How does Investfly Work? All Pros And Cons

Top commission-free stock broker - eToro

The main functions of Investfly include:

-

Algorithmic trading - users can create and automate their own trading strategies

-

Virtual stock exchange - users can practice trading without using real money

-

Technical analysis - using technical analysis tools, users can analyze stock charts and identify potential trends

-

Stock alerts stock - this feature helps users stay informed about market movements and potential trading opportunities

-

Market game - fun and interactive way to learn about stock trading

-

Technical stock screener - helps users identify stocks that meet their specific investment criteria

TU Experts in this article will delve into the functionalities of Investfly, an online platform tailored for stock trading. They'll discuss its features such as algorithmic trading, virtual stock exchange for practice, technical analysis tools, and stock alerts. The discussion will extend to automated trading strategies, covering components like entry and exit conditions, portfolio allocation methods, and risk management tools offered by Investfly. Additionally, the pricing options and educational support provided by the platform will be highlighted. Overall, the experts aim to provide insights into how Investfly can be utilized effectively for trading stocks, enhancing users' trading experiences and risk management capabilities.

-

What is Investfly?

Investfly is an online platform designed for stock trading, offering features like algorithmic trading, virtual stock exchange, technical analysis tools, and stock alerts.

-

What is the best Investfly plan?

The best Investfly plan depends on your needs and budget. The Premium Plan, at $19.99/month, offers a comprehensive set of features including automated trading strategies and backtesting.

-

Is Investfly safe?

While there are no widespread reports of fraud, users should ensure Investfly's legitimacy. Due diligence is essential, and users should verify reliability independently.

-

What type of trader is Investfly Best for?

Investfly caters to traders of all levels, from beginners to experienced investors. Its user-friendly interface and comprehensive trading tools make it suitable for a wide range of traders interested in automated strategies and risk management.

What is Investfly?

Investfly is an online platform built for trading stocks and engaging with a community of traders. Launched in 2014, it's designed to simplify stock trading, particularly for those interested in automated strategies without the need for coding skills. Users can create, test, and implement trading strategies using intuitive drag-and-drop tools, making it accessible for both novices and seasoned traders.

