How Forex Is Regulated In Hungary: Key Rules & Licensing

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex trading in Hungary is regulated by the National Bank of Hungary (MNB), which oversees Forex transactions and ensures compliance with EU regulations. Brokers must obtain a license from the MNB, requiring a minimum capital of €125,000, a physical office in Hungary, and two resident directors. These measures aim to protect investors.

Hungary’s Forex market isn’t a free-for-all — it’s tightly regulated, and every broker must play by the rules. Can you trade without a license? Not legally. Brokers face strict capital requirements, compliance checks, and marketing restrictions, all enforced by the Hungarian National Bank (MNB).

Your funds’ safety depends on who you’re trading with. Regulated brokers must follow EU capital protection rules, but offshore platforms? That’s a gamble. From tax obligations to trading restrictions, knowing the rules before you start can save you from big headaches

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

How is Forex regulated in Hungary

Forex trading in Hungary falls under the strict oversight of the National Bank of Hungary (MNB), which actively monitors brokers to keep trading fair and prevent scams. Any broker wanting to operate in Hungary must secure an MNB license and maintain a physical presence — not just a website. The regulator doesn’t just check paperwork; it looks at how brokers handle funds, customer service, and risk management to protect traders.

Since Hungary follows EU trading laws (MiFID II), brokers must keep traders’ funds separate from company money. This isn’t just a box-ticking exercise — it stops brokers from using your deposits for their own expenses. Hungary also enforces strict leverage limits — 1:30 for major Forex pairs and 1:10 for riskier assets like commodities — so retail traders don’t blow up their accounts overnight. Brokers must also fully disclose risks and submit regular financial reports, or they risk huge fines or losing their license.

Traders who stick with licensed brokers are protected by the Hungarian Investor Protection Fund (BEVA), which covers up to €100,000 if a broker goes bust. But don’t just take a broker’s word for it — always double-check their license on the MNB’s official site before opening an account. Hungary’s Forex rules aren’t just red tape — they’re designed to keep traders safe from shady brokers and unfair trading practices.

Licensing and basic regulatory rules

Forex brokers in Hungary can’t just start trading — they need approval from the National Bank of Hungary (MNB). Getting licensed isn’t just about paperwork. Brokers must show a solid business plan, prove financial stability with audited reports, and outline future projections before they even get considered. They also need to reveal their management team, ownership details, and risk management strategies. The minimum capital required? €125,000 — but many brokers hold more to gain credibility.

Hungary follows MiFID II, the EU’s rulebook for Forex brokers. But just because a broker has an EU license doesn’t mean they can do whatever they want. MiFID II enforces tight rules on transparency, client order execution, and risk management. Brokers must report every trade, provide clear risk disclosures, and maintain accurate financial records. If a broker is withholding trade data or making vague claims about risk, it’s a red flag.

Want to verify a Forex broker in Hungary? Don’t just take their word for it. Check the MNB’s website for licensed firms and scam warnings. If a broker isn’t on the approved list, stay away. These rules exist to keep traders safe and prevent shady brokers from manipulating the market.

