on the pre-market and post-market, the most favorable time for transactions coincides with the mode of operation of major stock exchanges.

Expert Opinion

In my experience, navigating the gold market requires a multifaceted approach that combines fundamental analysis, technical expertise, and astute risk management. The strategies outlined in the article offer valuable insights into how traders can capitalize on the dynamic nature of gold trading.

Personally, I have found that integrating fundamental factors such as geopolitical developments and real interest rates into my trading decisions provides a solid foundation. These broader market trends often set the tone for gold price movements, guiding my strategic positioning over the long term.

At the same time, technical analysis plays a crucial role in identifying optimal entry and exit points. Indicators like moving averages and the Relative Strength Index offer valuable signals that complement my fundamental analysis, allowing me to refine my trading strategy with precision.

Additionally, prudent risk management is non-negotiable. By employing stop-loss orders and adhering to strict position sizing, I mitigate downside risk and protect my capital against market volatility.

Also you should consider this fact that success in the gold market demands continuous learning and adaptation. Staying informed about market developments, refining trading strategies, and remaining flexible in response to changing market conditions are essential elements of a winning approach.

Conclusion

Gold trading offers various strategies tailored to different trading styles and objectives. For long-term investors, focusing on fundamental factors like geopolitical developments and real interest rates can guide trading decisions.

Active traders can explore technical strategies like breakout trading, supported by indicators such as moving averages and the Relative Strength Index. Beginners can start small, diversify their portfolio, and utilize risk management techniques to navigate the gold market effectively.

Understanding market hours and sentiment analysis further enhances trading success, with platforms like eToro offering copy trading options. By combining these insights, traders can optimize their approach and capitalize on opportunities in the dynamic gold market.

FAQs

Can I trade gold with $100?

Yes, you can trade gold with $100, but it's essential to consider the leverage and risk involved.

How to trade gold like a pro?

To trade gold like a pro, focus on learning both fundamental and technical analysis, develop a solid trading plan, and practice disciplined risk management.

What moves XAU/USD?

XAU/USD, the symbol for gold priced in US dollars, is influenced by factors like geopolitical events, economic data releases, changes in investor sentiment, and movements in the US dollar index.

What's the best time to trade gold?

The best time to trade gold depends on your trading style and preferences, but generally, the most active periods are during the European and US trading sessions when trading volume and liquidity are high.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.