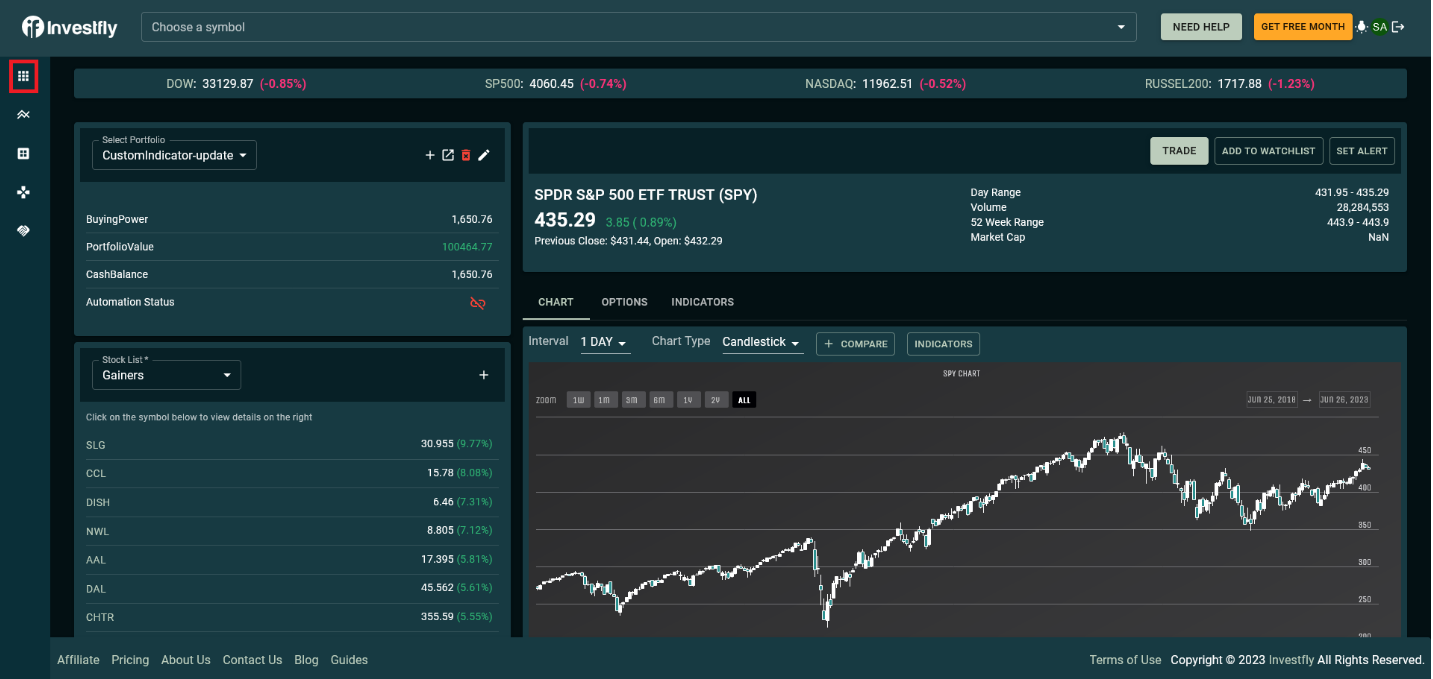

The platform provides a range of features, including real-time stock data, charting tools, news feeds, and stock screeners. Users can also link their brokerage accounts to execute trades based on their automated strategies directly through Investfly.

Beyond its technical capabilities, Investfly fosters a vibrant community where traders can share ideas, collaborate, and compete in trading contests. Whether you're a day trader or a swing trader, the platform aims to streamline the trading process, offering a blend of analysis tools, strategy-building resources, and community interaction.

Being cloud-based, Investfly doesn't require any installation and is accessible from anywhere with an internet connection. With its user-friendly interface and comprehensive suite of features, Investfly aims to empower traders of all levels to make informed decisions and enhance their trading experience.

Best stock brokers

Basic features of Investfly

Investfly is an online platform that provides a range of tools to assist users in their stock trading endeavors. Here's a breakdown of its main features:

Algorithmic Trading

With Investfly, users can create and automate their own trading strategies using a simple interface. This means you can set conditions for buying or selling stocks, and Investfly will execute trades automatically when those conditions are met. It's like having a virtual assistant managing your trades based on your rules. For example, you can set rules like “Buy AAPL when it hits a 52-week high with a 5% increase in volume” or "Purchase Pepsi (PEP) if Coca Cola (KO) rises by over 5%.

Investfly official website

Investfly official website

Virtual Stock Exchange

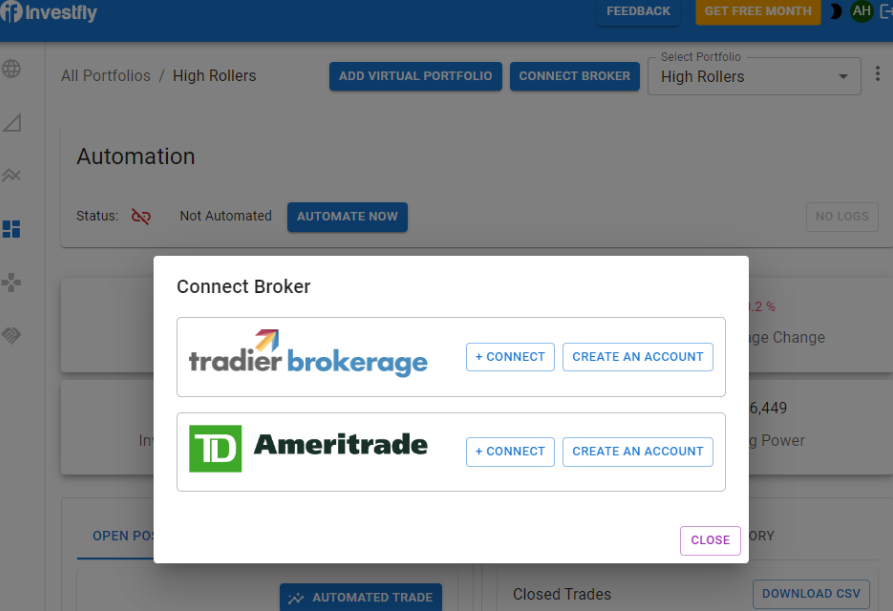

Investfly offers a virtual stock exchange where users can practice trading without using real money. It's like a simulation game where you can hone your trading skills and test out different strategies before diving into real trading. Currently, Investfly supports connections to Tradier and TD Ameritrade brokers.