All Forex Regulators Reviews

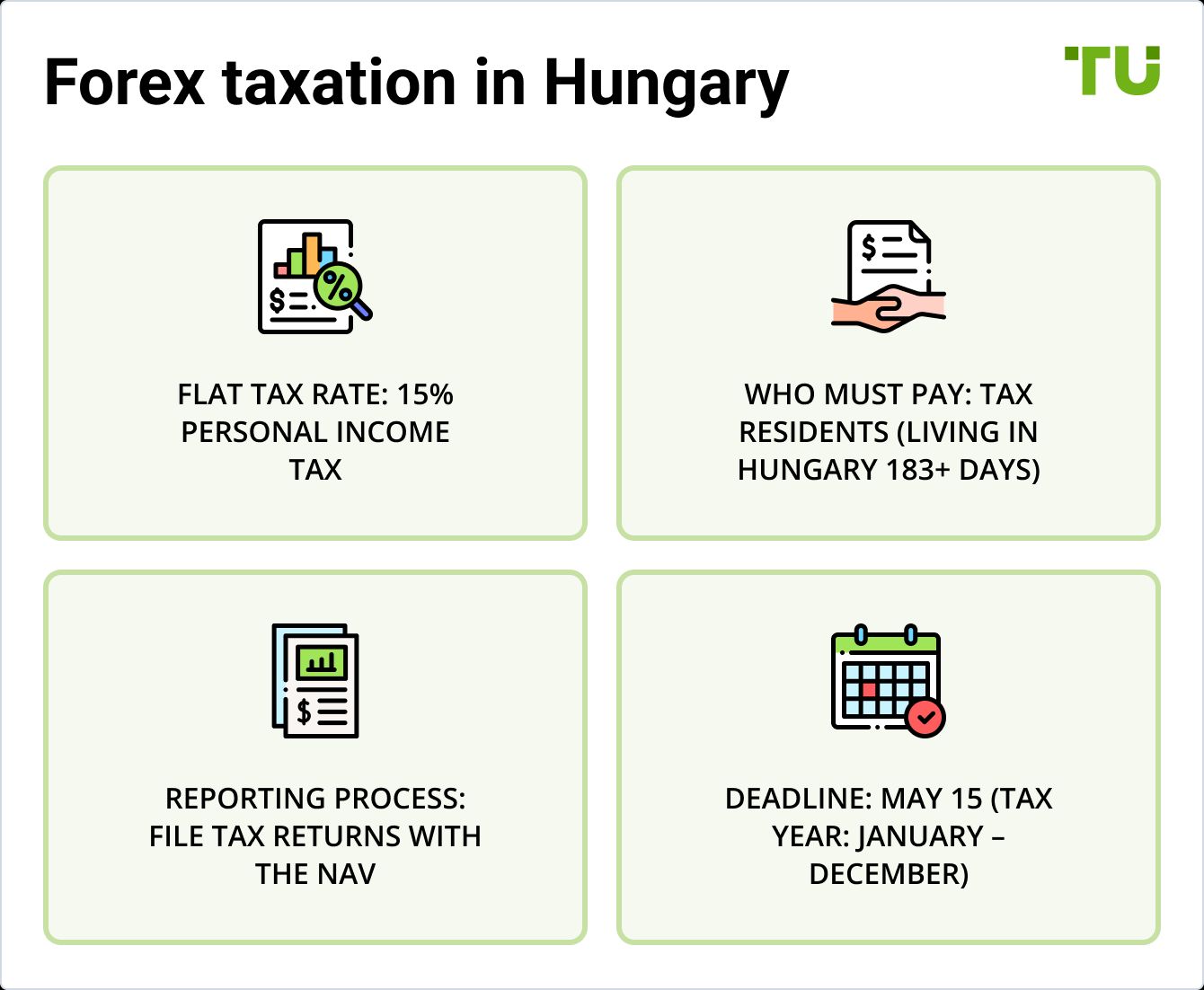

Taxation of Forex income in Hungary

In Hungary, income from Forex trading is subject to a flat personal income tax rate of 15%. This rate applies to all types of individual income, including profits from currency trading.

Tax obligations for Hungarian residents

If you live in Hungary for more than 183 days a year or have your main ties — like family or business — based there, you’re considered a tax resident. That means you’ll need to report all your income, no matter where it comes from — including Forex trading profits.

Reporting to tax authorities

If you live in Hungary, you’ll need to file your yearly tax return with the National Tax and Customs Administration (NAV). It’s done online through the eSZJA system, and the deadline is May 15 each year. Hungary’s tax year runs from January to December, so when you file, you have to report all your income — including Forex trading profits. Make sure to calculate the tax owed correctly to avoid issues later.

Taxation of income from foreign brokers

If Forex traders use foreign brokers, they still have to report their earnings and pay taxes in Hungary. Some countries may also take a cut upfront through withholding tax, but Hungary has tax treaties with many nations to prevent traders from getting taxed twice. In those cases, the tax you pay abroad can often be used as a credit toward what you owe in Hungary.

Protection of traders and investors

Licensed Forex brokers in Hungary can’t mix client money with company funds. This means your deposits stay separate and can’t be used to cover the broker’s expenses. On top of that, brokers must be upfront about fees, risks, and services — no shady fine print or misleading claims. Transparency isn’t just encouraged; it’s enforced.

