MT4 Review: Features, Pros, And Cons

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

MetaTrader 4 (MT4) is a popular trading platform known for its user-friendly interface, advanced charting tools, automated trading features, and support for Forex, CFDs, and other instruments. It’s ideal for both beginners and experienced traders, though its outdated design may not suit those seeking cutting-edge features.

MetaTrader 4 acts as a great resource for traders, offering a variety of tools and features. In this article, we will look at the main advantages and limitations of the MT4 trading platform. In addition, we will also cover the topic of MT4 trading bots, indicators, and copy trading features. Traders and beginners alike will find valuable information here for trading in the Forex market and beyond.

What is MetaTrader4?

MetaTrader 4 (MT4) is a powerful trading platform that helps users create and automate trading strategies. Developed by MetaQuotes Software, it offers a wide range of market tools to assist traders in making informed decisions. While MT4 is especially great for Forex and CFDs, it also supports other financial markets. What sets MT4 apart is its use of Expert Advisors, or trading robots, which allow for automatic trading. The platform also includes the MQL4 development tools, enabling users to build custom robots and indicators.

Since its launch in 2005, MT4 has become a popular choice among traders due to its great customization options and automation features. Beginners can take advantage of its demo account to practice without risking money, and features like copy trading and Expert Advisors make it easier to get started. For experienced traders, MT4 offers advanced charting and analysis tools to dive deeper into the market, plus the ability to create their own custom indicators using MQL4.

- Pros

- Cons

Ease of deployment. MT4 offers a hassle-free setup process, simplifying the onboarding for traders.

Lightweight platform. MT4 is designed to run smoothly without burdening your computer's resources, ensuring a seamless trading experience.

User-friendly interface. For beginners, MT4 features an intuitive design that facilitates ease of use.

Cross-platform compatibility. MT4 extends its accessibility to various operating systems, including Linux, Mac, Windows, iOS, and Android, providing flexibility for traders on different devices.

Automated trading. MT4 helps traders with automated trading capabilities. By using MetaQuote's proprietary MQL4 language, users can program trading strategies and create custom indicators.

Security. With a robust security framework, MT4 offers a safe trading environment. It connects users with licensed brokers through its trusted third-party platform.

Limited historical data. MT4's historical data for backtesting purposes is somewhat limited, potentially constraining traders seeking extensive historical insights.

Execution speed. MT4's execution speed may not be suitable for high-frequency trading strategies, as it may lag in processing rapid trades.

Limited automated trading on a web platform. While MT4 excels in automated trading, its web-based platform lacks support for automated trading, limiting its functionality for traders who prefer web-based access.

Is MetaTrader 4 free?

Yes, MetaTrader 4 is available for free download directly from the website. Upon your initial launch, you'll have the opportunity to set up a complimentary demo account, allowing you to explore and test all the functionalities of this trading platform. Moreover, a broker may offer MT4 for free to their clients, although they might adjust their spreads to account for the use of either the MetaTrader 4 standard account or the MetaTrader 4 Pro account.

MetaTrader 4 generates revenue by selling software licenses to brokers, who, in turn, offer the platform to their clients for opening live accounts. To open a live account, you'll need to select a broker and submit an application. Once your application is approved by the brokerage, you'll receive a user ID and password, granting you access to the platform with your own funds. The specific fee structure will be determined by the brokerage you choose, covering aspects like trading costs, account fees, and other associated charges.

Is MT4 good for beginners?

MetaTrader 4 (MT4) is renowned for its beginner-friendly features. Let's explore why MT4 can be an excellent choice for novice traders:

User-friendly interface. MT4 has a straightforward interface, making it exceptionally easy for beginners to navigate and use effectively.

Comprehensive learning resources. To aid beginners, a wealth of resources is available, including video tutorials, step-by-step guides, and online courses, ensuring that users can quickly grasp the platform's functionalities.

Built-in indicators. MT4 includes a range of built-in indicators and graphical tools. These tools are invaluable for beginners as they assist in analyzing market trends, empowering them to make well-informed trading decisions.

Demo account. MT4 offers a free demo account, providing beginners with a risk-free environment to practice trading and familiarize themselves with the platform without using real money.

Copy trading. MT4 introduces the concept of copy trading, allowing beginners to automatically replicate the trading activities of successful traders, making it easier for them to get started and learn from experts.