Investfly official website

Technical Analysis

Investfly provides various tools for technical analysis, such as moving averages, relative strength index (RSI), and Bollinger Bands. These tools help users analyze stock charts and identify potential trends or patterns to inform their trading decisions.

Investfly official website

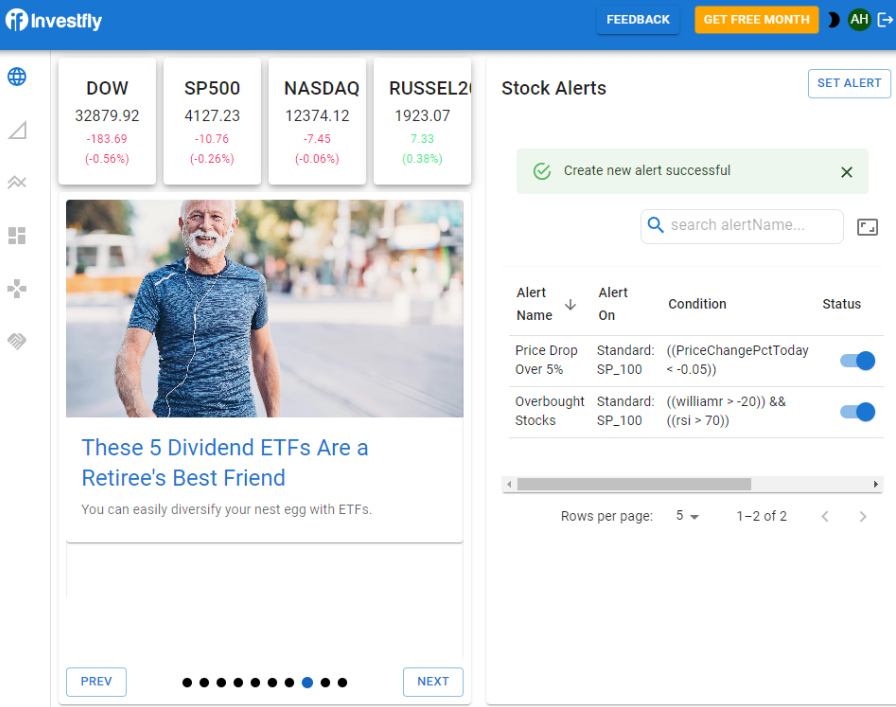

Stock Alerts

Users can set up alerts on Investfly to receive notifications when a stock reaches a certain price or when specific conditions are met. This feature helps users stay informed about market movements and potential trading opportunities even when they're not actively monitoring the market.

Investfly official website

Stock Market Game

Investfly hosts a stock market game where users can compete against each other to see who can make the most money. It's a fun and interactive way to learn about stock trading and put your skills to the test in a risk-free environment.

