Is Forex Trading Regulated In Algeria? Bank Of Algeria Regulations & Taxes Explained

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Yes, Forex trading is regulated in Algeria, but it operates under strict foreign exchange controls enforced by the Bank of Algeria. The government monitors capital flows to prevent money laundering and unauthorized fund transfers. Additionally, profits from Forex trading are subject to taxation, and traders must report their earnings to avoid legal complications.

This article explores the regulatory framework for Forex trading in Algeria, covering the Bank of Algeria’s restrictions, capital controls, and legal trading options. We will also break down tax obligations for Forex traders, discussing how profits are taxed and what traders must do to remain compliant. Finally, we will look at the challenges Algerian traders face and practical tips for navigating the country’s Forex market legally.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Regulatory framework for Forex trading in Algeria

Forex trading in Algeria operates within a complex regulatory framework designed to maintain economic stability and control capital flows. The Bank of Algeria serves as the central regulatory authority, overseeing all financial and currency exchange activities. This oversight ensures that the foreign exchange (Forex) market adheres to established laws, aiming to prevent illegal activities such as money laundering and capital flight.

Foreign exchange controls

A critical component of Algeria's Forex regulation is the implementation of stringent foreign exchange controls. These controls restrict the movement of capital, ensuring that foreign currency transactions are meticulously monitored. The Bank of Algeria plays a pivotal role in managing how foreign exchange is handled, requiring traders to comply with specific rules when engaging in currency transactions to avoid penalties or legal repercussions.

Legal status of Forex trading

While Forex trading is not explicitly illegal in Algeria, it is heavily regulated. The government has established clear foreign exchange controls that limit how individuals and institutions can participate in such trading. For individual traders, it's crucial to understand that these regulations restrict access to foreign brokers. Only brokers who meet Algerian standards and are authorized by the Bank of Algeria can legally operate within the country. This limitation often compels local traders to use regulated platforms that comply with governmental guidelines.

Capital flow management

The restrictions imposed are primarily aimed at controlling capital flows. Algeria's foreign exchange controls are designed to prevent large sums of money from leaving the country, which could negatively impact the local economy. Consequently, Forex trading in Algeria is less flexible compared to other regions. However, traders must remain compliant with the Bank of Algeria's regulations to avoid facing penalties.

Recent developments

In recent years, Algeria has made efforts to adjust its financial regulations to better align with global standards. For instance, the Revised Investment Law removed the obligation for foreign investments to present a positive foreign exchange balance, authorizing the free transfer of invested capital and its proceeds out of Algeria, subject to certain yet undefined levels of initial equity investment. Additionally, the Bank of Algeria has issued new regulations emphasizing manual currency exchange services, focusing on the sale of freely convertible foreign currencies against the Algerian Dinar.

All Forex Regulators Reviews

Taxation of Forex trading profits in Algeria

Forex trading profits in Algeria fall under the country's general taxation system. Understanding how these earnings are taxed is essential for traders to remain compliant with regulations and avoid penalties.