Updates and the future of MT4

As for the future of MT4, the platform developer, MetaQuotes, has focused on developing MT5, offering more modern solutions for traders. However, MT4 continues to receive updates aimed at maintaining security and stability.

In May 2024, MT4 build 1420 was released, which included security improvements, bug fixes, and increased platform stability. The platform supports automatic updates, ensuring users have timely access to the latest versions.

Looking forward, MT4 can be expected to remain relevant among traders who prefer its functionality. However, for access to more modern technologies and advanced automation capabilities, we recommend considering switching to MT5, which offers a wider range of tools and features for effective trading.

| MT4 | MT5 | Currency pairs | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investor protection | Max. Regulation Level | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 90 | No | 1:500 | 0,5 | 1,5 | £85,000 €20,000 €100,000 (DE) | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | Yes | 68 | No | 1:200 | 0,1 | 0,5 | £85,000 SGD 75,000 $500,000 | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | 80 | 100 | 1:50 | 0,7 | 1,2 | £85,000 | Tier-1 | Study review | |

| Yes | No | 80 | 1 | 1:200 | 0,6 | 1,2 | £85,000 €100,000 SGD 75,000 | Tier-1 | Study review | |

| Yes | Yes | 100 | 1000 | 1:400 | 0,1 | 0,4 | No | Tier-1 | Study review |

Key features of MT4

Mobile accessibility

MetaTrader 4 offers a mobile platform that provides traders with full control over their accounts, enabling them to access their trading accounts anytime and anywhere. Additionally, it includes a free chat feature for communication with fellow traders.

Automated trading with Expert Advisors (EAs)

MT4 introduces automated trading through specialized trading robots known as Expert Advisors (EAs). EAs can analyze market quotes and execute trades based on predefined algorithms.

Code base for EAs

Traders can access a library called Code Base, offering a collection of free EAs, technical indicators, and scripts. These EAs can be downloaded at no cost or purchased and rented from the online store known as the Market. Moreover, traders have the option to order custom EAs from professional MetaTrader freelance developers.

TradingSignals for copy trading

MT4 presents TradingSignals, a feature enabling copy trading. Successful traders can offer their trading signals for free or at a reasonable fee, allowing others to follow their trades. These signals are accessible in the Signals tab within the trading platform and on the company's website, simplifying the process of selecting signal providers and copying their trades directly from the platform.

Real-time news updates

The platform includes a news feed delivering real-time updates on significant market events, breaking news, and economic indicators. This feature keeps traders well-informed about the latest developments that could impact financial markets, including political events, economic data releases, and central bank announcements.

Market impact assessment

In addition to news updates, the news feed often provides assessments of the potential impact of specific news events on financial markets, assisting traders in making informed decisions.

New order management

MT4 offers a New Order tool that simplifies order management by providing a dedicated window for managing orders efficiently.

History center

The History Center tool allows traders to effectively manage their historical data by accessing a dedicated window for handling historical trading data.

Global variables

Traders can manage global variables through this tool, which includes a window for efficient management.

Smart trader tools

MetaTrader 4 also offers Smart Trader Tools, a suite of advanced trading utilities designed to help traders maximize their trading potential. This collection includes tools like Alarm Manager, Correlation Matrix, and more, providing traders with expert-like functionalities to enhance their trading experience.

Charting

MetaTrader 4 (MT4) boasts an array of charting features designed to help traders in analyzing market dynamics and enhancing their decision-making processes. Experts have provided a brief overview of MT4’s charting functionalities as follows.

Chart variety

MT4 supports three types of charts, namely broken line charts, bar sequence charts, and Japanese Candlesticks. This diversity allows traders to choose the chart type that best suits their analytical preferences. It has 30 built-in indicators and 23 analytical objects to choose from.