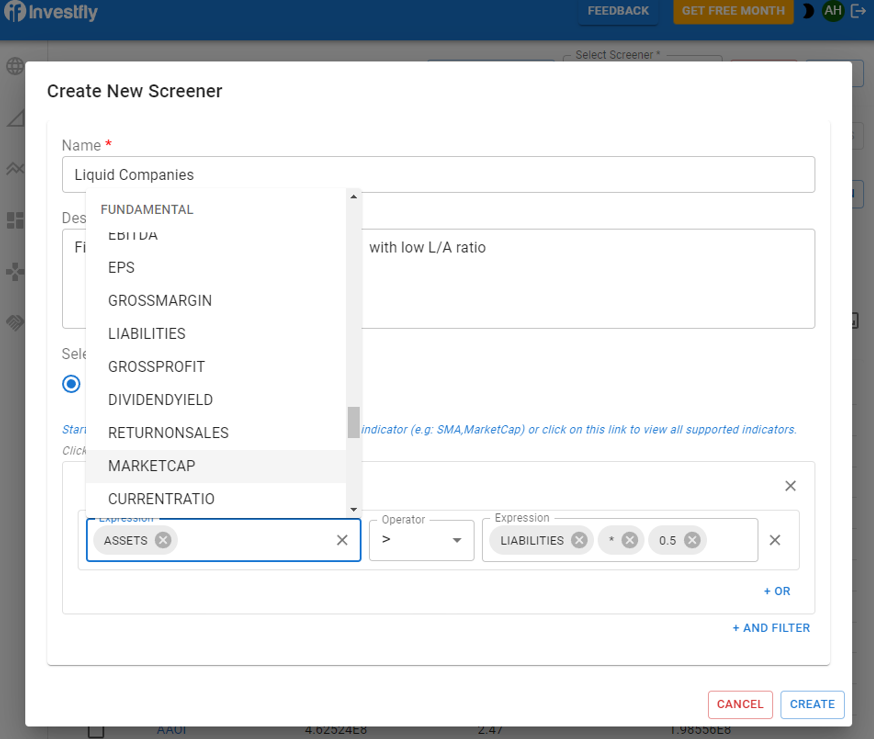

Technical Stock Screener

Investfly's stock screener allows users to filter through stocks based on various technical criteria, such as price, moving averages, and RSI. This tool helps users identify stocks that meet their specific investment criteria, saving time and effort in the research process.

Investfly official website

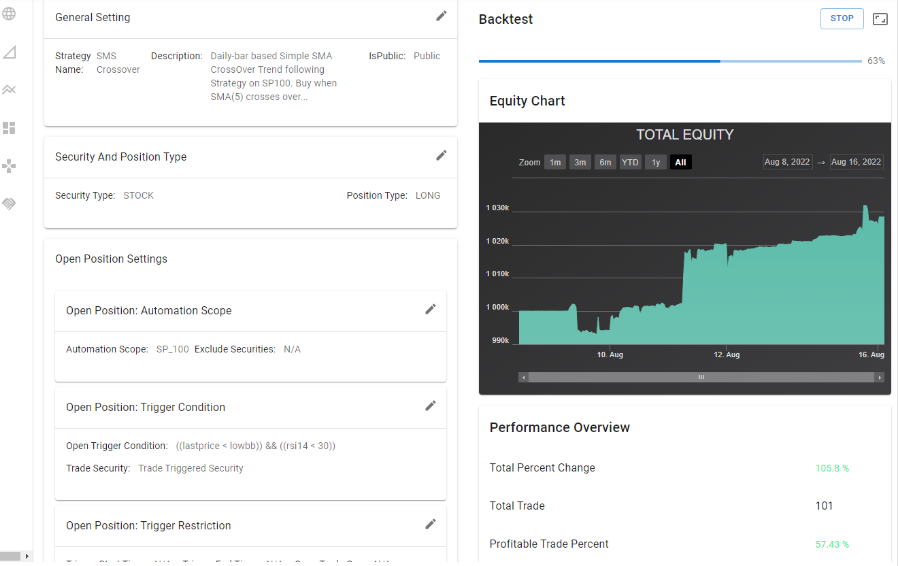

Automated strategies

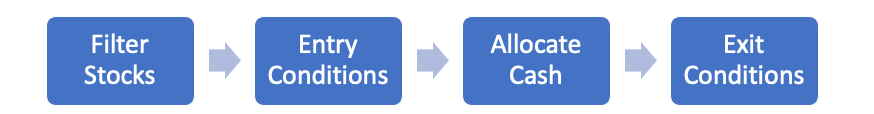

Automated trading strategies represent a structured set of rules or instructions that dictate when and which stocks to trade within the financial markets. Unlike single automated trades, which execute once, automated strategies are designed to operate across multiple securities, defining both entry conditions for opening new positions and exit conditions for closing existing ones. These strategies can be based on a variety of factors, including fundamental and technical indicators, stock prices, or mathematical models. Examples of automated strategies include trend-following and contrarian approaches.

Components of Trading Strategy

Automation Scope

When you're trading stocks, there are tons of options out there - some are small penny stocks, some are big names, some are in the tech sector, and others are in retail. It's not practical to try to trade all of them because each type of stock behaves differently, and it's hard to make a strategy that works for all of them.

