How Forex Is Regulated In Italy: Key Rules & Licensing

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex trading in Italy is subject to regulatory oversight, requiring brokers to obtain a valid license from CONSOB or another recognized EU authority.Forex trading profits are classified as capital gains and are taxed at a flat rate of 26%.

Italy has well-defined rules for overseeing brokers, designed to keep trading fair and safe for investors. Both Italy and the EU regulate Forex trading, and brokers must meet strict licensing rules to operate legally.

In this article, we break down the main Forex rules in Italy, including which authority oversees trading, what rules brokers must follow, and ways traders can verify a broker’s credibility. We also cover tax rules and trader protections to provide an overview of the market today.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

How is Forex regulated in Italy

The Forex market in Italy operates under strict government supervision to ensure transparency and investor protection. The primary regulatory bodies are the Commissione Nazionale per le Società e la Borsa (CONSOB) and the Bank of Italy (Banca d'Italia). These institutions oversee financial markets, investment firms, and brokers operating within the country.

Role of CONSOB and the Bank of Italy

The Commissione Nazionale per le Società e la Borsa (CONSOB) and the Bank of Italy operate in a uniquely layered oversight structure for Forex regulation, distinct from other European financial authorities. Unlike typical regulators that focus solely on licensing brokers, CONSOB actively monitors aggressive sales tactics and psychological marketing triggers used by Forex firms. This extends beyond misleading advertising to include behavioral analysis of broker communication strategies, ensuring they don’t manipulate traders with FOMO-driven promotions. Meanwhile, the Bank of Italy doesn’t just oversee capital adequacy; it has a silent veto power — it can block banking relationships between local financial institutions and high-risk brokers even if they meet standard regulatory requirements. This hidden safeguard allows Italy to cut off liquidity to potentially harmful Forex entities without lengthy public enforcement actions.

To operate in Italy, Forex brokers must obtain a license from CONSOB. The licensing process requires submitting a detailed application, including company statutes, proof of paid-up capital, details on shareholders and management, and a comprehensive business plan. Brokers must also demonstrate the implementation of robust internal control systems and anti-money laundering (AML) measures.

While many assume obtaining a Forex broker license in Italy simply involves meeting EU regulations under CONSOB’s oversight, a lesser-known aspect is the stringent capital reserve requirements that differ significantly based on the broker's service scope.

Regulatory objectives

The main objectives of Forex regulation in Italy are:

Broker activity control. Ensuring firms operate in compliance with established standards and protecting market participants from fraudulent practices.

Investor protection. Safeguarding client funds, ensuring transparency, and preventing unethical behavior.

Fraud prevention. Detecting and eliminating illegal activities, including insider trading and price manipulation.

Forex broker licensing requirements

To obtain a license in Italy, a brokerage firm must meet the following criteria:

Minimum capital requirements. The amount varies based on the type of services offered, ranging from €50,000 to €730,000.

Qualified personnel. Senior management and key employees must have relevant financial market experience and education.

Internal control systems. The company must implement effective risk management and internal auditing procedures.

Anti-money laundering (AML) compliance. Firms must establish policies and procedures to prevent financial crimes.

