Best Cryptocurrency Trading Strategies For Beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best crypto strategies for beginners:

Day trading: make quick trades within a single day to profit from short-term price movements.

Range trading: focus on buying at support and selling at resistance in sideways markets.

High-Frequency Trading: use algorithms to execute a large number of small, rapid trades.

RSI divergence strategy: spot trend reversals by comparing price action with the RSI indicator.

Hedging bitcoin: reduce risk by taking offsetting positions to protect against price volatility.

Trend trading bitcoin: follow the prevailing market trend, entering trades in its direction.

Swing trading: hold positions for several days to capture medium-term price movements.

HODL: hold cryptocurrency long-term, ignoring short-term market fluctuations.

Cryptocurrency trading is attractive due to its high volatility and sky-high growth prospects. However, a successful start requires an understanding of key strategies that will help minimize risks and improve trading results. In this article, we will look at basic approaches that are suitable for beginners and provide a structured approach to working with digital assets.

Best bitcoin/altcoins strategies for crypto beginners

The best cryptocurrency trading strategies should be easy to understand and well tested. They should exclude the use of high leverage and contain clear criteria that are understandable to a beginner.

Day trading

Day trading is a trading strategy where traders take a position and exit within 24 hours or on the same day. In day trading, the trader’s goal is to earn profits during intraday price movements in any cryptocurrency of their choice. This trading strategy usually requires investors to depend on technical indicators to know the entry and exit points.

Day trading in itself has some sub-strategies, and they include:

Momentum trading

This involves a trader taking a position on crypto whose price is moving up. Momentum trading isn’t just about riding the trend; it's about timing the trend shift. Many beginners mistakenly believe momentum trading is just following price movement, but the real skill is identifying when a trend is starting to shift.

Breakout strategy

In this strategy, a trader enters a market as early as possible in a trend, expecting the price to break out from the previous range. Breakout trading is based on the idea that when a market brake through an important resistance or support level, it will lead to significant volatility. This is why bitcoin traders try to enter the market at these key points hoping that they can ride the trend from start to end. Determining resistance or support levels requires technical indicators, such as the moving average convergence divergence (MACD) or RSI. Also, bitcoin traders use volume levels as confirmation signals.

Scalping

Scalping is aimed at extracting profit from small price movements over short time intervals. Traders make dozens or hundreds of trades per day. Key features of this strategy include:

Choosing liquid assets. Scalping is effective on assets with high liquidity, such as BTC or ETH. This ensures a minimum spread between the purchase and sale prices.

Using charts with small time intervals. Periods of 1 or 5 minutes allow you to track micro price movements.

Automation of the process. Using trading bots can significantly speed up the execution of trades and minimize human errors.

Trading on high volatility. Choose assets that demonstrate significant price changes during the day.