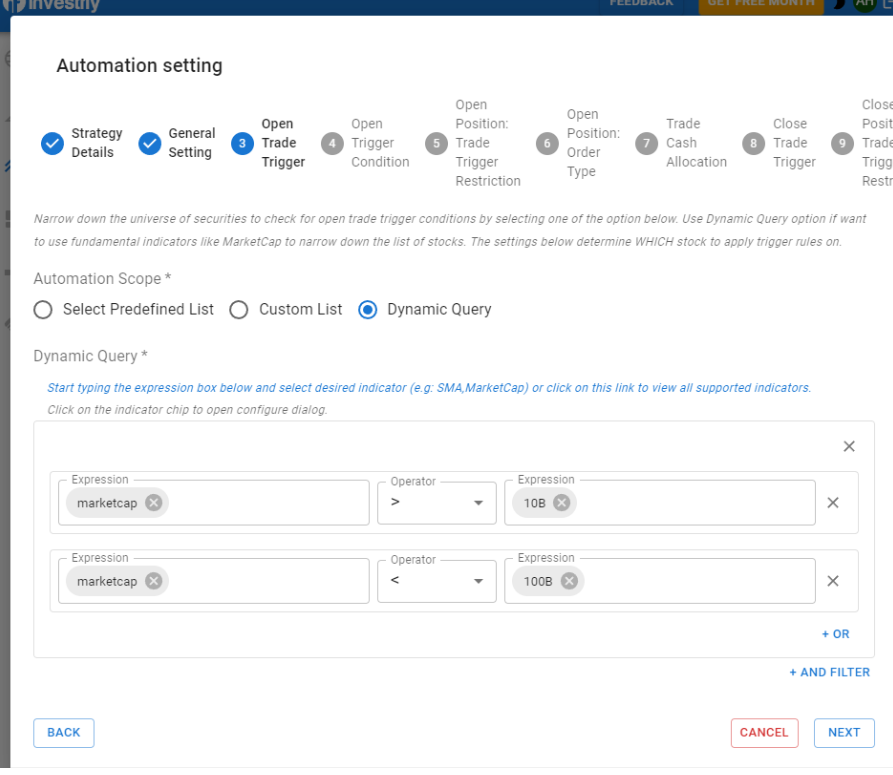

So, the first thing you need to do is narrow down the list of stocks you want to focus on. Investfly offers three ways to do this:

-

Predefined Lists: You can choose from lists that are already made, like the S&P 500 or the Dow Jones Industrial Average. These are groups of stocks that are known and tracked by investors

-

Custom List: You can make your own list of specific stocks you're interested in. Just type in the symbols of the stocks you want to include, separated by commas. For example, AAPL for Apple, WMT for Walmart, and TSLA for Tesla

-

Dynamic Filter: This is a bit more advanced. You can set up rules based on things like how big the company is (market capitalization) or other fundamental indicators. For example, you could say you only want to trade stocks with a market capitalization greater than $100 billion

Open Trade Condition (Entry Condition)

The entry condition in trading is like the timing signal that tells you when to make a trade with the stocks you've chosen. It's all about using indicators that change over time, like the stock price, moving averages, or the relative strength index (RSI).

For example, you wouldn't typically use things like a company's net earnings to decide when to trade because that doesn't change often. Instead, you'd use it to decide which stocks to include in your trading strategy in the first place.

To set up the entry condition, you create a logical expression using an expression builder. This expression uses a mix of fundamental and technical indicators, along with things like price, volume, and numerical values. It's like creating a rule that says, "If this condition is true, then it's time to make a trade."’

Trade signal generation

When it comes to generating trade signals, it's like getting a green light to make a trade when certain conditions are met. These conditions are based on rules you've set up using indicators and other factors.

Now, imagine you're getting signals for different stocks all at once. It's like getting a bunch of different traffic lights turning green at different times. But here's the thing: the order in which these signals come in can seem random. That's because the stock market sends information in a somewhat random order, and the system processes this information all at once to keep up with real-time trading.

So even if you have two identical strategies running, they might end up trading different stocks and getting different results. But here's the kicker: if your strategy is solid and your rules are good, it should still make you money in the long run. Sure, there might be some variation in outcomes, but if your strategy is consistently profitable, then you know it's working.

Portfolio Allocation

In managing your trading account, you'll be receiving trade signals randomly, either indicating to buy or sell certain stocks. The challenge lies in deciding how to allocate your funds when these signals come in. Should you invest all available cash into one stock? Or spread it out across multiple stocks? Two common approaches simplify this decision-making process:

-

Invest Fixed Cash Amount

Imagine you decide to allocate $500 for each trade signal you receive. If your account starts with $10,000 and you receive a buy signal, you'll invest $500 in the specified stock. You'll continue doing so until your cash balance runs out. If your account grows significantly to $50,000, you might consider increasing your fixed investment amount to, say, $1,000 per signal to make more meaningful investments with your larger account size.