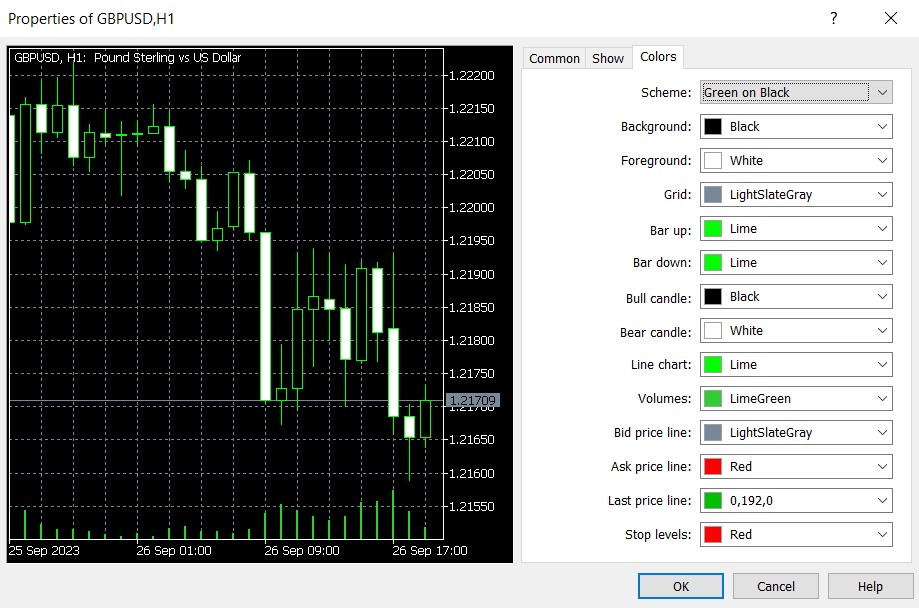

Appearance customization

Traders can personalize the appearance and properties of individual charts within the terminal. This customization can be effortlessly executed through the "Charts Properties" menu command, the chart's context menu command of the same name, or by simply pressing F8. This feature grants traders the flexibility to tailor their charts to meet their specific needs.

Trading directly on charts

MT4's user-friendly interface facilitates trading operations directly from the symbol's chart using the one-click trading function. This streamlines the trading process and enhances efficiency.

Technical analysis tools

MT4 equips traders with a useful selection of built-in indicators and graphical tools. These resources aid traders in dissecting market trends, identifying potential entry and exit points, and making informed trading decisions.

Trendline drawing

To pinpoint trend directions and key support or resistance levels, traders can easily draw trendlines on charts using the "Draw" trendline tool. This feature simplifies the process of visualizing trend patterns.

