Top 8 Best Trading Apps in Australia (2024)

Best Trading App in Australia - IC Markets

| App | Best For |

|---|---|

Best For Forex Education |

|

Best For Automated Trading |

|

Best for Stock Trading |

|

Best For Beginners |

|

Best CFD Trading Experience |

|

The Best Analytical tools |

|

Best Mobile Charting |

|

Best for all traders |

If you are a busy person, you probably don't have the luxury of sitting down by your laptop or computer to trade financial markets. Forex trading apps have become invaluable tools to traders and investors in the financial markets. Trading apps allow users to monitor trades and even place orders on the go at the click of a button. However, we have discovered that beginner traders spend precious time and resources searching for the best forex trading app to use.

With that in mind, our team researched which Australian Securities and Exchange Commission (ASIC) regulated brokers' apps will best suit newbies in Australia. We found 8 of the best ones we could recommend. We ranked these apps based on:

Do you want to start trading Forex? Open an account on eToro!Best Forex Trading Apps In Australia Comparison 2024

When digging for suitable apps to use for your trading, pay attention to these 8 apps:

| Broker | Trading App | Minimum Deposit | Local Regulation | Copy-trading | Max Leverage | AUD Account | |

|---|---|---|---|---|---|---|---|

cTrader |

$200 |

Yes |

Yes |

1:500 |

Yes |

||

eToro |

$50 |

Yes |

Yes |

1:30 |

No |

||

IBKR Mobile |

$0 |

Yes |

No |

1:50 |

Yes |

||

AvaTradeGO |

$100 |

Yes |

Yes |

1:400 |

Yes |

||

IG mobile |

$0 |

Yes |

No |

1:50 |

Yes |

||

fxTrade |

$0 |

Yes |

Yes |

1:50 |

No |

||

forex.com |

$100 |

Yes |

No |

1:50 |

No |

||

XM Group |

$5 |

Yes |

Yes |

1:30 |

Yes |

IC Markets - Best for Forex Education

IC Markets is an indigenous ASIC regulated broker established in 2007. The company aims to create the best trading experience for its clients. Its offers competitive prices and packs a good range of free forex education tools and technical analysis. IC Markets offers spreads as low as 0.0, which is one of the best in the market.

The Raw Spread account favors professionals as they can enjoy low spreads and commissions as low as $3.5. Users have access to over 60 currency pairs and quotes from 25 pricing sources on the platform.

IC Markets platform is ideal for beginner traders. The broker understands the needs of novice traders and provides free educational materials, video tutorials, webinars, and technical analysis to educate them.

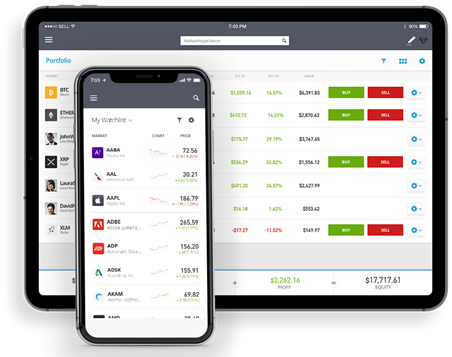

The IC markets cTrader app is available for both Android and iOS devices. It supports MT4 and MT5. Using cTrader, you can trade stocks, ETFs, indices, metals, and forex.

Another exciting feature of the app is integrating the No Dealing Desk (NDD) / Direct processing (STP) technology. If you are looking for a broker that guarantees fast trades, you should consider IC Markets as it boasts order execution speeds of 40ms.

IC Markets trading app

👍 Pros

• Quick and responsive charts and market quotes for faster trading.

• Fast execution speeds.

• High-quality technical analysis tools.

• Outstanding customer service available with 24/7 support.

👎 Cons

• No client protection feature against losses.

• No money protection for clients in Australia.

eToro - Best Automated Trading App

eToro has one of the best social trading platforms ever. The online broker began its operations in 2007 and has since maintained its mission to make trading easy for everyone. It is regulated by major authorities worldwide, including the EU, UK, and Australia, and has over 12 million users globally. This broker’s platform is ideal for beginners who want to automate their trading activities.

eToro’s copy-trading technology allows users to mimic the strategies of expert traders to increase their chances of making profits while trading financial instruments. Also, users have access to US stocks which they can trade at zero commission. eToro offers over 3000 tradable instruments including, CFDs, major cryptocurrencies and forex.