-

Maintain Fixed Number of Open Positions

Alternatively, you can specify the number of unique stocks you want to hold in your portfolio. The strategy then adjusts the investment amount based on your portfolio value. Suppose you want to maintain a portfolio with 3 different stocks at any given time. Initially, with a $10,000 account, you'll invest $10,000 / 3 = $3,333 in each stock when you receive a buy signal. If your account grows to $100,000, the strategy will adjust, and you'll invest $100,000 / 3 = $33,333 in each stock to maintain your desired number of open positions. This ensures that your investments scale proportionally with your account size, allowing for more balanced portfolio management.

Both approaches have their merits. The first is simpler to implement but may require manual adjustments as your portfolio grows or shrinks. The second is more dynamic and adjusts automatically based on your account size, making it a preferred choice for many traders. Ultimately, the choice depends on your trading preferences and risk tolerance.

Exit Condition

In addition to managing your portfolio's entry conditions, it's crucial to establish criteria for when to exit positions. Investfly offers several standard exit conditions as well as some customizable options:

-

Target Profit: This condition triggers the closure of a position once a specified profit level is reached. For example, if you set a target profit of 10%, the position will be closed automatically when it reaches or exceeds that profit margin

-

Target Loss: Similar to target profit, this condition prompts the closure of a position when a predetermined loss threshold is hit. For instance, if you set a target loss of 5%, the position will be closed to limit further losses once it reaches that level

-

Trailing Loss: This condition is dynamic and adjusts the exit point as the position moves in your favor. It sets a trailing stop-loss order that follows the price movement, protecting profits while allowing for potential gains

-

Timeout Condition: Positions can be closed automatically after a specified period, regardless of whether the profit or loss targets are met. For example, you might choose to close a position after 3 days or 20 minutes, depending on your trading strategy and time horizon

-

Custom Close Condition: This feature allows you to define your own criteria for closing positions based on specific logic or conditions. Similar to setting entry conditions, you can create custom rules using logical expressions tailored to your trading strategy

These exit conditions are essential components of your overall trading strategy, helping you manage risk, protect profits, and optimize your portfolio performance. In the next steps of creating your strategy, you'll delve into more details and fine-tune these components to suit your specific trading goals and preferences.