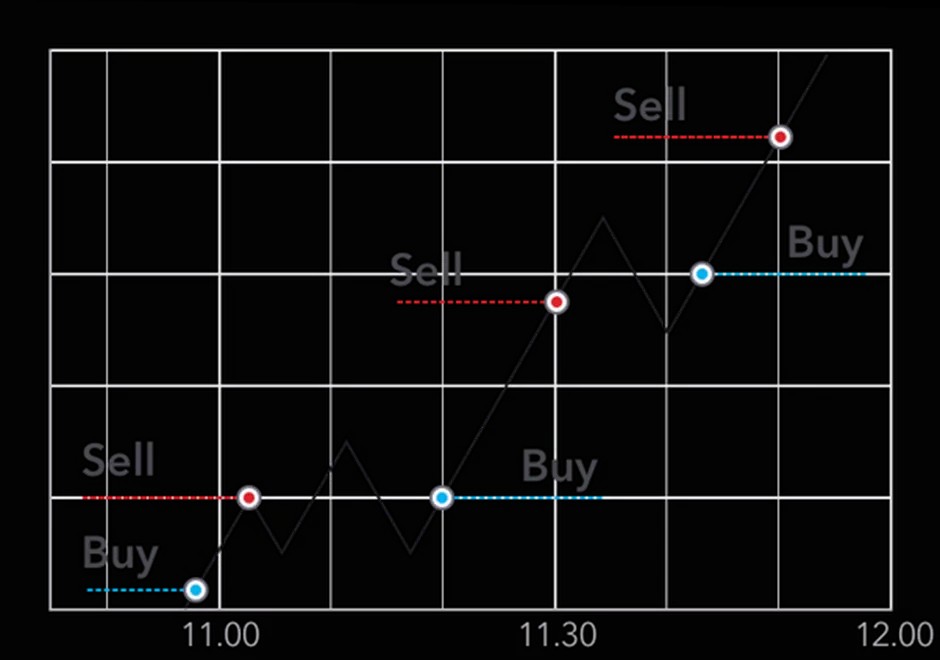

Range trading

Experienced analysts give out support and resistance daily, and most market players depend on the information provided by these analysts. Resistance is the point up to which the price of a cryptocurrency may rise, making the resistance level a price above the current price. Also, support is the level below which a cryptocurrency isn't supposed to fall, and the support level is usually below the current price.

In range trading, a trader identifies a range at which a cryptocurrency will rise or fall, buying or selling over a short period. The important thing about range trading is the risk factor which requires perfect market timing.

High-frequency trading

This is a type of algorithmic trading strategy used by quant traders. It involves developing trading bots and algorithms that help enter and exit a crypto asset. Although creating this kind of bots and algorithms is more advanced complex and requires a deep knowledge of mathematics and computer science, beginners who are fortunate to know and have access to advanced traders can use this trading strategy. There are many sub-strategies employed by traders who use High-Frequency Trading. For example:

Trading on buy and sell-side. In this strategy, traders place both buy and sell orders using limit orders above or below the current market price. The difference between the two orders is the profit they make.

Providing liquidity. This is a strategy where traders play the role of market makers by creating bid-ask spreads.

Statistical arbitrage. This strategy involves looking for price discrepancies between cryptocurrencies on different exchanges. They capitalize on these minor fluctuations by making ultra-fast transactions.

RSI divergence crypto trading strategy

RSI stands for Relative Strength Index. It is a chart indicator that measures momentum by computing the average gains and losses in 14 days. This is a more technical strategy, but it can be relevant in timing trend reversals right before they happen. This is the point the trend starts moving in an opposite direction, either from a downtrend to an uptrend or from an uptrend to a downtrend.

Although the RSI divergence strategy system can be used as a simple crypto trading strategy, it gives occasional false results. For example, the RSI has sometimes shown that a crypto asset is overbought, indicating a buy signal, but contrarily, the price continues downward.

Hedging bitcoin

For investors who already own bitcoin, hedging involves taking strategic positions to reduce the risk of previous or existing positions. This is done when investors believe there will be a short-term decline in the market price.

In this strategy, an investor opens a position to short bitcoin, which is the process of selling the asset at its current market price with the expectation that it will decline. If and when the market price falls, they'd repurchase it at the lower price and profit from the difference. This profit would eradicate any loss to your original positions.

Trend trading bitcoin

When a market trends, it consistently reaches higher highs or lower lows. This strategy is ideal for different timeframes. You are expected to hold your position open for the duration you believe the trend will continue - this could be hours, days, weeks, or months. Bitcoin is a trend as it has experienced surges in popularity which has led to an increase in its price.

However, being a volatile asset, bitcoin has also lost a lot of its value. Majorly, trends are driven by the fact that people don’t want to miss out on the possibly profitable investment, otherwise known as the Fear of Missing Out (FOMO). As a trend trader, you must stay on top of all news and events that could influence the price of bitcoin or altcoins.

Swing trading

Swing trading involves holding a cryptocurrency for a few days to a few weeks to profit from medium-term price movements. Traders use the following practical steps:

Identifying trends. Use indicators such as moving averages to identify the overall market trend. For example, if the price is above the 50-day moving average, it signals an uptrend.

Finding entry and exit points. Indicators such as the Relative Strength Index (RSI) can help you assess overbought or oversold levels. For example, an RSI below 30 indicates a possible price bottom.

Risk management. Set a stop loss just below the support level to limit losses.

HODL

HODL is a long-term strategy based on faith in the prospects of cryptocurrencies. Practical aspects of HODL:

Choose assets with long-term potential. Research projects like Ethereum, Cardano, or Solana that have a strong technological base and broad community support.