The mobile app’s interface is user-friendly and above-average. It also has a reliable search function and two-step authentication for better security. Both Android and iOS versions are available.

eToro trading app

👍 Pros

• Higher leverage and low commissions for beginners.

• Easy to use mobile app interface.

• Excellent for social trading.

• Multi-asset platform for crypto and stocks, with a good range of cryptocurrency pairs.

👎 Cons

• No base AUD support.

• Its best features are restricted to VIP accounts.

Interactive Brokers (IBKR Mobile) - Best for Stock Trading

IBKR is one of the oldest and most trusted brokers today. Since 1993, the ASIC-regulated brokerage firm has provided a robust, advanced platform for trading stocks. It boasts a wide range of tradable assets at very low margins. This broker charges some of the lowest fees for international stocks, especially US stocks.

If you are mainly interested in trading stocks, you should consider using the IBKR mobile app. Using the app, you can enjoy high-speed transactions, plenty of trading assets, and excellent reliability. IBKR provides users with a rich selection of research materials, daily updates, and analysts’ reviews for free. The app is compatible with iOS and Android devices.

👍 Pros

• Zero commission on stocks.

• High-quality research and educational materials in-app.

• Huge selection of stocks to trade.

• Ergonomic mobile app.

AvaTrade - Best for Beginners

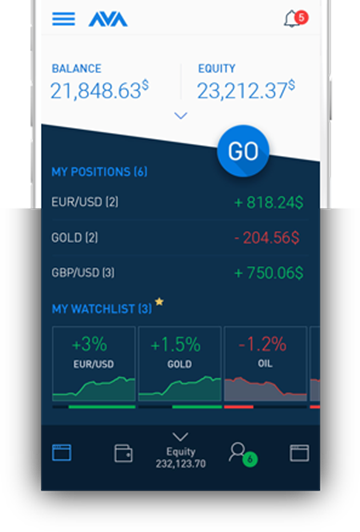

Avatrade is an online forex and CFD broker headquartered in Ireland. It is ASIC regulated and has one of the most innovative mobile apps. Its platform allows users to monitor their accounts, trade markets, and interact with other traders. in addition to an inbuilt risk management tool, over 1000 forex, CFDs, cryptocurrencies, and stocks are available to trade using the app. The platform is ideal for beginners as it has a range of products with low spreads and requires low initial deposits.

Avatrade’s mobile app, AvatradeGO, is available on iOS and Android. Beginner traders will have few issues using this app because of its user-friendly interface. It also has well-designed educational materials, and users do not need to sign up to access them. Avatrade has a dedicated training guide and videos for newbies that explain trading rules, market terms, and online strategies.

AvaTrade trading app

👍 Pros

• Suitable for newbies to learn the basics of trading forex and CFDs.

• AUD account available to Australian customers.

• Free deposit and withdrawal

• Copy and social trading using DupliTrade.

👎 Cons

• Occasional delays in funds transfer.

• High fees on inactive accounts.

IG - Best CFD Trading Experience

IG began its operations in 1974, making it one of the world's oldest, most experienced brokers. IG lists on the stock exchange (FTSE250) and top-tier regulators, including the ASIC, oversee its operations. You can feel safe using the broker's platform as it caters to over 313,000 clients in more than 17,000 markets globally.

IG provides an excellent trading experience. You can either go long or short, enjoy high leverage, and trade even on weekends. Traders also get to enjoy extended trading hours on US stocks. Trading instruments include indices, Forex, over 13000 shares, and 8 major cryptocurrencies. Australians have automatic access to CFD and forex accounts but must open separate accounts to trade stocks.

Opening an account is easy and takes between 6-8 minutes. However, it might take longer(up to 3 working days) to be verified.

IG'sIG's mobile app has a clear and intuitive design. However, some beginners may become overwhelmed when using the app for the first time. That is due to the app's many features, assets, and trading tools. Yet, the app provides a rich library of tradable assets, including Stock CFDs, hard metals, energies, options, bonds, and indices. Users can trade CFDs at 0.10% commission.

IG trading app

👍 Pros

• Daily news updates.

• Zero inactivity fees.

• Detailed information on trading assets.

• Offers over 17000 CFDs.

👎 Cons

• No educational materials in-app, as traders need to visit the IG website.

• Minimum deposit of £250.

Oanda - Best Mobile Charting

Established in 1996, Oanda is regulated in six tier-1 countries, including Australia. It is a low-risk broker for trading the financial markets. Its platform supports MT4 and MT5 with a strong reputation for top-quality market analysis.