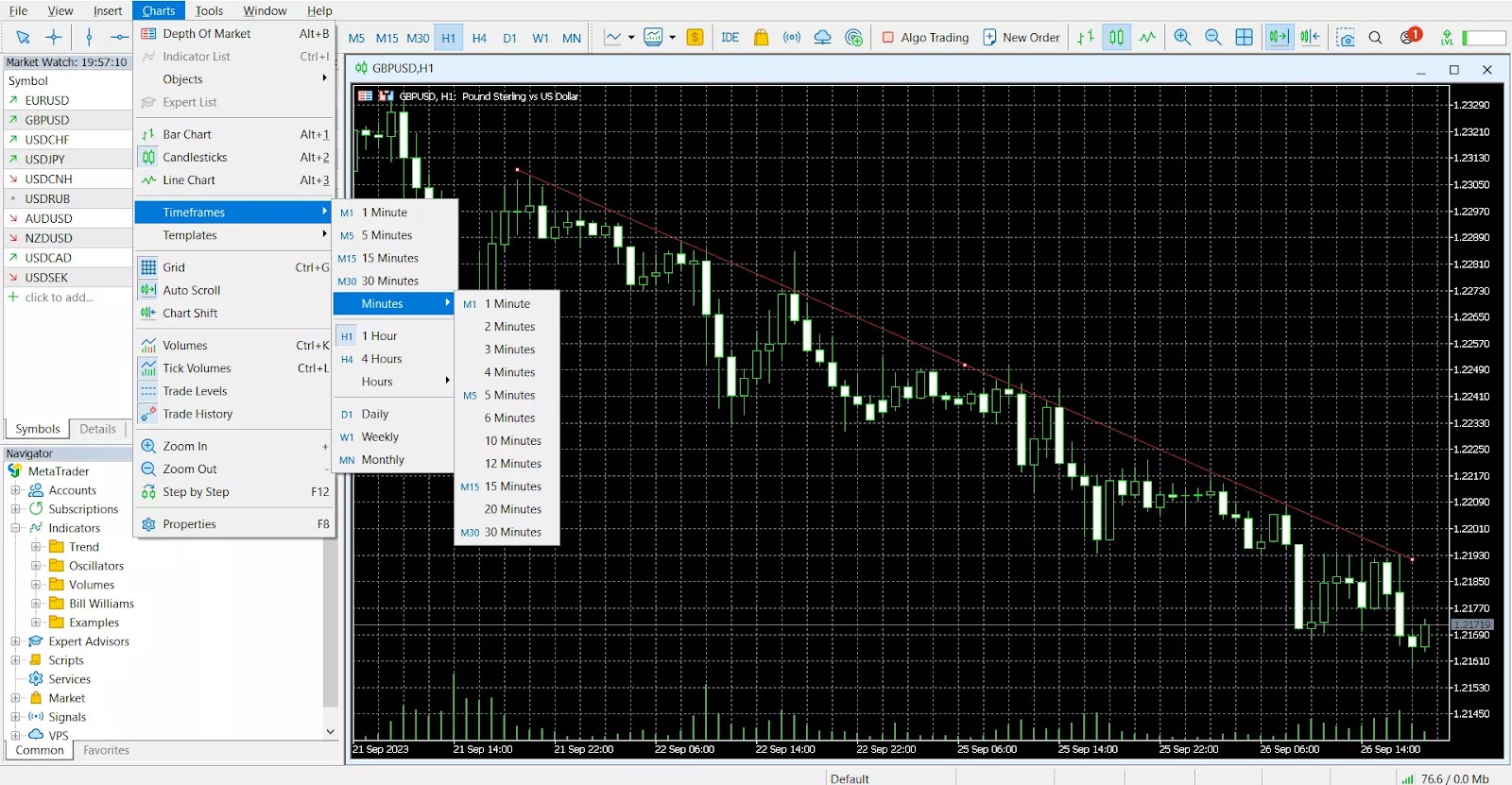

Customizable timeframes

MT4 offers traders the flexibility to view charts in various timeframes. This feature is important for traders seeking to gain insights into market movements over different time intervals, catering to diverse trading strategies and objectives.

Analytics

MetaTrader 4 (MT4) also equips traders with powerful analytics tools to stay well-informed and make strategic trading decisions. Following are the key features offered in MT4's analytics segment.

Economic calendar

MT4's news feed regularly incorporates an economic calendar, offering a schedule of upcoming economic events and indicators. This feature helps traders to plan their trading activities around significant events and anticipate potential market fluctuations.

Integration with trading activities

MT4 seamlessly integrates the news feed with other essential trading features, including charts and trading terminals. Traders can access news updates alongside their trading activities, facilitating well-informed decision-making based on the latest market insights.

Financial alerts and tools

MT4's platform offers traders access to real-time financial alerts and tools. These resources provide updates on market events, news from prominent financial institutions, interest rate decisions, and geopolitical developments, ensuring that traders are up-to-date with the latest market dynamics.

News and quote integration

For seamless transmission of quotes and news, MT4 offers a simple plugin or gateway. This functionality connects the platform with renowned quotes and news providers like IB Times, Trading Central, Dow Jones, Claws and Horns, MNI, and Bloomberg. Traders can access a lot of financial information to inform their trading strategies.

Customization and filtering

The news feed within MT4 provides customization options, enabling traders to filter news based on their preferred markets, instruments, or news sources. This approach ensures that traders receive relevant and timely updates.

Object anchors

Traders can strategically place object anchors at any position between chart bars. When switching between different timeframes, the object's control points retain their precise positioning. This feature enhances chart analysis and object placement for effective trading strategies.