Store assets in safe places. Use hardware wallets (such as Ledger or Trezor) to protect cryptocurrency from cyberattacks.

Ignore short-term volatility. Emotions can interfere with investing. You should hold assets even during periods of market declines, unless there are fundamental reasons to sell.

What is a crypto trading strategy?

A trading strategy is a way of trading in markets dependent on rules and norms that guide trading decisions. A cryptocurrency strategy usually consists of the following.

Choice of analysis method. Before you design a cryptocurrency trading strategy, you need to decide on how you will study the market. There are many analysis methods to choose from - like patterns, indicators, candles.

Choice of markets. This is the market you want to trade and making a choice is important. These can markets can be bitcoin/large-cap altcoins or low caps.

Studying graphs as part of homework. When developing your strategy, you have to pay special attention to studying charts.

Finding signals per the analysis method. It's important to ensure that the signals you will use match your analysis method.

Testing the strategy on historical data. The final component is to ensure you test your strategy using historical data. This will leave room for crypto trading mistakes detection and correction.

Also, each trading transaction consists of important parts like:

Entry point. The price at which a position is bought.

Stop loss. The price at which a position is sold to mitigate further losses.

Take profit. A type of order used to close a position when the desired price has been reached.

How to develop a cryptocurrency trading strategy

Developing an effective cryptocurrency trading strategy requires a systematic approach and careful preparation. The main steps in this process include:

Defining your goals and risk tolerance

Clearly articulate what you are trying to achieve, whether that is short-term profit, long-term capital growth, or portfolio diversification. Also, determine how much capital you are willing to risk on each trade, given your tolerance for potential losses.

Researching the market and choosing a trading approach

Understand the specifics of the cryptocurrency market, including its volatility, liquidity, and factors that influence pricing. Also, decide whether you will use technical analysis, fundamental analysis, or a combination of both to make trading decisions.

Developing a trading plan

Determine the conditions under which you will open and close positions based on the indicators and signals you have selected. Set rules for allocating capital between different assets and positions to optimize returns and reduce risks.

Strategy testing

Test the performance of your strategy on historical data to assess its potential profitability and identify potential weaknesses. Use demo accounts or paper trading apps to practice the strategy in real market conditions without the risk of losing capital.

Monitoring and adapting

Regularly evaluate the performance of your strategy by tracking profitability indicators and the ratio of successful to unsuccessful trades. Make necessary adjustments to the strategy in response to changing market conditions or after identifying its weaknesses.

Best crypto trading strategy alternatives

There are also opportunities for passive income in the crypto market, an excellent alternative for beginners. Here are a few of the alternatives.

Copy trading

Copy-trading involves mimicking the trades of professional traders. This allows the new traders to shorten the steep learning curve while keeping full access to their trading accounts. For example, suppose an expert trader buys a cryptocurrency when there is a fall in its price. In that case, you will also buy the cryptocurrency, trusting the professional to expect the price to increase in the foreseeable future. Crypto copy trading platforms are developed so that new investors can expedite their learning years while minimizing their risks.

Staking/farming and other passive incomes

Staking or Proof-of-Stake (POS) staking is the consensus method used in blockchain technology where networks decide on valid transactions. This typically involves a process where large amounts of a token are locked up for a time. Crypto staking is a good alternative and replacement for mining. Some blockchain networks require their users to commit their resources to the network. Then validators from the pool of users are selected. As a return, the validators earn interest on the amounts they stake.

Yield farming is another alternative, and it involves investors depositing tokens into a special smart contract known as a liquidity pool. The investors who contribute to this liquidity pool receive a share of the fees generated from traders accessing the pool.

Crypto signal providers

Crypto signals are a set of instructions sent from a signal provider to a group or an individual indicating what cryptocurrency they should buy, the price to buy at, the target sell price, and finally, the price to set the stop loss at.