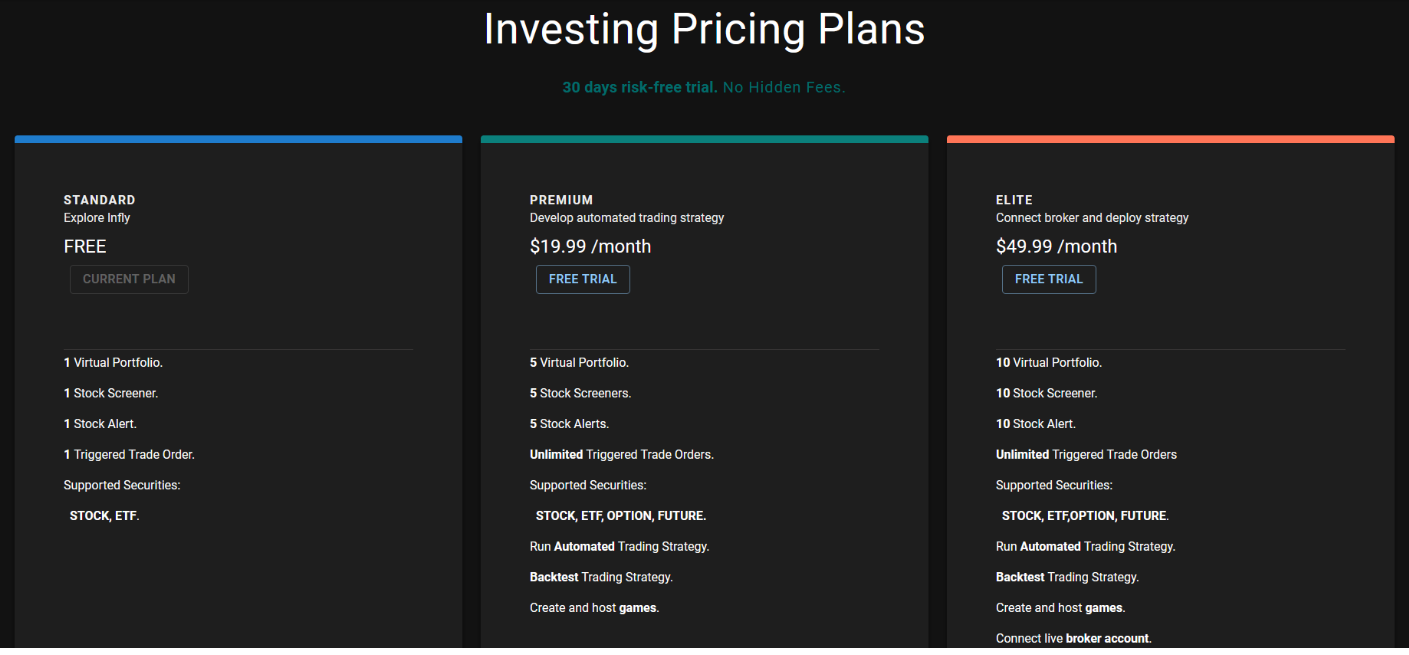

Investfly Pricing Options

| Plan | Cost | Features | Supported Securities |

|---|---|---|---|

Standard Plan |

Free for 30 days |

1 Virtual Portfolio - 1 Stock Screener - 1 Stock Alert - 1 Triggered Trade Order |

Stock, ETF |

Premium Plan |

$19.99/month |

5 Virtual Portfolios - 5 Stock Screeners - 5 Stock Alerts - Unlimited Triggered Trade Orders - Ability to run automated trading strategies - Backtesting of trading strategies - Create and host stock market games |

Stock, ETF, Option, Future |

Elite Plan |

$49.99/month |

All features from the Premium Plan - Connect your broker and deploy strategies live |

Stock, ETF, Option, Future |

Investfly official website

Education and support

Investfly official website

Investfly's educational trading tools include the following:

Student Portal

-

Trade Equities: Students can trade stocks in major global markets through the platform, allowing them to practice real-world trading scenarios

-

Create Multiple Portfolios: Users can create multiple portfolios to test various investment strategies and ideas simultaneously

-

Access to Premium Tools: Students gain access to Investfly's premium tools, enabling them to evaluate portfolio performance, conduct in-depth analysis, and utilize advanced trading features

-

Collaboration with Peers: The platform facilitates collaboration among students by providing features to share ideas, strategies, and insights with peers, fostering a collaborative learning environment

-

Discount for .edu Email: Students with a valid .edu email address receive a 50% discount on membership fees, making the platform more accessible and affordable for educational purposes

-

Free for Professors: Professors can set up and manage simulations and classes for free, allowing them to integrate practical trading experiences into their curriculum and enhance students' learning outcomes

Instructor Portal

-

Enhanced Classroom Experience: Instructors can complement traditional lectures with practical trading experiences, providing students with hands-on learning opportunities

-

Classroom Management: The platform allows instructors to manage classroom activities, organize trading contests, and track student progress, facilitating effective teaching and learning

-

Communication and Feedback: Instructors can post announcements, provide feedback, and communicate with students directly through the platform, promoting engagement and interaction within the learning community

These features of the Student and Instructor Portals aim to enrich the educational experience, providing students and instructors with valuable resources and tools to enhance their understanding of trading and investment concepts.

Support

Investfly offers robust support for its users.

-

Community Forums: Users can participate in community forums to engage with other traders, ask questions, and share insights. It's a valuable platform for learning from the experiences of other traders and seeking advice

-

Help Center: The Help Center provides detailed guides, FAQs, and troubleshooting information to assist users in navigating the platform and resolving any issues they encounter

-

Contact Support: Users can directly reach out to the Investfly support team for personalized assistance. Whether it's technical issues, account-related queries, or general inquiries, the support team is available to help users resolve their concerns promptly

Overall, Investfly aims to empower users with the tools, knowledge, and support needed to navigate the financial markets effectively. Whether you're a student, educator, or an aspiring investor, Investfly's educational resources and support system are designed to facilitate learning and success in trading.

Can Investfly enhance your risk management capabilities?

Yes, Investfly offers tools that can help you manage the risks involved in trading stocks:

-

Stop-loss orders: These are like safety nets for your investments. If the price of a stock drops to a certain level, the system automatically sells it to prevent further losses

-

Take-profit orders: Think of these as your profit guardians. When the price of a stock hits a specific target that you've set, Investfly automatically sells it, securing your profits

-

Position sizing: This is about controlling how much money you put into each trade. It ensures that you don't risk too much on any single investment, helping to protect your overall portfolio

But Investfly doesn't stop there. It goes further to boost your risk management skills by:

-

Providing educational materials: Investfly offers resources to help you learn about different risk management strategies. Understanding these concepts empowers you to make smarter decisions when trading

-

Offering a virtual stock exchange: This feature lets you practice trading in a simulated environment without using real money. It's like a training ground where you can test out your risk management strategies and see how they perform

-

Supporting backtesting: You can analyze how your strategies would have performed in past market conditions using historical data. This helps you spot any flaws in your approach and refine your strategies accordingly

Investfly official website

Is Investfly safe and can it be trusted?