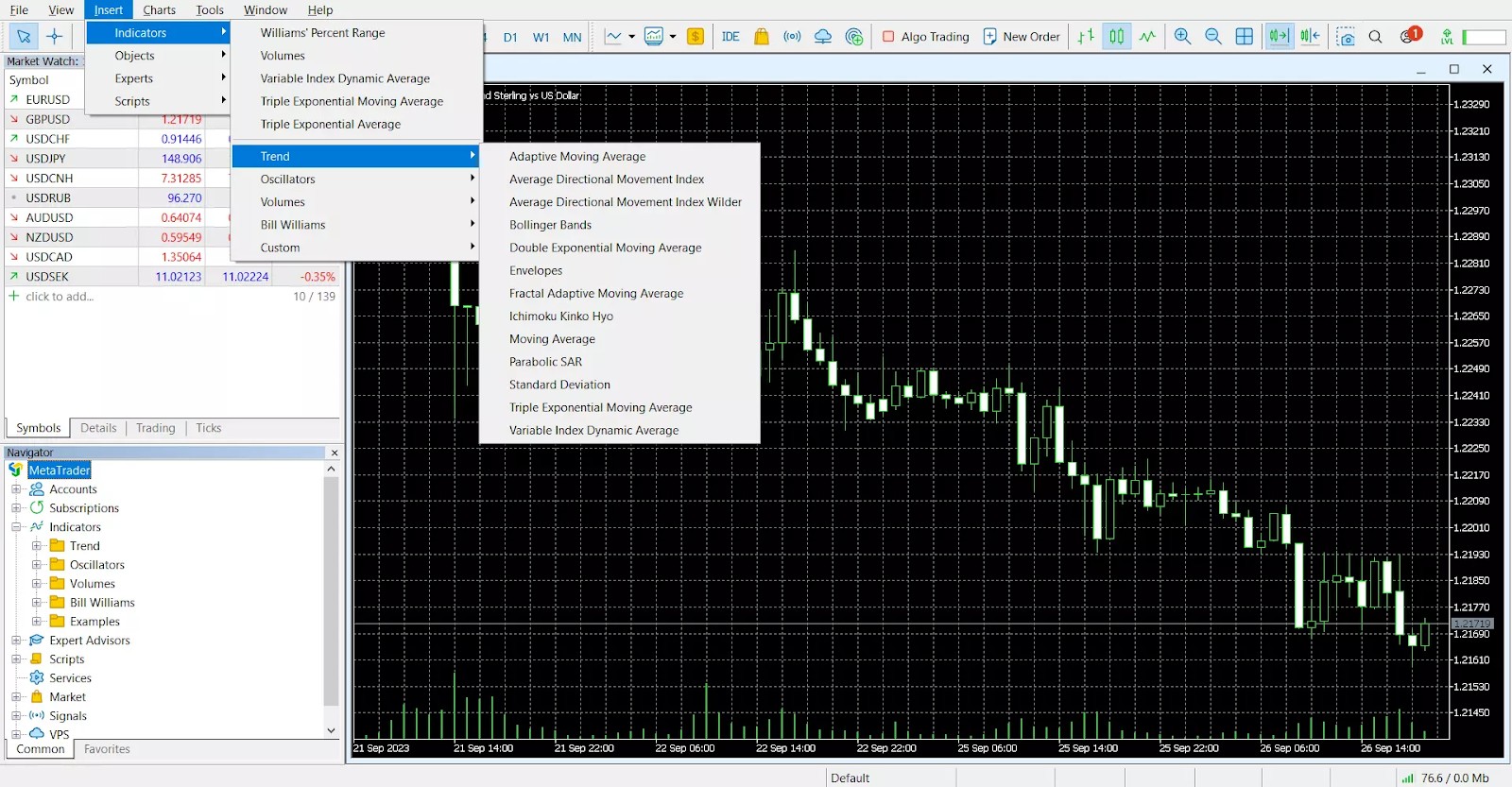

MT4 indicators

MetaTrader 4 (MT4) also provides traders with a comprehensive suite of built-in indicators to enhance their trading analysis. Here's a breakdown of some of the key indicators available in MT4:

Moving averages

Moving averages are crucial for understanding market trends. Traders can use these moving averages to identify trend directions and potential entry or exit points. For example, when a moving average crosses above the price, it signals a bullish trend, and vice versa.

Parabolic SAR (stop and reverse)

The Parabolic SAR is a trend indicator designed to detect potential trend reversals in currency pairs. It visually presents points below or above the price chart, and traders often use it to gauge market trends. When SAR points are below the price, it indicates an uptrend, and when above, it signifies a downtrend. This indicator is useful for setting stop-orders and trading decisions.

Average directional movement index (ADX)

The ADX helps determine existing trends' strength and whether a significant trend is in place. Traders can analyze the ADX, along with directional lines (-DI and +DI), to identify potential entry and exit points. A rising ADX indicates a strengthening trend, while a falling ADX suggests weakening or ranging markets.