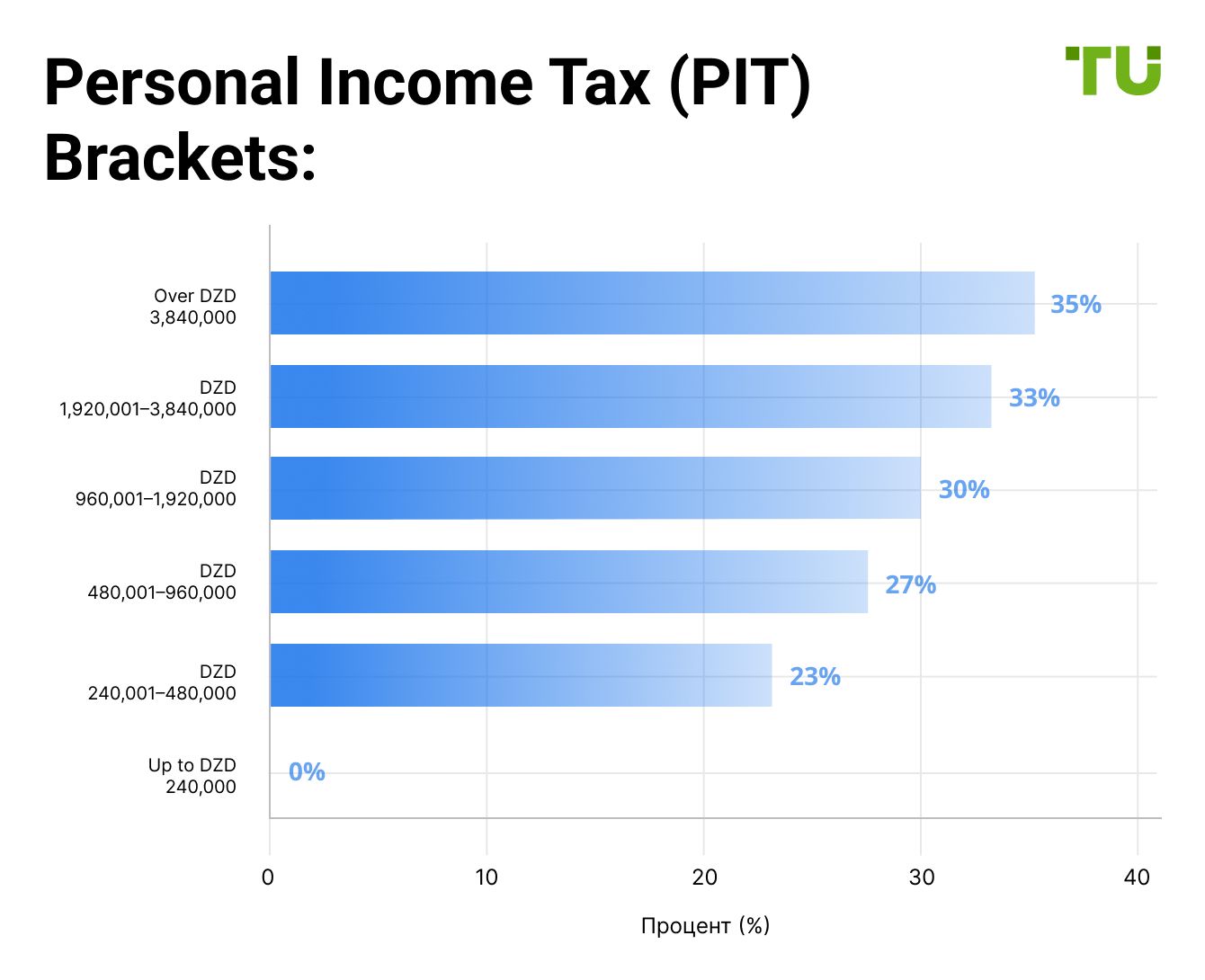

Personal income tax (PIT) rates

Algeria imposes a progressive personal income tax (PIT) on individual earnings, including profits from Forex trading. The tax brackets are from 0 to 35%.

These rates apply to an individual's cumulative annual income, including wages, business profits, and investment returns such as Forex trading.

Taxation of Forex trading profits

Algeria’s tax laws do not have specific provisions for Forex trading. However, profits from trading are generally considered part of taxable income. Traders are required to report these earnings as part of their total income and pay taxes based on the applicable PIT rates. Keeping detailed records of trades, profits, and losses is crucial to ensuring accurate tax reporting.

Withholding taxes

In addition to PIT, Algeria imposes withholding taxes on certain types of income.

Dividends. 15% for both residents and non-residents.

Interest. 10%, unless reduced under a tax treaty.

Royalties. 30% for both residents and non-residents, unless specified otherwise by a treaty.

These taxes are particularly relevant for traders earning passive income from dividends or interest on foreign-held assets.

Social security contributions

Employees in Algeria are required to contribute 9% of their pre-tax salaries to social security. While this primarily applies to employment income, traders should be aware of their overall tax liabilities, especially if trading is their main source of income.

Key tips for Forex traders

Consult a tax professional. Given the complexities of taxation, it is advisable to seek professional guidance on how Forex earnings should be reported and taxed.

Maintain accurate records. Detailed documentation of all trading activities, including profits and losses, is essential for compliance and tax calculations.

Stay updated on regulations. Tax laws can change, and keeping up with updates ensures traders remain compliant and take advantage of any beneficial tax provisions.

Choose a reliable broker . Working with a well-regulated and transparent broker helps protect your funds, ensures fair trading conditions, and simplifies reporting obligations.

| Available in Algeria | Tradable assets | Demo | Min. deposit, $ | Standard EUR/USD spread | Cent | Copy trading | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 132 | Yes | No | Not supported | No | Yes | No | 9.2 | Open an account Your capital is at risk. |

|

| Yes | 1400 | Yes | 5 | 1,0 | Yes | Yes | Tier-1 | 9 | Open an account Your capital is at risk. |

|

| Yes | 12000 | Yes | 10 | 1,0 | Yes | Yes | Tier-3 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 200 | Yes | 10 | 1,1 | No | Yes | Tier-1 | 8.7 | Open an account Your capital is at risk.

|

|

| Yes | 1000 | Yes | 100 | 0,8 | No | Yes | Tier-1 | 8.69 | Open an account Your capital is at risk. |

|

| Yes | 300 | Yes | 10 | 1.2 | Yes | No | Tier-1 | 8.6 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Practical considerations for Forex traders in Algeria

Forex trading in Algeria isn’t just about analyzing charts and picking currency pairs. The real challenge lies in navigating strict capital controls, limited broker options, and the banking system’s grip on foreign exchange transactions.