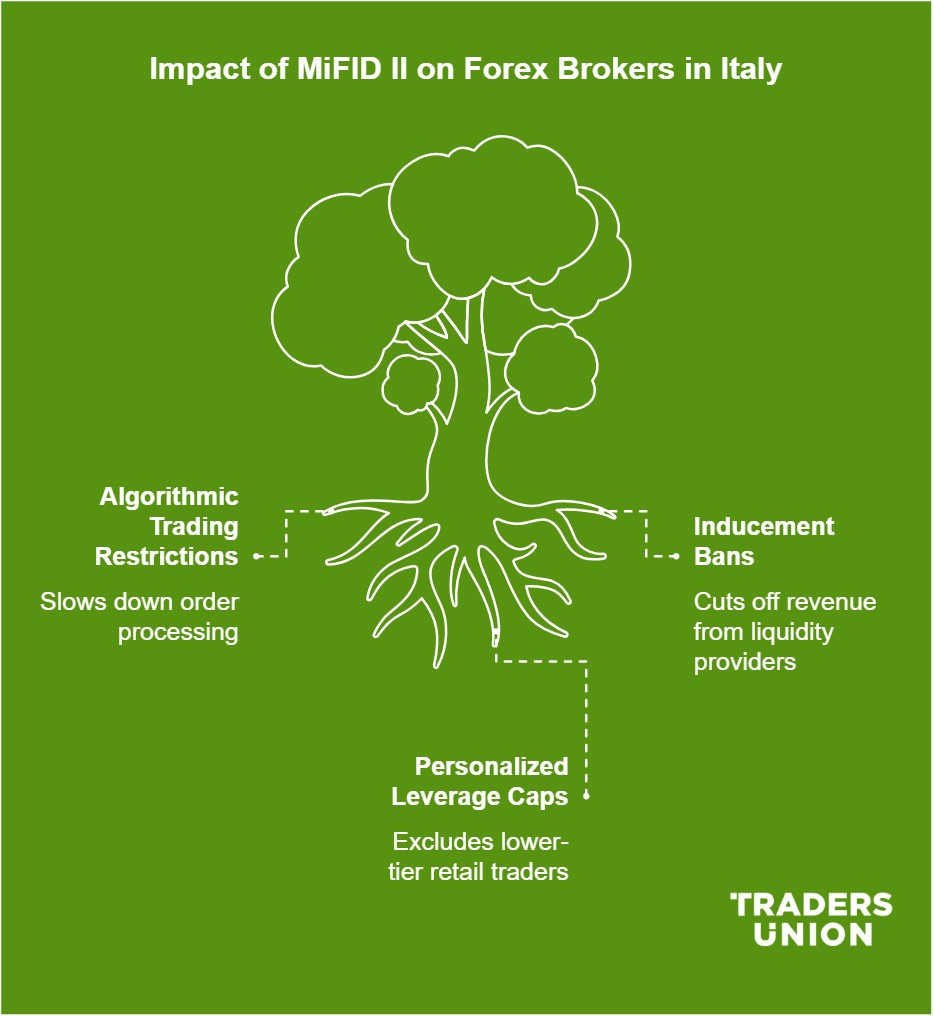

Impact of MiFID II on Forex brokers in Italy

MiFID II didn’t just change the rules for Forex brokers in Italy — it forced them to rethink their entire business model to stay competitive while meeting the strictest regulatory demands.

Algorithmic trading restrictions are silently reshaping broker offerings.MiFID II mandates brokers to continuously monitor and report algorithmic trading activity, but here’s the catch — Italy’s regulators have been particularly strict about "high-frequency trading" (HFT) models, forcing many brokers to tweak their execution speeds.

Inducement bans are cutting off a key revenue stream. While most brokers know MiFID II clamps down on inducements, the real issue in Italy is the scrutiny over profit-sharing arrangements with liquidity providers. Brokers who previously earned through volume-based rebates from liquidity providers are now being asked to justify every cent, leading many to restructure their entire pricing models.

Personalized leverage caps are keeping retail traders out.MiFID II is famous for limiting leverage for retail traders, but Italy’s regulators have taken it further. Brokers targeting Italian clients now face pressure to assess each trader’s risk tolerance individually before assigning leverage. This means some traders get lower leverage than standard ESMA limits, based on how the broker evaluates their profile. Some firms have even stopped onboarding lower-tier retail traders altogether to avoid compliance risks.

Leverage limits and negative balance protection

Regulators in Italy don’t mess around when it comes to Forex trading rules. If you’re a retail trader, forget about sky-high leverage — the limit is 30:1 on major currency pairs under MiFID II and ESMA regulations. More importantly, brokers must guarantee you won’t lose more than what you deposit, thanks to negative balance protection.