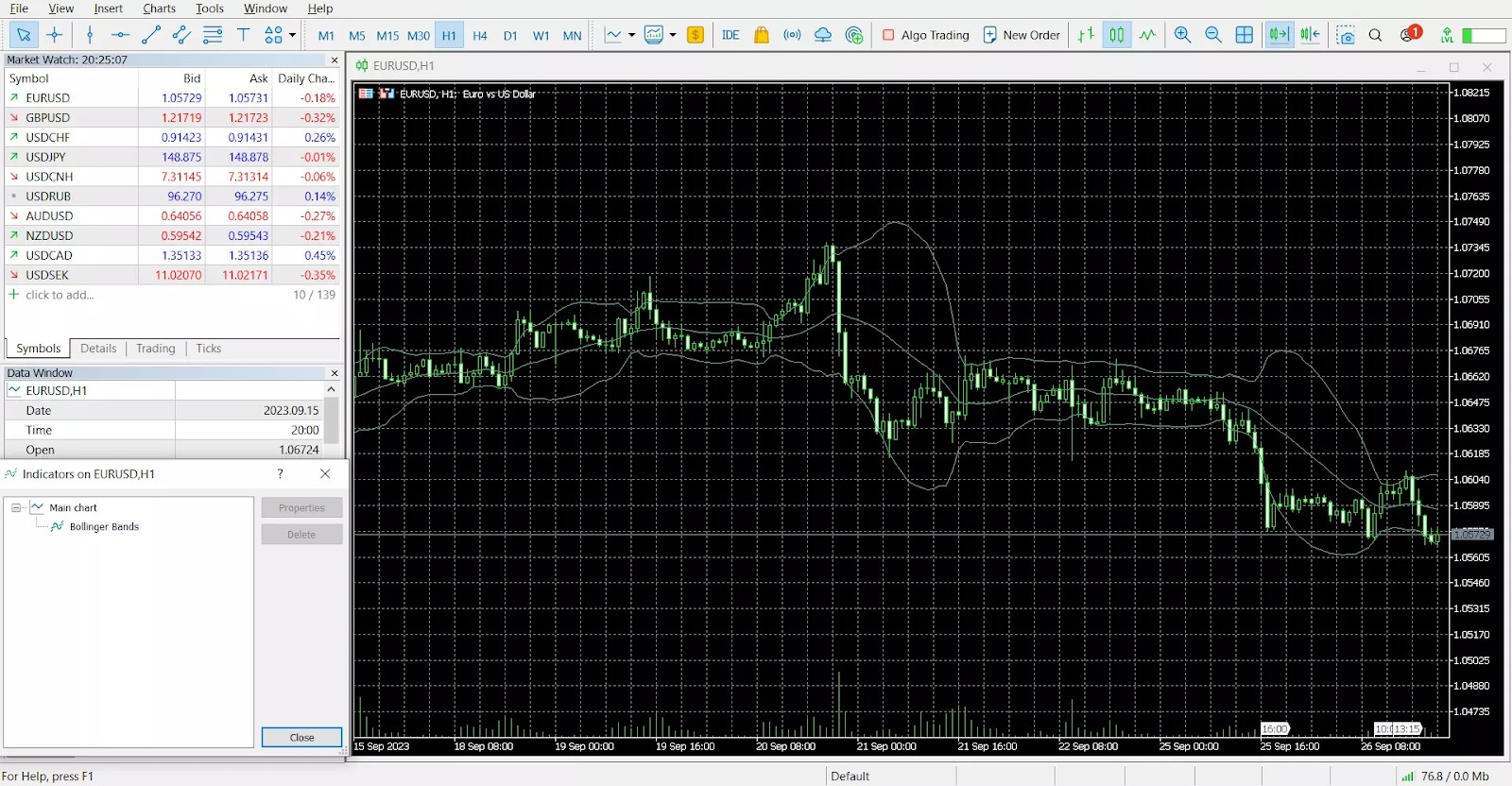

Bollinger bands

Bollinger Bands consist of statistically calculated bands around a short-term moving average, reflecting two standard deviations on each side. These bands expand or contract based on market volatility, making them sensitive to recent price actions. Traders typically use Bollinger Bands in conjunction with other indicators to detect trend reversals or potential breakout opportunities.

Stochastic oscillator

The Stochastic Oscillator compares a security's high and low closing prices within a specific timeframe. It offers insights into overbought and oversold market conditions. Traders observe the stochastic oscillator's reading to identify potential trend reversal points. When K is lower than D, it may signal a selling opportunity, and when K is higher than D, it suggests a buying opportunity.