The Oanda app operates on Android and iOS devices. Among its best features is its excellent charting. The app has 11 customizable charts and boasts over 65 charting indicators, including Bollinger Bands, Aroon, Donchian Channels, and Ichimoku Cloud.

It also has currency pair comparing functionality powered by TradingVIew. TradingVIew users can open and close trades directly using Heikin-Ashi, Renko, candle, and point-and-figure chart types. Additionally, users can annotate charts for future reference.

Oanda trading app

👍 Pros

• Fast account creation

• Superb research and technical analysis tools

• Easy-to-use trading platform suitable for beginner traders

• Wide selection of charting tools and indicators for professionals

👎 Cons

• Customer service not available 24/7

• No stock trading

Forex.Com - Best Analytical Tools

GAIN Capital Holdings founded Forex.com in 2001. StoneX Group Inc now owns the online broker. A subsidiary of StoneX Group, City Index Australia provides trading services to Australians. The company has operating rights from the ASIC.

Forex.com offers tight spreads on currency pairs and access to more than 4500 markets. If you are only interested in the forex markets and nothing else, then forex.com is your go-to platform. This broker provides over 80 currencies to trade on its MT4 and MT5 platforms.

For new traders delving into forex trading, forex.com provides a rich selection of educational materials, including live webinars and risk management guidance for free. It includes a customizable news feed, allowing users to view updates on preferred currency pairs before placing orders.

Forex.com saves time for traders with Trading Central, an automated technical analysis tool that helps identify trading patterns, provide trading opportunities, and analyze volatility in the forex markets.

The mobile versions provide an excellent trading experience with full trading capabilities as desktop versions. Users have access to real-time alerts, market commentary, and news updates. Using the app, you can trade forex either as CFD or Spot forex on MT4. Using the watchlist function, users can combine numerous assets to an easily accessible list. The app is downloadable on the Play Store and Apple Store.

Forex.com trading app

👍 Pros

• Sophisticated technical analysis and research tools.

• Low trading fees.

• No withdrawal charges.

• ASIC regulated broker committed to Australians.

👎 Cons

• High fees on stock CFDs

• Inactivity fee

XM Review

XM is an internationally regulated broker that provides multi-asset web and mobile trading platforms for forex, equities, commodities, indices, and cryptocurrencies. With over 1 million clients worldwide, XM has earned a reputation as a reliable broker for dedicated traders and investors.

Both inexperienced and seasoned traders can utilize the XM Trading App's simple and intuitive layout.

The menus are clearly arranged, and the layout is clear, making navigation simple. The app's design enables fluid interactions for anything from maintaining open positions to obtaining real-time market data. Users can tailor their trading experience to their preferences thanks to the availability of customizable options.

Here are a few Pros and cons of using the platform.

👍 Pros

•User friendly and intuitive Interface.

•A diverse range of tradable assets.

•In-depth charting tools and indicators for technical analysis.

•Even during periods of significant volatility, the performance is dependable and stable.

•Price alerts and notifications in real time.

👎 Cons

•For new traders, teaching resources may be more comprehensive.

What to look for in a trading app

Most brokers now have mobile versions of their web trading platforms. These apps provide a convenient way to explore the financial markets. But, you must understand the requirements for selecting an app before you choose one. The best trading apps should help you meet your goals while providing a whole trading experience.

Below are 5 key features to look out for in a trading app:

Intuitiveness

An app with a user-friendly interface makes things easier, especially for newbies. Use one that provides tutorials on how to access its features.

Device Compatibility

Not all mobile apps will run optimally on your device. You should ensure any app you use is compatible with your mobile device. To test software for bugs and operation glitches, use the demo version of the app. That way, you can know if the app works well on your device without putting your investments at risk.

Transaction speed

We can't overstate how crucial it is to use apps that guarantee fast execution of buy or sell orders because the forex market is volatile. Latency affects trading success, especially for scalp trading. Some forex trading apps offer instant order execution. Yet, It's best to work with brokers' apps that integrate Straight Through Processing (STP) technology.

Research tools and technical analysis

The mobile app should allow you access to real-time charts, updates, and well-researched information on any instrument you wish to trade. Other must-have tools include alerts and notifications, risk management, and technical analysis (for analyzing price trends) to help you determine your entry and exit points.