All Forex Regulators Reviews

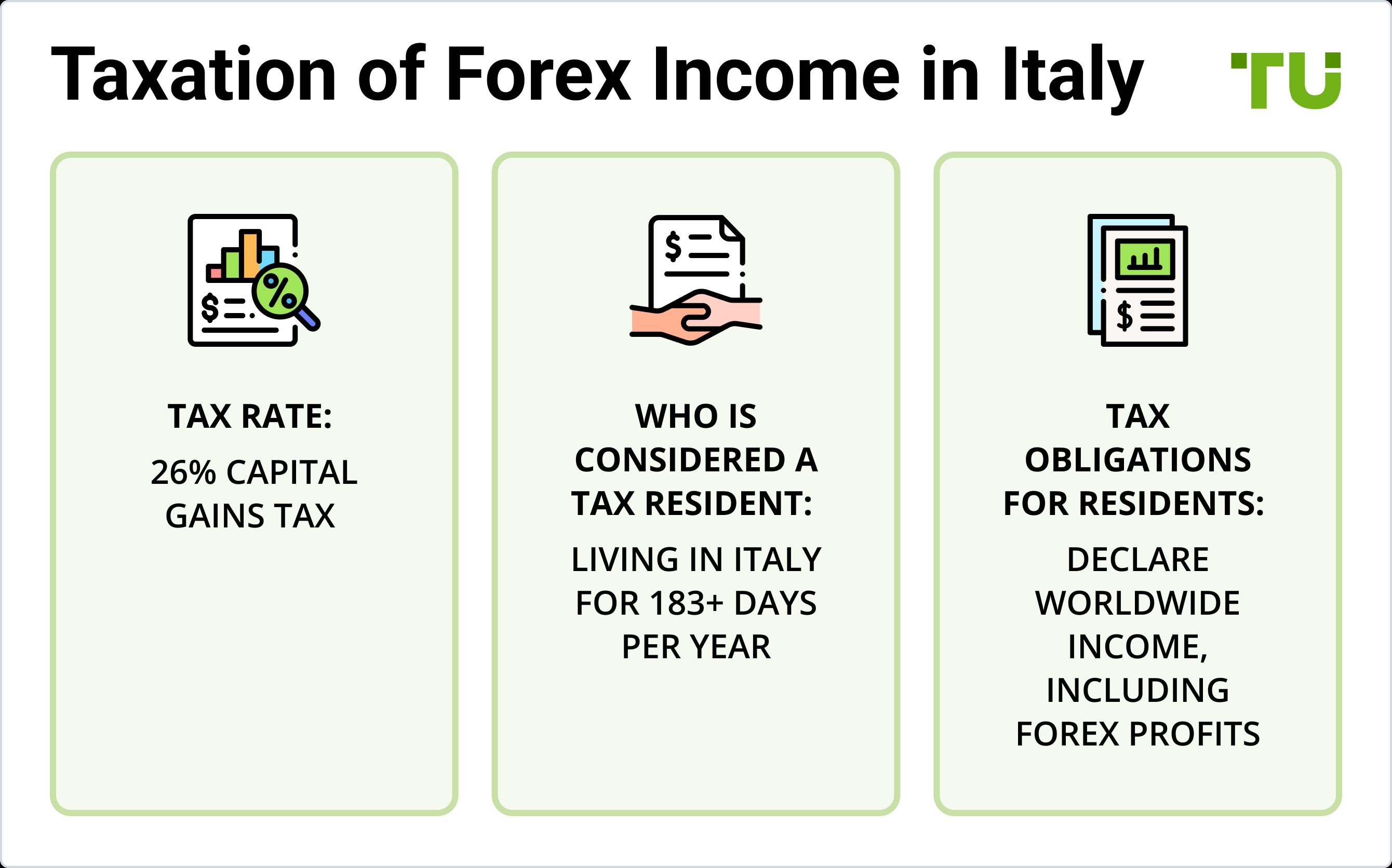

Taxation of Forex income in Italy

In Italy, income generated from Forex trading is subject to taxation under the current fiscal regulations. Below are the key aspects of taxation for residents, non-residents, and traders using foreign brokers.

Capital gains tax rates for Forex trading

Forex trading profits are classified as capital gains and are taxed at a flat rate of 26%. This tax applies to net profits earned from trading activities.

Tax obligations for Italian residents

A person is considered a tax resident in Italy if they:

Reside in the country for more than 183 days in a calendar year.

Have primary residence or their center of economic interests in Italy.

Tax residents are required to declare and pay taxes on their worldwide income, including profits from Forex trading.

Reporting requirements to tax authorities

Italian traders can’t escape taxes on Forex profits, no matter where their broker is based. Every year, residents have to report all income sources — including trading gains — to the Agenzia delle Entrate. Messing up the paperwork or missing deadlines? Expect fines.

Taxation of foreign brokers

If you’re trading through an overseas broker that doesn’t automatically deduct taxes, you’ll have to figure out and pay your own dues. Also, if you keep money in a foreign bank account, you need to report it, or you might get flagged for non-compliance.

How to choose a reliable Forex broker in Italy

Selecting a trustworthy Forex broker in Italy requires careful evaluation. Below are the key criteria for identifying a reputable broker, methods to verify licensing, and warning signs that may indicate fraudulent practices.

Criteria for choosing a licensed broker

Choosing a licensed broker in Italy isn’t just about regulation — it’s about ensuring your trading experience is smooth, secure, and built for success:

Must have a local Italian office. If a broker is licensed but doesn’t have a physical presence in Italy, expect slow responses for disputes and withdrawals.

Real-time fund segregation verification. Some brokers claim to separate client funds but don’t. Choose one that allows you to verify in real-time that your money is held separately from company funds.

Direct partnerships with tier-1 banks. If a broker relies on third-party payment processors instead of direct bank relationships, you risk slow withdrawals and potential fund freezes.

Leverage restrictions that align with your strategy. Some brokers lure traders with flexible leverage but limit adjustments based on trade volume. Make sure the leverage you choose doesn’t come with hidden caps.

Italian investor compensation scheme access. Not all brokers under EU regulation give Italian traders access to Fondo Nazionale di Garanzia, which protects deposits up to €20,000.