Relative strength index (RSI)

The RSI measures the average number of positive price changes relative to negative changes. It helps identify trends, their strength, and potential trend changes. RSI is often used alongside other technical indicators to reduce false signals. It's a valuable tool for traders looking to gauge market momentum and potential reversals.

Can I install indicators in MT4 mobile?

Yes, you can install indicators in MT4 mobile. To do this, go to the chart of your chosen symbol and tap the "+" icon. Then, select "Indicators" and choose the indicator you wish to add.

How do I set indicators on MT4?

Setting indicators on MT4 involves the following steps:

Locate and copy the MT4 custom indicator file on your computer.

Open the data folder in MT4.

Access the MQL4 file and navigate to the indicators folder.

Paste the indicator files into this folder.

Restart MT4.

Open MT4 again, find the Navigator panel, and select "Custom Indicators”.

Double-click on the indicator to add it to the chart.

Can I add new indicators to MT4?

Yes, does MT4 offer the flexibility of adding new indicators. So effectively, you can choose from the built-in indicators or create custom ones by modifying, adding, or altering the default indicator codes according to your trading preferences.

How to trade on MT4?

Log in. After installing MT4 and setting up your trading account, log in to the platform using your account credentials.

Select a financial instrument. MT4 offers a variety of financial instruments, including Forex, stocks, indices, and commodities. Choose the one you want to trade.

Place an order. Once you've identified a trading opportunity, click the "New Order" button. Here, you can select your financial instrument, specify the volume, and choose the order type.

Monitor your trade. Keep track of your trade on the "Trade" tab. You can also set stop-loss and take-profit levels to manage your risk.

Close your trade. When you're ready to exit your trade, simply click the "Close" button in the "Trade" tab.

MT4 bots

MetaTrader 4 is well-regarded for its robust automated trading capabilities. It helps traders with the ability to craft and implement their trading strategies through Expert Advisors (EAs). These EAs are automated trading systems crafted using the MQL4 programming language. EAs function by executing trades based on predefined rules and conditions, offering traders the advantages of automated and systematic trading.

MT4 is designed to support algorithmic trading, enabling traders to create, test, and apply Expert Advisors and technical indicators. The integrated MetaEditor is a dedicated tool for developing trading strategies in MQL4, complete with a debugger. This editor handles the compilation process as well. Following compilation, the application seamlessly transfers to MetaTrader 4 for testing or optimization in the Strategy Tester, yet another component of the MQL4 IDE.

Within MT4 also lies a free source code library of robots and indicators. This library is directly accessible from the platform, offering a selection of over 2,000 indicators, 950 trading robots, and 300+ scripts. These scripts are small applications that can automate various analytical trading functions, simplifying your trading activities.

Can traders add new bots in MT4?

Yes, traders have the flexibility to add new bots in MT4. This can be accomplished by downloading the desired bot file from reputable sources, like the MetaTrader Market, and then installing it within MT4. Additionally, traders can craft their own Forex bots using the MQL4 programming language, thereby enabling them to develop customized trading robots.

Are bots free or paid in MT4?

In MT4, bots come in both free and paid variants. While there are numerous free Forex robots readily available for download, traders should exercise caution when engaging with them.

Real cases of using MT4

MetaTrader 4 (MT4) provides traders with a wide range of tools for developing and implementing effective trading strategies. Let's look at two practical examples of using MT4: a strategy based on moving averages and copying trades via the "Trading Signals" service.

Strategy based on moving averages

Moving averages are a popular technical analysis tool that helps identify trend directions and potential entry and exit points for trades. One common approach is to use the intersection of several moving averages with different periods. Strategy example:

Settings:

Timeframe. H1 (hourly chart).

Indicators. Three exponential moving averages (EMA) with periods of 7, 19 and 100.

Trading rules:

Trend detection. EMA 100 is used to determine the general trend. If the price is above EMA 100 - an uptrend, below - a downtrend.

Buy signal. In an uptrend, when EMA 7 crosses EMA 19 from below, it can be a signal to open a long position.

Sell signal. In a downtrend, when EMA 7 crosses EMA 19 from above, it can be a signal to open a short position.

This strategy allows traders to effectively follow the trend and react to changes in market dynamics in a timely manner.

Copying trades via "Trading signals"

MT4 offers the "Trading signals" service, which allows you to automatically copy trades of experienced traders to your account. This is especially useful for beginner traders or those who want to diversify their strategies.