We have prepared a list of top crypto exchanges that provide access to these alternatives:

| Min. Deposit, $ | Coins Supported | Demo | Spot Taker fee, % | Spot Maker Fee, % | Copy trading | Staking | Alerts | Regulation | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| 10 | 329 | Yes | 0,1 | 0,08 | Yes | Yes | Yes | No | Open an account Your capital is at risk. |

|

| 10 | 278 | No | 0,4 | 0,25 | Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 1 | 250 | No | 0,5 | 0,25 | No | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 1 | 72 | Yes | 0,2 | 0,1 | Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| No | 1817 | No | 0 | 0 | No | No | No | No | Open an account Your capital is at risk. |

Typical mistakes and how to avoid them

Here are the most common mistakes in trading that are typical for most beginners. Understanding them and working on them will help beginner traders build a more stable approach to trading and protect their capital from unnecessary risks.

Unconscious use of leverage. Although leverage provides an opportunity to increase profits, it also significantly increases the level of risk. Many beginners use it without understanding all the consequences, which leads to significant capital losses. For beginners, we recommend starting with minimal leverage levels and avoiding aggressive strategies.

Emotional trading. Another common problem that hinders beginner traders. The fear of missing out on profits or the desire to recoup losses often lead to impulsive decisions that contradict the developed plan. Ignoring the strategy and trading on emotions almost always end in failure. To minimize such risks, it is important to stick to a pre-established plan with clear entry and exit criteria, and manage risks regardless of the current market conditions.

Another serious omission is ignoring the principles of diversification. Beginners often invest all their funds in one asset, expecting high profits, but forget about possible losses. This approach makes the portfolio vulnerable to sharp price fluctuations. A more effective solution is to distribute investments between different assets, which helps to reduce the overall level of risk and ensure greater portfolio stability.

Trading because you’re scared of missing out. Many beginners get caught in the trap of trading too much because they’re scared of missing out on a big market move. This overtrading not only racks up transaction costs but also leads to mental fatigue and unnecessary risks. Instead, focus on the best opportunities. Look for trades with a strong risk-to-reward ratio and wait for high-probability setups.

Not paying enough attention to protecting your capital. New traders often get so caught up in the excitement of making a profit that they forget to manage their risk properly. The mistake is setting large stop losses or using too much leverage, expecting the market to always go their way. A smarter approach is to trade with smaller positions and use tight stop losses.

Starting small and increasing your trades as you go

One of the best strategies for beginners is "trading in the same direction as the market". Many newcomers try to predict when a trend will reverse or make quick trades based on short-term price moves, often ending up with losses. Instead, focus on identifying and following the current trend. Look for clear price patterns and use simple tools like moving averages to confirm the market's direction. Don’t try to fight the market—let the trend guide your trades.

Another important approach is "starting small and increasing your trades as you go". A common mistake is diving in with big trades, hoping for fast profits, which can quickly lead to large losses. Begin with small trades and practice using demo accounts. Once you gain experience and see consistent success, gradually increase your trade size. The key is to avoid overextending yourself early on, as the volatile nature of crypto can quickly deplete your funds if you're not cautious.

Conclusion

Cryptocurrency trading offers unique opportunities to make a profit, but it requires a systematic approach and discipline. Choosing the right strategy depends on your goals, experience, and risk appetite. Beginners can start by learning basic methods such as HODL or Swing trading, gradually mastering more complex approaches. Effective risk management, the use of analysis tools, and strategy testing are the foundation of sustainable success in the market. Trade consciously, analyze your results, and do not forget to adapt your approaches to changing market conditions. This approach will help you develop as a trader and achieve your goals.

FAQs

How do I know if a short-term or long-term trading strategy is right for me?

Evaluate how much time you are willing to devote to trading and how comfortable you are with risk. If you prefer to analyze the market daily and actively manage positions, short-term strategies are better. For those who prefer less activity, long-term holding of assets is suitable.

Is it possible to combine several trading strategies?

Yes, it is possible. For example, you can use HODL for long-term investments and Swing trading to profit from medium-term fluctuations. The main thing is to keep track of trades and analyze their performance separately for each strategy.

What is the minimum deposit required to start trading?

The deposit size depends on the chosen strategy. Scalping may require more capital due to many low-profit trades. For HODL, the minimum deposit depends on the value of the selected asset, but in general, you can start with small amounts.

What are the most common mistakes beginners make?

Beginners often use too many indicators at the same time, which leads to confusion. Another mistake is to trust unconfirmed rumors or news without checking their impact on the market. It is recommended to choose 1-2 indicators and study their functions before using them.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.