Unlike traders in open markets, Algerian traders face restrictions that make depositing and withdrawing funds from international brokers a major hurdle. Instead of focusing only on technical strategies, traders need a game plan for accessing liquidity, managing currency conversion, and ensuring compliance with local laws.

One overlooked factor is the impact of the parallel currency market on Forex trading. Algeria has a well-known black market for currency exchange, where rates often diverge significantly from the official exchange rate. This dual exchange rate system means that traders relying on unofficial channels for funding accounts may face pricing inefficiencies, leading to unexpected costs.

Smart traders don’t just look at exchange rates on their trading platform — they pay attention to how local market fluctuations impact real purchasing power and cross-border transactions. Without this awareness, even profitable trades can end up losing value when withdrawing funds.

Recent developments and future outlook

Algeria's Forex trading landscape is evolving due to recent economic reforms and regulatory measures aimed at stabilizing the financial sector and curbing informal currency markets.

Recent developments

Economic reforms. In 2022, Algeria introduced a new investment law to attract foreign investors by replacing the previous 2016 framework. The new law emphasizes transparency, equal treatment of applications, and freedom to invest. These measures aim to modernize the financial sector and stimulate economic growth.

Currency reforms. To address the disparity between official and black market exchange rates, Algeria increased the annual tourist allowance to €750. This change is designed to reduce reliance on informal currency exchanges and stabilize the national currency by narrowing the gap between official and parallel market rates.

Foreign exchange reserves. As of early 2024, Algeria's foreign exchange reserves have increased to approximately $64.6 billion. This growth reflects a stable economic environment that could positively impact regulated Forex trading activities.

Future outlook

Algeria’s efforts to strengthen its financial markets indicate a more structured and controlled Forex environment. Continued attempts to align official and parallel exchange rates, combined with rising foreign exchange reserves, suggest a more stable and transparent trading landscape. These developments could boost investor confidence and attract more participants to Algeria’s regulated Forex market in the coming years.

You need to figure out how you’ll cash out your profits without unnecessary headaches

Most traders in Algeria think that if a broker allows them to sign up, they’re good to go. But the real struggle starts when they try to withdraw their money. The Bank of Algeria has tight controls over capital movement, which means getting profits back into your local bank account isn’t as simple as clicking ‘withdraw’. If you don’t have a plan for how to move your money legally, you could end up with funds stuck in an offshore account, unable to convert them into dinars without running into issues. Before you even start trading, you need to figure out how you’ll cash out your profits without unnecessary headaches.

Taxes are another tricky area. While Forex earnings are supposed to be taxed, enforcement is inconsistent — until it isn’t. The government is paying more attention to unreported income, and if you’re pulling in big profits, you don’t want a surprise tax bill down the road. The smartest traders don’t wait for problems. They spread out withdrawals, avoid drawing too much attention to large transfers, and make sure they’re not leaving a paper trail that raises red flags. If you’re planning to trade long-term, learning how to legally access and keep your money is just as important as knowing when to buy and sell.

Conclusion

Forex regulation in Algeria plays a critical role in shaping the Forex trading landscape. The Bank of Algeria's forex regulation ensures that all trading activities comply with strict guidelines aimed at maintaining economic stability and protecting local investors. While foreign exchange controls can present challenges for traders, the regulatory environment offers a clear framework for those who choose to engage in Forex trading within the country.

Looking forward, as Algeria continues to modernize its financial sector, there could be more opportunities for Forex traders. The Bank of Algeria might adjust its policies to further open the market, allowing greater flexibility for those involved in Forex trading. For now, understanding Forex regulation in Algeria and staying compliant with local laws is essential for successful trading in the country.

FAQs

Is Forex trading legal in Algeria?

Yes, forex trading is legal in Algeria. However, it is subject to specific regulations and foreign exchange controls enforced by the Bank of Algeria to ensure economic stability.

What role does the Bank of Algeria play in Forex regulation?

The Bank of Algeria serves as the central regulatory authority overseeing the financial sector, including forex trading activities. It sets conditions for banks and financial institutions to operate within the country, ensuring compliance with national financial policies.

Are there restrictions on currency transfers for Forex trading purposes?

Yes, Algeria enforces foreign exchange controls that regulate currency transfers. These measures impact how forex trading is conducted, particularly concerning the transfer of funds abroad.

How are Forex trading profits taxed in Algeria?

Profits from forex trading are considered part of an individual's taxable income in Algeria. Traders are required to declare these earnings in their annual tax returns and pay taxes according to the applicable income bracket.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).