Copying process:

Create an account on the MQL5 platform.

Select a signal provider from the available list, taking into account its statistics and conditions.

Subscribe to the selected signal.

Configure the copying parameters in MT4, such as trade volumes and risk levels.

Once set up, all trades from the selected provider will be automatically played on your account, allowing you to participate in the market without having to do any analysis or decision-making yourself.

Typical trader mistakes on MT4 and how to fix them

Using MetaTrader 4 provides traders with a variety of opportunities, but inexperienced users can make mistakes that negatively affect trading results. Let's look at the most common problems and how to prevent them using the platform's functionality.

One of the most common mistakes is trading without setting stop losses. Such an omission can lead to significant losses, especially in conditions of high volatility. MT4 helps avoid this problem by allowing you to set stop loss and take profit levels when opening a trade.

Many traders start trading without testing their strategies. This leads to unpredictable results and loss of funds. MT4 has built-in tools to eliminate this problem. A demo account allows you to test any strategy without financial risks, and the "Strategy Tester" provides an opportunity to check the effectiveness of automated trading systems on historical data.

Another common mistake is incorrectly calculating the position volume. Opening trades that are too large or too small can result in excessive risk or lost profits. MT4 has a built-in position calculation tool that takes into account the account size and acceptable risk level, helping traders avoid such miscalculations.

Ignoring technical errors can also cause losses. For example, an unstable connection or a program crash can disrupt the trading process. MT4 has a terminal log, which records all user actions and errors. Analyzing this log helps to quickly identify and fix problems.

Emotional trading is another challenge for traders. Impulsive decisions can result in unfounded trades and loss of capital. MT4 offers trading automation with the help of Expert Advisors, which execute trades according to specified rules, excluding the influence of emotions.

MT4 lets you customize layouts, add indicators, and create strategy templates

One often overlooked feature of MetaTrader 4 (MT4) that can truly benefit beginners is the ability to customize charts. While many traders stick to basic chart setups, MT4 allows you to change your layout, add your own indicators, and even create templates for different strategies. This ability to personalize your workspace means you don't have to repeat steps every time you analyze a pair. Set up templates that match specific market conditions, and you'll save time while making smarter, more efficient decisions.

Another useful tool in MT4 is the strategy tester. Many beginners skip this feature, but it’s key for testing your strategies. MT4 lets you backtest Expert Advisors (EAs) and strategies using historical data, giving you an idea of how a strategy might perform in the real world. Instead of jumping into live trading with no preparation, use the strategy tester to simulate trades and fine-tune your EAs. This will help you trade with more confidence and reduce unnecessary risk.

Conclusion

MetaTrader 4 remains one of the most popular platforms for traders due to its user-friendly interface, wide functionality, and automation capabilities. It is suitable for both beginners who can practice on demo accounts and use trading signals, and professionals who prefer to create their own algorithmic strategies. Despite the availability of a more modern version MT5, many traders choose MT4 for its simplicity and stability. However, users should take into account the platform's limitations, such as the speed of trade execution and limited historical data for testing. Overall, MT4 remains a reliable tool for trading, offering the flexibility and capabilities that are in demand in the financial markets.

FAQs

How to improve strategy testing results in MT4?

For more accurate strategy testing, download detailed historical data and select the appropriate time frame. Use tick simulation for results as close to reality as possible and test strategies in different market periods.

What are the risks associated with automated trading?

Risks include EA failures, errors in algorithm settings, and market conditions not taken into account in the strategy. To minimize them, test EAs on demo accounts and regularly update their settings depending on the market situation.

How to use MT4 charts to analyze multiple markets?

Create chart templates with installed indicators and set up separate windows for each asset. Use the Profiles feature to quickly switch between groups of charts, making it easier to work with multiple markets.

How to avoid mistakes when using copy trading?

Before subscribing to signals, study the history and statistics of the provider, including their reward to risk ratio. Set limits on trade volumes and ensure that the copied strategy meets your goals and acceptable risk level.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The Stochastic Oscillator is a technical indicator used in financial analysis to gauge the momentum of a security's price and identify overbought or oversold conditions by comparing the closing price to a specified price range over a defined period.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Ranging markets are a type of market characterized by short-term movement between apparent asset price highs and lows.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.