Safety and security

Ensure the trading app has top-notch security features. Read reviews and users' ratings of the app. That way, you can tell if it's safe to use the app. Also, prioritize apps that incorporate biometric login and two-factor authentication.

Customer support

At times, you might experience problems when using an app. You will need timely assistance from customer support. Before you sign up on any app, try chatting or sending an email to customer support. Ideally, you should get a response within a few minutes. Stick to brokers with good customer service.

How to Choose a Broker's App in Australia?

Your choice of a broker will largely depend on your goals and preferences as a trader. Since there are so many apps to choose from, here are vital steps that you should take when selecting an app:

Learn regulation and reliability

Use Forex brokers licensed by ASIC, the recognized regulator for Australian financial markets, to trade forex in Australia. That is the most intelligent way to protect your investments in an intrinsically volatile environment. Do extensive research on a broker to gather enough information on its operating rights. You can also read experts' reviews on the broker to obtain in-depth information.

Research trading assets

Check out for pairs the broker offers. Focus on apps with AUD pair offers. It's also crucial to study the fees and commissions attached to trading instruments. If you are more interested in crypto than stocks or CFDs, concentrate on brokers that offer more crypto pairs to trade as they'll tend to list more cryptocurrencies.

Explore app's features

If you are a beginner, go for less complicated apps. If an app packs many useful features but has a complex user interface, navigating it can be challenging and leave room for mistakes and time-wasting. Also, the app must provide helpful tutorials and videos to guide users. Choose apps with tools for managing risks, price alerts, financial news updates, and real-time charts.

Try a demo account

Beginners should first use demo accounts before operating live trading accounts. Doing so lets you test the app's functions and practice trading without blowing your budget. Most brokers provide demo accounts with enough virtual money for newbies to practice trading. Using a demo also helps you determine if the app aligns with your preferences and is compatible with your device.

Opening an account

The account opening process is similar on most apps. But some may be strenuous and require many documents for verification. Others brokers need verification documents to fund an account. In any case, consider apps with a less cumbersome registration process.

Best Forex Trading Apps For Beginners in Australia

As a beginner trader, you need ongoing training to navigate the financial markets for profits. Although consistent profits are not guaranteed, you want to avoid extreme losses or blowing your account. The best forex app should provide tools to assist novices.

Leverage the strategies of more experienced traders by using applications with copy trading capabilities. Doing so allows you to keep afloat in the financial markets while improving your trading skills. eToro’s app is an excellent platform for copy-trading, as it will enable you to interact with professional traders and mimic their trading strategies.

Again, we recommend using beginner-friendly apps that provide lots of educational materials and research tools and even short courses on rudimentary topics. IC Markets and Avatrade’s app is ideal as they pack high-quality, easy-to-understand tutorials on trading.

Is Trading Legal In Australia? Is it Safe?

Forex trading is lawful in Australia. The regulatory environment places no hindrances (except tax) on forex brokers as long as they are licensed in the country. The ASIC ensures that Australians investments are safe and secure as they explore financial markets.

However, according to Greg Yanco, Executive Director for Markets at ASIC, beginner traders and investors should be cautious when trading because of the “inherent volatility and complexities” of forex trading. It is better to choose international brokers with a proven track record or locally regulated brokers.

To protect your assets:

-

Be watchful of misinformation on trading strategies or products

-

Do your research before entering a trade

-

Know the basics before picking investments

Tips for Successful Use of Trading Apps in Australia

Consider the following recommendations to enhance your success as you begin your trading career with apps in Australia.

Select a Regulated Platform

Platforms authorized by respected financial regulators, such as ASIC, should be prioritized. Regulation guarantees that the platform meets stringent requirements, resulting in a safer and more secure trading environment.

Begin with a Demo Account

Several trading apps provide demo accounts. Use this function to practice trading with virtual funds before putting real money on the line.

Recognize the Risks

Trading carries a significant risk of loss. Before making trades, it's essential to familiarize yourself with risk management ideas, including position sizing, stop losses, and diversification. Never take a risk with money that you can't afford to lose.

Start Small

Make tiny trades at first to become accustomed to order execution, spreads, and fees when using a trading app. The size of your trades can be steadily increased as you gain experience. Rushing into important roles when you're new is a surefire way to fail.