Investfly offers a cloud-based platform for automated stock trading. Although there are no widespread reports of fraud, users should ensure its legitimacy. Official registration details are not explicitly provided, prompting users to seek clarification from the company. Market data sources are undisclosed, necessitating users to verify reliability independently. While Investfly streamlines trading, due diligence is essential to mitigate risks and make informed investment decisions.

| Pros | Cons |

|---|---|

Investfly offers a user-friendly interface, making it easy for investors of all levels to navigate |

Limited customization for automated trading strategies |

The platform provides comprehensive trading tools including screening, backtesting, and a trading simulator |

Free version restricts backtesting to one year, potentially limiting long-term analysis |

Competitive pricing with a free plan and affordable paid options |

Investfly enables users to develop and automate trading strategies based on preset rules, streamlining the execution of trades and potentially maximizing efficiency |

How to start using Investfly?

To start using Investfly for automated trading, follow these steps:

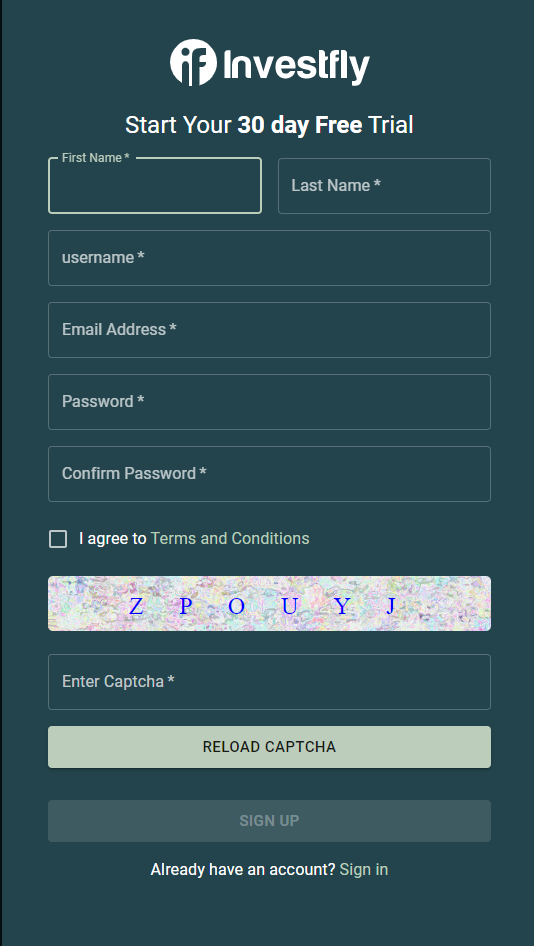

Sign Up and Log In

Investfly official website

-

Visit the Investfly website and click "Sign Up."

-

Fill in your details to create an account, then log in

Access the Dashboard

-

Upon logging in, you'll reach the dashboard

-

Take a moment to get familiar with the layout and available features

Create a New Trading Strategy

-

Click "Create New" (usually at the top right)

-

Choose to modify a template or create from scratch

Strategy Details

-

Name your strategy, provide a description, and set visibility (public or private)

General Settings

-

Select the security type (stocks or options) and position type (LONG or SHORT)

Automation Scope

-

Specify the automation scope based on your preferences and trading goals

Entry Conditions

-

Define the conditions for entering trades using technical indicators or other criteria

Trigger Restrictions

-

Set time restrictions if necessary to control when trades can be triggered

Save and Deploy

-

Review your strategy details and save it

-

If deploying, ensure it's set to Trade Triggered Security

Test and Monitor

-

Backtest your strategy using historical data

-

Monitor its performance and make adjustments as needed

Investfly is an online platform designed for stock trading, offering features like algorithmic trading, virtual stock exchange, technical analysis tools, and stock alerts. Investfly can be used effectively for trading stocks, enhancing users' trading experiences and risk management capabilities.

Glossary for novice traders

-

1

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Take-Profit

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).