Compensation funds for clients of licensed brokers

If a licensed Forex broker goes bankrupt, your money isn’t necessarily gone. Hungary’s investor protection fund can reimburse you up to a certain limit, making it one of the few safety nets traders have. But here’s the catch: not all losses are covered, and if you’re trading with high leverage or risky products, you could still be on the hook for more than you expect.

Risks of working with offshore and unlicensed brokers

Engaging with offshore or unlicensed brokers carries significant risks. Such companies often operate outside strict regulatory frameworks, which means client funds may not be protected, and fraudulent practices are more likely. Furthermore, in the event of disputes or financial losses, investors may struggle to recover their funds, as these brokers are not subject to local laws and regulations.

To ensure safety, traders should verify a broker’s license and confirm compliance with regulatory standards before opening an account. Choosing a licensed broker and understanding the available protections are essential steps to ensure investment security in Hungary’s Forex market.

| Available in Hungary | Demo | Min. deposit, $ | Standard EUR/USD spread | Investor protection | MNB (Hungary) | Max. Regulation Level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 100 | 1,0 | £85,000 €20,000 | No | Tier-1 | 9.1 | Open an account Your capital is at risk. |

|

| Yes | Yes | 5 | 1,0 | £85,000 €20,000 | No | Tier-1 | 9 | Open an account Your capital is at risk. |

|

| Yes | Yes | 10 | 1,0 | €20,000 | No | Tier-3 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | Yes | 10 | 1.2 | No | No | Tier-1 | 8.6 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 0,8 | No | No | Tier-1 | 8.69 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Hungary blocks EU-licensed brokers who don’t follow local rules

Hungary’s MNB isn’t easy on Forex brokers, and plenty of firms get blindsided by rules they didn’t even know existed. The biggest mistake? Thinking an EU license is a free pass. Even if you’re registered in another European country, Hungary doesn’t let you target local traders without direct approval from MNB. That means if your ads, customer service, or payment options cater to Hungarians, MNB expects you to play by their rules. If you don’t, you’ll get flagged — and possibly blocked from operating.

Then there’s Hungary’s strict stance on leverage. If a trader has low income, past losses, or limited experience, MNB expects brokers to manually reduce their leverage — even if the trader wants higher risk. Brokers who ignore this can get audited or fined, even if they’re licensed elsewhere. Some brokers assume they can slip through the cracks, but Hungary’s regulators actively monitor trading activity. If you’re running a Forex business here, cutting corners isn’t worth the risk.

Conclusion

The Forex market in Hungary is regulated at the state level, which ensures investor protection and broker transparency. Licensing, capital requirements, leverage limits, and mandatory reporting help minimize risks for traders. Taxation of Forex income requires compliance with certain rules, including filing reports and paying income tax. Working with licensed brokers provides additional guarantees, including access to compensation funds. Using offshore and unlicensed platforms carries significant risks, since clients of such companies are deprived of protection from Hungarian and European regulators. Checking a broker before starting trading helps avoid possible financial losses and fraud.

FAQs

What are the restrictions for Forex trading in Hungary?

Traders can trade Forex freely, but regulators impose leverage limits for non-qualified investors (e.g. 1:30 for major currency pairs). Certain trading instruments, such as binary options, are also prohibited. Brokers are required to disclose risks and cannot offer aggressive marketing strategies.

Can you trade Forex in Hungary without a license?

Individuals can trade independently without a license, but providing brokerage services without permission from the regulator is illegal. This can lead to large fines and criminal liability. To register a brokerage company, you must obtain a license from the National Bank of Hungary and comply with the requirements of MiFID II.

How can I check if a broker is blacklisted?

The National Bank of Hungary publishes lists of licensed brokers and warnings about illegal companies on its official website. You can also check the data through European financial regulators such as ESMA. If the broker is not listed or is already blacklisted, cooperation with them is associated with a high risk of losing funds.

What alternative instruments are available for trading in Hungary besides Forex?

In addition to Forex, traders in Hungary can trade stocks, bonds, indices, cryptocurrencies and commodities through licensed platforms. Futures and options regulated by European law are also available. The choice of instrument depends on the trader's strategy, risk level and investment goals.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).