How To Choose the best stock app in Australia

Choosing the right stock trading app is essential for a seamless and successful trading experience. Whether you're a seasoned trader or just starting, understanding what to look for in a trading app will guide you to the best platform for your needs. Here's what to consider:

Ease of Use: User-friendly navigation allows you to quickly find information and place trades without confusion

Available Securities: Check for a wide range of assets like stocks, ETFs, mutual funds, futures, and Forex

Educational Resources: Tutorials, webinars, and other resources are crucial for beginners to develop skills

Fees: Understand the fee structure, whether it's commission-based or commission-free trading

Research Tools: Stock screeners, news feeds, and market analysis are essential for informed trading decisions

Customer Service: Having accessible customer support can make a significant difference in your trading experience

Mobile App Features: If you plan to trade on-the-go, ensure the mobile version is efficient and feature-rich

If you're wondering which platform encapsulates all these features, eToro stands out as a favorauble option. Here are some reasons why you should choose eToro:

Access to a Wide Range of Financial Assets: eToro offers over 3,000 different assets, including stocks, cryptocurrencies, ETFs, indices, and more

Innovative Social Trading Experience: eToro's social trading platform allows users to connect and share knowledge. Users can also copy successful trades

Fractional Shares: Investing in a portion of a share instead of a whole one is possible with eToro, making it easier to invest in expensive stocks

eToro combines an extensive range of trading options with innovative features, making it a strong choice for traders and investors in Australia. Its accessibility, unique social trading experience, and fractional share support make it a preferred option if these factors align with your trading needs.

Do I pay taxes for Forex trading in Australia?

Forex trading in Australia isn't just about understanding markets and trends; it's also about knowing the tax implications. In Australia, forex trading is regarded as a speculative activity, and thus, it falls under the purview of capital gains tax (CGT).

When you trade forex, the tax you'll owe is calculated based on the difference between the purchase price and the sale price of the asset. The CGT rate aligns with your individual marginal tax rate, which can range anywhere from 0% to 45%, depending on your income.

Here's where things get interesting: the way CGT applies to forex trading depends on how long you've held your investment. A reduced rate applies for individuals holding investments over 12 months, while the full marginal tax rate is charged for shorter-term investments. Businesses also have specific rules based on the holding period.

And don't forget, if you happen to incur losses in your forex trading, these can be claimed as a deduction, offsetting other income and potentially reducing your overall tax bill. Understanding these nuances ensures that you're well-prepared come tax time, allowing you to trade with confidence and clarity.

How Much Money Do I Need to Start Forex Trading in Australia?

Starting Forex trading in Australia doesn't necessarily require a huge investment. The amount of money you'll need depends on several factors, including the specific broker's account requirements and the type of trading account you open.

Some brokers may allow you to open an account with as little as $50, and in certain cases, you could even begin trading with just $5. But it's crucial to understand that this starting amount will also define your trading capacity and risk levels.

When considering how much to invest, think about your trading style, risk tolerance, and overall financial goals. Some traders may prefer to start with a more substantial sum to have greater flexibility and risk management options. Others might opt for a minimal investment as they learn the ropes and develop their trading strategies.

The key is to find a balance that suits your individual needs and aligns with your trading approach, all while adhering to your broker's specific requirements.

FAQs

What to invest in 2024 Australia?

Blue chip stocks like CSL and Commonwealth Bank, internet stocks like Afterpay, ethical ETFs, renewable energy stocks, cryptocurrencies, and global equities are among the top opportunities for Australian investors to consider in 2024. Spreading money across multiple assets can result in excellent returns while lowering risk.

What is the best app for stock trading in Australia?

Several trading apps in Australia are designed exclusively for stock trading. Choose an app that matches your trading preferences, has an easy-to-use design, and gives you access to a diverse range of stocks.

Is eToro legal in Australia?

Yes, eToro is ASIC-licensed and completely legal for Australian residents to use.

What is the best trading app for beginners in Australia?

Stake and Superhero are the top trading applications in Australia for beginners. Both assist new traders in minimizing risks and learning the ropes.

Do mobile apps attract any fees?

No. Most brokers provide mobile apps as an extension of web platforms. Using apps requires no subscription.

Can I use apps of non-ASIC regulated brokers?

Most brokers have operating rights in at least one country. The ASIC does not make it compulsory to use only brokers regulated in Australia. Yet, it's safer to use brokers that fall within the regulatory jurisdiction in Australia.

Are all broker's fees the same?

No. Each broker decides its commissions and fees. Please read our reviews to find brokers that offer the lowest costs.

Are there risks associated with using mobile apps than web platforms?

Yes. So, you can protect your identity and investment by using apps with tight security features.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.