Transparent slippage policies. Some brokers manipulate order execution by delaying fills or widening slippage during news events. Pick a broker that openly discloses execution speed and slippage records.

| Yes | Demo | Min. deposit, $ | Standard EUR/USD spread | Investor protection | Max. Regulation Level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | 0,6 | £85,000 €20,000 CHF 100,000 | Tier-1 | 6.97 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 0,4 | €20,000 €100,000 (DE) | Tier-1 | 6.71 | Study review | |

| Yes | Yes | 100 | 1,0 | No | Tier-1 | 6.25 | Study review |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Verifying a broker’s license through CONSOB and other regulators

Verifying a broker’s license isn’t just about checking a name on a list. Here’s how to dig deeper and spot hidden red flags.

Check the CONSOB warning list. Even if a broker claims to be regulated, they might be on CONSOB’s blacklist for past violations.

Verify the license type. Some brokers hold restricted licenses that don’t allow them to serve retail traders in Italy.

Look for the physical office. A real broker should have a registered address in Italy. If their address leads to a virtual office, be cautious.

Cross-check multiple databases. Brokers sometimes use a valid license number from a different company. Check CONSOB, ESMA, and the home regulator’s site.

Verify international licenses. If the broker claims to have additional licenses from regulators such as the FCA in the UK, visit the FCA official website and perform a similar verification.

Warning signs of unreliable and fraudulent brokers

Spotting an unreliable broker isn't just about checking a license — fraudsters have evolved, and their tricks are more sophisticated than ever. Here’s what beginners often overlook.

Price manipulation tricks. If you notice price spikes or sudden slippage right when you're about to close a profitable trade, the broker might be manipulating spreads to eat into your profits.

Fake “instant withdrawals.” Some shady brokers advertise instant withdrawals, but they stall you with KYC delays or random "security checks" to keep your funds locked.

Too-good-to-be-true bonuses. Brokers that offer massive deposit bonuses often have fine print that traps you into unrealistic trading volume requirements before you can withdraw.

Negative reviews vanish. If every review you find is glowing and complaints suddenly disappear, the broker might be paying to remove negative feedback.

Sloppy legal pages. Fake brokers copy-paste terms from legitimate sites, leading to odd contradictions or outdated legal references. If their legal pages mention regulators they aren’t actually licensed by, it’s a red flag.

A thorough background check and careful broker selection process will help safeguard your investments and provide a secure trading experience in Italy’s financial markets.

Italy’s hidden Forex regulation rules that can make or break your brokerage

Italy’s CONSOB (Commissione Nazionale per le Società e la Borsa) isn’t just another financial watchdog — it has some of the toughest Forex broker regulations in the EU. One overlooked hurdle? The “operational substance” requirement. Unlike some jurisdictions where a virtual office might pass compliance, Italy demands that brokers have a real, functional presence in the country. This means not just a legal address but actual in-country staff handling customer service, risk management, and compliance. Without this, even a broker with a valid EU passport could find themselves blocked from operating effectively in Italy.

Another hidden challenge? Tight controls on marketing and onboarding. While many brokers assume their ESMA-regulated license gives them free rein across Europe, Italy has additional restrictions on advertising leveraged products. Brokers must prove that their marketing materials don’t mislead retail traders — which means things like ROI projections, success stories, or even aggressive CTAs (“Join now and profit!”) could lead to penalties. Even affiliate promotions are heavily scrutinized, and any broker working with influencers or ad networks must pre-approve all external marketing with regulators or risk being shut down.

Conclusion

Forex regulation in Italy ensures transparency, investor protection and stability in the financial sector. Broker licensing, strict MiFID II requirements and CONSOB supervision create a safe environment for traders. Compliance with tax obligations and choosing a regulated broker are key factors for successful trading. Using official registers to check the license helps to avoid fraud and financial risks. By adhering to established regulations and choosing reliable brokers, traders can minimize risks and improve the efficiency of their investments.

FAQs

What are the minimum deposit requirements of Italian brokers?

The minimum deposit amount depends on the broker and the type of trading account. Some companies set the threshold from 100 to 500 euros, and for professional accounts the amount can be higher. Regulated brokers are required to disclose this information in advance, as well as warn clients about the risks associated with trading.

Do Italian traders need to register with the tax authorities?

If trading is the main source of income, a trader may be required to register as a sole proprietor and pay the corresponding taxes. If trading is not regular, the income is subject to capital gains tax and is reported in the annual declaration.

What tax benefits are available to traders in Italy?

Professional traders registered as sole proprietors can benefit from preferential tax regimes. Depending on the structure of the business, this may include reduced tax rates or deductions for trading expenses.

What trading restrictions may apply in the Italian market?

In addition to leverage limits for retail clients, regulators can impose temporary bans on certain assets during periods of high volatility. The country also has rules to combat market manipulation, including a ban on insider trading.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).